Anna Bliokh/iStock via Getty Images

As oil prices bounced back in the recent week, Obsidian Energy Ltd.’s (NYSE:OBE) stock price increased by 15% in the past five days. Also, InPlay Oil Corp.’s (OTCQX:IPOOF) stock price increased by 17% in the past five days. Assuming for WTI crude oil price of $105 per barrel in 2022, OBE expects its adjusted funds from operations (“FFO”) to be $563 million in 2022, up 141% over 2021. Also, assuming WTI crude oil price of $85 per barrel for the second half of the year, IPOOF expects its 2022 adjusted funds flow to be between $139 to $143 million, up 196% to 204% over 2021.

Obsidian Quarterly highlights

In its 2Q 2022 financial results, OBE reported production revenues of $277 million, compared to 2Q 2021 production revenues of $111 million. Also, the company’s revenues increased by 36% QoQ. OBE’s funds flow from operations increased from $42 million in 2Q 2021 to $157 million in 2Q 2022. In the second quarter of 2022, the company’s FFO per diluted share increased by 238% YoY and 98% QoQ to $1.86. OBE’s total production increased from 24651 boe/d in 2Q 2021 to 29407 boe/d in 1Q 2022 and 31575 boe/d in 2Q 2022, driven by significantly higher heavy oil production in 2Q 2022 compared with the same period last year. As a result, OBE reported a 2Q 2022 free cash flow of $113 million, compared with a 2Q 2021 free cash flow of $20 million.

In the second quarter of 2022, WTI oil price per barrel increased by 15% QoQ and 64% YoY to $108 per barrel. Meanwhile, OBE’s light oil average sales price increased by 19% QoQ and 82% YoY to CAD$140 per barrel. Also, the company’s natural gas average realized price increased by 49% QoQ and 90% YoY to CAD$7.38 per million cubic feet (in the second quarter of 2022, Henry Hub natural gas price increased by 53% QoQ and $134 YoY to $7.24/mcf.

It is worth noting that the foreign exchange rate ($US/CAD$) increased from 1.26 in 2Q 2021 to 1.27 in 1Q 2022 and 1.28 in 2Q 2022. “Our strategy is focused on maintaining moderate production growth, operational excellence, improving our debt leverage, and delivering top quartile total shareholder returns,” the company stated.

InPlay Oil Corp. Quarterly Highlights

In 2Q 2022, IPOOF reported total production of 9063 boe/d, compared with 2Q 2021 total production of 8644 boe/d. The company’s crude oil sales increased from $20 million in 2Q 2021 to $48 million in 2Q 2022. Its NGLs sales increased from $2 million in 2Q 2021 to $7 million in 2Q 2022. Finally, IPOOF’s natural gas sales increased from $3 million in 2Q 2021 to $16 million in 2Q 2022. IPOOF reported 2Q 2022 total sales of $72 million, up 182%.

The company’s crude oil average realized price increased by 81% YoY to $136 per barrel. Its NGLs average realized price increased by 100% YoY to $60/boe. Finally, IPOOF’s natural gas average realized price increased by 133% to $7.6/mcf. IPOOF reported 2Q 2022 adjusted funds flow of $41 million, or $0.45 per diluted share, compared with a 2Q 2021 adjusted funds flow of $8 million, or $0.12 per diluted share. The company’s net debt decreased from $76 million in the second quarter of 2022 to $51 million in 2Q 2022.

“The Company drilled, completed, and brought on production six (6.0 net) extended reach horizontal (ERH) wells in Pembina, two (1.7 net) ERH wells on our Prairie Storm assets, and one (0.2 net) non-operated Willesden Green ERH well during the first half of 2022,” the management stated. “The Company completed the drilling operations of an additional two (1.9 net) 2 mile ERH wells in Willesden Green in the second quarter which were brought on production in July,” the management continued.

The market outlook

Oil prices decreased significantly in recent weeks. According to Figure 1, WTI crude oil price dropped to $77 per barrel on 26 September 2022 and bounced back to $86 per barrel on 4 October 2022. Figure 2 shows that Brent crude oil price decreased to $82 per barrel on 26 September 2022 and bounced back to $92 per barrel on 4 October 2022. Oil prices decreased in September as interest rate hikes by major central banks around the world to combat inflation weakened the sentiments on the economic recovery. A global recession combined with uncertainties about the war in Ukraine and uncertainties about the COVID-19 pandemic means lower energy demand.

However, due to the ongoing Russian oil sanctions by the European Union countries and Iranian oil sanctions, oil prices should be supported. Moreover, OPEC+ may announce major cuts in production to stop oil prices from decreasing. Goldman Sachs estimates the price of Brent crude oil to average $100 per barrel over the last three months of the year. According to EIA, the Brent crude oil spot price averages $98 per barrel in the fourth quarter of 2022.

Figure 3 shows that natural gas prices in the United States decreased from more than $9/MMBtu to $6.7/MMBtu in the past few weeks as summer demand decreased (as a result of lower temperatures in the United States). Also, due to lower natural gas exports as a result of storm-related outages at the Freeport LNG export plant in Texas, the second-biggest U.S. LNG export plant, more natural gas is available for domestic use. EIA expects Henry Hub price to average $9/MMBtu and then fall to an average of about $6/MMBtu in 2023 as U.S. natural gas production rises.

Figure 1 – WTI crude oil price

tradingeconomics.com

Figure 2 – Brent crude oil price

tradingeconomics.com

Figure 3 – U.S. natural gas price

tradingeconomics.com

Obsidian and InPlay Oil performance

In this detailed analysis, I have done some investigations in Obsidian and InPlay Oil profitability ratios to evaluate the companies’ abilities to bring income and utilize its assets to generate profit for their shareholders. To cater beneficial insights into the financial well-being of each company, I have analyzed the profitability ratios across the board of margin ratios and return ratios. To be more useful, I have calculated the ratios compared to previous periods.

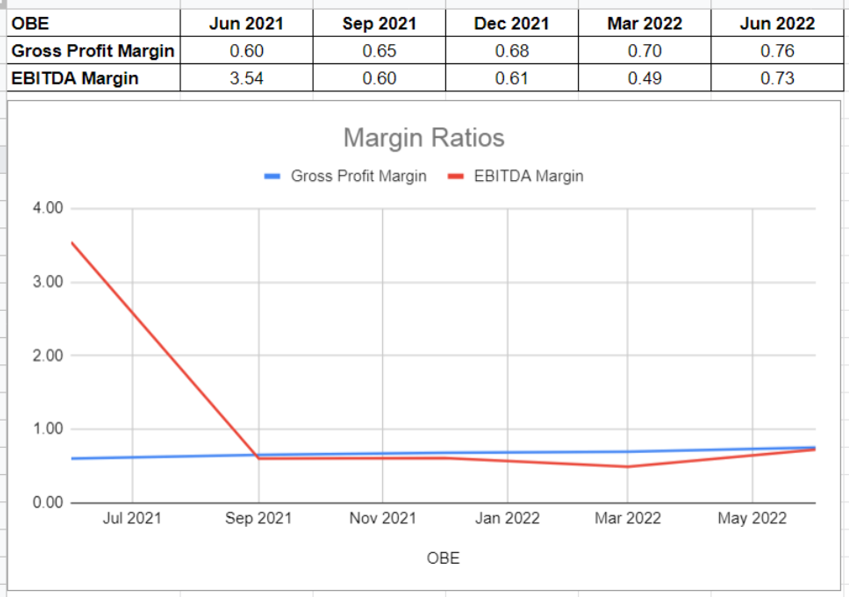

Overall, margin ratios capture the capability of the company to convert sales into profits in a variety of measurements. In this regard, I will investigate Obsidian energy’s gross profit and EBITDA margin conditions and then, compare them with InPlay Oil’s. Obsidian’s gross profit margin has been in an improvement path during the preceding year and sat at 0.76 in 2Q 2022. Its current gross margin increased by 8% versus its level of 0.70 in the 1Q 2022, and 26% year-over-year compared with the same time in 2021. Meanwhile, after a 19% drop in OBE’s EBITDA margin in the first quarter of 2022 from 0.61 at the end of 2021, it increased back to the level of 0.73 in the 2Q 2022 notwithstanding being far lower than its year-over-year amount of 3.54 in 2Q 2021.

The benefit of investigating the EBITDA margin is that it excludes volatile expenses and thus is a good measurement to represent a clear picture of the performance between peers. In short, Obsidian Energy’s margin ratios have improved both quarterly and year-over-year compared with the same time in 2021 (see Figure 4).

Figure 4- Obsidian’s margin ratios

Author (based on SA data)

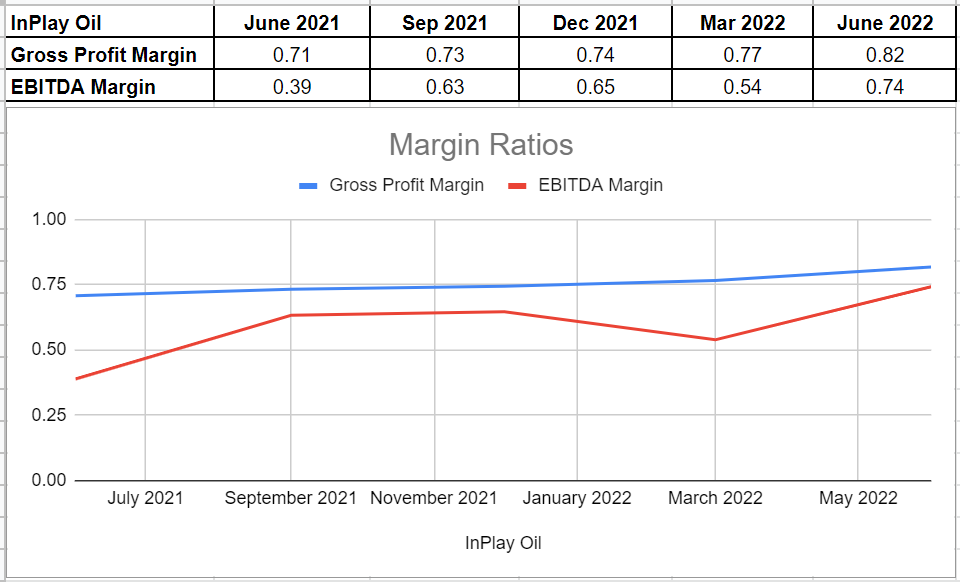

Also, in the case of InPlay Oil’s margin ratios, there is a witness that the company has developed its margin ratios during the last year. To shed some light, IPOOF’s gross profit margin has increased continuously and sat at 0.82 at the end of the second quarter of 2022. Its profit margin increased by 15% year-over-year compared with its amount of 0.71 in 2Q 2021. Furthermore, its EBITDA margin sat at 0.74 in the second quarter of 2022, which is far higher than its level of only 0.39 at the same time in 2021 (see Figure 5).

Figure 5 – InPlay Oil’s margin ratios

Author (based on SA data)

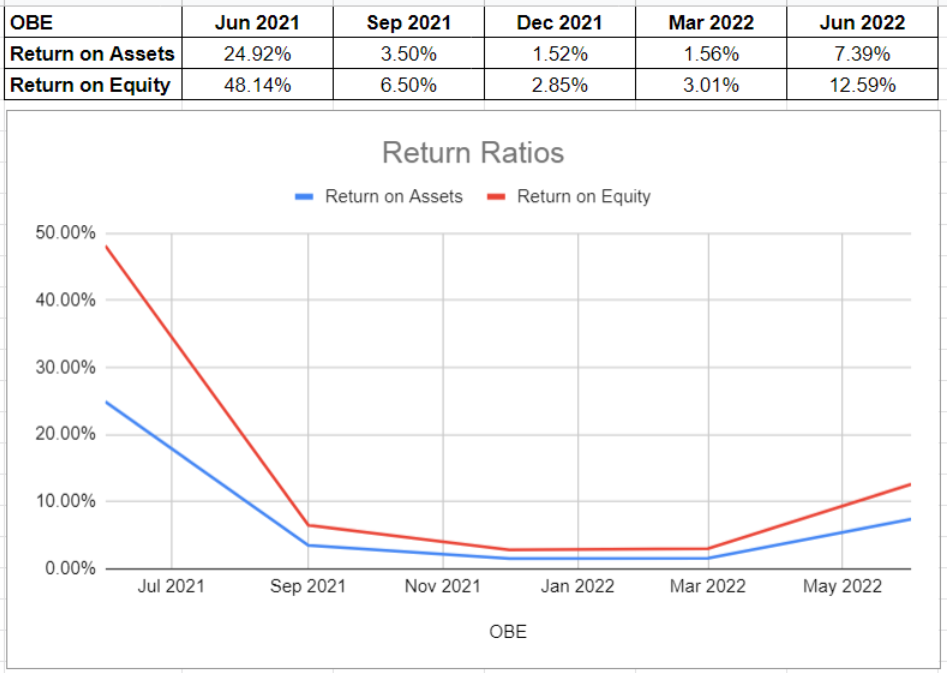

To represent Obsidian’s ability to cater returns to its shareholders and compare it with InPlay Oil, I have investigated their return on assets and return on equity ratios. The ROA ratio reflects how much profit a company is able to generate for every dollar of its assets. Obsidian’s ROA ratio experienced a deep drop in its third and fourth quarters of 2021, and sat at 3.5% and 1.5%, respectively. However, since the beginning of 2022, its return on assets ratio has started to increase, and finally sat at 7.4% in the second quarter of 2022. Similarly, its return on Equity sat at 12.5% in 2Q 2022 after an intense drop to 2.85% at the end of 2021. This ratio indicates the net income of the company, which is relative to the shareholders’ equity. The return on equity ratio is useful as it measures the rate of return on the money that has been invested into the company. Thus, Obsidian’s increasing return on equity shows its capability of generating cash, and thereby, less dependency on debt financing (see Figure 6).

Figure 6- Obsidian’s return ratios

Author (based on SA data)

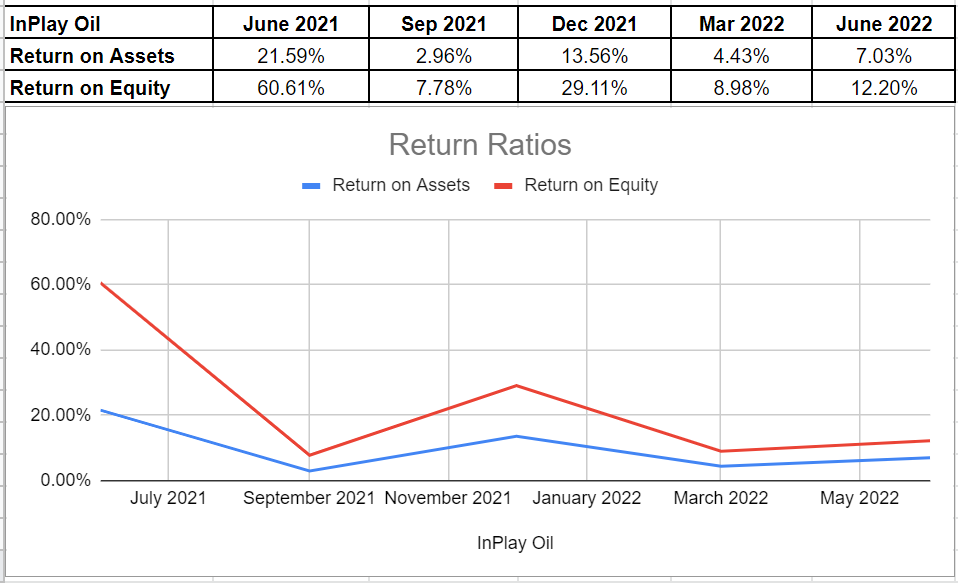

Regarding InPlay Oil’s return ratios, it is observable that after a 913 bps decline in its ROA ratio in the first quarter of 2022 compared with its amount of 13.5% at the end of 2021, it increased back 7% in 2Q 2022. Also, its return on equity increased back to 12% in the second quarter of 2022 after dropping deeply in 8.9% in 1Q 2022, versus its previous level of 29% at the end of 2021 (see Figure 7).

Figure 7 – InPlay Oil’s return ratios

Author (based on SA data)

Conclusion

Ultimately, when all was said and done, according to the preceding remarks and comparing some profitability metrics between Obsidian Energy and InPlay Oil, I realized that both companies are performing well and are in a healthy position to bring some benefits to their shareholders in the future. Albeit being bullish on both stocks, I would rather hold Obsidian Energy, as its profitability ratios represent more stability during the preceding year.