frantic00

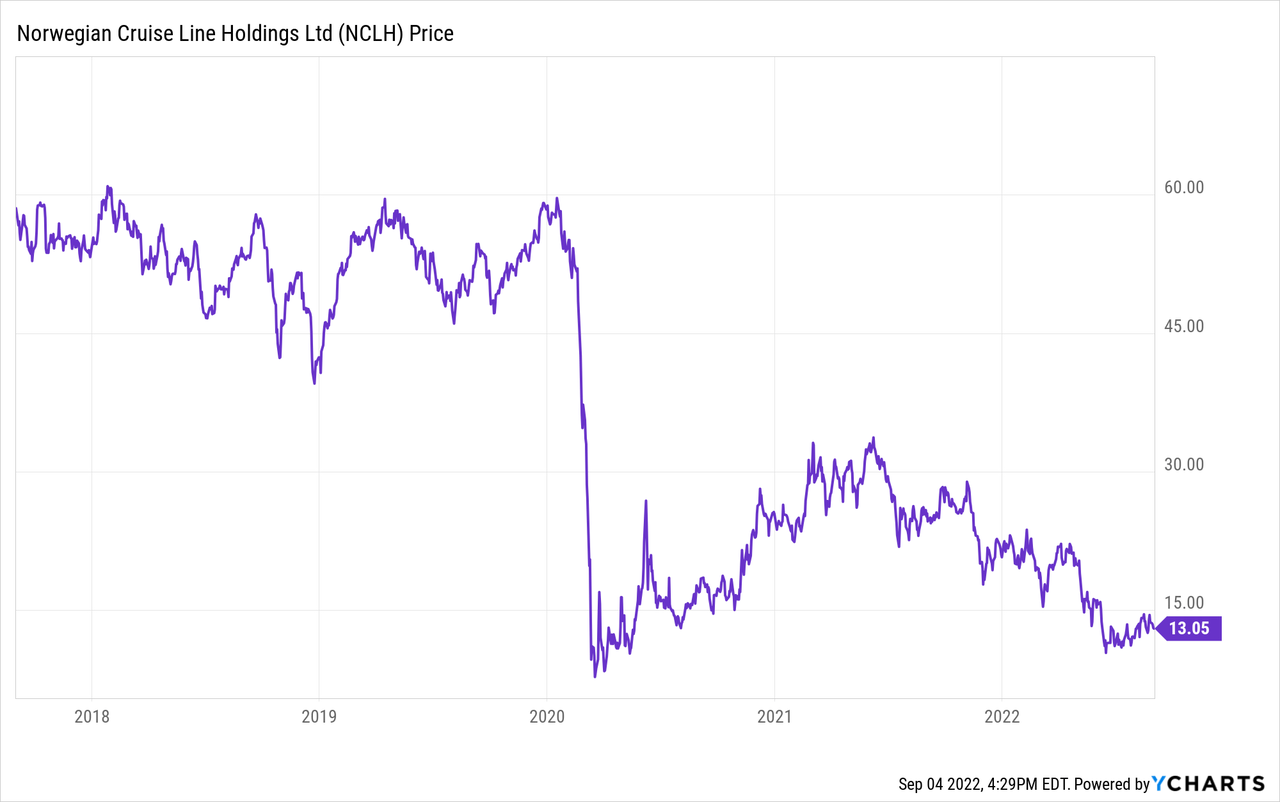

Norwegian Cruise Line (NYSE:NCLH) was a stock that was absolutely battered in the COVID-19 pandemic. The company’s fortunes and its stock price by extension. It had since mounted a miraculous return from the pandemic lows, but the recent turmoil in equity markets brought about largely by the Federal Reserve adopting a hawkish approach has once again brought the stock to its knees.

Cruise lines are somewhat of a cyclical opportunity, which means you usually don’t want to hold them going into a possible recession. Still, with valuations this low, one has to ask is Norwegian Cruise Line a buy at these levels?

Company Outlook

Norwegian is coming off of an understandably poor earnings report. As inflation and talks of a recession have checked consumer confidence, optional luxury purchases like vacations and cruises would expectedly see some headwinds.

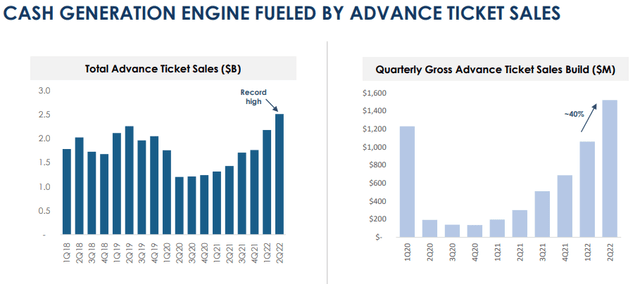

Interestingly, Norwegian has continued to produce strong ticket sales, recently hitting a record high in the second quarter of 2022.

Norwegian Cruise Line

This is an excellent sign of life for investors as the thesis that there is some version of pent-up demand brought about by the drop-off during the Covid 19 pandemic may be gaining credence. There is also the fact that the United States recently lifted its Covid 19 test requirements for international travel. Cruises often involve complicated steps due to the tendency to visit multiple nations while on board. It was likely because of this that the company had been seeing lower revenue numbers in the last fiscal year. But as the world moves past the pandemic, there should be elevated demand for an extended period. Investors should pay keen attention to testing requirements for developed nations and any new variants that may threaten travel demand. But for right now, signs are pointing to a global easing of travel restrictions, and Norwegian has managed to get its full fleet deployed, which is always good news.

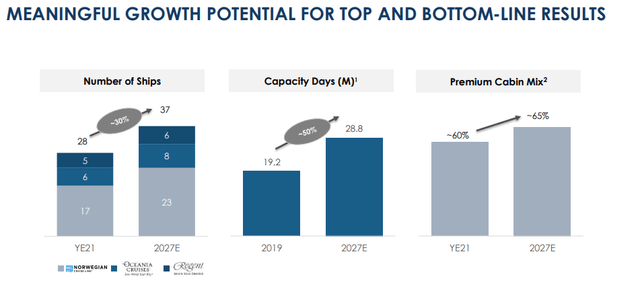

Norwegian also has aggressive growth targets for its fleet. The company is looking to increase its number of ships by 30% by the end of 2027, which would leave it at 37 ships while also increasing capacity days by 50% during the same period of time.

Norwegian Cruise Line

The company is confident that its moves will begin to bear fruit for investors in the not-too-distant future. In the recent report, the management team mentioned that they expect 2023 EBITDA to be a record. This will likely be brought about by the return of occupancies to normal levels and superior pricing in 2023 vs. 2019. We believe this is a reasonable target in the event that the world only sees a mild economic slowdown, with a recovery beginning in Q2 2023.

Valuation and Forward-Looking Commentary

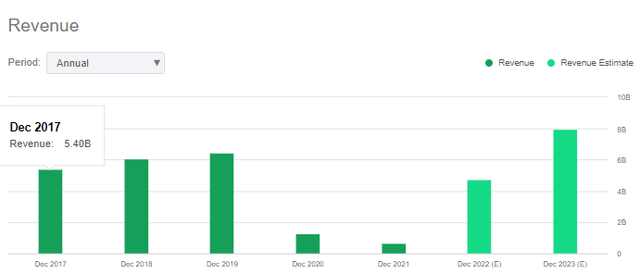

Norwegian Cruise Line is still in the middle of its pandemic recovery. While the Company is putting in its best performances since the Covid 19 pandemic, there’s still a long way to go. We shouldn’t see revenue rise above 2019 highs until the end of 2023. This wouldn’t be an awfully long time for investors to wait, especially when you consider that we may be going into one of the biggest global slowdowns in US history.

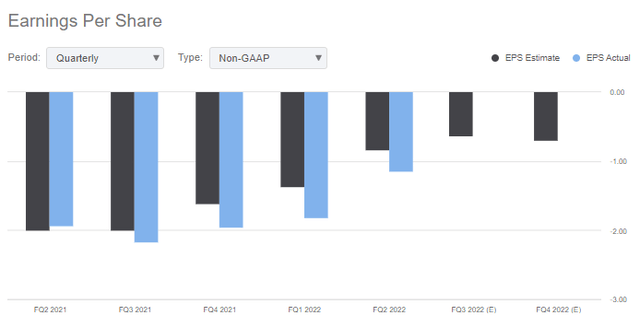

Seeking Alpha

The company is also facing its standards with profitability And has been having a hard time living up to expectations, missing EPS estimates in four of the last five reports.

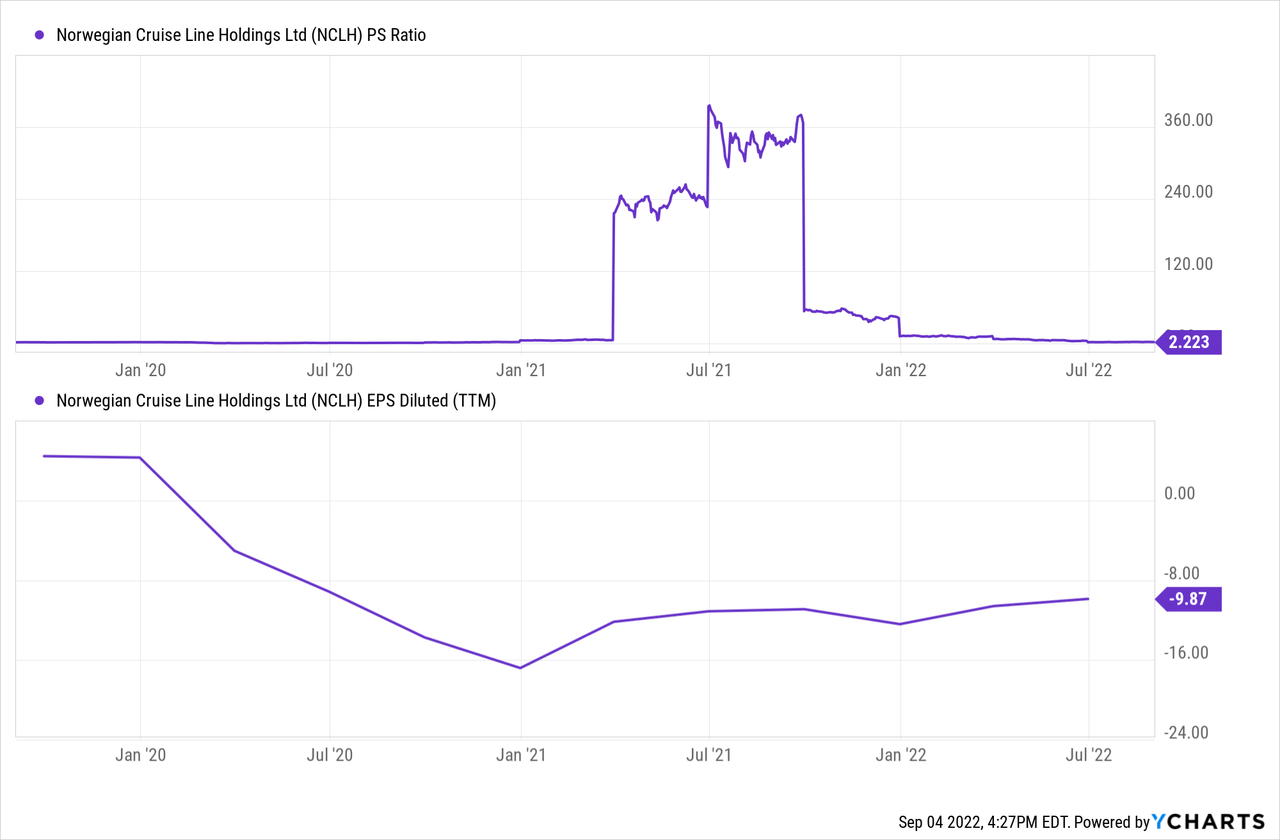

SeekingAlpha

At current levels, investors are paying just $2.22 for each dollar of the company’s revenue which typically implies that the stock is trading at bargain levels. The problem is with the poor EPS performance and clear headwinds in the short term; one may argue that the low valuation is deserved. Concerning multiples and short-term risks, I would argue that Norwegian is fairly priced at current levels.

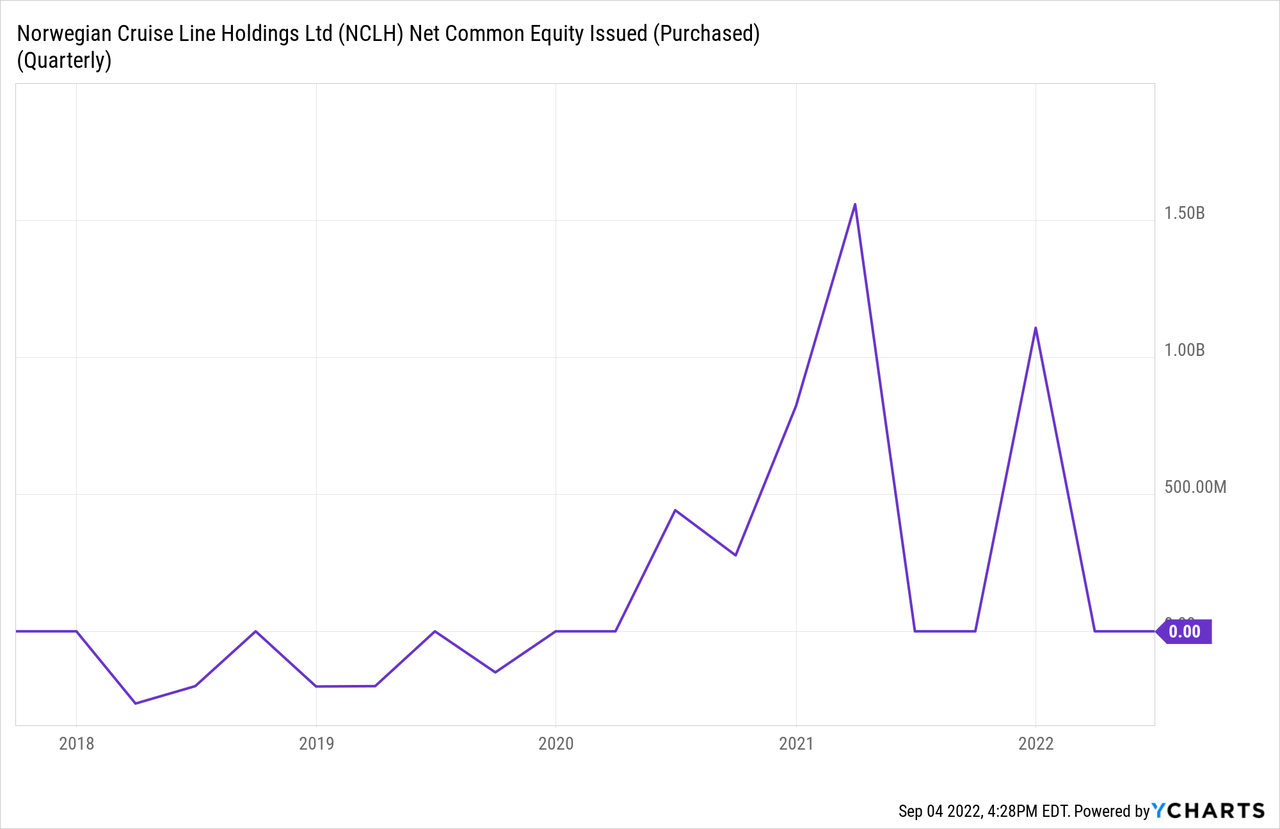

Because of this, the company has been relying on secondary offerings to bolster liquidity which is never ideal but certainly understandable. We can, however, see that EPS figures are at least trending in the right direction, and the main reason for the drop-off in the company’s performance now looks to be in the rearview mirror.

I do have concerns about the need for further dilution in the future. At the time of the right thing of this article, the company had roughly $4.53 per share in cash, which sounds robust. Still, when you consider that they had recently been putting in Quarterly EPS losses of more than $1.5 per share (and -$9.87 EPS TTM) and that we are possibly in the early stages of a recession, there is some cause for hesitation. There are no real execution concerns for Norwegian, the management team is doing the best they can, but they have been dealt a tough hand of cards here.

The Takeaway

Norwegian is more of a revenue recovery story than gross undervaluation. The management team is demonstrating its experience with prudent moves operationally and with offerings. It would perhaps be prudent for them to strengthen their balance sheet via further dilution in the near term. If strong ticket sales growth continues, they may not need to do this, and for right now, things are looking encouraging. I eagerly await their return to profitability as they have been somewhat unfairly battered by the pandemic and tight travel restrictions. I am bullish on the company long-term but in no great rush to buy due to the short-term risks associated with anything travel related in a slowdown. At some point, I think we may see an amazing bargain on the stock, but we are not there yet. I rate the stock a Hold.