travelview/iStock Editorial via Getty Images

Deutsche Bank Aktiengesellschaft (NYSE:DB) has been suffering for a while. It went through a long restructuring process, which had a strong negative effect on DB’s stock price. The better news is its net revenues for 2022 should total between EUR 26-27 billion.

Management claims DB’s results are particularly strong in fixed income trading, the private bank, and the corporate bank. This is not bad, given the current macroeconomic environment. The banking sector should benefit from higher interest rates. At the same time, many banks are at risk, since the global economy and especially the EU countries are about to enter a long recession. I gave DB a “Buy” rating due to its undervaluation and improving results. Let me explain all this in some more detail.

DB’s earnings history and 2022 revenue guidance

As I have mentioned before, Deutsche Bank has been going through a painful process of restructuring. So, any material improvement in earnings and revenues is the management’s victory and a piece of great news for its stockholders.

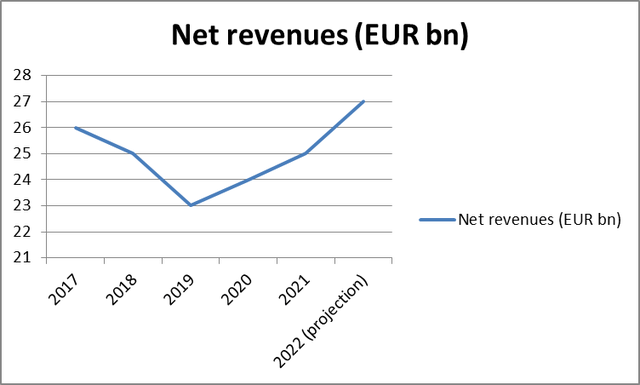

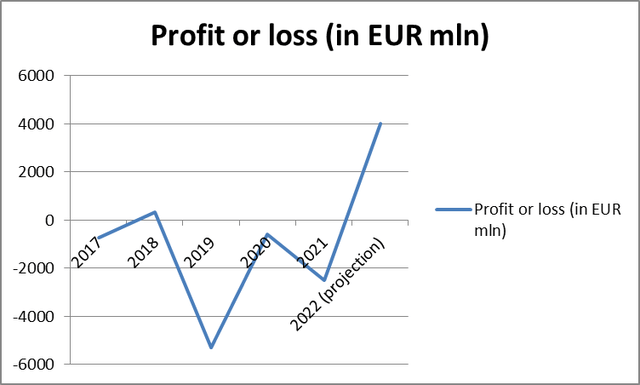

To compare DB’s projected results for 2022 to its historical figures, I decided to prepare this table and two graphs. The table below shows the profit/loss record and the net revenue history.

|

Year |

Net revenues (EUR bn) |

Profit or loss in (EUR mln) |

|

2022 (projection) |

26 – 27 |

4000 |

|

2021 |

25.4 |

(2500) |

|

2020 |

24.0 |

(600) |

|

2019 |

23.2 |

(5300) |

|

2018 |

25.3 |

341 |

|

2017 |

26.4 |

(735) |

Source: Prepared by the author based on Deutsche Bank information.

To start with, it is clear the bank’s earnings have not been particularly stable in the last several years. This is also true of its net revenues.

However, 2019 was the worst year, since it was a year of transformations for the bank. In summer 2019, DB had to restructure its business by focusing on more profitable areas and exiting poor-performance activities. In 2019, Deutsche Bank moved away from equities trading for institutional clients. Although equities trading is profitable for the banking sector thanks to high fees, it is also risky due to volatility. All this was clearly in favor of the bank since its results improved materially after 2019. To Deutsche Bank’s advantage was its conservatively managed balance sheet, as well as an improved capital and liquidity position.

Deutsche Bank

Source: Prepared by the author based on Deutsche Bank’s data.

So, as I have mentioned before, the bank’s net revenues started growing after 2019. For the full fiscal 2022, they are projected to total between EUR 26-27 billion. The management confirmed this in the bank’s July guidance.

Deutsche Bank

Source: Prepared by the author based on Deutsche Bank’s data.

The bank’s profit/loss track record is not brilliant, of course. In the years 2017, 2019, 2020, and 2021, the bank reported substantial losses. However, it is projected that for the full year 2022, the bank will report a EUR 4bn profit. You might argue that projections are not reliable. Certainly. But the results for the recent several quarters did show signs of improvement. For example, for the second quarter of 2022, Deutsche Bank reported a post-tax profit of EUR 1.2bn, its highest level since 2011! It would not be far too optimistic to say DB would end up recording about EUR 1bn on average for each quarter of 2022. So, if we multiply this result by 4 (4 quarters of the year), we would end up with EUR 4bn for 2022.

Deutsche Bank’s key indicators

|

Indicator name |

DB’s indicator |

|

Net Interest Margin |

1.39% |

|

Post-tax Return on Tangible Equity (February 2022) |

11.8% |

|

CET1 ratio |

13% |

|

Cost-to-income ratio |

73% |

|

Projected leverage ratio |

4.5% |

Source: Prepared by the author based on Deutsche Bank’s data.

The last reported net interest margin is 1.39%, which is not horrible, given DB is a European bank. The ECB kept the interest rates negative during the pandemic. That is why the European commercial banks’ interest rates are still low, whilst the net interest margins (the profits banks make by borrowing and lending money) are low as well.

The post-tax return on tangible equity is quite reasonable, given the bank’s profit track record. In 2021, DB’s post-tax RoTE was just 9.7%. Now it is a sound 11.8%, above the bank’s targeted 10%. The cost-to-income ratio does not suggest the bank is brilliant at cost-cutting, but it looks like DB is improving. Quite recently this indicator was 80%.

The CET1 ratio is also quite reasonable, 13%. It has been above 12% for a while. So, in that respect, DB inspires trust. DB’s projected leverage ratio for 2022 is 4.5%. An indicator above 5% is generally considered to be good. Deutsche Bank has further room for improvement. But its leverage ratio is not horrible either.

Overall, Deutsche Bank’s fundamental indicators are reasonable.

Macroeconomic environment

The macroeconomic environment seems to be highly challenging. The Eurozone’s inflation is breaking multi-decade record highs. Many EU citizens have started living in poverty as they are struggling to pay their food and energy bills. The GDP is falling, whilst the ECB is forced to hike the interest rates to fight soaring prices. The EU seems to severely suffer from stagflation.

The interest rate rises are highly likely to make the economic situation even worse. However, higher rates are positive for the banking sector. It is a well-known fact that the financial sector’s interest income rises as interest rates go up. However, a recession is a catastrophe for any bank, especially one that has just survived a restructuring. Deutsche Bank has a significant presence in Europe and this could be a substantial risk.

Quite recently, there were some rumors in the press saying Deutsche Bank is on the verge of bankruptcy. In my view, these rumors are highly dramatizing the situation. Sure, DB is not the most profitable bank and the global economy is not doing great. But DB’s financial indicators suggest the bank’s earnings are improving. However, the very fact so much talk is in the press could make some investors panic, which could put DB in an unpleasant situation.

Valuations

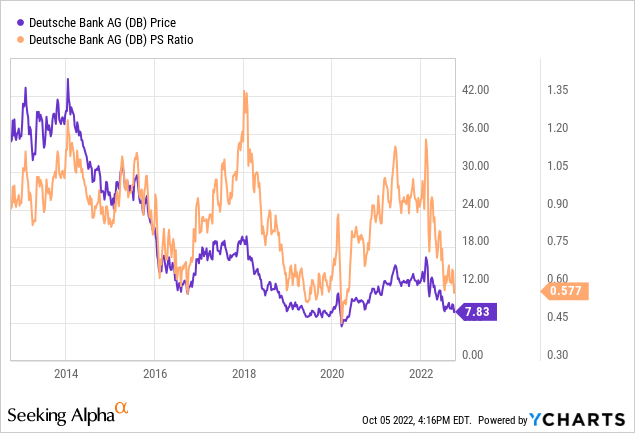

To get an idea of DB’s valuations, I decided to see the bank’s P/S ratio history. Y-Charts generated the following graph for me.

The truth is that DB’s P/S is near the lows reached in 2020 when the whole stock market crashed due to the pandemic. So, it looks like Deutsche Bank is not overvalued in that respect.

The recent diluted EPS for 2Q 2022 was EUR 0.33 per share. If we assume these were the average DB’s results for each quarter of 2022 and multiply these by 4, we will get a figure of EUR 1.32, my projected EPS for the full 2022. If we take the share price of EUR 7.93, as of the time of writing, and divide it by EUR 1.32, we will get a price-to-earnings (P/E) ratio of 6. A P/E below 10 for a bank is quite low.

I would say that Deutsche Bank’s stock is not overvalued.

Conclusion

Deutsche Bank does not have a brilliant track record when it comes to earnings. But it seems their financial position is getting better. DB’s liquidity is at reasonable levels. We might see good earnings results for Deutsche Bank sometime soon. However, the macroeconomic situation in Europe is the main area of concern. After all, banking is a cyclical industry. The rumors about DB’s troubles ahead seem to be exaggerated. My main concern is investors’ potential panic. Overall, DB seems to be OK and its shares look undervalued.