ktsimage

Poseida Therapeutics logo (Poseida Thereapeutics website)

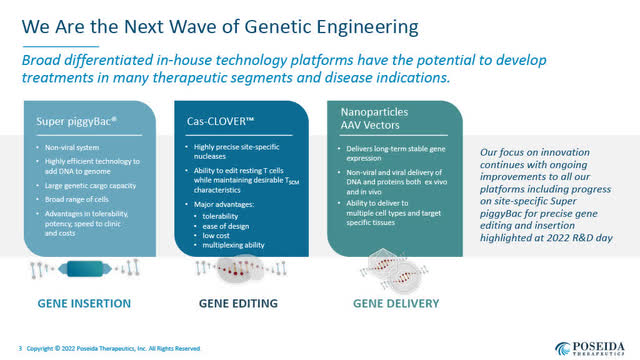

San Diego-based Poseida Therapeutics, Inc. (NASDAQ:PSTX) is a clinical-stage biopharmaceutical company that has developed a suite of proprietary genetic engineering platform technologies to create differentiated cell and gene therapeutics with the potential to cure cancers, rare diseases and beyond with a single treatment with minimal side effects.

Poseida’s market cap of approximately $300 million is equal to its current estimated $300 million in cash (or equivalents), which includes a recent $110 million received from Roche described in more detail below.

For the reasons discussed in this article, the author believes Poseida is currently undervalued.

Poseida’s Three Platforms of Genetic Engineering (Poseida’s August 2022 Presentation)

Poseida’s three central internally developed technology platforms include:

Super piggyBac DNA delivery system (Poseida June 2022 corporate presentation)

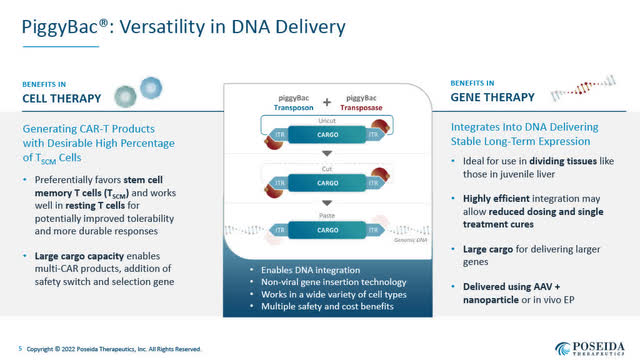

- a non-viral Super piggyBac DNA delivery system for gene insertion, which provides versatility in DNA delivery;

- a non-viral Cas-CLOVER site-specific gene editing system; and

- a nanoparticle and AAV-based gene delivery system.

Poseida believes its technologies provide a differentiated and disruptive innovation in CAR-T cell and gene therapies with the potential to create single-treatment cures.

While Poseida works with third parties contract manufacturers to produce its product candidates, it recently completed building its pilot GMP manufacturing facility in San Diego, California, adjacent to its headquarters to develop and manufacture preclinical materials and clinical supplies for its allogeneic CAR-T Phase 1 and 2 clinical trials. (Source: Form 10-Q filed with the SEC on August 11, 2022).

Roche Strategic Global Collaboration Agreement:

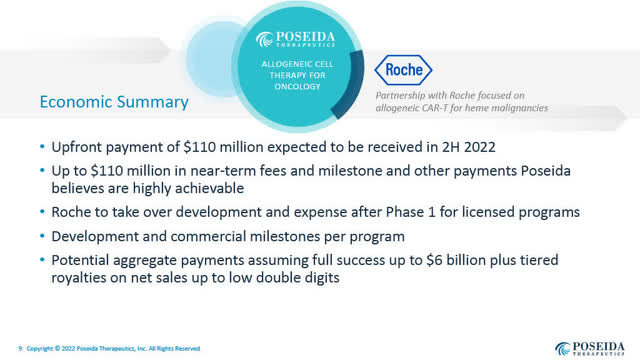

On August 3, 2022, Poseida announced a strategic global collaboration agreement with F. Hoffmann La Roche Ltd. and Hoffmann-La Roche Inc. (collectively “Roche”) (OTCQX:RHHBY) (the “Roche Agreement”) potentially worth up to $6 billion. The deal includes the payment of $110 million upfront, with an additional $110 million in near-term milestone payments based on what Poseida’s CEO describes as readily achievable targets that can likely be met.

The Roche Agreement became effective upon the expiration or termination of the applicable waiting period (generally 30 days) under the Hart-Scott-Rodino Antitrust Improvements Act of 1975. Accordingly, it is anticipated the Roche Agreement will close and be effective by the publication date of this article or shortly thereafter.

The Company held an investor webcast on August 3 to discuss the Roche deal. The webcast is available on the Company’s website here.

$80,500,000 Follow-up Financing:

On August 4, Poseida announced a $70,000,000 financing (20 million shares at $3.50) subject to an additional 30-day 15% broker/underwriter options, all of which were exercised, and which raised gross proceeds of $80,500,000 (approximately $75.3 Million net after fees).

Poseida’s Prospectus Supplement filed on August 4, 2022, with the SEC will be referred to below from time to time as well as the Company’s Form 10-Q filed with the SEC on August 11, 2022.

I also had a 30-minute Zoom call with Poseida’s CEO Mark Gergen on August 9 prior to writing this article.

Investment Summary:

Poseida’s differentiated proprietary genetic engineering technologies are being used to develop and advance next-generation cell and gene therapeutics.

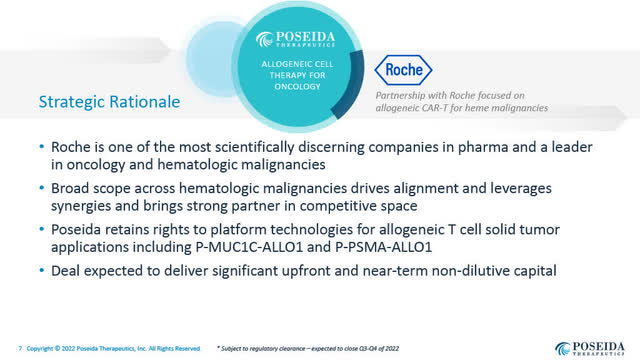

Poseida’s newly announced global collaboration deal with Roche (relating to its existing and additional next-generation allogeneic CAR-T cell therapies in the treatment of hematologic malignancies, potentially worth $6 billion and up to $220 million upfront or near term), follows the announcement in October 2021 of a major Takeda (TAK) collaboration deal worth up to $3.6 billion, relating to Poseida’s gene therapy technology.

The Roche and Takeda agreements help validate the science, value and potential of Poseida’s technology platforms and substantially defray Poseida’s future clinical trial and development costs.

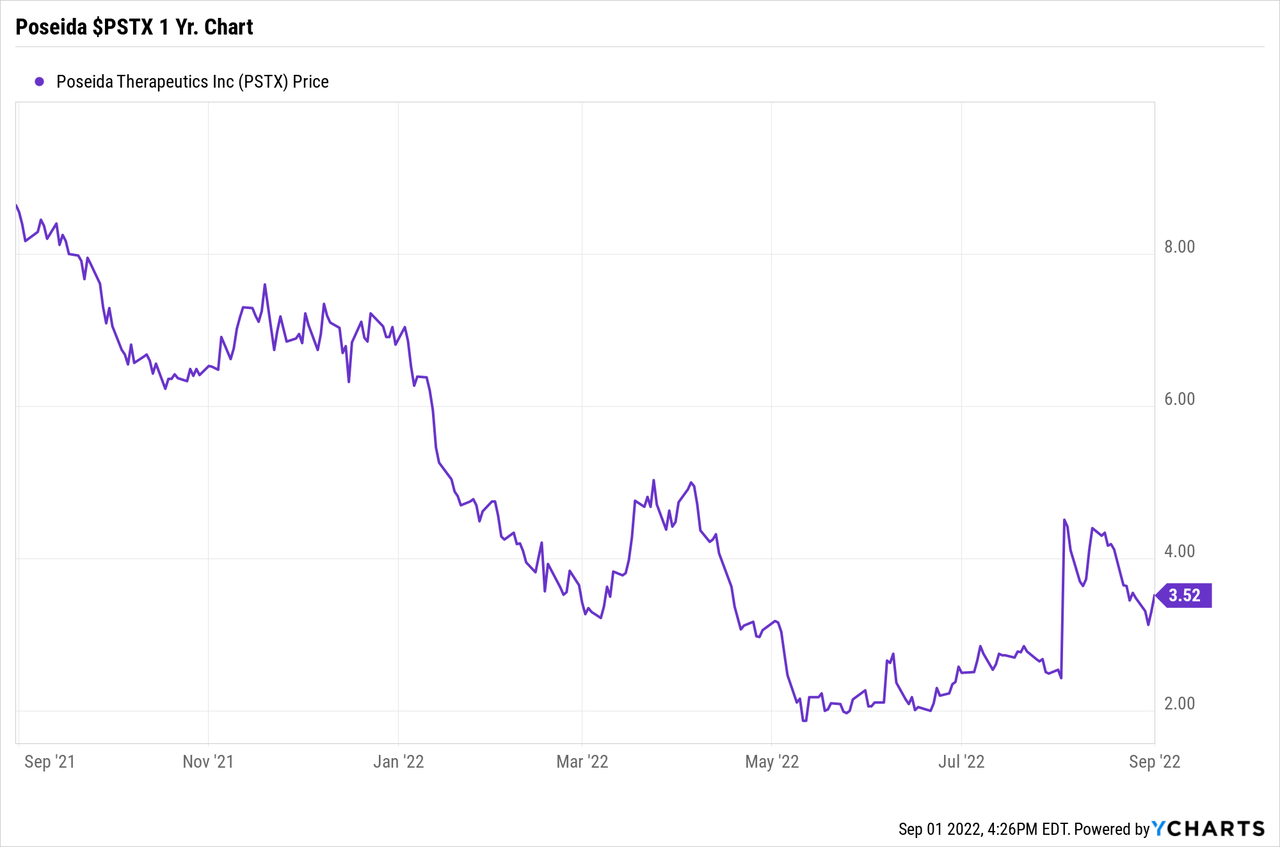

Poseida’s market cap of approximately $300 million is equal to the estimated $300 Million value of its cash (or equivalents) which Poseida is anticipated to have in early September. The author believes that the current market cap undervalues Poseida’s cell and gene platform technologies, multiple cell and gene therapy clinical programs, pre-clinical pipeline, intellectual property and cash.

There appears to be a disconnect in how the scientific and industry community (as validated by the recent Roche Agreement and the Takeda Agreement) views the value of Poseida versus how the market is valuing the Company.

Poseida’s upcoming catalysts include two near-term H2 readouts in two Phase 1 clinical trials as well as the likelihood of receiving an additional $110 million in near-term milestone payments from Roche (which Poseida indicates are milestones that are highly likely to be met within a year, if not sooner).

While Poseida has great promise, it remains an early-stage, high-risk company, suitable for risk-tolerant investors.

Poseida Therapeutics, Inc.: Corporate Summary

1 Year Share Price Range: $1.82 to $8.65

Share Price: Close on September 1, 2022: $3.52

Market Cap, close on September 1, 2022: Approximately $300 Million

85,728,726 common shares outstanding following recent financing: $80,500,000 gross proceeds, or approx. $75.3 million net after fees. There are 85,728,726 common shares outstanding following the recent $80,500,000 financing. (Source: Prospectus Supplement)

The 85,728,726 shares do not include the 12,578,225 outstanding options (weighted average exercise price of $8.06), 2,275,267 restricted stock units, 121,122 warrants ($4.96 average exercise price), 2,614,787 shares that can be issued under the 2020 Equity Incentive Plan, and 1,621,649 shares reserved for future issuance under Employee Stock Purchase Plan. (Source: Prospectus Supplement)

Unaudited cash and equivalents as of June 30, 2022: approx. $142.6 million (Source: Prospectus Supplement)

Cash (estimated by the writer) as of early September 2022: including the $110 million upfront received from Roche and the net $75.3 million received from this month’s financing, I have estimated Poseida’s current cash position at approximately $300 million (my estimate).

Cash Burn: According to its Form 10-Q, filed with the SEC on August 11, 2022, Poseida utilized net cash of $91.1 million during the 6 months ending June 30, 2022. Under the terms of the Roche Agreement, Roche will assume certain clinical trial costs in the future but I am assuming that the cash burn rate will continue at its present rate for the next few years. The Company has provided guidance that conservatively, it currently has sufficient liquidity to carry out its current plans into mid-2024 without taking into account most of the second anticipated $110 million in milestone payments that can be earned in the near term under the Roche Agreement, or including any other milestone payments under either the Roche or Takeda agreements.

Term Debt: According to the Company Form-10Q, Poseida entered into a Loan and Security Agreement with Oxford Finance LLC, as amended in February 2022 under which the Company borrowed $60 million in term loans. Interest-only payments are payable through to April 1, 2025, followed by 23 equal monthly payments of principal and applicable interest, and other terms. The loan may be repaid on terms prior to February 22, 2024, after which it may be repaid without any prepayment penalty.

Poseida’s Cell Therapy Pipeline:

In addition to its gene therapy pipeline (discussed later), Poseida’s Cell Therapy pipeline includes an autologous “auto” as well as allogeneic “allo” chimeric antigen receptor T cell therapies, commonly known as “CAR-T” therapies, in the treatment of various cancers, including solid tumors, multiple myeloma, B-Cell and Heme Malignancies.

For those unfamiliar with the terms, “autologous” CAR-T are derived from the cells of the patient being treated (being a custom and generally very expensive process and potentially deriving cells from a sick and often elderly individual), while an “allogeneic” CAR-T is derived from a third-party donor’s cells which can be replicated making it a cheaper “off the shelf” product, and generally derived from a younger healthy donor.

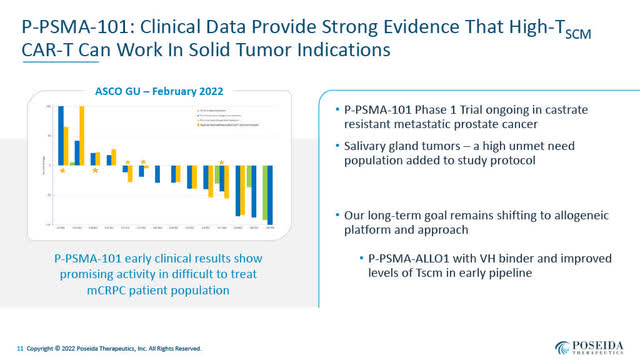

Poseida is focused on advancing its allogeneic CAR-T therapies where it believes the future of CAR-Ts lie, although it began clinical development with an autologous CAR-T cell program, P-PSMA-101, discussed in more detail below, which Poseida believes has provided substantial learnings.

Poseida’s Differentiated Technology:

As Poseida’s CEO Mark Gergen discussed during the August 3 webcast, one of Poseida’s differentiators is its focus on Tscm cells, otherwise known as stem cell memory T cells, which Poseida believes are “the ideal cell type for allogeneic cell therapies.”

Poseida believes it has shown that its proprietary non-viral Cas-CLOVER gene editing technology is a superior method of producing CAR-T cell therapies which use T cells that are genetically modified.

In a peer-reviewed paper published June 29, 2022 in the Journal of Molecular Therapy Nucleic Acids (authored by members of the Poseida team, including founder Dr. Eric Ostertag, MD, Ph.D.), Cas-CLOVER is a novel high-fidelity nuclease for safe and robust generation of TSCM-enriched allogeneic CAR-T cells, Poseida’s Cas-CLOVER gene editing has been shown to preserve a higher percentage of Tscm cells, which have a self-renewing capacity, low off-target activity, and a more effective anti-tumour response.

As set out in the paper’s abstract,

The use of T cells from healthy donors for allogeneic chimeric antigen receptor T (CAR-T) cell cancer therapy is attractive because healthy donor T cells can produce versatile off-the-shelf CAR-T treatments. To maximize safety and durability of allogeneic products, the endogenous T cell receptor and major histocompatibility complex class I molecules are often removed via knockout of T cell receptor beta constant (TRBC) (or T cell receptor alpha constant [TRAC]) and B2M, respectively. However, gene editing tools (e.g., CRISPR-Cas9) can display poor fidelity, which may result in dangerous off-target mutations. Additionally, many gene editing technologies require T cell activation, resulting in a low percentage of desirable stem cell memory T cells (TSCM). We characterize an RNA-guided endonuclease, called Cas-CLOVER, consisting of the Clo051 nuclease domain fused with catalytically dead Cas9. In primary T cells from multiple donors, we find that Cas-CLOVER is a high-fidelity site-specific nuclease, with low off-target activity. Notably, Cas-CLOVER yields efficient multiplexed gene editing in resting T cells. In conjunction with the piggyBac transposon for delivery of a CAR transgene against the B cell maturation antigen (BCMA), we produce allogeneic CAR-T cells composed of high percentages of TSCM cells and possessing potent in vivo anti-tumor cytotoxicity.”

Poseida’s Three Ongoing Phase 1 CAR-T Clinical Trials

As shown in the Cell Therapy Pipeline slide below (also described in Poseida’s Prospectus Supplement), Poseida currently has three ongoing Phase 1 CAR-T clinical trials:

P-PSMA-101 Interim Ph 1 Clinical Results (Poseida June 2022 Presentation)

- P-PSMA-101, an autologous CAR-T targeting prostate-specific membrane antigen “PSMA” developed to treat metastatic castrate-resistant prostate cancer “mCRPC” and salivary gland carcinoma. Encouraging preliminary Phase 1 results in mCRPC were presented by Dr. Susan Slovin of Memorial Sloan Kettering Cancer Center on February 17, 2022 at ASCO-GU. A short video of Dr. Slovin’s ASCO-GU presentation of those results and describing P-PSMA-101 is available here. A slide presentation above summarized the interim Phase 1 clinical data presented at ASCO-GU. Poseida indicates that further clinical results from this P-PSMA-101 Phase 1 trial will likely be presented in 2023. (Note: A second-generation allogeneic CAR-T program, P-PSMA-ALL01, targeting PSMA is currently in pre-clinical development).

- P-BCMA-ALL01, a fully allogeneic CAR-T targeting BMCA developed to target relapsed/refractory multiple myeloma. Initial clinical results are expected to be released in H2 2022, subject to coordination with Roche. P-BCMA-ALL01 will be exclusively licensed to Roche under the newly announced Roche agreement. Under the Roche agreement, Roche will be responsible for the majority of development costs for P-BCMA-ALL01 and will assume all development costs following the completion of the Phase 1 trial.

- P-MUC1C-ALL01, a fully allogeneic CAR-T to treat solid cancer tumours, remains fully owned by Poseida. Initial Phase 1 results are expected to be released in H2 2022 and if successful, will help validate Poseida’s thesis of developing CAR-Ts with a larger proportion of Tscm T-cells to safely and effectively treat solid tumours.

Poseida’s Global Collaboration Agreement with Roche Focused on Allogeneic CAR-T Cell Therapies for Hematologic Cancers Announced August 3, 2022

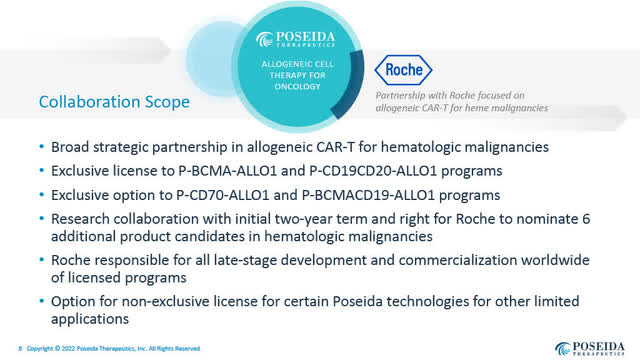

Poseida announced a strategic global collaboration and licensing agreement with Roche (OTCQX:RHHBY) to advance a number of Poseida’s existing and additional next-generation allogeneic CAR-T cell therapies in the treatment of hematologic malignancies.

Poseida retained full rights to its allogeneic CAR-T cell programs in solid tumours.

Poseida’s Global Partnership with Roche (Poseida August 2022 corporate presentation)

Under the Roche Agreement, Poseida will receive $110 million upfront and up to an additional $110 million in near-term milestones, which Poseida believes is highly achievable. In my recent conversation with Mark Gergen, he confirmed that by “near-term” he meant that the $110 million in milestones would highly likely be achieved within approximately 12 months.

In addition, Poseida is eligible for additional net milestones and other payments from Roche potentially worth up to $6 billion in value, as well as tiered royalties into the low double-digits on net sales royalties.

In return, Roche gets access to a number of “off-the-shelf” allogeneic CAR-Ts for hematologic malignancies, including P-BCMA-ALLO1 for multiple myeloma, (currently in a Phase I study), and P-CD19CD20-ALLO1, described as an allogeneic “dual CAR-T” for B-cell malignancies, for which an IND is anticipated to be filed in 2023.

Poseida and Roche will also work on additional targets.

Economic Summary of Roche Agreement (Poseida August 3, 2022 presentation)

Strategic Rationale for Roche Agreement (Poseida August 3, 2022 presentation)

Collaboration Scope of Roche Agreement (Poseida August 3, 2022 presentation)

October 2021: Poseida – Takeda Collaboration Agreement in Gene Therapy

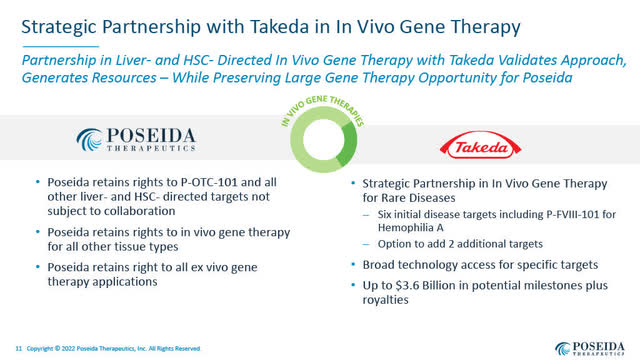

The Roche deal follows a major research collaboration and licensing deal in In-Vivo gene therapy that Poseida entered into with Takeda Pharmaceutical Company Ltd. (TAK), announced on October 12, 2021.

The Takeda agreement provided Poseida with $45 million upfront and potentially up to $3.6 billion in payments if all options are exercised and milestones achieved, in addition to tiered royalties on commercial sales.

Strategic Partnership with Takeda (Poseida August 3, 2022 presentation)

The Takeda agreement allows Takeda,

…to utilize Poseida’s piggyBac, Cas-CLOVER, biodegradable DNA and RNA nanoparticle delivery technology and other proprietary genetic engineering platforms for the research and development of up to eight gene therapies”.

Poseida’s Senior Leadership Team:

Poseida has an experienced management team led by Mark Gergen, appointed CEO in February 2022. Prior to that date, Mark Gergen was Poseida’s President and Chief Business Officer. He has been a director since 2018. Prior to Poseida, he was Senior Vice President and Chief Operating Officer of Halozyme, Inc. and Executive Vice President and Chief Operating Officer at Mirati Therapeutics (MRTX). (For more information about Poseida’s leadership team, see Poseida’s website)

Directors:

Poseida has a group of 7 very experienced Directors. Their names and biographies can be found on Poseida’s website here. Of particular note, In addition to Mark Gergen, Poseida’s Directors include:

Executive Chairman Dr. Eric Ostertag, M.D., Ph.D., who served as Poseida’s founding CEO from July 2015 to January 2022. According to Poseida’s website, Dr. Ostertag invented or co-invented a majority of the genetic engineering platform technologies used by Poseida for human therapeutics.

Dr. Charles Baum, President, Head of Research and Development, and a Director at Mirati Therapeutics (MRTX), a company he founded and where he served as CEO from 2012 to 2021.

Ms. Cynthia Collins, with more than 40 years of experience in cell and gene therapies and the life sciences, served as the CEO of Editas Medicine (EDIT), a leading pioneer in gene editing.

Poseida’s Scientific Advisory Board also includes an impressive group.

Upcoming Catalysts

Poseida’s upcoming milestones and catalysts include:

- Phase 1 Clinical update from P-BCMA-ALL01, fully allogeneic CAR-T targeting BMCA developed to target relapsed/refractory multiple myeloma in H2 2022 (although the disclosure will be subject to coordination with Roche);

- Phase 1 Clinical update from P-MUC1C-ALL01, fully allogeneic CAR-T to treat solid cancer tumours, which remains fully owned by Poseida in H2 2022;

- Phase 1 clinical results from P-PSMA-101, autologous CAR-T, in the treatment of mCRPC in 2023;

- Second-generation pre-clinical allogeneic CAR-T program, P-PSMA-ALL01, targeting PSMA; IND filing and initiation of Phase 1 clinical trial in 2023 (disclosure subject to coordination with Roche);

- Additional milestone payments of $110 million from Roche in H2 2022 and 2023 (my estimate based on management’s advice that the milestones are easily achievable within approximately the next 12 months).

Analysts’ Price Targets

Firm: Recommendation Price Target Date

BTIG (Justin Zelin) Buy $20.00 Aug. 18, 2022

Cantor Fitzgerald (Jennifer Kim) Overweight $24.00 Aug. 12, 2022

William Blair (Raju Prasad) Outperform No PT Aug. 11, 2022

Piper Sandler (Edward Tenthoff) Overweight $11.00 Aug. 11, 2022

BofA Securities (Alec Stranahan) Buy $12.00 Aug. 3, 2022

Summary

Both the recently announced Roche Agreement and last October’s Takeda Agreement have helped validate the science and potential of Poseida’s differentiated proprietary genetic engineering technologies as well as some of its clinical stage and early-stage pipelines.

Poseida’s proprietary technologies include:

1. non-viral Super piggyBac DNA delivery system for gene insertion;

2. non-viral Cas-CLOVER site-specific gene editing system; and its

3. nanoparticle and AAV-based gene delivery system

Poseida’s near-term catalysts include its two near-term H2 clinical Phase 1 readouts, and third Phase 1 clinical results from its autologous drug candidate in 2023.

In addition to its current cash position, there is also the likelihood of receiving an additional $110 million in near-term milestone payments from Roche (which Poseida indicates are highly likely to be met and the amounts paid within approximately 12 months).

With a market cap of approximately $300 million, equal to the estimated $300 Million value of its cash (or equivalents), Poseida’s cell and gene platform technologies, multiple cell and gene therapy clinical programs, pre-clinical pipeline, intellectual property and cash are undervalued.

There appears to be a disconnect in how the scientific and industry community (as validated by the recent Roche Agreement and Takeda Agreement) views the value of Poseida’s technologies and pipeline assets versus how the market is valuing the Company.

Analysts covering Poseida have a bullish view of Poseida’s potential.

For investors who have done their due diligence and understand that Poseida is an early-stage biotech company with a high risk/ high reward profile, Poseida may be an attractive investment, particularly for those with a 2 to 4-year investment time horizon.

Risks

Poseida should be considered a high-risk, early-stage company that is unlikely to generate material revenues, let alone profits, for years to come. Investors could lose some or most of their investment.

While Poseida has indicated that it has sufficient liquidity to fund its operations including clinical trials through to mid-2024, and will likely earn additional milestone payments under the Roche and/or Takeda agreements, there is no assurance that it will have sufficient funds longer-term to fund its operations.

For further details of the potential risks involved, see the risk factors set out in the company’s most recent public SEC filings available on the Company’s website and on EDGAR.