Justin Sullivan/Getty Images News

Dear readers,

In this article, we’re going to add another Japanese company to the coverage spectrum – and now I’m talking about Canon (NYSE:CAJ). This is a Japanese business with a storied history and a great current franchise. It’s one of the main camera manufacturers and players in the professional segment of the world.

We’re going to look at what makes the company tick, and whether an investment could be of any interest to you here.

What is Canon Inc?

Canon is a Japanese multinational corporation based in Tokyo that focuses on the design, research, and manufacturing of optical imaging equipment and industrial products.

Its primary products are things like lenses, cameras, Medtech, scanners, printers, and various types of semis. The company produced the Kwanon, Japan’s first-ever 35-mm camera. The company has multiple achievements under its belt, including improvements on British-made Bell Punch cameras in making a well-working electronic calculator. The company’s Pellix model which came out in 1965, was among the first of its kind as well, a working SLR.

Like many companies in optical imaging/equipment, Canon had to handle the shift from analog to digital cameras. Unlike other companies, Canon handled it very well. Its current product lines include:

- Compact Digital

- Video Cameras/Film and digital SLRs

- Camcorders

- Lenses

- Broadcasting equipment, including Free Viewpoint solutions

- Professional displays

- Projectors

- Photolithography equipment

- Scanners, Printers, microfilm scanners

- Binoculars

- Microscopes, including diagnostic systems such as ultrasound/x-ray

- CCTV solutions

- Rotary encoders

…and much more. In short, many things optical, the company does. Most consumers will be aware of Canon because it builds and makes both amateur and professional-grade DSLR cameras.

The rise of smartphones with built-in cameras which are actually quite capable of fulfilling the need of over 95% of people’s imaging/photographing needs has severely hurt this company’s operating results among consumers for the past 10-or-so years.

The company’s operations are split into 4 relatively easily-understood segments – and the mix might surprise you.

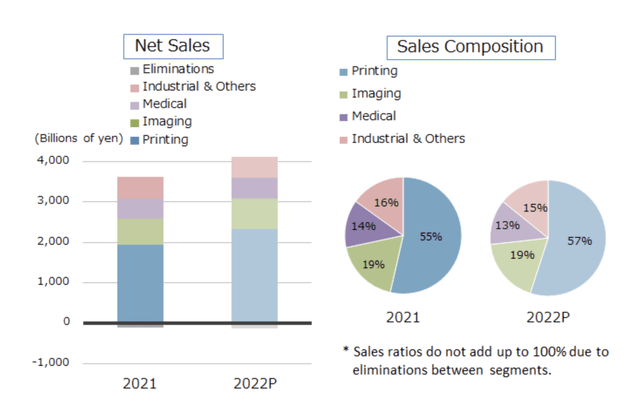

Canon IR (Canon IR)

Because Canon is primarily a printing company these days, not a photography or even film equipment company. Over half the company’s sales come from printing, with the 3 other segments together not even being above 45% for the 2022E Fiscal.

The geographic mix is more as would be expected. Japan still accounts for more than a fifth of sales, with NA/SA coming in at around 30%, with Europe at 25%. The rest is APAC.

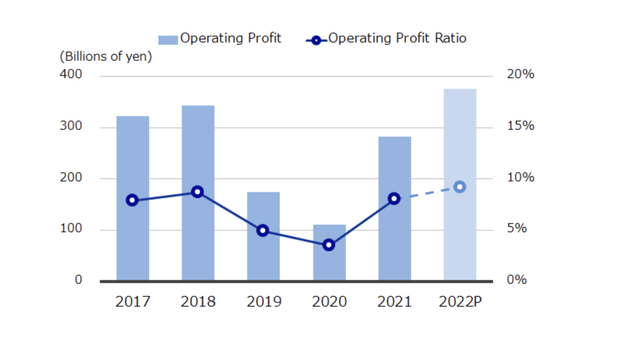

Company sales have been in a downward trend since 2017, cratered during COVID-19 induced 2020, and started climbing back up again in 2021. The current expectation is for 2022E to reach the levels of 2017-2018, which would mean a return to significant growth for the company.

Operating profit trends have followed this cycle – but done so in an even more volatile manner than the sales record. The cratering in 2020 was massive and saw ratios/margins drop to below 5%. We’re now on our way back up again.

Canon IR (Canon IR)

The company’s dividend record is spotty. Canon “wants” to pay a good dividend, and even paid an extraordinary commemorative dividend on its 80th birthday back in 2017, but then cut the dividend by 50% in 2020, only to now slightly raise it. The current yield is between 3-4% and this is where it seems projected to stay with about half the 2022A behind us.

This corresponds to a very conservative payout ratio, coming no higher than 45-48%, which is an improvement to the latest few years with payout ratios over 135%.

Canon’s financial health is superb. The company warrants an “A” from S&P Global, which of course speaks for itself. Like many Japanese companies, Canon almost entirely lacks debt. The company’s LT debt/cap is currently at 7.21%, one of the lowest I’ve ever seen in this segment. The company has in fact been reducing debt strategically even more as we move forward and expects to end the year with debt/assets of below 7%.

So, Canon is certainly safe.

But the safety of course isn’t enough. Can it actually grow?

I haven’t exactly been positive about the other Japanese businesses I’ve reviewed given their stagnant performance and future uncertainties. I will clearly state that I see Canon has less of this than its competitors in other segments.

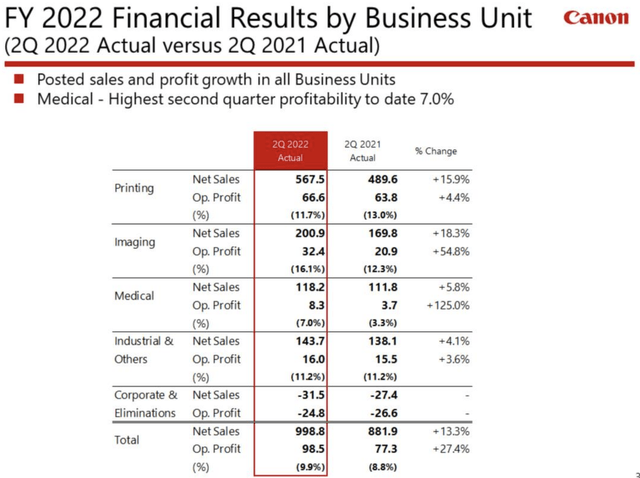

Recent results show us sales increase despite the ongoing conflict and macro. Sales in fact increased double digits, 13.3%, and marks the sixth consecutive quarter of sales growth.

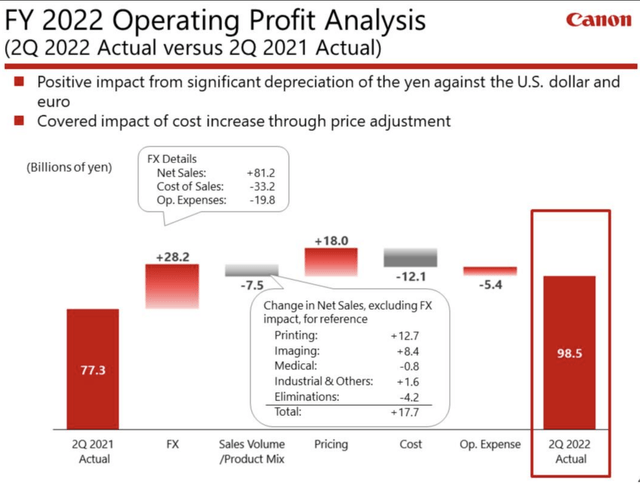

Profit is of course the second question given how things ebb and flow today. Despite significantly increasing logistical and input costs, the company managed to control expenses and increase operating profit by 27.4%, meaning more than twice as much as the company’s sales increase. In part, this was because of the mix, with more full-frame cameras, but it was also due to company actions, managing to control pricing.

FX continues to hound Japanese companies though. The yen is depreciating, and this results in some interesting flows. Still, look at the business unit-level results here.

Canon IR (Canon IR)

And many of these numbers are really despite headwinds. Take printing, which is managing to keep its shape despite the fact that most businesses have not seen returns to the office at high levels as of yet. The bridge for operating profit gives some clarity as to how things are increasing here, in large part due to FX and pricing.

Canon IR (Canon IR)

Canon is doing what most companies are doing. It’s adjusting and working what it can in order to keep its profitability. Many of its products are not consumer-grade stuff, but things that are harder to replace and with higher “stickiness” in their customer base. This is another positive.

The full-year projections call for a total 16.1% net sales increase, and a 13.7% gross profit increase. OpEx is actually expected to decline as a percentage of sales, and profit is expected to increase, coming to a net profit projection of 22% up at 214B Yen.

Demand for company products is excellent. The company’s order book is well-filled, and the company has increased production. The problem here is a part shortage, and the company is diversifying suppliers and searching for alternative part solutions.

Canon is, as I said, primarily a printing company. Its high-speed cut-sheet inkjets, large formats, “Prosumer”, and Office products are where Canon generates most of its sales. As of current trends, its sales are actually up, and the company is increasing its output – while also increasing prices.

It’s very fair to say that Canon is doing quite well. Company cash flow is expected to be up for the full year, and order and sales trends show promise and confirm the longer-term positive for the business.

The company even had sufficient capital to buy back shares, which it has done at appealing valuations seen from a 20-year perspective. The company makes it clear that it sees the company return to 4,000B Yen in sales for the first time in 5 years for the 2022E period, while income climbs to the highest level in over 10 years.

Let’s look at valuation.

Canon’s Valuation

Canon’s upside comes from several perspectives. For one, we have a clear dividend upside, with prospective payout growth. That’s going to be pretty major going forward, and important in the current environment.

Secondly, you can’t overstate the fundamentals of Canon. This is a well-entrenched company with boundless expertise in several fields. Their products aren’t impossible to replace, but they’re a hard company to switch from if you’ve built your portfolio or office around their products. Switching costs/issues are there. Couple this with a superb credit rating, and you have a sticky A-rated company.

Thirdly, the valuation is actually appealing at this point. Looking at the share price for this year, you can clearly see the ups and downs and the patterns the stock seems to follow for the time being.

Canon Share price (Seeking Alpha)

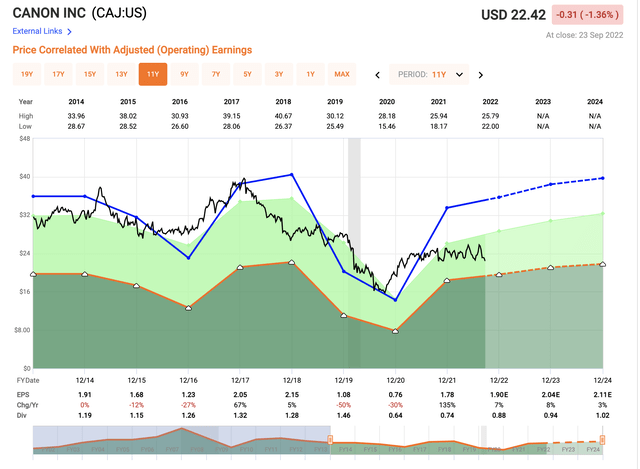

How this translates into the valuation is currently as follows. The company trades to a conservative average P/E of 12x. This is already pretty low, but the market is currently in a position where “standard” rules of valuation are out the window, as it seems to be searching for a bottom. However, Canon has not advanced its valuation, while at the same time significantly advancing its prospects, results, and forecasts.

Canon Valuation (F.A.S.T graphs)

Like many companies in this market, this means that Canon is actually in a very good position at this time. And unlike other Japanese businesses, I do see a realistic prospect for the company achieving its forecasted, near-double-digit annual rates of growth for the foreseeable future.

Oh, they may be lower than the forecasted 7-8%. But even in that case, you’re talking about a world giant trading at 12x as opposed to the average of 20x.

Even if you only assume completely flat trading at 12x until 2024E, your RoR would be close to double digits per year, or 24% until 2024 while raking in around 3-4% dividend – likely more due to raises.

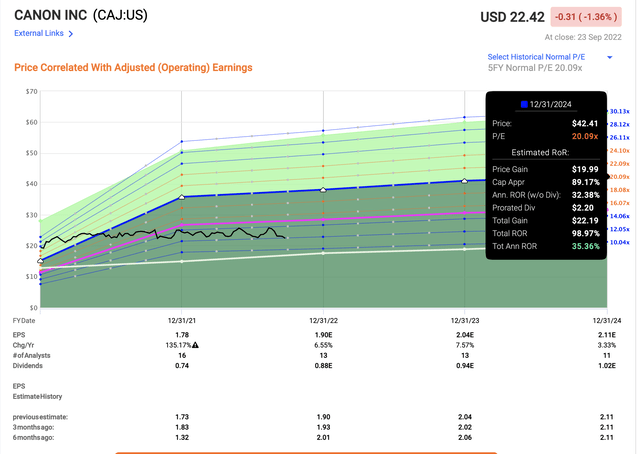

In the case of full normalization to a 20x P/E, Canon could actually become a triple-bagger, generating RoR of close to 100% or annualized RoR of over 35%.

Canon Upside (F.A.S.T graphs)

I don’t see the company trading significantly below those ranges for extended periods of time. If it does and the results and forecasts stay unchanged, I would say its time to potentially make this company a core holding of a conservative dividend portfolio.

Canon is too good to be ignored. The growth pathways and fundamentals include both time-tested segments like Medtech, printing, and photography – but also future growth potentials, such as a nearly-untapped VR/AR industry that’s valued in the 10’s of billions of dollars. A company like Canon will be a major player in such an industry, unless they sleep through it, which Canon has never done.

Canon is the 3rd-largest owner worldwide of active patents, and generates over 2,500 new patents, on average, every year. This company is a serious contender in everything having to do with imaging and similar technologies.

It has very strong legs to stand on, and it has the potential to make a “jump” for the next new, segments.

I forecast current company growth models to hold even in the face of macro and expect EBITDA growth of 3-5%. Analysts would agree with this, with 15 analysts following the native 7751 ticker. They consider Canon to be undervalued by at least 10%, with a current native share price of 3,277Y, the target being close to 3,600.

What it boils down to is essentially if it’s too early to invest in Canon – if the company has further to fall. I don’t engage in crystal ball exercises, and I say that at this valuation, the company is actually attractive. I’m starting coverage of Canon, and I call this one a “BUY” with a native share price of 3,500Y, which comes to around $24.5 for the ADR CAJ.

This is where we begin.

And Canon is the first native Japanese company in my portfolio.

Thesis

My thesis for Canon is as follows:

- Canon is one of the premier imaging, camera, and printing companies on the planet. It has a solid foundation as well as excellent growth prospects. At the right valuation, this company goes from being a possible buy to being a very compelling prospect for long-term investing.

- At a conservative 12x P/E, I not only consider the company somewhat attractive but a definite “BUY”. I’ve established a starter position – my first position in a native Japanese ticker.

- I start following Canon with a $24.5 ADR price target, or 3,500Y for the native Tokyo ticker.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.