Justin Sullivan

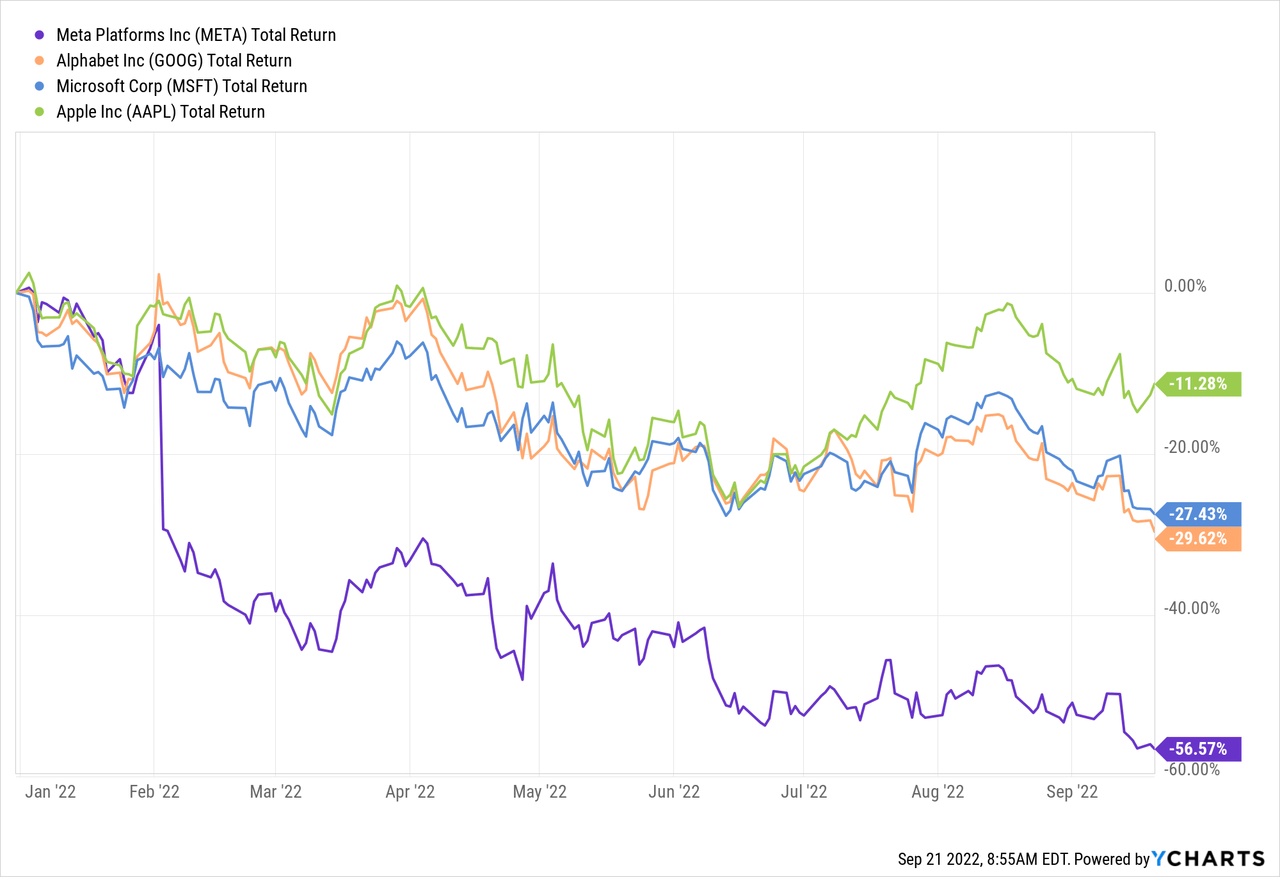

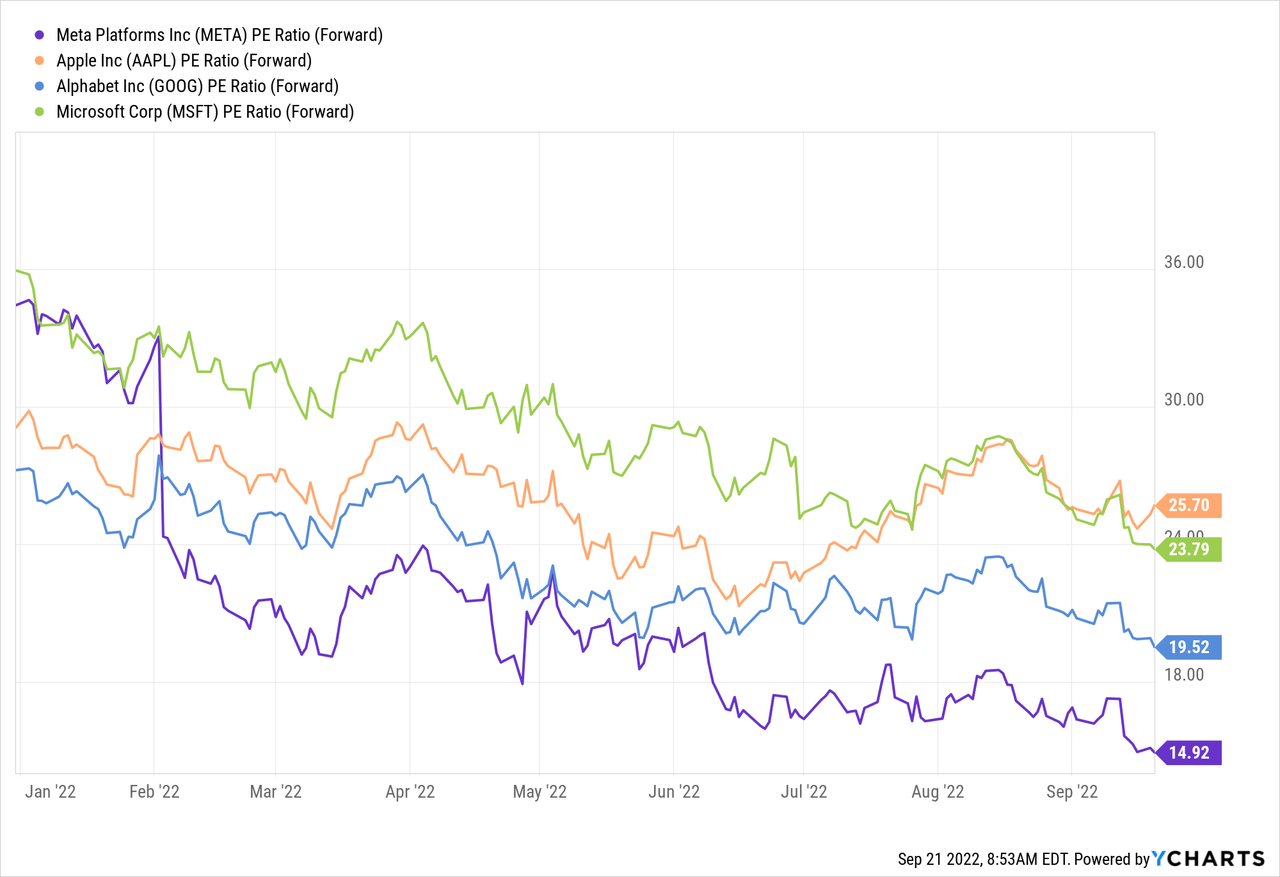

Shares of Meta (NASDAQ:META) have significantly underperformed large cap peers from Alphabet (GOOG) (GOOGL) to Apple (AAPL) as markets react to slowing top-line growth and a concerning earnings outlook under the current macro narrative. From a valuation standpoint, Meta currently trades at under 15x forward P/E, a significant discount to tech peers and 2023 P/E of ~13x also indicates a discount to 15.8x of the S&P 500.

Understandably, the stock continues to draw interest from value-oriented investors who are constantly looking to own above-average companies at below-average prices. While no one can dispute the fact that Meta is a wildly successful company in the digital advertising space with high-quality assets like Instagram, I’m afraid the stock remains a value trap as Meta’s sales and earnings are challenged by strong COVID comps, Tik Tok competition, ongoing impact from iOS privacy changes, worsening macro outlook and most notably margin-destroying investments in the metaverse.

To a certain extent, I believe tough 2021 comps, short video competition from Tik Tok and iOS privacy impact are well understood and appreciated by the market, as Meta has communicated these issues for several quarters already. Eventually, slowing revenue growth will probably stabilize, Instagram Reels will likely see improving monetization (though currently lower than Feed and Stories), and the issues surrounding iOS measurement and targeting will be addressed (though some of the lost signals will never be recovered).

However, CEO Zuckerberg’s intention to bet the farm on Reality Labs still remains at least a medium-term drag on earnings as investors are increasingly looking to the bottom line. Reality Labs generated an operating loss of $10 billion in 2021 is expected to lose another $13 billion in 2022 and almost $15 billion in 2023. While this may not exactly be a problem in an easy monetary environment where investors have unlimited patience for money-losing projects, markets are finding fewer reasons to “let it slide” now the core advertising business is slowing under a higher interest rate regime.

Speaking of the metaverse, I continue to have difficulty finding sources of optimism on the project. Thus far in 2022, Reality Labs revenue grew 48% YoY in 2Q22 and 30% in 1Q22 on a quarterly operating loss of $2.8 billion and $3 billion, respectively. Unfortunately, what Meta has done and showed to the world (per the above avatar in Horizon Worlds) is nothing but a major disappointment.

For perspective, the production budget for Grand Theft Auto V was $265 million while Cyberpunk 2077 cost $316 million. Having already “invested” 10x the combined budgets of both highly sophisticated video games, Reality Labs appears to be burning a lot of cash on something that comes nowhere close to any AAA title. Also, if billions have been dedicated to the metaverse, shouldn’t Reality Labs at least be doubling its revenue every quarter?

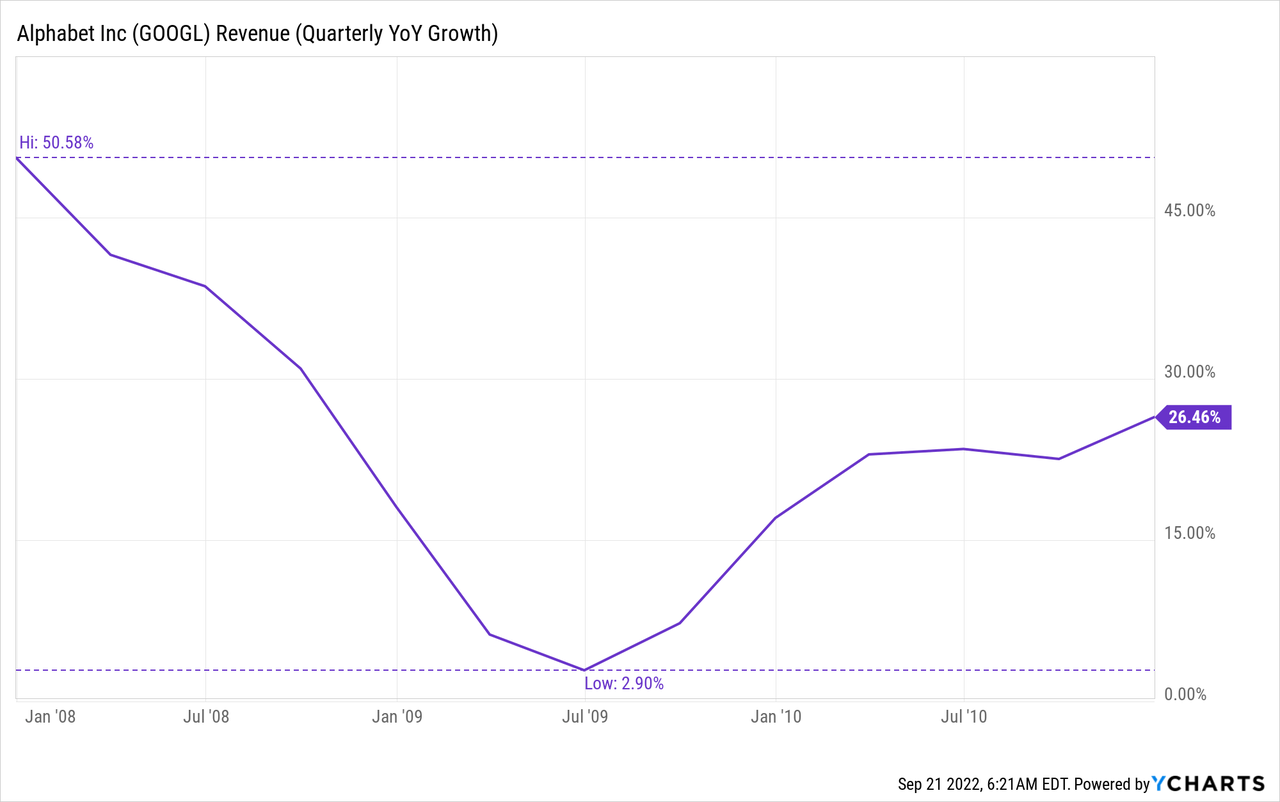

Given the current macro narrative, another issue troubling investors is how Meta will perform in a recession. While there’s no perfect answer, we can learn from history that Google saw its revenue growth slowed materially to below 3% in Q2 2009. In contrast, Yahoo Display revenue declined by 13% in the same period.

Given Facebook advertising belongs to the top end of the marketing funnel vs. Google Search at the lower end with more focus on conversion over impression, it’s conceivable that Facebook’s ad revenue could easily experience a 5% to 8% drop in a recession. Doing some quick math, a 5% decline in 2023 revenue leads to EPS of ~$9 vs. $11.11 consensus for 2023 EPS (+13.5% YoY growth over 2022 EPS). If Meta does get caught up by lower ad spend in a recession, shares may have more downside risks.

In summary, the conventional wisdom is that Meta’s stock is too cheap to ignore, but investors should really ask why the stock got here in the first place. The market seems to have a number of logical reasons for this and there’s plenty of evidence suggesting that Meta’s outlook is indeed concerning. As a result, I continue to see the shares as a value trap however cheap they might appear to be, and would best recommend investors to question their underlying assumptions when buying the stock solely based on valuation.