curraheeshutter

From the beginning of the year to mid-June 2022, TransGlobe Energy’s (NASDAQ:TGA) stock price, which is an oil exploration and production company, headquartered in Canada, increased from $3 to more than $5 per share. The stock price dropped below $3.5 as oil prices retreated from their highest levels in 2022. However, crude oil prices are still significantly high, and as long as the war in Ukraine and the nuclear tensions between the United States and Iran continue, oil prices will remain high. TGA is well-positioned to benefit from the market condition. The stock is a buy.

2Q 2022 highlights

In its 2Q 2022 financial results, TGA reported petroleum and natural gas sales of $109 million, compared with 2Q 2021 sales of $85 million, up 29%. The company sold 104 Mbbls of crude oil to Egyptian General Petroleum Corporation (EGPC) for proceeds of $11.8 million. Also, in Egypt, TGA sold one cargo lifting 451 Mbbl of entitlement crude oil during 2Q 2022 for proceeds of $46.3 million. The company’s petroleum and natural gas sales (net of royalties) increased by 48% to $75 million. TGA’s realized derivative loss on commodity contracts decreased from $3.65 million in 2Q 2021 to $0.72 million in 2Q 2022. Moreover, TGA’s production & operating expenses decreased by 25% to $15 million. On the other hand, the company’s selling costs increased by 20% to $2 million.

In the second quarter of 2022, TGA reported funds flow from operations (FFO) of $42 million, or 57 cents per diluted share, compared with 2Q 2021 FFO of $17 million, or 24 cents per diluted share. The company’s 2Q 2021 net earnings of $8 million, or 11 cents per diluted share, increased to $32 million, or 44 cents per diluted share in the second quarter of 2022. Due to planned maintenance at a third-party processing facility in Canada, the average production volumes of TGA decreased by 7% YoY to 12132 boe/d in 2Q 2022. However, it is worth noting that as a result of new development wells drilled in 2022, production in the Eastern desert increased. Also, its average sales volumes decreased by 24% YoY to 12609 boe/d in the second quarter of 2022. Despite the company’s lower sales volumes during the second quarter of 2022, its average realized sales price increased from $56.48/boe in 2Q 2021 to $95.37/boe in 2Q 2022, up 69%. 2Q 2022 average realized price on Egypt sales was $10109/bbl and on Canadian sales was $59.65/boe. Due to higher commodity prices and the company’s improved economic interest under the Merged Concession agreement, TGA’s consolidated netbacks increased by 49% YoY to $42.25/boe in 2Q 2022.

The market outlook

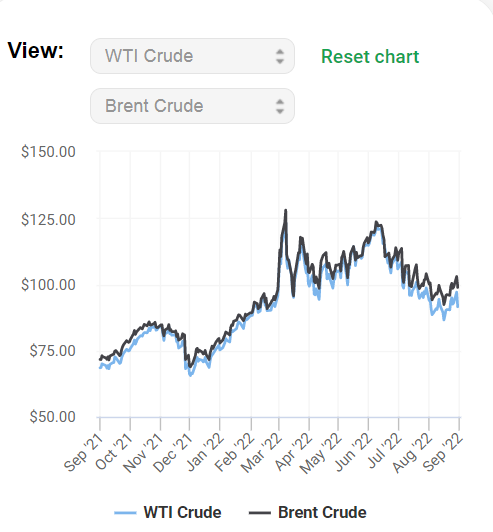

In my last article on TGA, I explained that Due to the continuing war in Ukraine and US sanctions against Iran oil, I expect oil prices to remain high for the rest of 2022. Also, I said that even if the oil prices decline, TGA will do well due to its free cash flow generation ability. From 31 December 2021 to 8 June 2022, WTI and Brent crude oil prices increased from $75 per barrel to more than $120 per barrel (see Figure 1). However, oil prices dropped to below $90 per barrel in mid-August 2022. Oil prices bounced back in the last two weeks. EIA forecasts that the spot price of Brent crude will average $105 per barrel in 2022 and $95 per barrel in 2023. Of course, the end of the war between Russia and Ukraine, or the easing of oil sanctions against Iran, may cause the oil prices to drop even to $70 per barrel in a few weeks. However, I don’t expect the geopolitical tensions in Europe and nuclear tensions between Western countries and Iran to end in the second half of 2022.

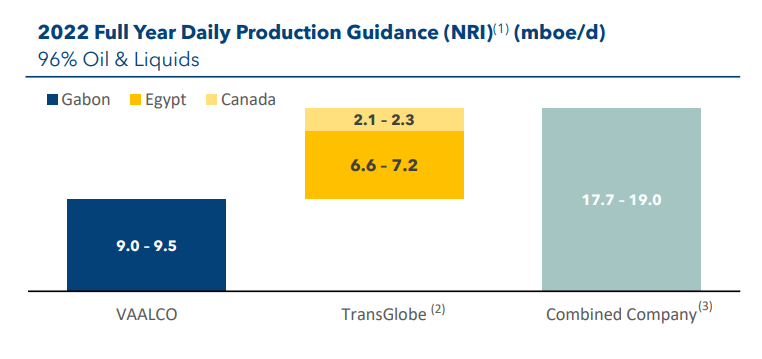

In the second quarter of 2022, TGA’s crude oil average realized price was $95.37 per barrel, up 69% YoY and 16% QoQ. I estimate the company’s 3Q 2022 crude oil average realized price to be $87 per barrel. Based on my estimation of TGA’s 3Q 2022 crude oil average realized price, I estimate that the company’s revenues in the third quarter of 2022 to be $95 million. Moreover, I estimate the company’s FFO to be $36 million in the third quarter of 2022. Figure 2 shows that TransGlobe expects its full-year 2022 daily production (net revenue interest share of volumes on a working interest basis, after deduction of royalty) to be 8.7 to 9.5 mboe/d. According to the company’s production guidance for the full year 2022 and Brent and WTI crude oil prices of around $90 per barrel for the rest of 2022, I estimate the company’s 2022 Canadian crude and Egypt crude netbacks to be $73 and $33 per barrel. Also, with Brent and WTI crude oil prices of around $80 per barrel for the rest of 2022, I estimate the company’s 2022 Canadian crude and Egypt crude netbacks to be $58 and $26 per barrel.

Figure 1 – Crude oil prices

oilprice.com

Figure 2 – 2022 production guidance

2Q 2022 presentation

TGA performance outlook

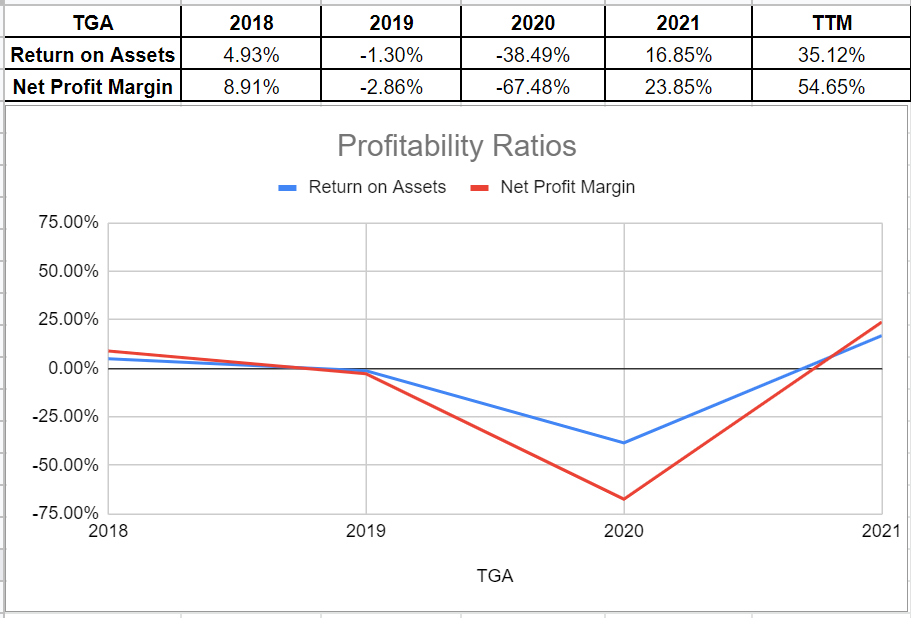

TGA’s net profit margin showed impressive growth and sat on 23.85% at the end of 2021 compared with its amount of (67)% in 2020 when the pandemic started, and we all remember the following plunge in oil prices. The company’s net profit margin kept increasing to sit at 54% in TTM. Which means, for each $1 revenue the company earns about $0.54 net profit. Moreover, across the board of return on assets, the ROA ratio in TTM shows that 35% of the company’s net earnings is related to its assets. TransGlobe Energy’s return on assets boosted impressively during 2021 and sat on 16.85% versus its previous level of (38.5)% at the end of 2020. Both net profit margin and ROA amounts in TTM are well above the amounts before the pandemic started. Ultimately, TransGlobe Energy’s profitability ratios provide a good capture of its ability to generate income relative to the revenue and assets (see Figure 3).

Figure 3 – TGA’s profitability ratios

Author (based on SA data)

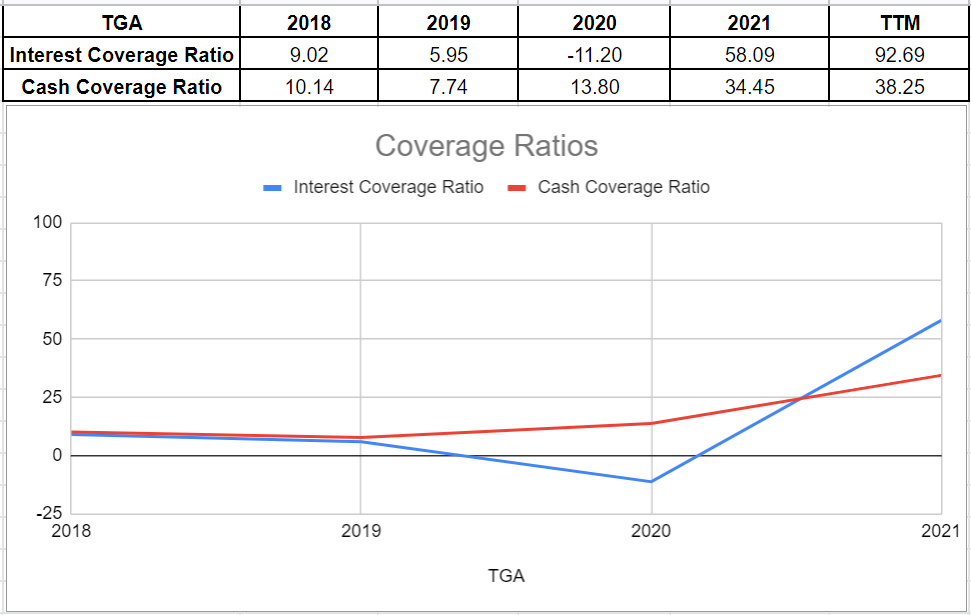

Furthermore, we can analyze TGA’s coverage ability across the board of its interest-coverage ratio and cash-coverage ratio. Its ICR in TTM indicates that 92 times the company can pay its interest expenses on its debt with its operating income. Also, TGA’s cash coverage ratio in TTM has been strengthened slightly compared to its amount of 34.45 at the end of 2021. Thus, as a conservative metric to compare the company’s cash balance to its annual interest expense, TGA’s cash-coverage ratio in TTM has been 38.25, which is quite higher than its amount at the end of 2021. In sum, for the sake of the company’s coverage ratios, there may not be concerns about TGA’s ability to cover its obligations (see Figure 4).

Figure 4 – TGA’s coverage ratios

Author (based on SA data)

Valuation

Analyzing TransGlobe Energy’s financial condition and updating its valuation data indicate that the stock is a good scope for investment. Albeit fairly volatile due to the fabric of the industry, I consider TransGlobe stock undervalued. Even if the oil price declines, the company will be preserved because of its profitability and coverage abilities. Moreover, the management’s strategy of reducing the debt amount will help them to be conserved from unpredictable downturns in oil prices in the future.

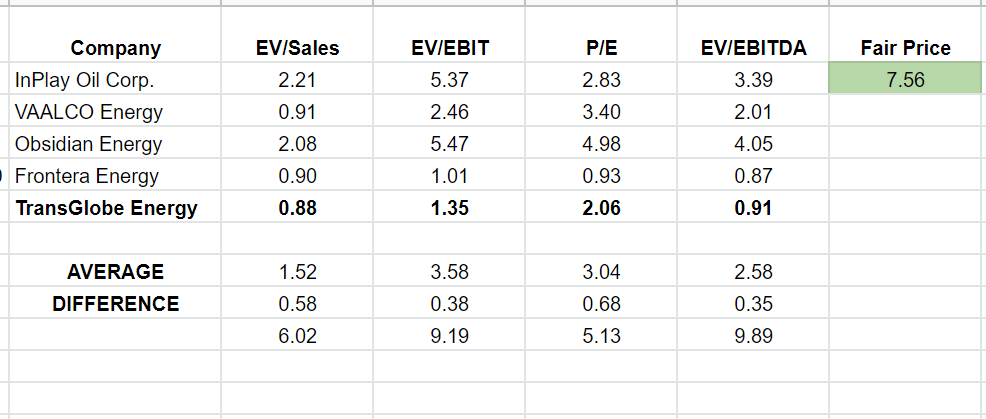

Apart from the company’s performance analysis, I used Comparable Companies Analysis to evaluate the stock’s fair value. The CCA model indicates that the stock is undervalued and has an upside potential to reach around $7 (see Table 1).

Table 1 – TGA stock valuation

Author’s calculations

Summary

My stock valuation shows that TGA is worth more than $7 per share. However, I do not see the company reaching this level in the short term as oil prices retreated from their 2022 record highs. On the other hand, due to the geopolitical tensions in Europe and the Middle East, I do not expect crude oil prices to experience another drop by the end of the year. TransGlobe Energy’s profitability ratios show the ability of the company to generate significant income relative to the revenue and assets. The stock is a buy.