DNY59

Right now, the market is in free fall.

Interest rates are surging and investors are quite literally running for the exit.

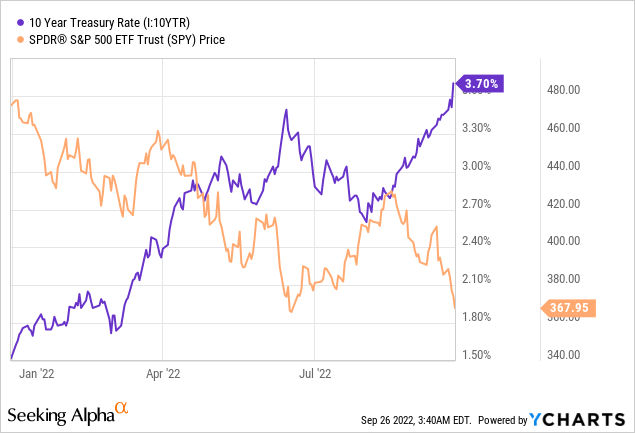

You can clearly see the inverse relationship between the S&P 500 (SPY) and the 10-year Treasury (IEF) in the chart below. As interest rates rise, stocks dip lower and lower:

And with inflation remaining at suborning high levels, we can expect many more rate hikes before things finally stabilize. The Fed recently made this clear and it is causing investors to lose hope.

But before you panic and sell your stocks, you must remember a few important things:

- It is impossible to time the market because it is a forward-looking machine.

- The recovery is always unexpected and most gains happen in a few days.

- Valuations are already historically low, pricing materially higher rates.

- Not all businesses suffer from higher interest rates to the same extent.

- Some businesses even benefit from this uncertain environment.

So it is not as simple as saying that “interest rates will rise, and therefore, stocks will drop further.” If it was so simple to predict the market, we would all be billionaires.

Generally speaking, it is not possible to time the market, and beyond that, not all stocks react similarly to rate hikes since they have different balance sheets, they are priced at different valuations, and they also react differently to inflation.

The key in today’s environment is to buy businesses that enjoy three things:

- Low Valuation: They need to be already so heavily discounted that you enjoy a significant margin of safety if interest rates keep rising.

- Strong Balance Sheet: Low leverage and well-laddered debt maturities so that the profitability of the business isn’t materially impacted by rate hikes.

- Benefits from the High Inflation: It allows the business to hike its prices and grow its revenues at a faster rate than its expenses.

And believe it or not, they are surprisingly many such businesses. Of course, they could still drop in the near term (we don’t a crystal ball), but in the long run, you would expect such resilient and undervalued businesses to deliver strong returns.

In what follows, I highlight two such stocks that I have been accumulating following the recent correction:

KKR & Co. Inc. (KKR)

Asset management businesses are some of my favorites because they essentially allow you to earn a return without putting much or any of your own capital at risk.

If you can convince other investors to invest with you, it can become a very profitable and capital-light business with consistent earnings and rapid growth potential.

But not all asset management businesses are created equal.

Some sub-segments of this market are highly competitive, lack barriers to entry, and as a result, also lack pricing power. The best example would be the business of exchange-traded funds (“ETFs”). BlackRock (BLK) is only able to charge a 0.09% fee for the management of its S&P 500 ETF (SPY), and besides, investors can leave you at any time so the earnings are not sticky. Right now, investors are running away, and consequently, BlackRock will earn fewer fees in the coming quarters.

But some other asset managers have much greater pricing power and may even benefit from today’s environment.

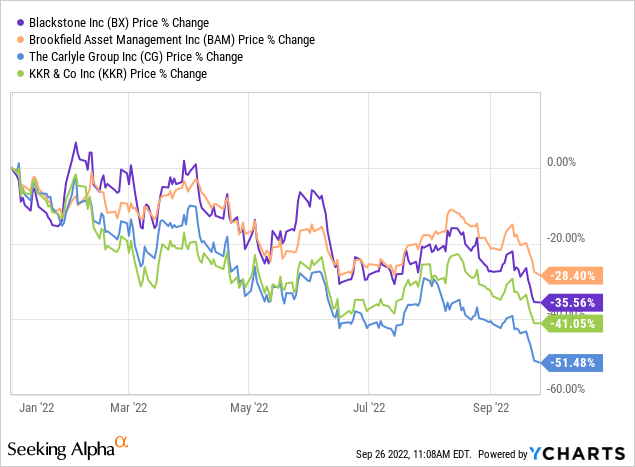

I am here referring to alternative asset managers like KKR (KKR), Blackstone (BX), The Carlyle Group (CG), and Brookfield Asset Management Inc. (BAM).

They specialize in less-competitive asset classes like private equity, private debt, infrastructure, energy, commercial real estate, hedge fund solutions, and so on. These are private and illiquid investments that are harder for investors to access, and therefore, the asset managers are able to charge higher fees and the investors need to commit to longer terms. They cannot simply run away at the first sign of uncertainty.

Some of these asset classes may also suffer from today’s environment, but others may benefit. Importantly, when there is high uncertainty, investors typically seek greater diversification, which ends up benefiting the alternative asset managers.

Therefore, today’s high stock market volatility and lack of protection provided by bonds may turn out to be a tailwind for alternative asset managers that can grow their assets under management.

Despite that, they have all collapsed as if their businesses were set for significant pain in the years ahead:

We think that this is an opportunity.

The market overreacted to the fact that performance fees will likely be smaller in the near term but failed to recognize that these businesses will ultimately benefit from this uncertainty in the long run.

I am bullish on most of the major asset managers, but my top pick is KKR because I think that it is set to grow its assets under management even faster than its closest peers, it has a fortress balance sheet, a cheaper valuation, and its insiders have significant skin in the game. Main Capital recently announced that it was doubling down on KKR and noted that they expect its share price to reach $136 by 2026 (more than triple the current level). I am currently working on a detailed investment thesis for members of High Yield Landlord.

UMH Properties, Inc. (UMH)

Real estate (VNQ) is one of the best inflation hedges in the world, but not all real estate is created equal.

Some of it is more vital than others, and some of it also enjoys better pricing power in a world of high inflation and poor economic conditions.

Manufactured housing communities can be particularly attractive investments because they provide affordable housing and tenants typically cannot find a cheaper option in their local market. This gives you pricing power in today’s world, as there is always growing demand for affordable housing and this demand may even grow in a recession.

UMH Properties

Moreover, the tenant typically (but not always!) owns the house and only rents the lot, which means that it is highly dependent on the landlord since moving a house would be costly and impractical. It also means that the landlord has less capex since it only needs to maintain the park and its associated infrastructure. So, the impact of inflation on your expenses is relatively low, but the impact of inflation on your revenue is significant.

UMH Properties is my top pick in this sector for three reasons:

- Strong Balance Sheet: It has low leverage at just a 20% LTV and its debt maturities are well staggered. Therefore, the impact of rising rates would be very limited.

- Rapid Growth: We recently interviewed the management for High Yield Landlord, and learned that they expect to grow their funds from operations (“FFO”) per share by 50% over the coming 5 years. Most of this growth is highly predictable as it will come from rising occupancy, rising rents, and new lot developments.

- Low Valuation: Despite this rapid growth and strong balance sheet, UMH is trading at an estimated 30% discount relative to the value of its underlying assets. Based on its FFO, it also trades at just 16x cash flow and it pays a near 5% dividend yield that’s well-covered and growing.

Finally, I also like that the management has a lot of skin in the game. They own 10% of the company and they are motivated to see the value of their stake grow.

Bottom Line

Just because interest rates are rising does not mean that nothing is worth buying. There are a number of businesses that are severely discounted and could ultimately even benefit from today’s environment. In many cases, it is a case of short-term pain for long-term gain.

At High Yield Landlord, we are selectively accumulating businesses that aren’t materially impacted by the rising rates, but are still heavily discounted. We expect those to bounce back the fastest from today’s correction.