ANNVIPS

Thesis

Skechers U.S.A. (NYSE:SKX) is a stock that we believe is worth taking a look at. The company’s recent financial performance and guidance have been good and exceed its also solid historical growth rates. We believe that the company’s brand and product offerings should provide a solid moat for the business, and based on our analysis, we believe the stock is valued attractively based on historical metrics.

Company Overview

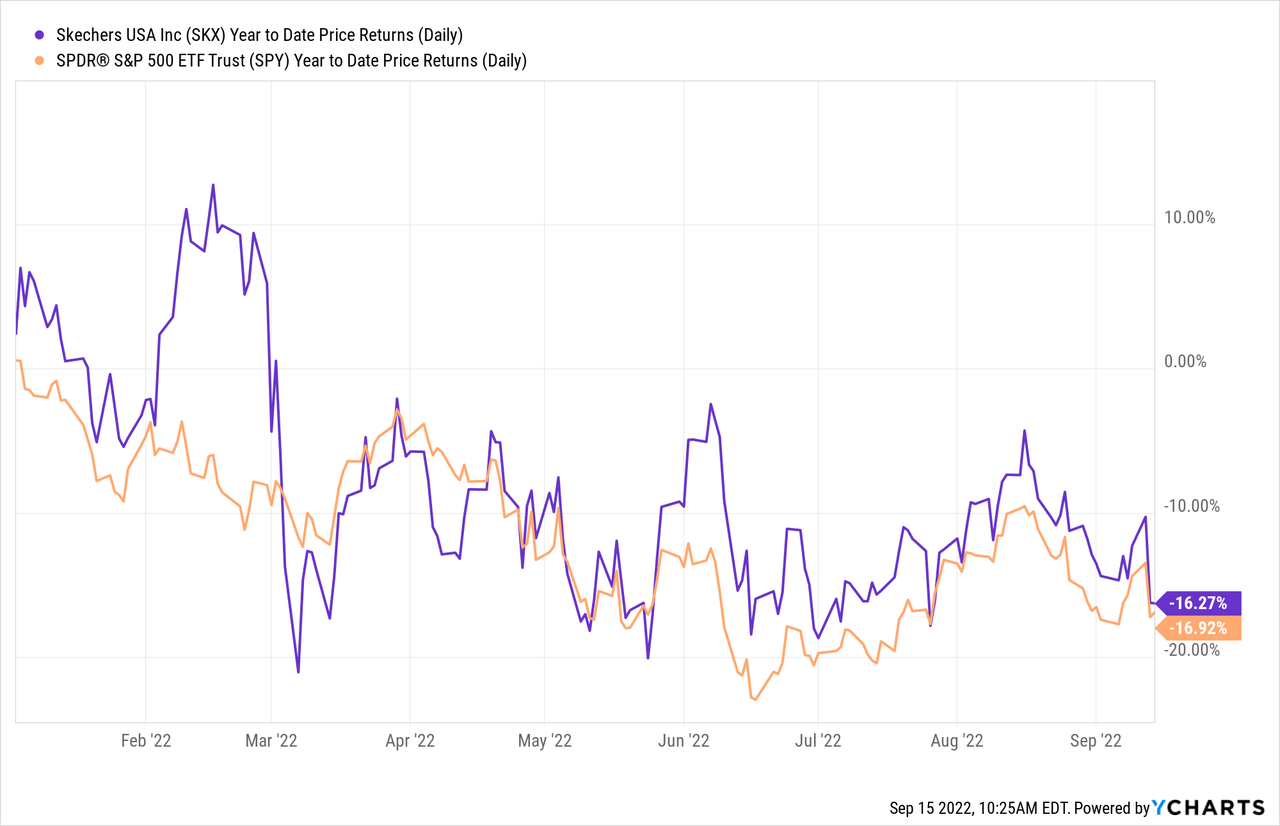

Skechers U.S.A., Inc. is an American multinational footwear company headquartered in Manhattan Beach, California. The brand sells primarily footwear such as athletic shoes and is now the third-largest athletic footwear brand in the United States. In 2021, the company reported shipping more than 200 million pairs of shoes. The company’s stock performance has been in-line with the overall market returns. Skechers returned -16.27% year-to-date, compared to S&P 500’s return of -16.92% in the same time frame.

Financial Performance

Strong Revenue Growth

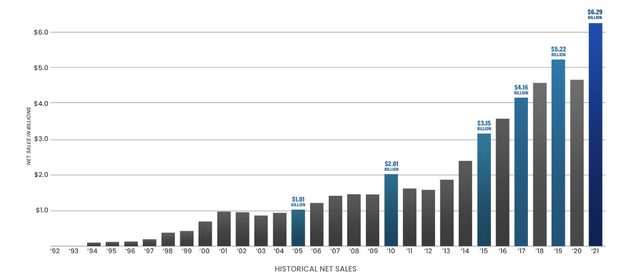

The company’s Q2 2022 financial results included many bright spots for investors. Management reported a quarterly sales number of $1.87 billion in Q2, which presented a YoY increase of 12.4%. Given supply chain disruptions, China COVID-19 lockdowns, and the pandemic, the company’s ability to grow its top-line is significant and shows the resiliency of the business. In the Americas alone, the company reported an even higher 21% YoY quarterly revenue growth. Such performance is similar to the company’s historical financial performance, as the company has been able to steadily grow its revenue for the past few decades. From 2010 to 2021, Skechers has seen a ~10% revenue CAGR, which is remarkable for a standalone footwear brand.

Q2 2022 Earnings Presentation

Share Repurchase Program

In Q2 2022, Skechers purchased around $24.2 million of its shares as part of its $500 million share repurchase program. Management reports that approximately $450.8 million remained in the share repurchase program, which should boost investor confidence and stock price support. The company has previously also conducted additional share buyback programs in its long history, and we believe that such programs are likely to continue to increase shareholder return.

Upbeat Guidance

Guidance for Fiscal Year 2022 remains upbeat, with management reporting a sales guidance between $7.2 billion and $7.4 billion for the year. Using the midpoint of this guidance range, that presents a 16% YoY revenue growth. Such revenue growth is extremely strong given the unideal macroeconomic environment, and we believe the guidance shows management’s confidence in its business prospects and their ability to execute on strategic targets.

Strong Brand and Product Offerings

Skechers is well-known among consumers, especially for providing shoes that are comfortable and stylish to wear. We believe the popularity of the brand provides a large moat for the business, as brand value and consumer loyalty are hard to replicate. Though the brand is not as well-known and/or global as Nike (NKE) or adidas (OTCQX:ADDYY), we still believe it has better brand recognition than smaller, boutique brands, and that should provide enough competitive advantage to compete against any new entrants in the market. In addition, the company’s recent product line called “GOrun MaxRoad” has proved to be very popular with consumers, and many reviews have called the product to be some of the best in class running shoes for an affordable price range.

Valuation

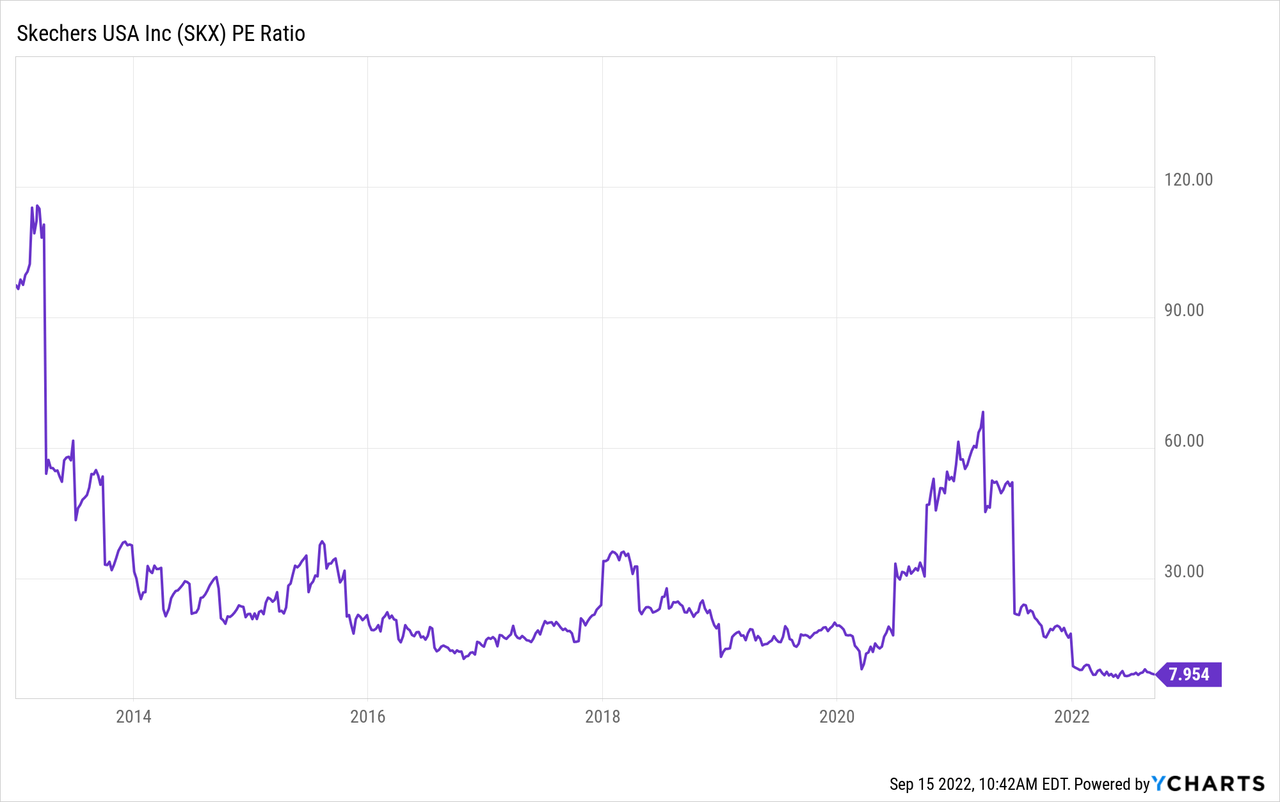

We like to look at historical valuation PE levels as a quick measure to make sure that we are buying at the lower ranges of the historical valuation. Right now, the company trades at ~7.95x trailing P/E ratio and that valuation multiple is at historic lows as one can see below. With an implied earnings yield of 12.5%, we believe that investors will be getting a good value for a company with strong fundamentals, brand value, and solid growth. In addition, given the remaining share buyback program, we believe this multiple is simply too low.

Risks

Inflationary risks are considerable given the company’s reliance on raw materials and the fact that it is operating in a consumer discretionary industry. The recent CPI print has significantly raised expectations for continued rate hikes, and such monetary policy could significantly affect consumption in the U.S. and abroad, which can have significant impact on Skechers’ financial performance. Though Skechers will nonetheless be impacted as inflation persists, we believe that the company has a strong balance sheet to help them remain flexible during uncertain economic times. The company has around $750 million in cash, which represents more than 10% of its current market capitalization. In addition, the company is well diversified across the globe, and there doesn’t appear to be any outsized risk to a particular demographic or region. Lastly, the company also operates some stores using a franchisee model, which should help provide more consistent cash flow.

Conclusion

Skechers is a great consumer discretionary stock that we believe is at the lower end of its valuation and should deserve your attention. The company’s financial performance has been overall strong despite the minimal catalysts to boost the brand, and we believe that the company’s market and financial position should help minimize any major issues in the event of a higher-than-expected inflationary environment and/or recession.