dra_schwartz

Cryoport

Every time it rains, it rains Pennies from heaven. Don’t you know each cloud contains Pennies from heaven? – Johnny Burke

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 20, 2022.

Beating the stock market is a lofty aspiration shared by many investors. After all, it’s extremely difficult to gain an edge on the market, yet the rewards are highly satisfying. While there are various strategies, one approach is to make sure you have a few powerful growth stocks that can give you outstanding alphas. By holding such equities for years (to allow the company to maximize its growth), the multi-bagger profits would allow you to outperform the market.

That being said, I’d like to revisit another stellar growth company known as Cryoport, Inc. (NASDAQ:CYRX). As a leading operator, Cryoport is profiting from the tailwind of the cellular therapy sector. At the upturn of the next bull market cycle, you can anticipate that Cryoport shares would appreciate substantially. In this research, I’ll feature a fundamental analysis/update of Cryoport and share with you my expectation of this stellar growth equity.

StockChart

Figure 1: Cryoport chart.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. I noted in the prior research:

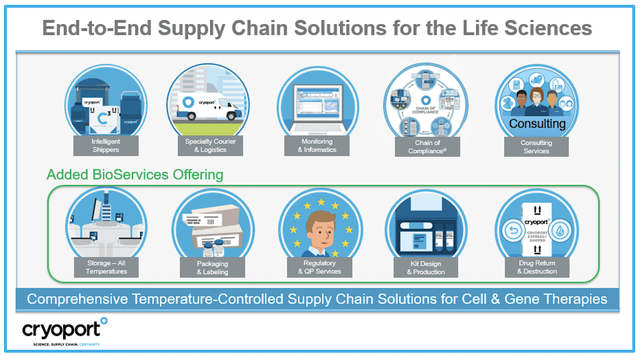

Operating out of Nashville, Tennessee, Cryoport provides logistic solutions for the CAR-T, cell/gene-based therapy, and regenerative-medicine innovators. That is to say, the company offers strict temperature-controlled transport and storage of biological specimens to ensure their livelihood, efficacy, and safety. As you can see, these biological specimens are sensitive to temperature and other environmental factors. As such, it’s crucial to transport and store them in a highly controlled environment like what Cryoport is providing.

Cryoport

Figure 2: Logistics business.

Tracking The Cryoport Investment Thesis

Before proceeding with the analysis, you should put your stock into its appropriate investment category. That way, you can better track its progress for you to know when to buy, sell, or hold. Here, Cryoport fits into the category of “growth biotech.”

Now, Cryoport is not a pure biotech, so to speak. After all, the company runs a logistics service business for other gene-therapy innovators. Moreover, the firm employs a highly sophisticated merger/acquisition approach to pick up smaller companies for leaping growth.

Notably, you want to monitor both growth from established operations as well as growth via acquisition. So long as the company continues to buy more firms and ramp up their topline revenues, you know that your investing thesis (i.e., story) is working out.

Industry Tailwind Supporting Cellular Therapy

As you can see, the cellular therapy sector is booming in recent years. And, there is no signs of it slowing down. There are many companies – like Kite Pharma (GILD), Juno Therapeutics (BMY), Novartis (NVS), bluebird bio (BLUE), CRISPR Therapeutics (CRSP), etc. – that are tinkering with their cellular therapies.

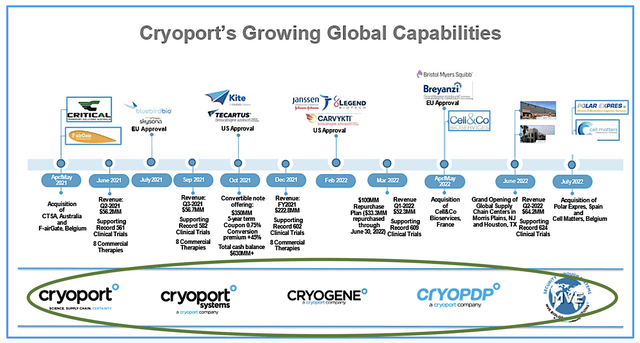

From the figure below, you can see that Cryoport is now delivering logistics services for key innovators like Kite Pharma. Leveraging its powerful M/A growth approach, Cryoport continues to quickly ramp up its topline growth (i.e., revenues) through additional buyouts. As their infrastructure is further expanded, I anticipate that Cryoport will take the majority market share by servicing many more innovators.

Cryoport

Figure 3: Strong industry tailwind.

EMEA Expansion – Belgium With Cell Matters Acquisition

Shifting gears, let us assess the recent acquisitions that signaled more incoming sales growth. In July this year, Cryoport acquired a Belgium-based company known as Cell Matters. The aforesaid buyout would give Cryoport an integrated end-to-end services in Belgium – as part of its Europe, Middle East, and Africa (EMEA) expansion.

By expanding into strategic areas in the EMEA, Cryoport can benefit from growth synergy. And while it’s extremely difficult to create growth synergy, “additive growth” would still position the stock to appreciate much higher in the coming years.

Cryoport

Figure 4: Cell Matters acquisition.

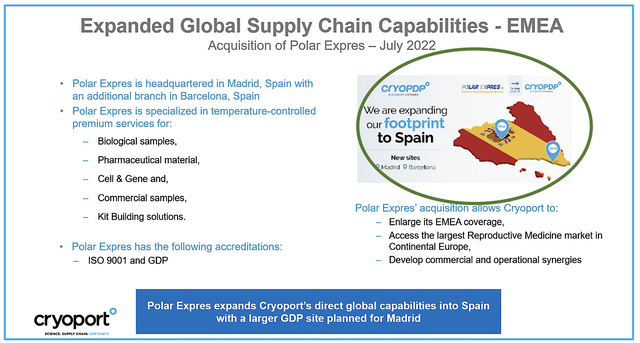

EMEA Expansion – Spain With Polar Expres

Interestingly, Cryoport has also been busy with another deal in July. Specifically, the company bought out Polar Expres to gain a presence in Spain. If you recall, one of Cryoport’s businesses is reproductive medicine. As such, Polar Expres now gives Cryoport access to the largest reproductive medicine in Continental Europe.

With entry into a huge market, you can anticipate that Cryoport will aggressively increase sales for its reproductive medicine in the coming quarters.

Cryoport

Figure 5: Polar Expres acquisition.

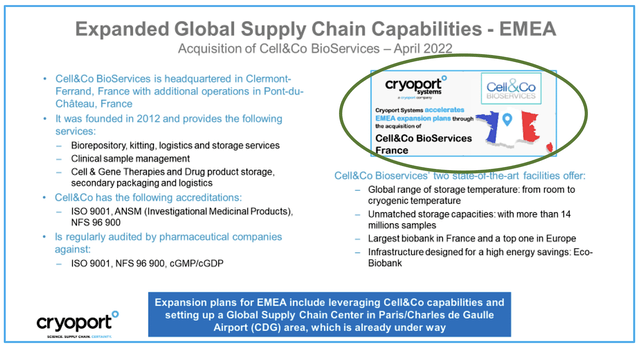

EMEA Expansion – France With Cell & Co BioServices

Beyond the aforesaid deals, Cryoport also scooped up Cell&Co BioServices back in April. Operating out of Ferrand, France, Cell&Co offers Cryoport the largest storage/bio-bank in France and Europe. In combinations with the previous transactions, Cryoport now laid the foundations for many years of growth to come.

Cryoport

Figure 6: Cell&Co BioServices acquisition.

Strategic Partnership With Takeda

Just as important, Cryoport concurrently leverages on partnership for growth. After all, a partnership can help absorb the engineering and development costs while boosting growth. On September 8, BioLife reported that the company entered into a strategic partnership with Takeda’s BioLife Plasma Services.

The said collaboration would integrate the Cell Matters expertise with Takeda’s to build out a facility in Houston, Texas. Of note, the partnership aims to standardize and improve accessibility to specimen collection for cellular therapy. That is to say, it alleviates the key constraints (i.e., apheresis collection and blood/sample donations) at centers. Commenting on this partnership, the CEO (Jerrell Shelton) remarked:

This strategic relationship with BioLife Plasma Services is a prime example of how our world-class expertise in providing supply chain solutions to the life sciences industry and our expansion into new geographies and services offerings, such as bioservices and cryo-processing, creates exciting new opportunities. Our goal is to streamline the complex processes necessary to treat an increasing number of patients with today’s most advanced cell therapies while ensuring the highest quality and safety standards.

Now, operations are expected to begin this year (with apheresis scheduling and collections to be initiated by BioLife Plasma Services in the Houston area). Notably, Cryoport will provide cold chain solutions inclusive of packaging, logistics, data management, consulting, program management, cryo-processing, and bioservices.

Operational Performance – Robust Expansion In All Business Segments

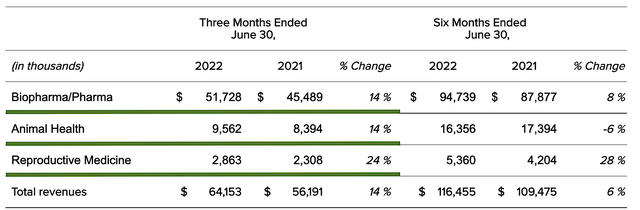

All the acquisition and partnership mentioned, let us see how Cryoport translates its efforts into topline growth. As you’d expect, all business segments (i.e., biopharma, animal health, and reproductive medicine) enjoyed double digits revenue growth.

The most robust growth comes from the reproductive medicine business. As you recall, the Polar Expres acquisition would galvanize this segment to more aggressive growth in the coming quarters.

Cryoport

Figure 7: Robust growth in all business segments.

Operational Performance – Supporting More Clinical Trials

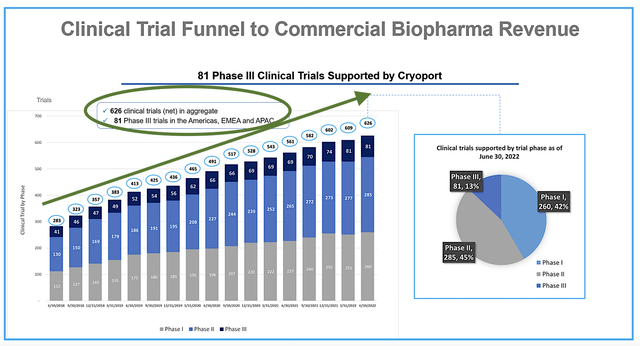

As Cryoport is running on all engines (organic and M/A), its largest business segment (i.e., biopharma) is garnering more businesses. Precisely speaking, the company is now supporting a total of 626 clinical trials.

Of that figure, 81.3% are in their Phase 3 clinical studies. That’s significant because a Phase 3 study supports many more patients. As such, it means much more revenue for Cryoport.

Cryoport

Figure 8: Linear growth in supported clinical trials.

Competitor Landscape

Regarding competition, there are emerging players and established companies. I elucidated in the prior article:

As you know, the fiercest competitor of Cryoport is BioLife Solutions (BLFS). These two innovators have captured the most dominant market shares of the logistics business. Notably, clients of biopharmaceutical companies give the most business to these two firms due to their strong service and brand. Nevertheless, BioLife has suffered from integration issues recently which caused it to lag behind Cryoport by a wider margin.

Financial Assessment

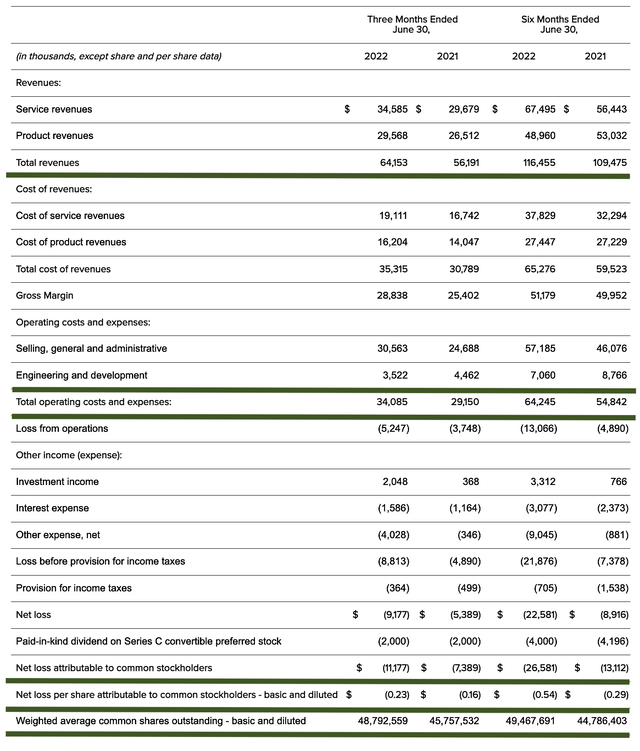

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 2Q2022 earnings report for the period that ended on June 30.

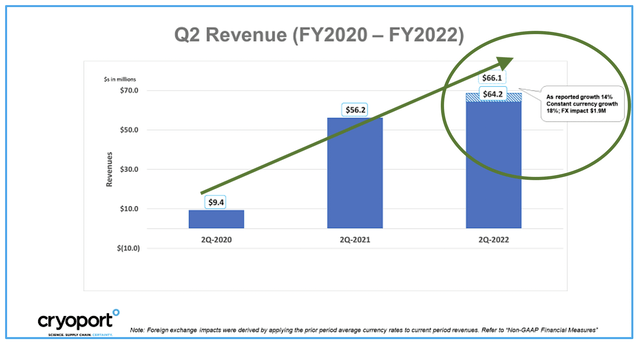

As follows, Cryoport procured $66.1M in revenue compared to $56.2M for the same period a year prior. Adjusting for currency exchange rate, the year-over-year (YOY) growth rate is 18%. With increasing business, Cryoport is projected to procure $260M to $265M in revenue for Fiscal 2022. Mr. Shelton commented:

Our strategic expansion continued to progress during the second quarter and included the grand openings of Cryoport’s two new Global Supply Chain Centers in Texas and New Jersey. These world-class facilities form the foundation of our Global Supply Chain Center Network and include the important addition of GMP (Good Manufacturing Practices) BioServices to our portfolio of premier, comprehensive supply chain solutions. During the quarter, we further strengthened our presence in the EMEA region with the acquisition of Cell&Co BioServices in Clermont-Ferrand, France. We anticipate that Cell&Co BioServices will play a significant role in the further development of our Global Supply Chain Center Network as we expand into the Paris, France region.

Cryoport

Figure 9: Aggressive topline growth.

That aside, the engineering and development (which is similar to research & development or R&D for traditional biotech) registered at $3.5M versus $4.4M for the same comparison. As a rule-of-thumb for growth biotech, I’d like to see increasing R&D because the money invested today can turn into billions of dollars in profits tomorrow. After all, you have to plant a tree to enjoy its fruits. Though Cryoport is not big on R&D, it acquires such expertise from other operators. Hence, that explains the low R&D investment.

Cryoport

Figure 10: Key financial metrics.

About the balance sheet, there were $550.6M in cash, equivalents, and investments. On top of the $64.2M quarterly revenue and (against the $34.0M quarterly OpEx), there should be adequate capital to fund operations for years without worrying about the cash runway.

Valuation Analysis

It’s important that you appraise Cryoport to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. For a medical diagnostic device, I focus on market penetration and sales. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 48.0M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Biopharma business |

Currently procuring $180.2M for Fiscal 2021, $52.3M for 1Q2022 and projected to increase to $3B (estimated based on the $36.92B cell/gene therapy market that is growing at the 39.62% GAGR) | $750M | $156.25 | $140.62 (10% discount because uncertainty in market penetration) |

| Animal Health | Currently $7.8M for Fiscal 2021 (Will wait for more substantial revenues before valuing) | N/A | N/A | N/A |

| Reproductive Medicine | Currently $2.4M for Fiscal 2021 (Will wait for more substantial revenues before valuing) | N/A | N/A | N/A |

|

The Sum of The Parts |

$140.62 |

Figure 11: Valuation analysis

Shares Repurchase Program

A “quick and dirty” way to know if a stock is trading at a deep bargain is by looking at the company’s share repurchase program. Unless it’s a deep bargain, a company usually won’t execute a shares buyout.

As you can appreciate, Cryoport’s Board approved the repurchase of $100M of their stocks from March this year through December 31, 2025. In 1H, Cryoport bought back 1.3M shares at the average price of $24.84 for approximately $33.3M. Given that there’s roughly $67M left (and that Cryoport shares are trading far below its true value), you can expect much more shares repurchase to come.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this stage in its growth cycle, the biggest risk for Cryoport is whether the revenue would continue to ramp up. And, this ties into whether the company can continue to make growth-added acquisitions.

You can see that buying a company is easy but merging it to deliver synergy is extremely difficult. As such, there is a significant risk that their future acquisition might not bear fruits. Moreover, Cryoport might grow too aggressively and thereby run into a potential cash flow constraint. As the cash runway is quite robust, the risk here is minimal.

Conclusion

In all, I maintain my buy recommendation on Cryoport with a 5/5 stars rating. Cryoport is a rare investment opportunity because it is profiting from the strong industry tailwind favoring cellular therapy innovators. So long as the cellular therapy sector continues to grow, leading companies like Cryoport (and BioLife) will enjoy more business, thus continuing to ramp up their topline growth. Over the years, the company would then bank a profit due to the economy of scale.

As it leverages growth with the sophisticated M/A approach, Cryoport can grow much faster than other firms. Over the years, Cryoport has been quite busy with making additive acquisitions. 2022 alone witnessed three significant buyouts – Cell&Co, Polar Expres, and Cell Matters. Then, there’s the Takeda partnership.

Despite such strong growth, Cryoport is still a young company with substantial upsides. By purchasing shares in such a firm and holding it for many years, you can earn multi-bagger profits.