JGalione/E+ via Getty Images

Tattooed Chef, Inc. (NASDAQ:TTCF), a plant-based food company, produces and sells a portfolio of frozen foods in the United States.

In June 2022, we have published an article on Seeking Alpha, titled: “Why we are avoiding Tattooed Chef for now”. After considering the pros and cons, at that time, we have rated Tattooed Chef’s stock as a “hold”.

On the positive side, the main drivers for our rating were:

- Double-digit revenue growth in the first quarter of the year.

- Potential improvement of margins due to the investment in cold storage facilities and automation improvements.

On the negative side, we have pointed out several risk factors, which were:

- High valuation.

- Macroeconomic headwinds, including low consumer confidence, high commodity prices.

- Current, decreasing trend of margins.

All in all, we believed that the despite the headwinds, TTCF could be a hold, due to the impressive growth figures.

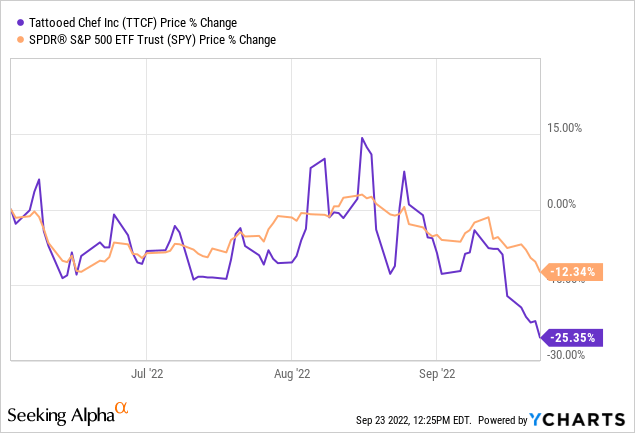

From June to September, the stock essentially performed in-line with the broader market, despite the higher volatility. However, due to the sharp decline starting in mid-September, TTCF finished this time span much lower than the S&P 500.

Now, we will revisit our analysis and provide an updated view, taking into account the recent news and developments that may have an impact on the firm’s financial performance going forward. We will focus on two pieces of new information, which could have particularly large impacts on the stock prices going forward.

Expanded Walmart distribution deal

In August 2022, it was announced that TTCF’s presence in Walmart (WMT) stores will significantly increase. It is expected that the brand’s frozen shelf presence will expand from 5 to 13 SKUs, plus they will be made available in about 2000 Walmart stores, in contrast with the current number of about 300 stores. We believe that this move will help TTCF to gain further brand awareness and provide tailwinds for further sales growth.

Additionally, the firm has acquired assets from Desert Premium, which are currently operating in a leased facility in New Mexico, significantly expanding the cold storage and ambient storage capacities. This step is in-line with the firm’s previously highlighted strategy of increasing cold storage capacity. The new facility is expected to be cash flow neutral for the rest of 2022.

While these news had a material positive impact on the share price, these gains were soon given up as market sentiment turned more bearish.

On the other hand, the firm’s quarterly financial performance was rather unimpressive.

Financial performance

In August TTCF has reported quarterly earnings and provided an updated outlook for the rest of the year. The firm has missed both on top- and bottom-line estimates, causing the share price to drop significantly after the announcement. The outlook has been also revised downwards, with gross margin expectations falling as low as 8-10% compared to the previous guidance of 10-12% due to the inflationary forces. The downward pressure on the margins is likely to last in the upcoming quarters.

During the conference call, the CEO has openly addressed the macroeconomic challenges and their expected impacts on the company:

We certainly experienced some challenges during the first half of the year, across the board inflationary pressures impacted our operations, especially our gross profit which includes domestic and international freight costs that have risen dramatically, […]

The worse than expected performance also resulted in many analysts downgrading the stock and cutting their price targets.

On a more positive note, we have to mention that the firm has extended its revolving credit facility to $40 M, which we believe could provide more financial flexibility to TTCF in the current volatile market environment.

Key takeaways

All in all, the macroeconomic headwinds that we highlighted in the previous quarter continue to negatively impact the firm’s financial performance. According to the revised outlook, the company expects these headwinds for the rest of 2022, potentially up to mid-2023.

The expansion of the distribution deal with Walmart could serve as a good opportunity to raise brand awareness and capture a larger portion of the market share. We also expect this action to keep fuelling the impressive revenue growth of the firm in the near future.

Due to the earnings induced sell-off, the firm became slightly more attractive from a valuation point of view; however, we still believe that the premium it is trading at compared to its peers is not justified.

For these reasons, we maintain our hold rating on the firm.