designprojects/iStock via Getty Images

Archer Aviation, Inc. (NYSE:ACHR) is one of a number of ventures worldwide that is vying to be a leader in the Urban Air Mobility – UAM – transportation segment. The world is on the cusp of experiencing what was science fiction just a few years ago; the ability of a family-sized group of people to affordably move around dense urban areas much faster than they can in any form of ground transportation is about to change. Many of the UAM concepts are based on electric vehicles, leveraging the growing capacity of batteries to store greater amounts of electricity at lighter weights and of multiple lightweight electric motors to work together through computerized flight controls. The ability to take off and land vertically (eVTOL or electric vertical takeoff and landing) puts air transportation close to people and is the heart of the UAM concept. Some UAM concepts envision autonomous (self-flying) vehicles while others will use commercially trained pilots. Several models are designed to be used like current ground-based ride share services, using automation to pool riders and trips. ACHR is pursuing a piloted version of each of these concepts in a vehicle that can carry one pilot and up to four passengers.

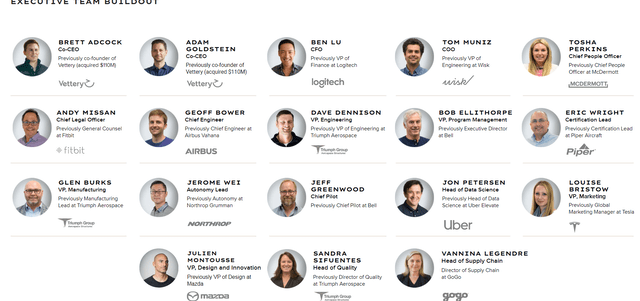

ACHR is one of the younger companies in the UAM industry; the industry itself has been in serious development for more than a decade. Archer is pursuing two lines of business including the eventual production and mass production of eVTOL vehicles as well as the commercial transportation of passengers using those vehicles. ACHR, like many of the UAM companies, is led by a team with broad types of business and commercial experience. There is considerable interest in this embryonic concept with a number of investment funds committing capital in an industry which Morgan Stanley believes could reach over $1 trillion in less than 20 years.

UAM Market (Archer.com)

Despite being a relatively young company Archer used its second quarter 2022 earnings release to highlight the progress it has made in its goals. Having completed hover flight – the ability for an aircraft to elevate itself from the ground and hold its position above the ground – ACHR says it is on track to advance its flight tests to transitional flight in which the aircraft will leave its position above the ground and fly forward towards a destination. While most of the UAM concepts envision operating like small helicopters, ACHR’s concept is based on an aircraft with 12 electric motors attached to a fixed wing type aircraft with the motors capable of transitioning from being capable of providing vertical lift to tilting to provide forward movement.

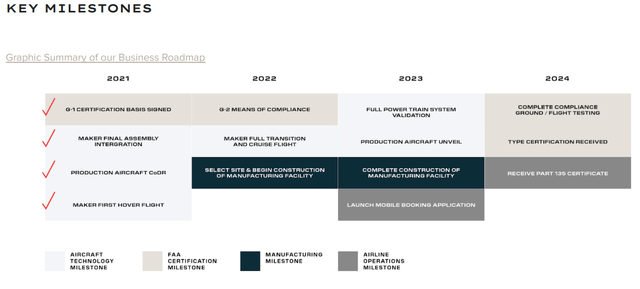

ACHR milestones 2Q2022 (Archer.com)

ACHR also says that it continues to test its prototype aircraft, Maker, but is shifting its primary focus to Midnight, its production vehicle. Archer says that it has finalized the design of Midnight and will soon be shifting its focus to building production facilities. The U.S. Federal Aviation Administration is deeply involved in the certification process of the UAM industry and ACHR did make progress in moving toward certification of its platforms.

Archer Midnight (Archer.com)

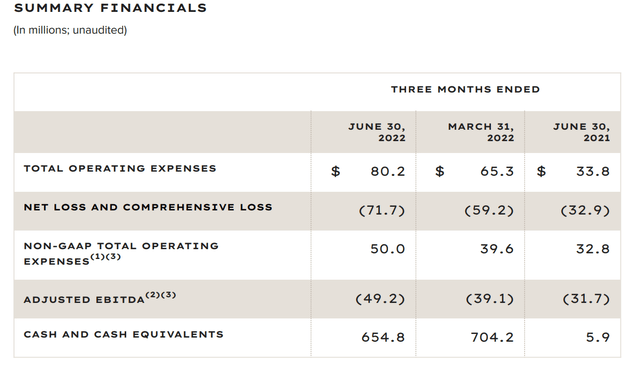

Burning cash as startups do

In looking at ACHR’s 2nd quarter 2022 financial report, several numbers stand out. First, they are burning cash s they continue to develop their product but before they are largely able to begin taking in revenue. That principle played out with Archer as it spend over $80 million in the MRQ for total operating expenses or $50 million on a non-GAAP basis, with the primary difference stock-based compensation. They have $655 million in cash, a figure that is likely to continue to drop as use funds from their capitalization last year. It is also certain that their expenses will accelerate as they move closer to production and certification of the aircraft. While the cash burn might appear concerning, gaining FAA approval will dramatically improve investor and customer confidence in the company which should lead to orders that will generate cash. Archer expects to pursue two lines of business with some of its aircraft being sold to customers for their use and some of the aircraft being held for use in the air taxi operations the company intends to operate. While aircraft sales to other customers will generate cash, the aircraft that are produced for internal use will only generate cash when they operate although it is possible that they can secure financing for production aircraft that are destined for their own passenger operations.

ACHR 2Q2022 financial summary (Archer.com)

Archer Exec team 2021 (Archer.com)

United’s big vote of confidence

United Airlines (UAL) has been a noticeably high-profile partner to ACHR. UAL made a commitment for up to 200 aircraft last year and just provided a $10 million pre-delivery payment which the companies announced on the day of ACHR’s earnings. While airlines rarely invest in completely new technologies, pre-delivery payments are common. UAL also has warrants making it potentially a large beneficiary if ACHR is successful. UAL’s former CEO serves on the Archer board of directors.

United’s interest in the eVTOL segment and UAM is significant; UAL has also invested in other emerging technologies including supersonic aircraft, saying that both products represent opportunities for the Chicago-based airline to distinguish itself from competitors and gain first mover advantages as new technologies come to market. United’s network is heavily built around large sprawling metro areas including the New York City; Washington, DC; Chicago; Houston; and San Francisco and Los Angeles metro areas where UAM might be attractive. Archer expects to develop its service in the Los Angeles and South Florida markets. United might use its aircraft in other markets; while it is a large operation in LA, it is not the largest airline and United is one of the smallest U.S. airlines in S. Florida. Thus, United will not likely object to where ACHR wants to develop its own air taxi service while United will likely complement ACHR’s internal air taxi operations with UAL’s service in its own strength markets.

ACHR UAL partnership ( Archer.com)

ACHR says that it expects a significant number of passengers it will initially carry will be to/from airports where United could see a significant competitive advantage if high value airline passengers see a connection between UAL’s services and those provided as part of UAL’s urban air mobility operations. It is not certain how UAM operations will integrate with airline operations at airports but UAL could be instrumental in helping define processes and standards for the UAM industry to the benefit of the sponsoring airline.

There is another aspect of the ACHR-UAL operation that might be a major motivation for United which operates the world’s largest regional airline operation relative to its own mainline operation; a higher percentage of United’s current domestic operation is conducted by contracted regional airlines than for any other U.S. airline. In order to solve its dependence on an aging fleet of increasingly inefficient and expensive regional jets, UAL has embarked on one of the most aggressive fleet acquisition strategies in U.S. airline history. UAL has committed to purchasing or leasing over 500 narrowbody (single aisle) domestic aircraft, predominantly from the Boeing 737MAX family. UAL will receive scores of new MAX aircraft this year followed by well over 100 aircraft next year.

While United customers will experience a significantly improved product and UAL’s cost per passenger will fall as regional jets are replaced by mainline aircraft, UAL must make this transition in a very challenging environment including during one of the deepest pilot shortages the industry has ever seen. United, like other U.S. airlines, is having to cut its schedules because of a lack of employees but esp. among regional jet pilots.

ACHR is pursuing a strategy of using piloted aircraft in order to reduce the complexity of the certification process for electric powered aircraft; adding in self-flying functionality will greatly increase the complexity of the regulatory process. Pilots for ACHR aircraft are expected to be capable of flying with lower requirements than for pilots that fly larger commercial airliners. Therefore, it is possible that United could benefit from having a contracted or internally operated fleet of Archer aircraft to use to help provide a pipeline for pilots that ultimately end up at United.

No shortage of risks

Archer has risks just as any startup does. From a technology standpoint, it appears that the concept of eVTOL is viable and the concept of urban air taxis is also viable. ACHR must manage the cost to develop its own aircraft and must also navigate the complexities of the regulatory approval process; while the FAA has agreed to use approval processes similar to what European regulators will use, there is no assurance that the process will be on the schedule that Archer or any of its competitors are planning.

The speed to market might not matter if every competitor is delayed during the government approval process and if there is enough eventual demand to support multiple manufacturers and providers. There will certainly be consumers that are early adopters but there will certainly also be significant challenges in reaching a stable operating environment which is what is necessary for consumers to be willing to regularly use the services. While flight tests will certainly validate the weather that the eVTOL aircraft can be used in, the chances are high that they will not be able to operate during significant portions of time in many parts of the U.S. The market for services in metros such as S. Florida and southern California will not support an industry. Profitability of eVTOL in general will have to justify expansion of the concept to parts of the country where usage might be low in some seasons of the year.

Archer Aviation has at least one unique challenge compared to other UAM companies. Archer is accused of stealing intellectual property from competitor Wisk Aerospace via the hiring of several key engineers. It is important to note, however, that Wisk is not moving the design which Archer is accused of stealing to production; its latest design not only looks significantly different but also is an autonomous (self-flying) design. ACHR denies that it stole anything and the U.S. Attorney’s office decided not to pursue a case against Archer after an investigation but the primary employee in the case no longer works for Archer. Archer is countersuing and Wisk is required to further define its case in federal court later this year. ACHR’s narrative of the Wisk litigation can be found on pages 13 and 14 of the company’s most recent 10-Q. It is possible that ACHR could be found guilty of illegally obtaining Wisk’s intellectual property but it is more likely that Archer will be able to show that its value as a company comes from bringing a design to market, something that Wisk is not near as close to doing, in part because it chose to use a different design and build an autonomous, rather than piloted, vehicle.

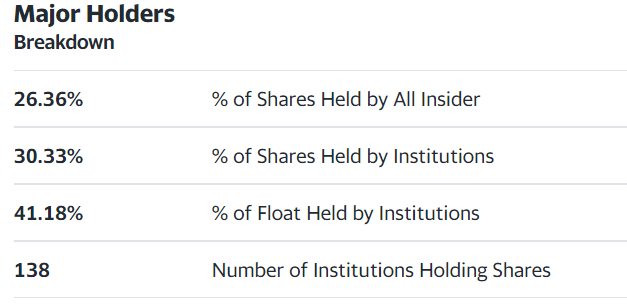

ACHR holders (Yahoo Finance)

ACHR Valuation and Stock Performance

Traded on the NYSE, Archer Aviation has seen a rough year – indeed more rough than the fledgling UAM industry as a whole and worse than the market as a whole with the stock losing 60% of its value. It is now valued at a slight premium to book value but has a market cap of one-third of its principle U.S. competitor, Joby Aviation (JOBY). While both companies have double-digit percentages of short interest, ACHR’s is lower. On most metrics, ACHR is on track or better than its primary U.S. competitor, Joby Aviation.

ACHR 1 year chart (Seeking Alpha)

Ultimately, investing in the eVTOL sector comes down to whether you believe that the sector can move from concept to production in the next couple of years, has a viable product that will meet a real consumer need, a solid business plan to implement a new technology, sufficient capitalization, can navigate the regulatory environment, and is making consistent progress in moving from development to production. It is hard to argue against Archer Aviation on any of those factors.