peshkov

One of the beautiful things about investing in the oil and gas exploration and production space is that there are a number of companies to choose from. These can be categorized by area of concentration, whether they focus largely on oil or natural gas, and even by market capitalization, with some firms being microcap companies and others being some of the largest firms on the planet. One prospect that warrants investor attention is none other than Gran Tierra Energy (NYSE:GTE). As a player that focuses on international operations, that has essentially all of its production in the form of oil, and that has a fairly small market capitalization of $486.5 million as of this writing, this particular prospect can make for a nice addition to the portfolio of many different types of investors. It also helps, assuming the company achieves the targets it set for itself, that shares are trading on the cheap on a forward basis. And for this reason above all others, I have decided to rate the enterprise a solid ‘buy’ at this moment, reflecting my belief that it will likely outperform the broader market for the foreseeable future.

Gran Tierra Energy – A unique prospect with surprising clarity

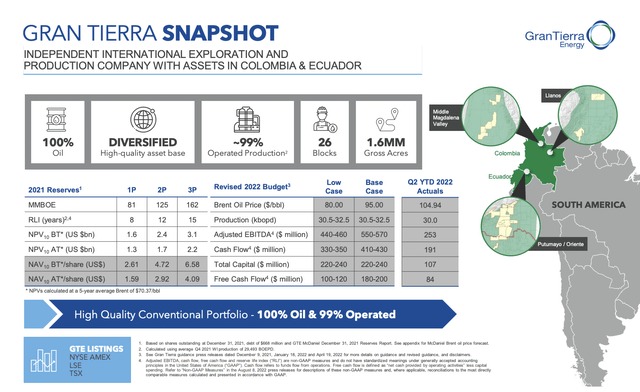

The management team at Gran Tierra Energy describes the company as an international player in the exploration and production space. The company typically focuses on development in proven, under-explored conventional basins, with its current portfolio consisting of reserves located in both Colombia and Ecuador. It is worth noting that its exposure between these two regions is not equal. 98% of its reserves, for instance, are located in Colombia and roughly 91% of its capital expenditure budget for the 2022 fiscal year is dedicated to the resources in that country. In all, the company intends to dedicate its resources to between 26 and 32 wells during the 2022 fiscal year, with a total capital budget of between $220 million and $240 million.

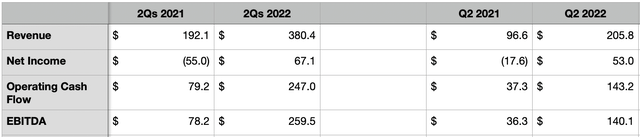

Author – SEC EDGAR Data

So far in 2022, the financial picture of the company has been rather robust. Revenue in the first half of the year came in strong at $380.4 million. That’s up from the $192.1 million reported the same time one year earlier. The greatest strength for the firm came in the second quarter, with oil sales totaling $205.9 million compared to the $96.6 million reported one year earlier. Because of high energy prices, the firm has even managed to turn a profit so far this year, with net income of $67.1 million crushing the $55 million loss experienced in the first half of the 2021 fiscal year. If there’s one thing that you should know about the oil and gas exploration and production space, it’s that a player in this market that’s generating net income instead of a net loss almost certainly is generating strong cash flow as well. For the first six months of its 2022 fiscal year, the firm managed to generate $247 million in operating cash flow. That’s roughly triple the $79.2 million generated the same time one year earlier. Similarly, EBITDA for the company rose from $78 million in the first half of 2021 to $259.5 million the same time this year.

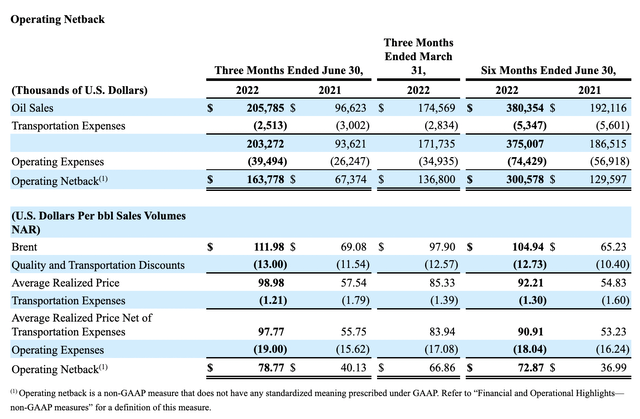

Gran Tierra Energy

It is absolutely true that a key driver behind this increase on both the top and bottom lines for the company was the higher pricing that the company realized for its oil sales. The price per barrel of Brent crude in the first half of the year came in at $104.94. That’s up from the $65.23 experienced just one year earlier. Pricing was particularly strong in the second quarter of the year, with the amount per barrel totaling $111.98. That stacks up favorably against the $69.08 per barrel experienced in the second quarter of 2021. Of course, realized pricing is a different matter entirely. This much can be seen in the image above. The increase in capital spending that the company has engaged in relative to the same time last year was also instrumental in pushing production higher. Total sales volume in the first half of the 2022 fiscal year came in at 22,790 barrels of oil per day. That represents an increase of 17.7% compared to the 19,357 barrels per day sold in the first half of the 2021 fiscal year. I specify that this is the amount sold instead of the amount produced because the company did actually produce more than this. However, the firm also had to allocate some of its production toward royalties as is often the case when dealing with international production.

Given current market conditions, I can understand why investors might be fearful of the future for this firm. If the economy truly does start to suffer more than it has already, it is possible that we could go into another oil glut. If this were to come to pass, prices could plunge materially. Having said that, I don’t think there is a significant risk of that taking place. And in the event that it doesn’t, the upside for investors from here could be material. Consider management’s own guidance for the 2022 fiscal year.

Gran Tierra Energy

At present, the base case provided by management calls for Brent crude to average around $95 per barrel. If this comes to pass, the firm would generate annual EBITDA of between $550 million and $570 million. Even if they are wrong and we see the base case which would be $80 per barrel, the amount generated would be between $440 million and $460 million. Management also provided guidance when it came to operating cash flow for both of these scenarios. Under the base case, operating cash flow would be between $410 million and $430 million. And under the low case, it would be between $330 million and $350 million. At present, Brent pricing is somewhere in between at around $86 per barrel. So it’s unclear what the exact picture will look like. Absent a significant deterioration in the market, however, I have a hard time believing that the rest of this year could be so painful as to bring the average down to $80.

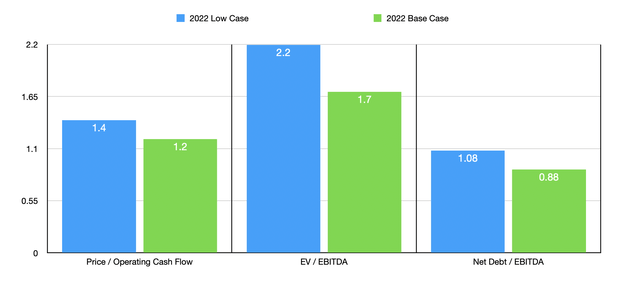

If management guidance comes to fruition, then shares are looking rather cheap. In the base case scenario, the firm would be trading at a forward price to adjusted operating cash flow multiple of 1.2. This increase is only to 1.4 using the low scenario. Meanwhile, the EV to EBITDA multiple for the company would be 1.7 under the base case and 2.2 under the low case. These numbers are cheap no matter the angle that you look at them from. Many of the companies that I write about in my oil- and gas-focused Marketplace aren’t trading quite that low. To make matters even better, using the current amount of debt on the company’s books, the net leverage ratio should come in at between 0.88 and 1.08. And that assumes that the company does not continue to pay down debt throughout this year. Total net debt as of this writing is roughly $486.2 million. Management is hoping to reduce this to less than $400 million by the end of the year. And along the way, the company will likely engage in further share repurchases. After all, the company did recently announce that it was now authorized to buy back up to 36 million of its own shares moving forward.

Author – SEC EDGAR Data

Takeaway

Given all the data we have today, I will say that Gran Tierra Energy seems to be a great prospect for investors to consider. Although the oil and gas exploration and production space should be approached cautiously, particularly if you are only neutral or if you are bearish about its prospects, the upside potential from here, especially for a firm with low leverage, could be material. Given these factors, I’ve decided to rate the business a solid ‘buy’ at this time, reflecting my belief that it will likely outperform the broader market for the foreseeable future.