Kameleon007

Investment Thesis

Apogee Enterprises (NASDAQ:APOG) delivered strong results in Q2 23 including increased revenue, improved operating margins, and healthy EPS growth. Strong backlog value, robust demand, and recently implemented pricing increase to offset cost inflation should help its revenue growth in the coming years. The company’s operating margin improvement was driven by its “Lean & Continuous improvement” and “Active business portfolio” strategy. In the Lean and continuous improvement strategy, the enterprise has established company-wide operating systems with common tools and programs, which increased Apogee’s operational effectiveness and productivity. The Active Business portfolio approach focuses on allocating its resources to top-performing businesses and increasing the productivity of its segments. Active business portfolio initially focused on the Framing system and Glass segment, whereas “Lean & Continuous” focused solely on the Glass segment. But the company is expanding these strategies to other parts of the business, which should lead to improved operational efficiency and operating margin in the coming years. APOG stock is trading at a discount to its historical level, making it a good buy.

APOG Q2 2023 Earnings

Last month, Apogee Enterprises reported better-than-expected Q2 2023 results. Sales for the quarter stood at a record $372.10 million, an increase of 14.2% Y/Y, and was above the consensus estimate of $342.84 million. Architectural Frame System (which accounts for ~46% of the company’s total sales) had another exceptionally strong quarter where revenue grew 26% year-over-year to $172.8 million. Improved sales growth, along with better productivity and price management, resulted in increased EPS. The adjusted earnings per diluted share grew to $1.06 which was better than the consensus estimate of $0.83.

Revenue Outlook

Apogee has seen robust demand in its end markets for its products and services in recent quarters. Most indicators for the non-residential sector remain favorable and the architecture billing index has been positive for 18 consecutive months indicating a strong pipeline of new projects. Last quarter, the architectural framing segment had revenue growth of 26%, the architectural service segment recorded 11% revenue growth, and the LSO segment reported 7% revenue growth year-over-year. In addition to an increase in end market demand and high backlog, this substantial growth has been supported by the price increase by the company to offset cost inflation in the market.

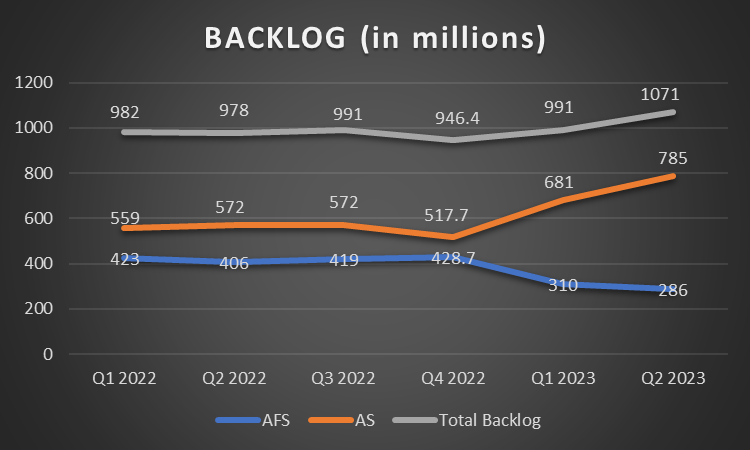

The backlog value of Apogee has increased sequentially from the last quarter, indicating increased order volume and demand for its products and services. As of August 27, 2022, the backlog for the Architectural Service segment stood at $785 million, an approximately 15% sequential increase. This increase in backlog was significantly driven by new project wins in the transportation & healthcare markets. Labor shortage due to supply chain inefficiency also slowed backlog to sales conversion rate for the service segment which added to backlog growth. The backlog value for its framing systems segment was approximately $286 million, which was a sequential decline compared to $310 million in the first quarter.

Apogee’s Backlog (Company Data, GS Analytics Research)

The overall backlog for Apogee stood at $1.07 billion, an increase of 9.5% compared with the second quarter of the previous year and an 8.1% sequential increase, indicating growth in order volume for its products and services. While there are some risk due to rising interest rates, there are offsetting factors as well like return to work-from-office driving non-residential demand as well as several bills passed by the federal government, including a $1.2 trillion infrastructure bill that will provide significant support and growth for the infrastructure and construction industries as well as CHIPS Act that has allocated $33 billion for semiconductor fabrication plants creating a potential opportunity for construction projects.

Looking forward, I believe price increase initiatives to offset inflation, good demand in the non-residential sector and high backlog value should help the company’s revenue. Further, as supply chain ease and APOG increase its productivity, I expect improved backlog conversion will also help revenue growth in the coming quarters.

Margin Outlook

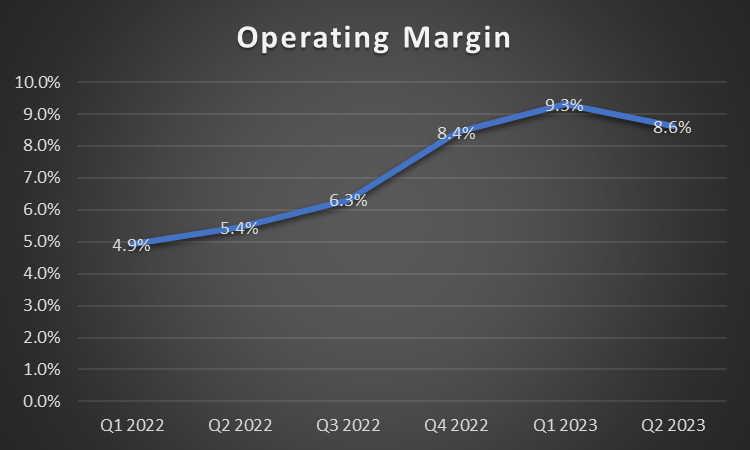

Apogee’s Segment Operating Margin (Company Data, GS Analytics Research)

In the second quarter of FY23 operating margin was 8.6%, which was 320 basis points higher than the adjusted margin of 5.4% last year. The operating margin for framing systems stood at 11.9%, which was at the higher end of the management’s target of between 9% and 12%. For the service segment, the operating margin stood at 5.1%, which is a sequential improvement from the first quarter but below last year’s second-quarter margin of 7.4%. Overall operating margins in the service segment were suppressed due to the integration of Sotawall into its business. However, I am not too worried about it and believe as the integration of Sotawall into Architectural Services’ Harmon business progresses, it should drive significant operational improvements in the coming years.

Apogee has launched and is implementing an Enterprise Strategy – Active Business portfolio – to improve its business profile by shifting its business mix towards higher operating margin offerings. Management plans to accomplish this by allocating its resources to grow its top-performing businesses and actively addressing underperforming businesses. It should improve their productivity and operating margin over the years.

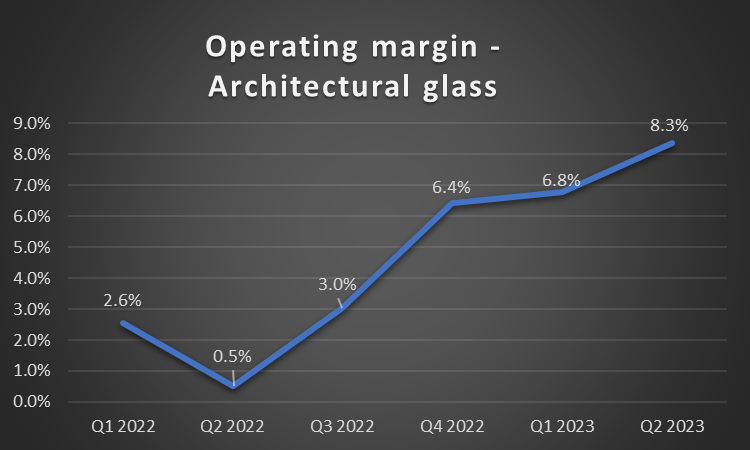

Architectural Glass Operating Margins (Company Data, GS Analytics Research)

In Architectural Glass, the operating margin continued to trend higher, reaching 8.3% last quarter. Adjusted operating margins showed sequential growth due to productivity gains from their Lean & Continuous improvement program. The segment underwent a strategic shift from a decentralized operating model to one with center-led functionality and expertise enabling it to leverage the scale of the enterprise to better support the needs of the business.

Under this strategy, management has established company-wide operating systems with common tools and processes that are supported by a robust talent management program. This should help the company deliver improved operating margin year over year. Secondly, this program had an initial emphasis on the Architectural Glass segment only, but now management is expanding it to other segments of the business, which should improve the overall operating margin for Apogee in the coming years.

Apogee’s implementation of “Lean & Continuous” and “Active Business Portfolio” strategies to improve operational efficiency, price management to offset cost inflation, and stabilization in the supply chain stabilizes bodes well for its margin improvement looking forward.

Valuation and Conclusion

APOG stock is trading at 10.67x FY23 EPS estimates. This is a discount versus its 5-year average forward P/E of 13.76. The company also has a decent dividend yield of 2.12%. Given the company’s good margin growth prospects and factors like high backlog and price increases supporting revenue growth, I believe the company is undervalued and provides a good buying opportunity for medium to long-term investors.