jetcityimage

Investment Thesis: I take the view that Nissan Motor will see modest growth in the short to medium term and is a “Hold.”

In a previous article back in July, I made the argument that I did not see upside in Nissan Motor Co., Ltd. (OTCPK:NSANY) in the short to medium-term, on the basis that the stock appeared to be more expensive than previously on a P/E basis, as well as sales of the Nissan LEAF model have been decreasing.

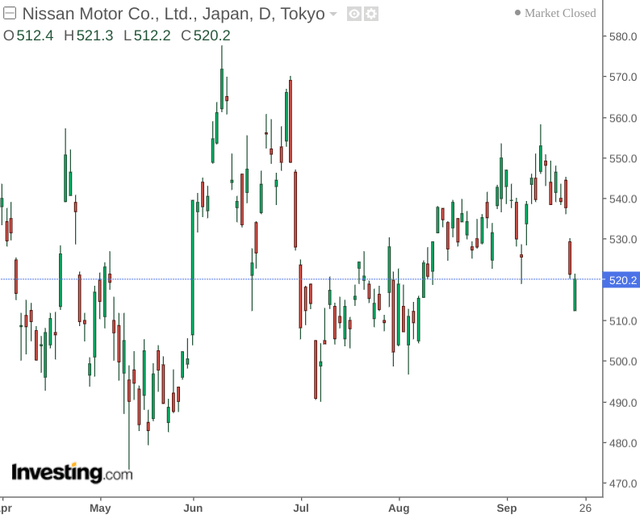

The stock has seen little change since then, with price remaining more or less stationary over the past few months.

investing.com

The purpose of this article is to assess whether the stock might have potential to see longer-term upside once inflation and supply chain pressures subside.

Performance

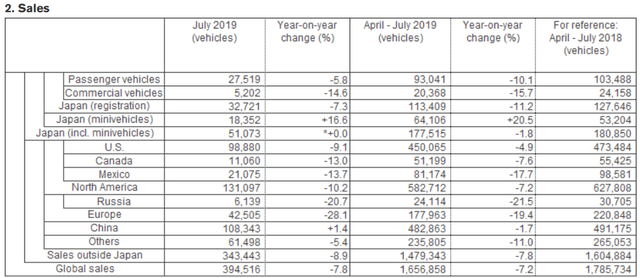

To get a better overview of longer-term performance for Nissan, here is a comparison of sales figures for July 2019 and July 2022.

July 2019

Nissan production, sales and exports for July 2019

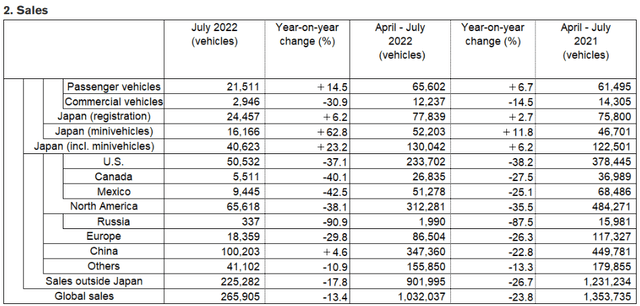

July 2022

Nissan production, sales, and exports for July 2022

When looking at the above, we can see that global sales for July 2022 are still substantially lower than what they were in July 2019.

Moreover, it is also noteworthy that while 385,850 vehicles were produced globally in July 2019, this had fallen to 284,755 in July 2022.

In this regard, production constraints caused in significant part by a semiconductor shortage have limited potential sales growth for Nissan.

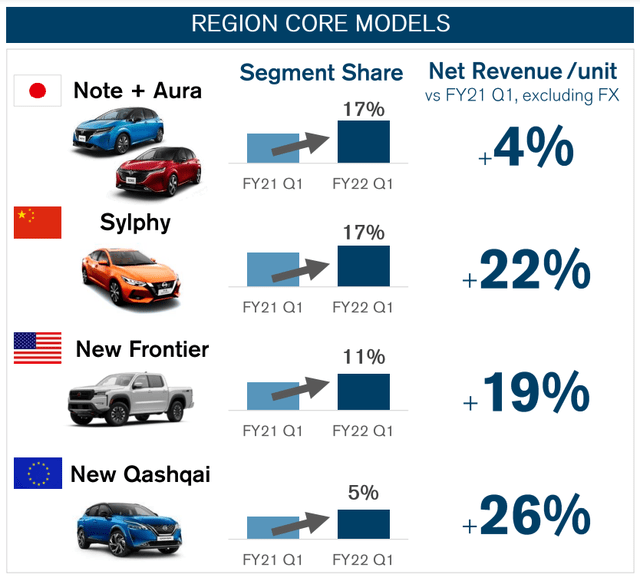

With that being said, we can also see that the segment share of core models across regions has also grown substantially – with the New Frontier model accounting for a greater portion of sales across North America while the Sylphy model leads growth across China.

Nissan Motor Corporation: Fiscal Year 2022 First Quarter Financial Results

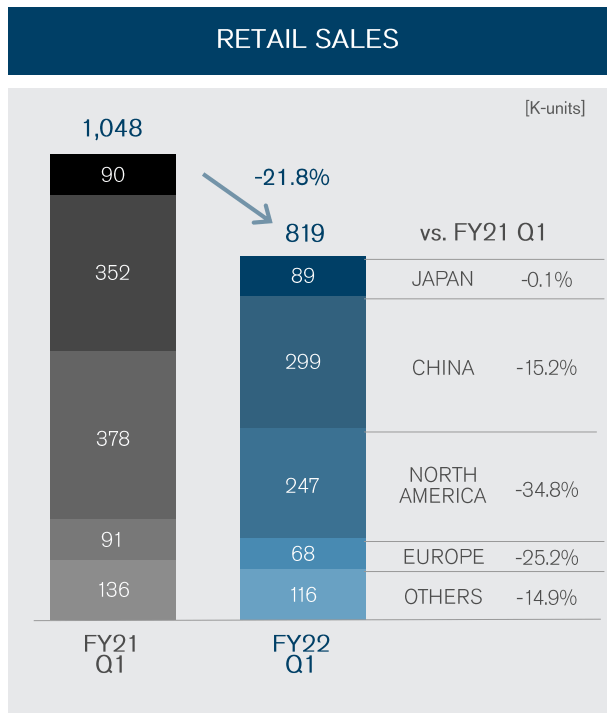

When looking at the geographical breakdown of retail sales – what is particularly interesting is that while sales as a whole have fallen from the same quarter in the previous year – North America accounts for a lower portion of sales (down to 30% from 36%), while that of China rose from 33% to 36%.

Nissan Motor Corporation: Fiscal Year 2022 First Quarter Financial Results

Even with the effects of COVID-19 lockdowns in China, we can see that the region has seen a lower sales decline on a percentage basis than North America and Europe.

Looking Forward

As mentioned, inflation and supply chain concerns could place pressure on Nissan Motor going forward.

However, one potentially encouraging sign is the fact that the sales decline has not been as sharp in China and demand for the Nissan Sylphy model in China continues to remain vibrant. Going forward – China could represent an opportunity for Nissan Motor to: 1) bolster its product line in that region further to boost sales growth while also 2) cutting back on additional production costs associated with selling to North America and Europe by keeping more production closer to home.

With that being said, the Chinese market is likely to prove more competitive for foreign automakers going forward – with foreign automakers having seen their share of the Chinese market shrinking to 45.6% last year.

Moreover, risks of further lockdowns in China could also hit production further – with production for Nissan and other Japanese automakers having taken a significant hit earlier this year.

In this regard, increasing dependence on the Chinese market also comes with risks.

Conclusion

To conclude, Nissan Motor could still see modest growth in the short- to medium-term as a result of production bottlenecks. While China could prove to be more resilient in terms of longer-term growth, domestic competition is increasing and the prospect of further lockdowns could also prove to be obstacles with respect to production.

In this regard, I take the view that growth for Nissan Motor will be modest in the short to medium term.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.