rarrarorro

Introduction

I am a big Warren Buffett disciple, and he has for years advocated unequivocally for this stock, and I will continue to back his bullish belief. I maintain my strong buy rating for Vanguard S&P 500 ETF (NYSEARCA:VOO). In my opinion, VOO is the S&P 500 Index that has the best ratio of expense fees to liquidity. VOO has an expense ratio of just 0.03%, a third of its primary competitor SPDR S&P 500 Trust ETF (SPY). While VOO has much less liquidity in comparison due to much lower volume, this is not an issue for investors who do not have substantial sums of money as it still has over 4 million shares traded daily.

A little background on VOO is that it is an ETF from Vanguard that tracks the S&P 500. There is a reason that the index is the benchmark for wall street. The S&P 500 is approximately the 500 most prominent publicly traded companies in the United States. A fair comparison to the index is a slice of the American economy. From this slice, the index returns the “average” stock movement of the market. For more specific inclusion rules,

- The company should be from the U.S.

- Its market cap must be at least $8.2 billion.

- Its shares must be highly liquid.

- At least 50% of its outstanding shares must be available for public trading.

- It must report positive earnings in the most recent quarter.

- The sum of its earnings in the previous four quarters must be positive.

The American Tailwind

VOO is a bet on what Warren Buffett calls “The American Tailwind.” As explained in his 2019 Annual Letter from Berkshire Hathaway (BRK.A)(BRK.B),

Charlie and I happily acknowledge that much of Berkshire’s success has simply been a product of what I think should be called The American Tailwind. It is beyond arrogance for American businesses or individuals to boast that they have ‘done it alone.’ The tidy rows of simple white crosses at Normandy should shame those who make such claims.

There are also many other countries around the world that have bright futures. About that, we should rejoice: Americans will be both more prosperous and safer if all nations thrive. At Berkshire, we hope to invest significant sums across borders.

Over the next 77 years, however, the major source of our gains will almost certainly be provided by The American Tailwind. We are lucky – gloriously lucky – to have that force at our back.

And similar to how Berkshire Hathaway has developed a wide variety of assets across America, in essence betting on America, VOO has an equal and arguably more diverse slice of America.

VOO Historically

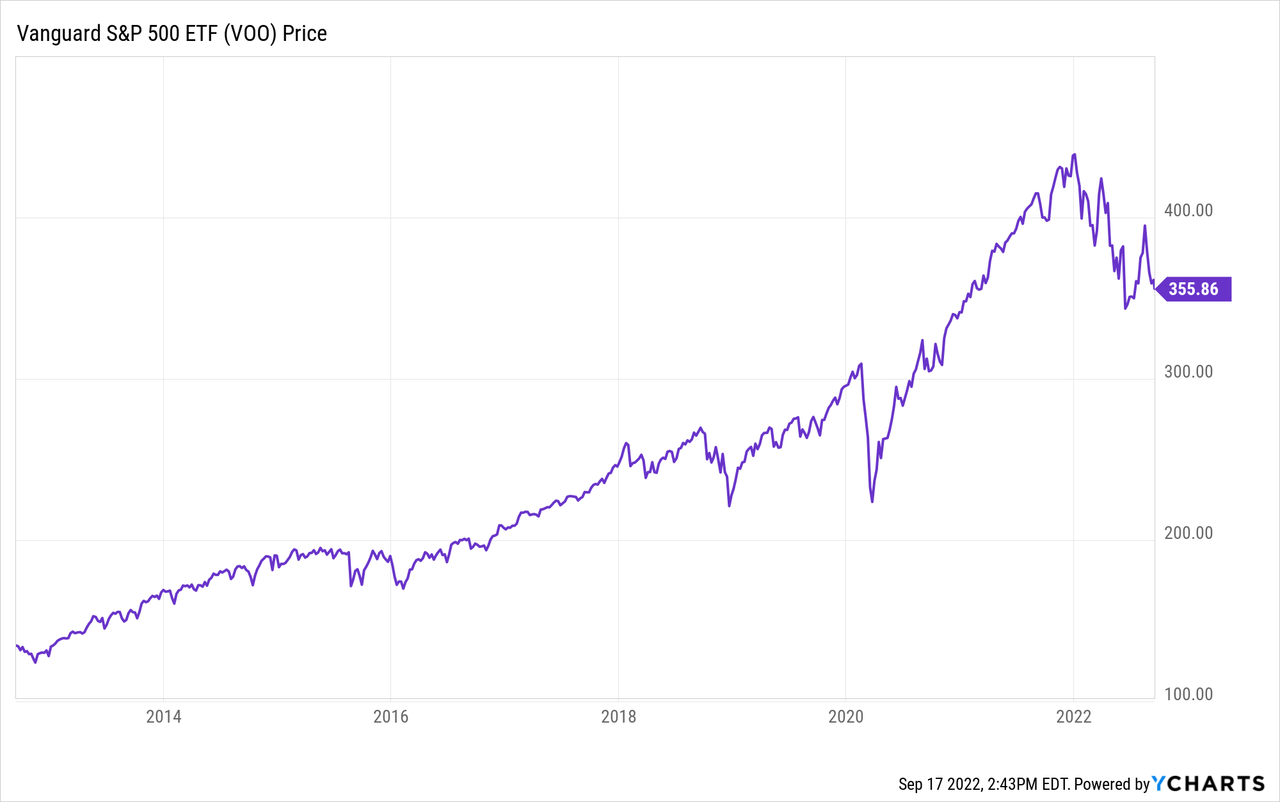

Below are some charts to show VOO’s historical performance. VOO has gained 165% over the past ten years, averaging a remarkable 16.5%, without considering the dividend, which is currently 1.57%. If you add in 1.5%, the investment has averaged over 18% returns over the past ten years.

Warren Buffett’s Public Support

Warren Buffett has said, “for most people, the best thing to do is to own the S&P 500 index fund.” Warren made this statement knowing the difficulties of picking good companies and the stress-free environment of simply buying into the index and looking away. Throughout Buffett’s annual letters, he hammers home this point, arguing that he must show his stock is a better investment to make up for the more stressful and complicated business he is involved in.

The Three Actions To Guarantee Success

The first thing an investor must do when making this investment is have a long-term mindset. The longer the period an investor plans for then, the less the current market situation matters. If we go into a recession right now, but an investor has a 30-year mindset, then the investor does not have to worry.

The second thing an investor can do to guarantee success is to buy VOO at a regular interval continuously. By doing this, the investor does not have to worry about if the price is high or if the price is low. They don’t have to worry about what bill the government passed or the inflation rate. All the investor needs to do is keep buying. The product of this action will be a slow accumulation of shares at an average price that is very good.

The final thing to guarantee success is to not look at the price of this investment. While this may sound counterintuitive, the market can be irrational. The last thing an investor wants to do is let the cost of their investment start to affect how they view it. The market is yelling a price every minute, but an investor does not have to listen. VOO is an investment in America. As long as the investor believes in their investment thesis that America will succeed, then looking at the stock price will only cause unneeded emotions.

Risks

VOO is, in essence, an investment in America. Anything that will affect the American economy will affect this stock. While sector and company-specific risks are minimized, they will still affect the overall picture. Overall, VOO is about as safe as an investment in stocks an investor can make if they follow the steps to succeed above.

Conclusion

VOO is and has always been the most straightforward stock recommendation I have made. My investment thesis boils down to this, America has created exceptional wealth in the past, and I believe it will continue to do so in the future. For this reason, a wise investment would be to own a piece of the wealth creation.