AerialPerspective Works/E+ via Getty Images

The renowned Benjamin Graham once said that a market is a voting machine in the short term and a weighing machine in the long term. This does not appear to be the case with Vontier (NYSE:VNT) yet. The mobility conglomerate has been struggling to make investors believe in its path to growth and has been “rewarded” with a negative price movement since its spin-off from Fortive, in May 2020.

If you believe that fundamentals drive the price long-term, as I do, then Vontier is currently a bargain, trading well below intrinsic value. While I see the exciting value, I probably would want to wait for a catalyst to back up the price and see the evolution of debt, capital allocation, and the real impact of EMV revenue erosion.

Business

Vontier separates its operating segments into 1. mobility technologies and 2. diagnostics and repair tools, with the first reaching more than 75% of 2021 revenue and the latter with the remaining 25%. Total revenues for the last reporting quarter (Q2) were $776M, (adjusted) operating margin came up to 21.5%, and (adjusted) diluted earnings per share to $0.72 – all up YoY.

Mobility technologies incorporate, among other smaller businesses, the well-known Gilbarco Veeder-Root, the integrated fueling dispensing, and the newly acquired DRB which focuses on integrated solutions in the car washing industry. Other revenue streams come from technology services related to the mobility side, like vehicle tracking and fleet management. The company is mostly concentrated in the North American markets with 71% of its revenue, but is also exposed to some high-growth markets in the developing world and western Europe.

The diagnostic and Repair tools segment is comprised of Matco Tools and Hennessy Industries which offer a wide variety of repair tools and equipment also for vehicles, complementing the above mobility segment.

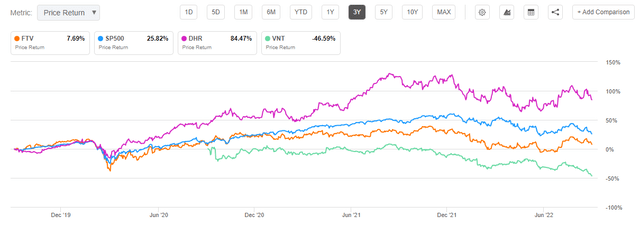

The company advocates their proprietary “Vontier Business System (VBS)” which they indicate drives their performance and company culture, translating into “long-term shareholder value creation” by a vague application of a series of tools and processes. A similar system exists in previous mother companies Fortive (FTV) and Danaher (DHR) with similar explanations. If we consider the last 3 years, then only Danaher managed to deliver the so promised shareholder returns while the other two have lagged the overall market.

Price Returns (%) of SP500, DNR, FTV, and VNT (Seeking Alpha)

I believe that Vontier possesses several small interesting “moats” over some of the segments that they operate in. They have strong and dominant market positions which are hard for competition to enter.

Developments: Spin-off to today

Since the spin-off in May 2020, Vontier has been trying to capitalize on the short-term revenue boost caused by the EMV transition tailwind with some capital allocation directed to growth acquisitions and some buybacks. This strategy appears to be working as we have been presented with some good non-EMV growth and a few interesting acquisitions; Driivz and Tritirium (DCFC) in the electric charging software and hardware space, New-Zealand Invento to strengthen their payment solutions, and the bigger, already discussed, DRB position in the vehicle wash integrated solutions space. Besides other possible synergies from the acquisitions, there should be interesting growth opportunities for DRB internationally to profit from existing connections and synergies from the dominant fueling business.

The company has accumulated a significant amount of debt on its balance sheet ($2.6B), from which $1B is in variable rate to be repaid $600M in 2023 and $400M in 2024. This will, best case scenario, require new financing at a probably higher cost than what they currently have. Worst case scenario, Vontier will not be able to sign additional lines to service its debt and is forced to take serious measures, like the sale of parts of the business.

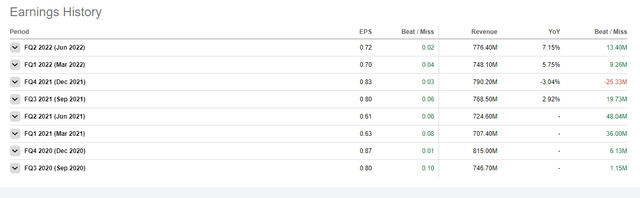

The past track record is positive with good results, the company has successfully beaten earnings estimates ever since the spin-off took place.

Vontier Earnings History (Seeking Alpha)

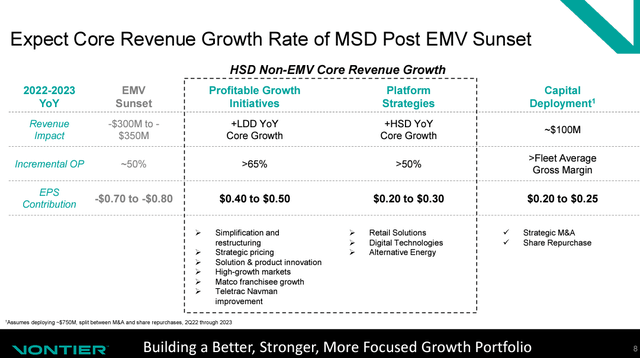

What seemed like an opportunity to pivot the business towards growth, the EMV forced transition transformed itself into a headwind with investors having different opinions regarding the short-term impact and future growth. It also didn’t help the fact that management disclosed a larger decline in revenues already happening in 2023 instead of a slow decrease until 2025. Even with a steeper decline and analysts’ negative estimates, management reinforces the belief in growth for 2023.

Q2’22 Earnings Presentation (Vontier)

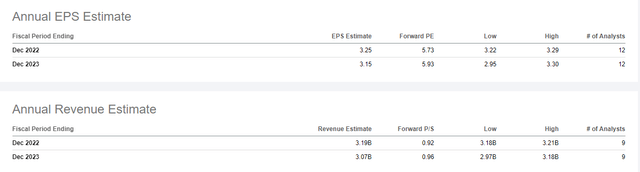

Analysts’ Expectations (Seeking Alpha)

Worth highlighting the recent CFO change with David Naemura being replaced by the now former CFO of Harsco (HSC), Anshooman Aga. In my opinion, management changes, especially the ones without a reason, are a red flag to take into consideration. It also adds up that Harsco doesn’t appear to be doing great after a significant acquisition.

Base Case

Considering a mid-single-digit free cash flow growth and a discount rate of 10% after 2023, I believe the fair value of Vontier to be, at least, in the high 20s. I regard it as fair and conservative to assume a US GDP growth rate for their growth after the 2023 EMV headwind and a discount rate of 10% even with increasing interest rates. This is still a stable, not very cyclical, and cash flow positive business with impressive scalable gross margins and recurring revenues. The fueling business, although at risk in the future, is not going to disappear soon, and it is still capable of producing interesting returns.

If we then consider a relative valuation, the difference is even more overwhelming. Vontier currently trades at an EV/EBIT (FWD) of 7.60 and a Price/FCF (FWD) of 5.66 while Fortive trades at an EV/EBIT (FWD) of 25.46 and a Price/FCF (FWD) of 17.71, Dover (DOV) trades at an EV/EBIT (FWD) of 13.23 and a Price/FCF (FWD) of 13.35 and Danaher trades at an EV/EBIT (FWD) of 26.33 and a Price/FCF (FWD) of 22.16. With just a change in the future expectation and trading multiples, it’s possible to see a 2x in the price for Vontier.

Bear Case and Risks to Consider

Short term I think the bear case could materialize if they fail to overcome the revenue and earnings decline for next year, failing their projections for the next year. This should prove yet another stock price decline and further doubts over their ability to execute. The considerable debt amount will probably be harder to service and maintain despite having now a high-interest coverage ratio, but it will be hard to grow by acquisitions if you don’t have any financial flexibility. The renewal of the debt due in 2023 and 2024 will be harder and more expensive.Long-term wise, the transitioning of the fueling systems to the electric charging hardware and software related will prove key to providing a safe future. Although still far away, it’s a given that fossil fuel vehicles will eventually disappear and so Vontier needs to start already building the (correct) foundations.

Conclusion

It’s amazing to see how low Vontier stock price has reached since its IPO price of $34, especially when seeing the underlying business developing. Despite the current bargain price, it’s hard to see a turning point soon for the stock because of the likely decline in the fundamentals for 2023 exacerbated by today’s tough macro environment.I believe that the mentioned debt and CFO potential problems are more than priced in at current prices. Vontier is being valued almost as a dying business when it’s far from the case, mobility solutions provided will continue to be important for days to come, and, although still soon, it’s aligning itself with some interesting long-term trends.