Jonathan Kitchen

Plains All American Pipeline’s (NASDAQ:PAA) business model relies heavily on growth from the Permian Basin in Texas and New Mexico. During the past few months, the Energy Information Agency’s (EIA) weekly report continues to show significant levels of gasoline demand destruction (up to 7%). Yet, crude inventories continue to collapse, suggesting significant production increases are still needed to stabilize the petroleum material balance. Demand destruction could hinder Plains from achieving its growth goals. Or will it, and is the destruction real?

The Backdrop

Before reviewing Plains’ most recent report, an honest look at real consumption is necessary. The EIA reports several critical petroleum numbers weekly on Wednesday for the previous week. In the past, investors and markets relied heavily upon this report for decision-making. In the past several weeks, analysts, for good reason, started challenging the accuracy and honesty of the numbers. From a report on Oilprice several suspect arguments surfaced.

“”For the week ending July 22nd, implied gasoline demand rebounded to 9.2 million b/d – a 1 million b/d increase vs the last two week average, and the second highest level of 2022,” BofA wrote in the note to clients. Curiously, the EIA reported a steep drop in gasoline demand shortly thereafter, prompting Piper Sandler global energy strategist to label the data “crooked”, saying the methodology left “significant room for error”.”

Continuing:

“We are supposed to believe that in July, in the middle of driving season we are only using 8.6 million barrels per day. That would be down half a million barrels a day from May of this year; that would be below the Covid low of 2020,” Sandler noted. “So we ask all the refiners, we ask all the retailers, we ask everybody that reported earnings this season. Every single one of them tells you that their sales are not down materially from even pre-covid days. Some report record high sales,”

CEO Gary Simmons of Valero (VLO) had this to say:

“I can tell you, through our wholesale channel there is really no indication of any demand destruction… In June, we actually set sales records. We read a lot about demand destruction and mobility data showing in that range of 3% to 5% demand destruction. Again, we’re not seeing it in our system.”

Valero is the second-largest refinery in the United States. From another source, GasBuddy, also tracks retail demand, which during the same week had usage up 2% year over year while the EIA reported down 7%. Something is amiss. Although the refineries might have been selling overseas from its natural competitive advantage, GasBuddy data throws ice water on that thought.

With respect to outside competition, primarily OPEC+, the damage isn’t likely solved outside through an Iran deal either. OPEC claimed to cut production recently, claimed. In truth, “[t]he small cut is actually quite irrelevant considering that OPEC+ is estimated to be some 2.9 million bpd behind collective quotas.”

The Last Quarter

Next let’s review a few financial numbers, but the real important investor story follows afterward. The company reported:

- EBITDA equaled $615.

- Full year 2022 EBITDA guidance increased by $100 million to plus or minus $2.375 billion.

- Outperformance of NGL and crude oil transportation drives the upgraded numbers.

- Leverage target ratio of 4.0 by year’s end.

- Asset sales target increased by $100 million.

- Cash used to repurchase a modest amount of stock at $50 million.

Management offered a few comments dealing with inflation. Although much of the business is insulated, management noted, “All of this being said, we continue to expect annual escalators to offset expenses and provide a modest net benefit.” Expect higher tariffs.

The Company

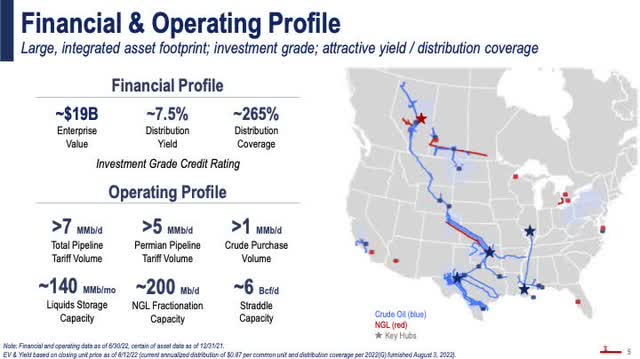

Several slides from Plains’ last presentation follows. The first summarizes the company. Its yield is modestly low at 7.5%. Why?

Plains All American

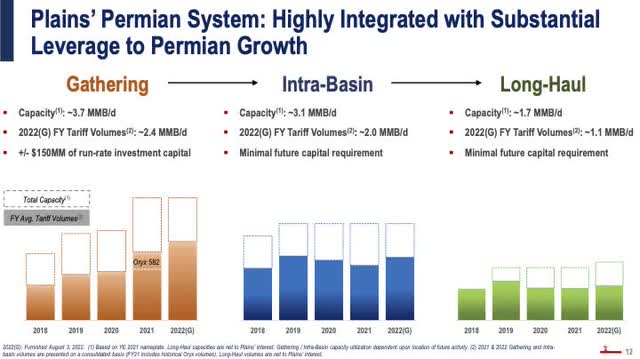

Between 2018 and today, the company engaged into a massive capital build-out. Notice the large excess capacity now within gathering, basin and long-haul as a result.

Plains All American

The company, heavily dependent upon the Permian Basin, noted that production increases are running ahead of plan with growth now expected at 650,000 and 700,000 barrels a day of production growth at year-end’s exit.

Continuing:

“In our NGL segment, we continue to advance capital-efficient optimization and debottlenecking opportunities at our existing facilities. Furthermore, we expect growing Western Canadian gas production to drive incremental gas order flow volumes towards our strategically located Empress facility.”

And from management the magic words, “With regard to our financial strategy, we expect to continue to generate significant free cash flow over the next number of years.” With leverage now in line, cash is used for stock buybacks or increases in distribution. Opportunities for new capital projects will also be considered. NuStar Energy (NS) expects the Basin to increase its production from 5+ million barrels per day to over 9 million by 2025. Plains’ excess capacity for long-haul and inter-basin would be exhausted, but revenue also explodes without capital needs.

A valuable summary follows in the next slide.

Plains All American

The point shown in the slide probably ranks most important, “Significant Capacity for Equity Returns.”

Distribution

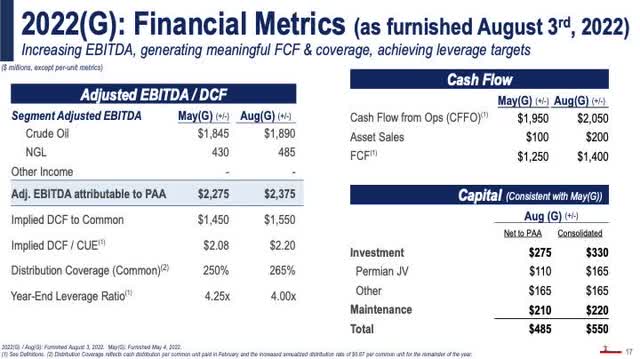

On the issue of future investor returns, management stated, “And … the real question on capital allocation is the split between distribution increase and buybacks… I think you’ll see that we will continue to support distribution increases.” The next slide from the presentation shows the DCF to common ratio at 250% plus, plenty to cover the current distribution now at $0.87 cents.

Plains All American

The slide also shows the business ratio, crude oil making up 80% of the cash flow. Permian isn’t the whole crude system, but it is the bulk at 80% of the total volumes. Approximately 60% of the cash flow is generated from that basin, or $1,500 million in EBITDA. If Plains doubled that cash flow to $3000 EBITDA by 2026, the company could more than double its distribution to near $2.00 per year. The stock would more than double in price.

Risk & Investment

Reviewing risks, always entertain the idea of demand destruction from a major recession. In this case, the event would be temporary. The company is positioned well to survive from a one to two-year slowdown. Within the U.S., another risk exists, which is noted within a recent article disclosing the federal administration’s lack of support for fossil fuels: “Joe Biden’s administration has leased far fewer acres for oil and gas drilling offshore and on federal land at the early stages of his presidency than has any other leader since Harry Truman…”. The Federal Government disdain toward necessary and cheap energy production continues. Public rhetoric never trumps actual practice. Again, true investors could end up playing the waiting game, but will also be paid. Plains fixed its high-risk circumstances in the past few years, allowing holders to be patient for growth without significant risk. This is a growth story, either now or in the future regardless. Buying on weakness might again be a fabulous long-term investment. Plains story is a growth story; it’s about when will it happen. We believe it is now happening and will continue.