Csondy

Investment Thesis

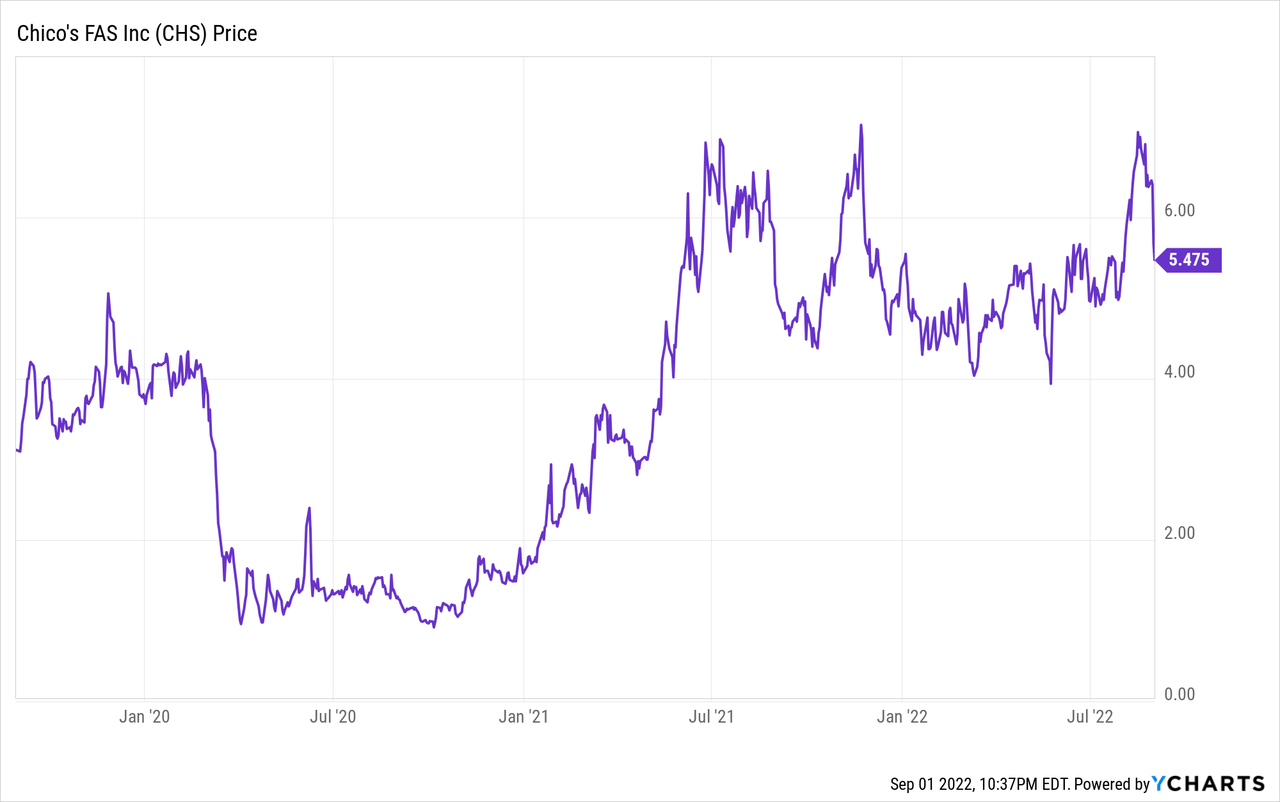

Chico’s FAS (NYSE:CHS) is among the best performing retailers, which is even more impressive given the challenging overall macroeconomic environment. Prior to the pandemic, management set the stage for a massive turnaround, which is now bearing fruition. While other retailers merely battled for survival during the pandemic, CHS became stronger. This is clearly evident in the company’s second consecutive beat-and-raise quarterly report, highlighted by the highest-ever second quarter EPS. Robust sales in digital platforms, as well as effective marketing initiatives, have resulted in gross margin expansion and double-digit operating margins. These operational and strategic wins combined with a core customer who is affluent, recession-resistant, and in need of “occasion wear” create a compelling dynamic for continued momentum into fiscal year 2023. With shares trading at less than 7x the midpoint of fiscal year 2022 EPS guidance, CHS is significantly undervalued.

This is the third article that we have written about Chico’s FAS. Readers can access our earlier articles with these links:

Chico’s FAS: A Chic Turnaround Underway, Potential Substantial Upside

Chico’s FAS: Building Greater Confidence

Background

Chico’s FAS is one of our best stock ideas, given its (1) best-in-class management team that was assembled during the past three years; (2) achievement of a successful turnaround, despite pandemic headwinds; (3) compelling 3-year strategic plan that is already bearing fruition; (4) incredibly loyal affluent customer base that is recession / inflation resistant; and (5) very attractive valuation while being an “unfollowed name” on Wall Street.

While we detailed the new management team extensively in our previous articles, we will simply underscore three core executive team members. Molly Langenstein is Chief Executive Officer and her visionary leadership before, during, and after the pandemic is primarily responsible for the stock increasing more than 6x from its 2020 lows. PJ Guido is Chief Financial Officer, having joined the company approximately a year ago. Guido continues to strengthen this retailer’s balance sheet with strong free cash flow generation, driven by operating margin improvement. In addition, earlier this week, CHS announced the hiring of Leana Less as Senior Vice President of Marketing. Less brings 27 years of marketing experience. In our view, this appointment is a key catalyst for fiscal year 2023 and provides us more confidence for continued momentum. We think Less will significantly enhance the company’s already strong marketing programs to propel customer acquisition and augment customer loyalty, which are critical components of the Chico’s FAS 3-year growth strategy and 4 pillars (customer-led, product obsessed, digital-first, and operationally excellent).

Three-Year Growth Plan

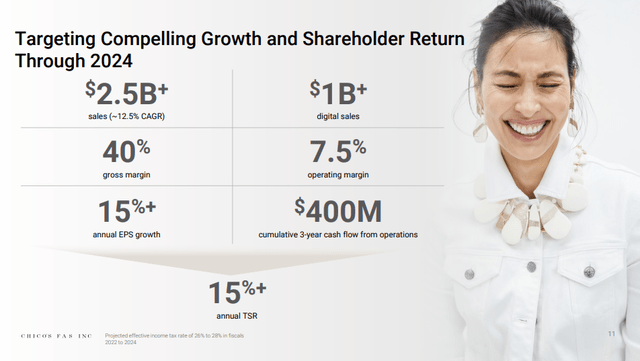

In March, management hosted a virtual investor day, presenting an exciting yet realistic 3-year strategic plan.

Chico’s FAS 3-Year Strategic Plan (Chico’s FAS)

These financial targets through fiscal year 2024 are reasonable and underscore why CHS is significantly undervalued. Despite the anticipated 15% annual EPS growth, the stock currently trades at less than 7x the midpoint of EPS guidance for this year. Moreover, with $73.5 million ($0.60 per share) in net cash on its balance sheet at the end of 2Q:F2022, CHS is trading at less than 6x the midpoint of 2022 EPS guidance. Given $99 million of long-term debt and anticipated $400 million of cumulative operating cash flow through fiscal year 2024, we expect Chico’s FAS to be debt-free by year-end fiscal year 2023, as we conservatively model 50% of operating cash flow to be used for debt reduction and 50% to be utilized for growth-enhancing capital expenditures. Upon reaching a debt-free balance sheet, we expect management to aggressively repurchase shares.

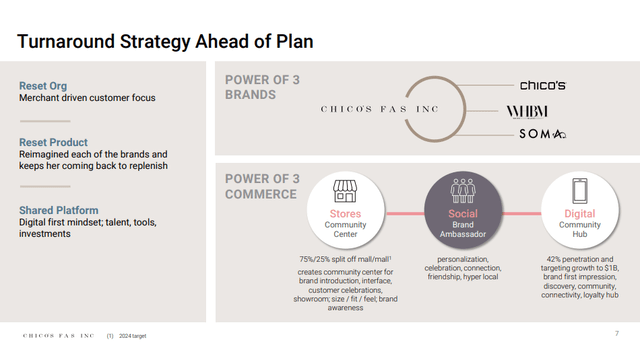

Chico’s FAS Turnaround Strategy (Chico’s FAS)

Underpinning these 3-year financial targets is the successful turnaround led by Langenstein and her executive team. Chico’s FAS is merchant-driven and customer-focused, resulting in improved merchandise quality and fit, as well as a shared platform strategy that synthesizes stores, brand ambassadors, and digital communities / sales channels.

2Q:F2022 Results

Chico’s FAS reported record second-quarter EPS of $0.34, a 62% increase year over year buoyed by 19.5% same-store sales growth and a 300 basis point expansion in gross margin to 41.4%. By brand, same-store sales jumped 30% at Chico’s and 32% at White House Black Market, while retreating by 9% at Soma (due to the slowdown in lounge and cozy categories). Nonetheless, all three brands realized double-digit same-store sales increases compared to the second quarter of fiscal year 2019 (pre-pandemic), highlighting the success of the company’s turnaround. Effective marketing initiatives, strategically focused on digital, drove a mid-single digit increase in the customer count, higher average spend per customer, and a younger average customer age. Moreover, recently launched loyalty programs at each of three brands have led to increased shopping frequency. In sum, these initiatives led to less promotional activity, more full-priced sales, higher average unit retail and stronger productivity.

With these results, CHS raised its full-year guidance.

- Consolidated net sales of $2,140 million to $2,170 million (up from $2,130 million to $2,160 million)

- Gross margin rate as a percent of net sales of 38.8% to $39.1% (up from 38.3% to 38.6%)

- SG&A as a percent of net sales of 32.2% to 32.5% (down from 32.6% to 32.9%)

- Diluted EPS of $0.79 to $0.87 (up from $0.64 to $0.74)

Management raised the midpoint of the EPS guidance range by 20%, yet CHS shares have fallen by 15% in the two trading days since then.

The Bulls Bay View

We believe this stellar performance is clearly the result of management’s vision, strategy, and execution of its turnaround during the past three years. Moreover, unlike many other retailers that merely survived the pandemic, Chico’s FAS clearly utilized the opportunity to become considerably stronger. Not only did this retailer improve every aspect of its operations (merchandising, store fleet, cost structure, etc) but also its emotional connection with customers.

As we think about the market’s upside-down reaction to the extraordinary 2Q:F2022 report, we think irrational pessimism is largely to blame. Chico’s FAS is an underfollowed, small-cap growth stock with minimal sell-side analyst coverage. Excluding boutique research firm, The Retail Tracker, which is not part of consensus estimates, CHS appears to only be covered by two analysts: Dana Telsey of Telsey Advisory Group and Susan Anderson of B. Riley Securities. Anderson was not present on the quarterly earnings conference call. As a result, not much attention is given to this retailer, even when exceptional performance is achieved. Further, at the same that Chico’s FAS announced its results, Express (EXPR) released its report, which was diametrically opposite, particularly for its women’s business during the second quarter as well as outlook for the balance of this year. EXPR dropped 27% in the two trading days, since its second quarter report. Unfortunately, CHS appears to trade at the whims of short-term retail sentiment, which is overall negative. However, we are confident that ultimately the stock price will reflect the long-term fundamentals during the next 12 to 18 months.

A negative view that we have heard is that Chico’s FAS was too positive in its commentary and guidance. A retail analyst tweeted that he is even considering shorting CHS since it raised guidance in this macroeconomic environment. At a minimum, there is skepticism by market participants. However, this skepticism wasn’t given to Lululemon Athletica (LULU), which beat and raised, and traded up 10% in after-hours trading. Langenstein ended the CHS quarterly conference call with this upbeat message:

“We are extraordinarily confident in the momentum of our business and our ability to deliver our outlook. Digital and store sales grew for the quarter. Full price sales were 60% greater than 2019. We delivered higher AUR, traffic and conversion and customers are overwhelmingly responding to our product differentiation.”

This was a powerful communication. If there were ever an opportunity (i.e., risk-free moment) to strike a more cautious tone, this was the time. Retail sentiment is weak and fearful, and many retailers cut their guidance. Since becoming CEO, Langenstein has executed near flawlessly, and she would not risk her credibility if there were even a small chance of missing the heightened guidance.

Another negative spin on Chico’s FAS quarterly report is that the results are so good that they are essentially “as good as they get” and the retailer will be confronted next year by very challenging year over year comparisons. For reasons stated earlier in this article, we think CHS has incredibly strong momentum, given its merchandise and marketing that is resonating with its loyal customer base. The trend of increased demand for occasion wear fashion (work, travel, special events, etc) is likely to accelerate, not decelerate, on the heels of the end of pandemic times. Moreover, women’s fashion is a frequent need. The Chico’s FAS performance is not like that of Peloton (PTON), Teladoc (TDOC), or even Best Buy (BBY), companies that realized “as good as they get” short-term results during pandemic lockdowns. In contrast, CHS results are indicative of successful strategic initiatives, as well as long-term secular growth.

Further, the affluent customer base to which Chico’s FAS caters is likely inflation / recession resistant. Sales trends throughout the second quarter were very strong, even in June when inflation likely peaked. In addition, evidence for the hypothesis that retailers with upper-income clientele are best positioned in this environment was also uncovered by recent quarterly reports from Nordstrom (JWN) and The Gap (GPS).

On the Nordstrom quarterly conference call, Erik Nordstrom, Chief Executive Officer, expressed the dichotomy within retail this way:

“Across both banners [Nordstrom and Nordstrom Rack], the softening trend was more significant in customer segments with the lowest income profiles, while we saw greater resilience in the higher income segments. For example, in the Nordstrom banner, items with lower AURs underperformed higher AURs. Within our Designer business, higher-priced luxury product significantly outperformed lower-priced product. Customers sought newness and responded very positively to the Fall assortment overall, but were less responsive to our private label product and clearance items.”

One of the few bright spots for The Gap is that Banana Republic increased sales by 9% year over year and same-store sales grew by 8%. Banana Republic is the premium brand within the GPS portfolio.

Conclusion

Chico’s FAS is an exceptionally well-managed women’s specialty apparel retailer that is significantly undervalued, even more so after dropping 15% in the two trading days following its beat-and-raise second quarter fiscal year 2022 report. This retailer is growing its affluent customer base, with customers shopping more frequently, spending more per ticket, and buying more full price merchandise. Robust free cash flow has yielded a $73.5 million net cash position. After management raised the midpoint of EPS guidance by 20%, shares trade at less than 7x. After backing out the net cash, the stock trades at less than 6x. These multiples appear low, since the long-term EPS CAGR is at least 15%. Therefore, we suggest the unwarranted 15% selloff presents investors with a buying opportunity, as CHS will likely re-rate higher to be in-line with its fundamentals / earnings power.