piranka

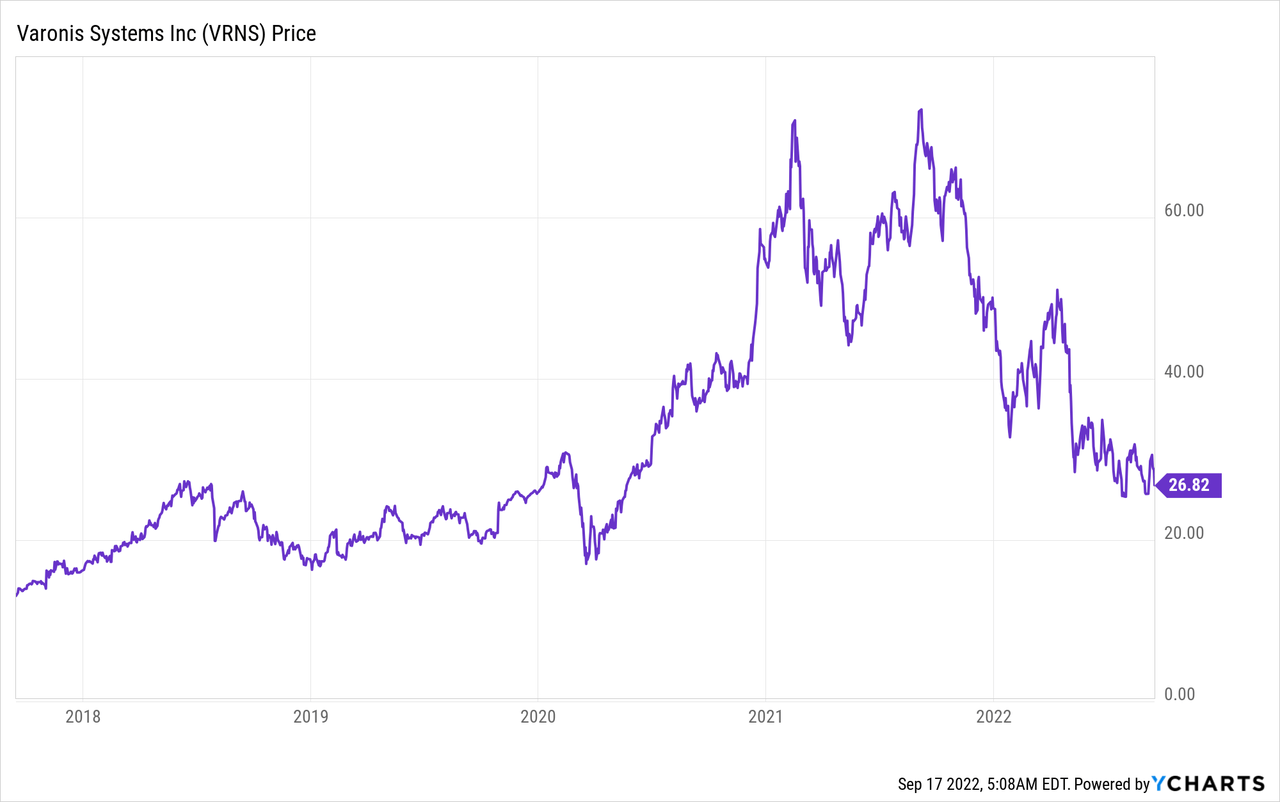

Varonis (NASDAQ:VRNS) is a leader in automated data security and compliance. Today’s businesses have vast amounts of data and it’s growing each day. In fact, the big data market was valued at $41.33 billion in 2019 and is forecasted to be worth $116 billion by 2027, exhibiting a 14% compounded annual growth rate [CAGR] over the period. According to Varonis, “almost every breach” involves data assets that are stored in central databases. In addition, the cybersecurity industry is forecasted to grow at a compounded annual growth rate of 13.33% and reach $298.7 billion by 2027. Varonis is poised to ride the growth across these industries. The company has recently beat analyst expectations for revenue and are growing margins steadily. Thus in this post, I’m going to drill down into the company’s business model, financials, and valuation, let’s dive in.

Secure Business Model

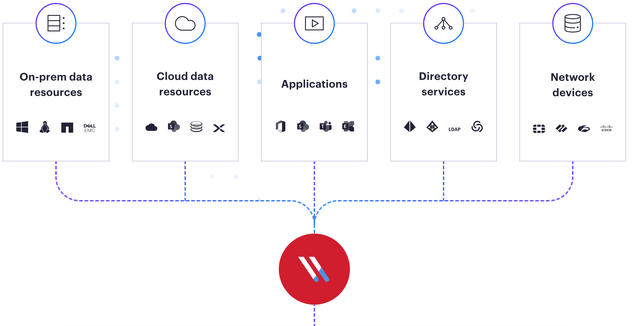

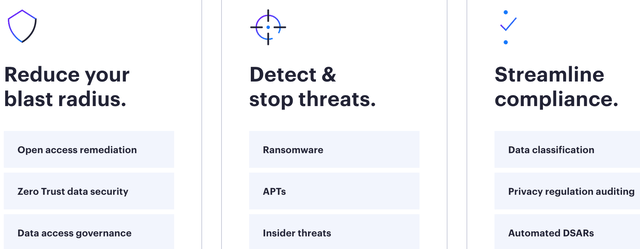

The rise of cloud applications means data is shared more freely between applications and each has different permission models. A mission-critical example would be Customer Relationship Management [CRM] data inside an application such as Salesforce. This has customer information that must be protected under GDPR and CCPA, but it is also vital to business success. If stolen, this would result in huge fines and vast reputational damage among consumers.

Varonis (investor relations)

Varonis solves these problems with its data protection, visibility and security platform. This helps to identify where sensitive customer data is across (on-prem and the cloud), secure it, and make sure it is compliant. A common security policy the company implements is the “Zero Trust” security model. This method means by default people in the network are given “least privileged” access to only the applications they need. This helps to prevent an attacker from accessing the network via a nonvital application, but then moving laterally to a mission-critical app such as one in the finance department.

Varonis (Official Website)

Varonis gives a unified view of a customer’s data. However, the platform also automates helps with “database hygiene” by automating the removal of outdated data. The company’s competitive advantage is its patented technology. In addition, the company is rated the number one product for File Analysis by Gartner customer reviews with 4.6 out of 5 stars.

Growing Financials

Varonis generated strong financial results for the second quarter of 2022. Revenue was $111.45 million, which popped by 26% year over year and beat analyst estimates by $242k. Subscription revenues were a key driver which increased to $84.4 million and popped by 44% year over year. Maintenance and services revenue was $27.1 million, with renewal rates greater than 90% which shows strong product stickiness.

Revenue growth was driven by a strong performance from North America, with $80.8 million generated increasing 31% year over year. North America makes up 73% of total revenue and thus the company will be minimally impacted by the strong dollar, despite concerns in the conference call. EMEA revenue was $27.2 million which showed slower growth of 11% overall. This region was impacted by FX headwinds as the euro dropped to a 20-year low against the dollar. In addition, Varonis exited from Russia which caused the revenue to take a $4 million to $5 million hit. If I make adjustments for these headwinds, EMEA growth was actually 25% which was fantastic.

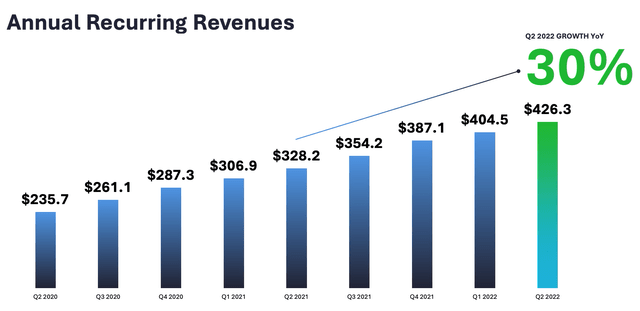

The Rest of the World revenue came in at just $3.5 million, which did pop by 47% year over year, but this is off a low base. For a SaaS company Annual Recurring Revenue [ARR] is a vital metric to analyze. In this case, ARR was $426.3 million in Q2,22 up 30% year over year.

ARR (created by author Ben at Motivation 2 Invest)

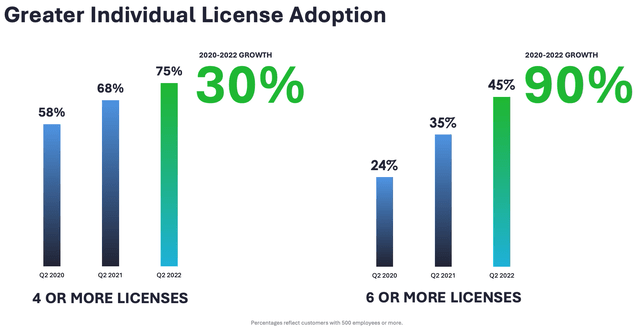

ARR growth was driven by strong traction from the company’s new “bundle” offerings as they aim to increase the number of licenses customers take on. The trend is positive so far with 75% of their customers purchasing four or more licenses up from 68% last year. In addition, 45% of those customers purchased six or more licenses, up from 35% in the prior year.

License adoption (Investor presentation )

Despite growing rapidly, Varonis is also expanding its margins. For example, its Gross margin was 87.2% for Q2,22, which was greater than 86.9% for the prior year. Operating expenses were $95.5 million in Q2, with an Operating margin of 1.5%, which was higher than the 1.2% in the prior year. Now although the company still has a long way to go with margin expansion, it was great to see some operating leverage taking hold, which is one of the benefits of a SaaS platform.

Varonis has a solid balance sheet with cash, cash equivalents and short-term investments of $789 million, in addition to $248.2 million in long-term debt.

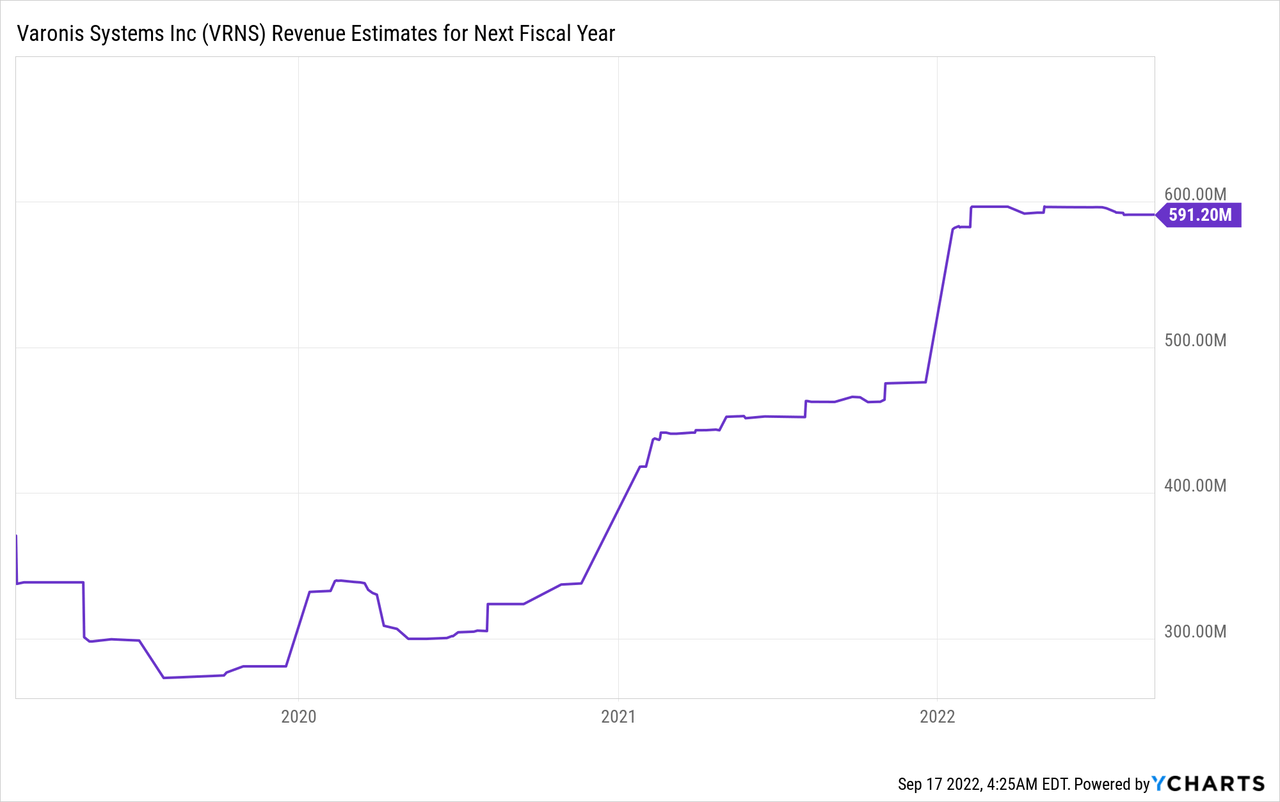

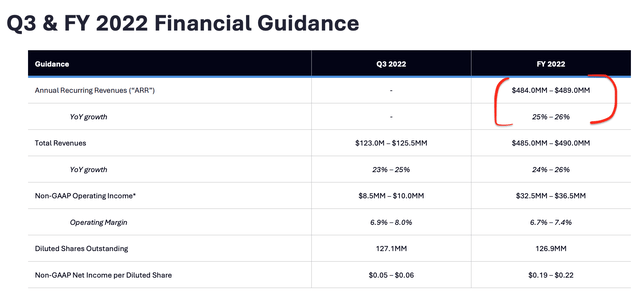

Moving forward, the company is guiding for $484 million for FY 2022, with a 25% to 26% growth rate expected. The operating margin is also forecasted to expand significantly next quarter to between 6.9% and 8% which is fantastic.

Guidance (Investor Presentation)

Advanced Valuation

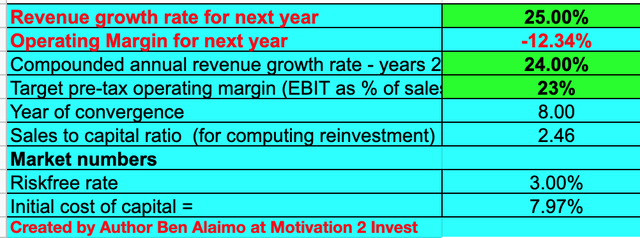

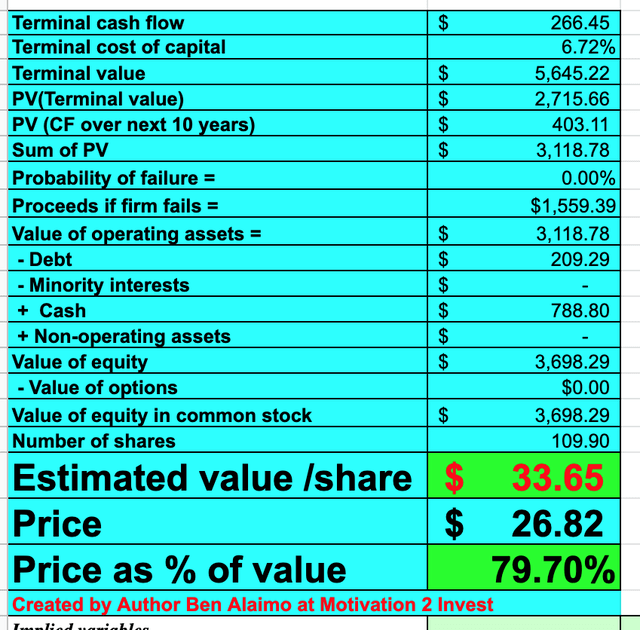

In order to value Varonis, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 25% revenue growth for next year and 24% for the next 2 to 5 years, which is aligned with management and analyst estimates.

Varonis stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the company’s operating margin to increase to 23% over the next 8 years, which is the average for the software industry. I expect this to be driven by the increased operating leverage and greater license sales. This is also fairly conservative given management is forecasting an ~7% operating margin for FY,22 alone. In order to increase the accuracy of the valuation, I have also capitalized R&D expenses.

Varonis (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $33/share, the stock is trading at ~$26.8 per share at the time of writing and thus is ~21% undervalued.

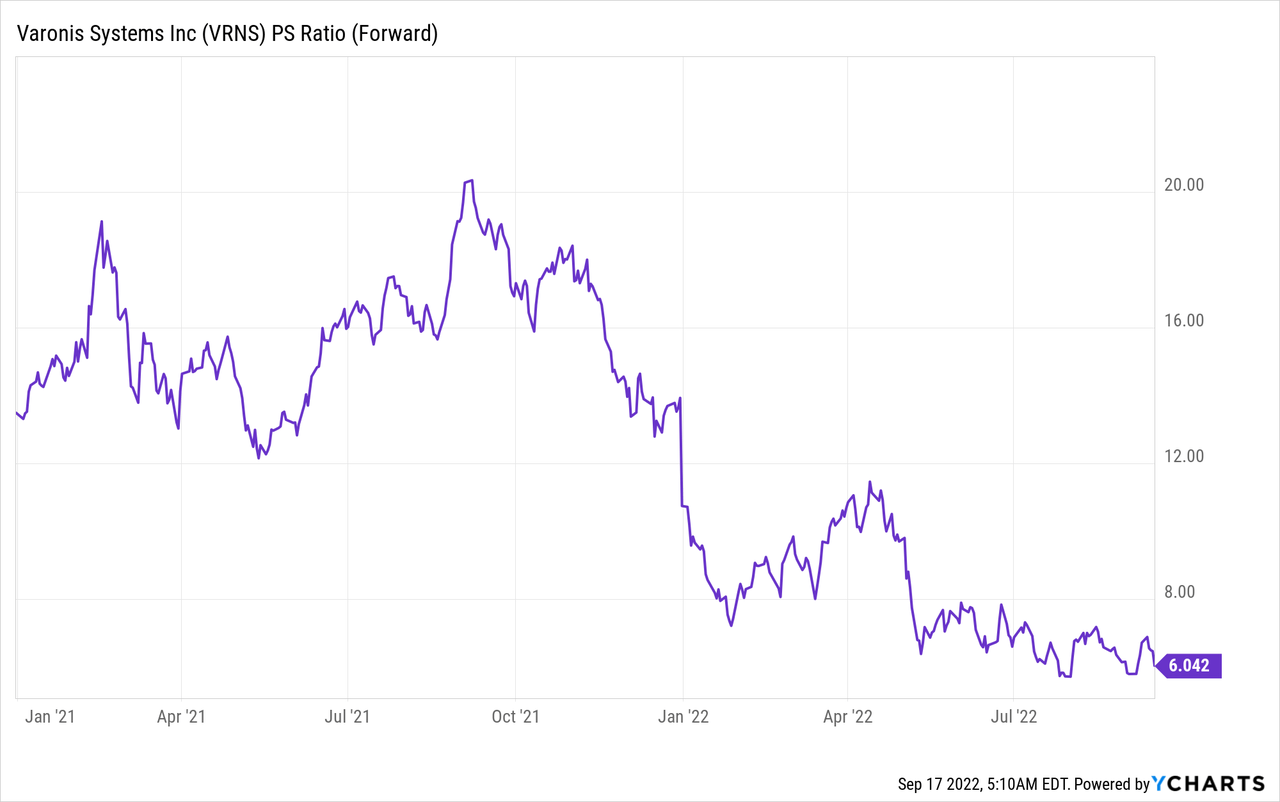

As an extra data point, Varonis trades at a Price to Sales ratio = 7, which is 21% cheaper than its 5-year average.

Risks

Competition

Despite Varonis having patented technology, there are competitors in the file analysis/compliance industry. These include Netwrix, Veritas, IBM stored IQ suite, and many more. The good news is that Varonis does seem to be the most highly rated and leader in the category, as mentioned prior.

Recession/IT spending slowdown

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. This may cause companies to temporarily delay IT/security spending until more certainty is known with regards to budgets.

Final Thoughts

Varonis is a leader in data security and compliance. Given the industry tailwinds, across big data, compliance, and cybersecurity, the company is poised to benefit from secular trends. The stock is undervalued intrinsically and relative to historic multiples and thus could be a great investment for the long term.