phuttaphat tipsana/iStock via Getty Images

TFF Pharma (NASDAQ:TFFP) has a unique platform, Thin Film Freezing, to turn drugs into an inhalable form which produces a host of benefits:

- Many drugs are not well absorbed orally, for instance, because they don’t dissolve in water.

- An inhalable form bypasses digestion which enables much lower dosages with lower toxicity, side effects and possible drug-drug interactions.

- They also bring the drug directly to affected areas in case of lung and airway problems (or pathway for the line of attack, as in the case of airborne viruses).

- Dry powder form greatly extends the shelf-life of drugs and vaccines and bypasses cold-chain storage of some vaccines.

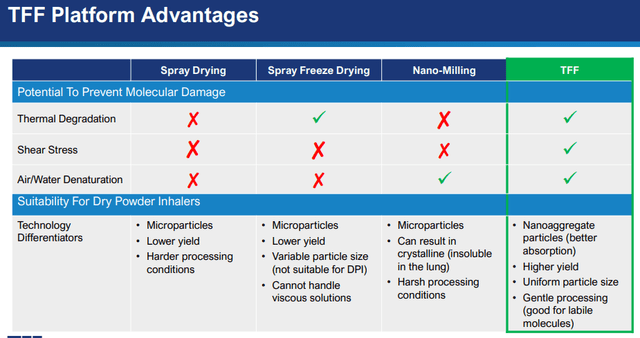

Management also claims their TFF platform is better than alternative forms of dry powder inhalable formulation techniques:

TFFP IR presentation

The company’s specialists recently published a scientific paper (written by the co-inventor of Thin Film Freezing, Bill Williams, Improved Formulations to Enable Stable Delivery of Biologics published in BioPharm International) buttressing the advantages of TFF over other dry powder formulations, in short summary:

- Dry-freezing leads to aggregation in many cases which can negatively impact bioactivity. TFF formulations don’t suffer from this. TFF formulations don’t suffer from this.

- Many biologics are vulnerable and cannot withstand the impact of shear and stress or elevated temperatures during the drying process. TFF formulations don’t suffer from this.

- TFF dry powder formulations preserve bioactivity until 40 degrees Celcius, eliminating cold-chain distribution and storage (which led to $1B+ of Covid vaccine destruction recently). This also holds for vaccines containing the MF59 adjuvant (which require refrigerated storage, but not in TFF powder form).

- Vaccines with MF59 are also sensitive to accidental slow freeze conditions, which TFF formulations obfuscate.

TFF formulations of vaccines and drugs for respiratory illnesses seem particularly promising and management argues that they are working with a number of vaccine producers, but they have said so for quite some time

Yet despite all these compelling benefits it is one of our more frustrating holdings. There is so much potential, and so many possible use cases and partnerships, but nearly all of the progress is made at the pre-clinical stage where they continue to add drug candidates and pharma partners, many of which we discussed in previous articles (see here and here).

It is true that these involve reformulations for already approved drugs and therefore the reduced 50(B)(2) regulatory pathway is not as taxing but this still is a matter of years rather than months but investors hoped that there would be more progress on the monetization front by now.

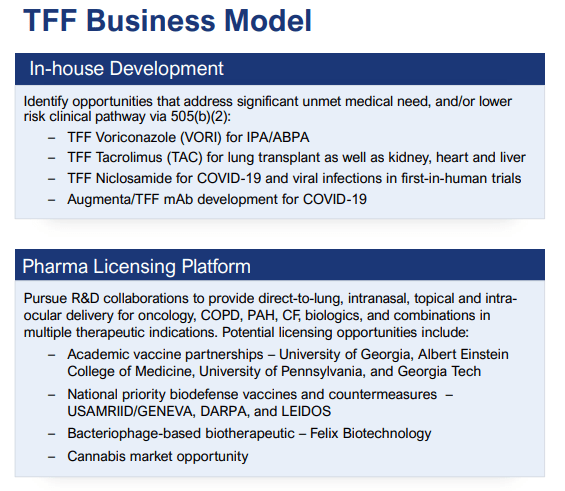

Business model

TFFP IR presentation

The internal development program produces TFF dry powder form of drugs for which patents are expired and the costs are born by TFF Pharma, but at some stage, partnerships are sought to share the clinical trial cost.

The company has four internal development programs (Tacrolimus, Voriconazole, Niclosamide, and Augmenta 3378, an inhaled form of monoclonal antibodies) with Vori and Tac in stage 2 clinical trials as the most advanced of these.

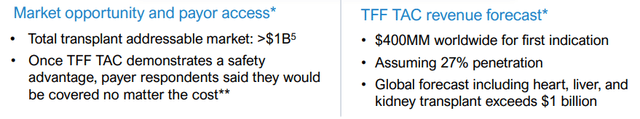

Both drugs have significant market opportunities, here is Tacrolimus

TFFP IR presentation

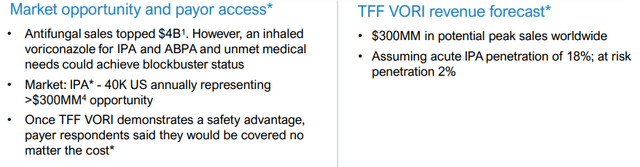

And for Voriconazole:

TFFP IR presentation

The both have phase 2 results expected in Q3 and the idea is that management will look for partnerships (Q2CC):

As previously discussed, we intend to partner these programs and we’re currently working with Torreya Partners to reach out broadly to potential interested companies.

This would bring urgently needed revenues with the company sitting on just $20.9M of cash and cash equivalents, which won’t last them even a year.

UNION Therapeutics could also offer a deal as the results from the phase 1 Niclosamide study were positive and the Covid situation looks to scream for a product like this, from the Q2CC:

And many of the patients that die are in high risk categories, cancer patients, patients who can’t take Paxlovid due to drug-drug interactions. And we think that those patients will benefit from inhaled Niclosamide because they’re — again like Voriconazole when we deliver to the lung, you can avoid drug-drug interactions. And we’ve also seen that from the Paxlovid rebound, it’s very clear that BA.5 and potentially future variants will take longer.

UNION has an option for worldwide licensing which is likely to contain at least some upfront payment. To give you some idea of the possible sums involved, from the linked PR:

Under the agreement, UNION will pay TFF up to 210 million USD related to option exercise, development and commercial milestones, as well as tiered single-digit royalties on product sales.

Management proposed a sort of new model going forward based on the Augmenta 3387 monoclonal antibodies deal (Q2CC):

Augmenta, we were going to take through Phase 1 and still might, and then split proceeds from that point on. So we have a number of different options available to us as we seek to — we kind of refresh and serially look at taking products through the pipeline. In general, Jonathan, it takes about $7 million to $12 million depending on the cost of the API to get us to that inflection point.

It seems like a reasonable cost-saving way to shift the internal development projects once these are taken to their inflection points with monetization deals in place. However, there is a trade-off as future revenues will be lower the earlier a project is shared with commercial partners.

This new handing over after phase 1 trials are completed might have a direct impact on the situation with UNION and TFF formulations of Niclosamide.

On slide 23 of their August 2022 IR presentation there was a footnote that Niclosamide would begin phase 2 trials in Q3/22 with the proviso that it would transition to UNION.

It wasn’t all that long ago that the Roth had a 12 month price target of $27 based on 4x 2030 operating income of $195M from royalties (Vori, Tac and cannabis, so plenty of upside from other programs).

If these royalties are lower because partners assume cost of development then this is at the detriment of their long-term revenue perspective, but it looks like the company has little choice.

Partnerships

The company isn’t just dependent on their own development work, they partner with a host of pharma companies from the start as well.

The company has over two dozen partnerships with pharma companies to produce dry powder form for one or more of their drugs and continues almost every quarter to add to these.

They did so again and gained 3 more top-20 pharma partners in Q2, which is of course significant but not leading to any immediate revenue generation as these are almost certainly early-stage pre-clinical lab-bound formulation agreements.

Surely management hoped they could fund at least a few of their internal programs through monetization deals of these programs, two of such deals were promised before the end of last year but didn’t materialize.

The company has accumulated so many new partnerships that it even had to add a new lab to accommodate all the increasing work, but they argued they did so within the existing budget.

Finances

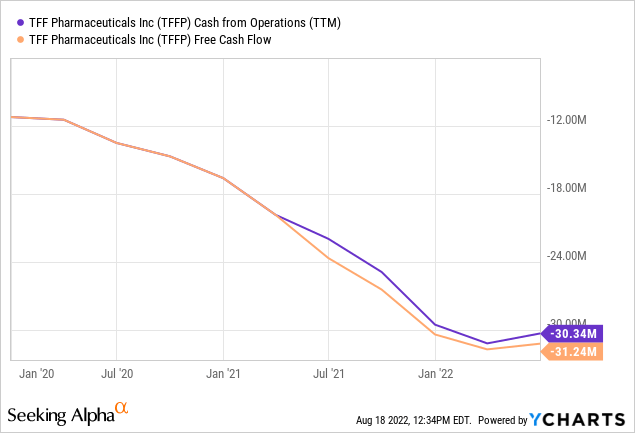

With just $20.9M in cash and equivalents left, the company really has to start generating revenues fairly soon as the cash bleed is significant:

The bleed is varying with the net loss and likely to decline at least to some extent as the two phase 2 clinical trials (Vori and Tac) will conclude in Q3 or early Q4, but still, the company is hardly in a comfortable position.

We were promised two deals by the end of last year, but these didn’t materialize and still haven’t materialized. One of these almost certainly was supposed with PLUS and this is still in the cards.

They tested yet another formulation on consumers and with respect to a commercial launch, management is “hopeful that, that can still happen later in the year.”

They are also introducing the technology to other companies in the cannabis space and feel that it’s a healthier alternative to vaping, so this remains their best bet for a near-term considerable revenue stream as they don’t have to dance through all the phases of clinical trials.

But nothing of this was really new, apart from the new partnerships.

Conclusion

TFF Pharma remains an attractive but frustrating proposition for shareholders. We are quite convinced that their TFF technology will ultimately prevail and be monetized through a significant number of deals.

But it takes time and most of the partnerships are still at a pre-clinical stage, and given the company’s finances time begins to run out for deals to materialize without the company having to resort to additional financing.

If you have patience and a capacity to absorb disappointments, the payoff of this can still be large.

Investors are waiting for the phase 2 results of Vori and Tac, which should arrive in late Q3 or early Q4 and then the subsequent partnership deals with upfront money to give them a financial lifeline.

After a successful phase 1 study Union Therapeutics could lift its option for worldwide licensing of the TFF formulation of Niclosamide, but they might not be in a hurry as there is still considerable clinical work ahead.

PLUS is another candidate from their partnerships and it is entirely up to PLUS to decide when to bring the product to market, they’re not dependent on trial outcomes.