piranka

Company Overview

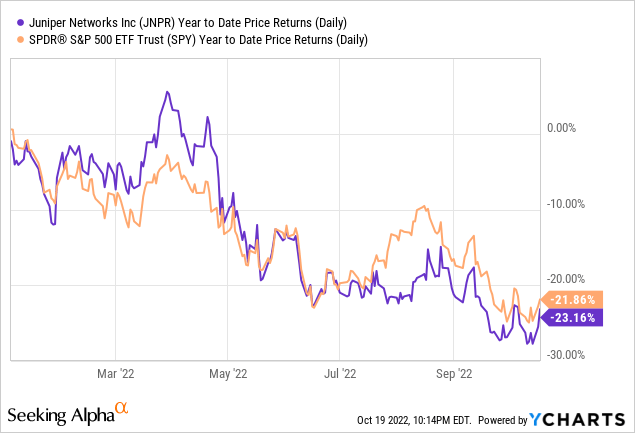

Juniper Networks, Inc. (NYSE:JNPR) provides networking products and services, such as routers, switches, security services, and more. The company sells physical products along with services, such as technology implementation, data migration and more. Year-to-date, the company’s stock performance has tracked closely of the broader index. Juniper Networks shows a -23.16% decline this year, compared to S&P 500’s decline of -21.86%. The company’s current market capitalization stands at $8.8 billion with a 3.00%+ dividend yield.

Steady Growth

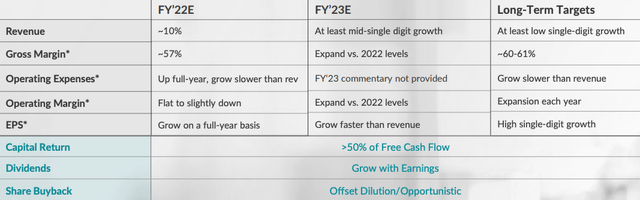

Q2 2022 financial results have been a solid quarter for Juniper Networks, seeing revenue growth on key areas. The company reported a total net revenue of $1.3 billion, with product segment bringing in $839.8 million and service segment bringing in $429.8 million. The product segment grew at a 10.6% YoY pace, while the service segment grew a bit slower at a 4.0% YoY growth rate. The growth rate is in line with the company’s expectations as the company prepares for a long-term strategy involving steady growth, high capital returns, and strong business health. Specifically, the company plans for low single-digit growth with a high gross margin of around 60%. Though such plans would not please growth minded investors, we believe this reasonable strategy and a commitment to shareholder return through dividends and share buyback could provide a healthy, compounding return for long-term investors.

Investor Presentation

Market Tailwinds

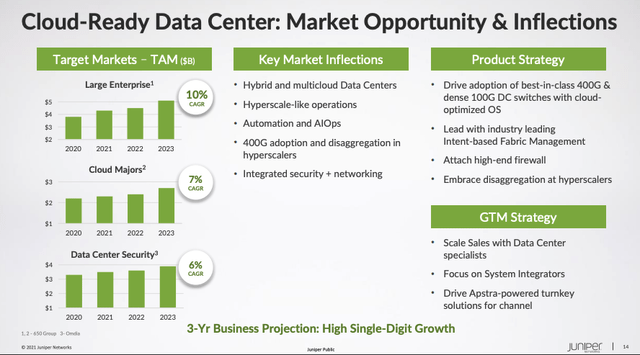

Juniper Networks operates in an industry with favorable tailwinds. Given the company’s size, customer base, and market position, we believe that management is more than capable of keeping its market share and growing along with the size of the market at the very least. Based on the company’s estimates, large markets like Cloud Data Centers are projected to grow meaningfully in the next few years. This demonstrates that the company is operating in a growing market with secular tailwinds. In addition, the amount of cross-selling opportunities are immense for the company. The size and market position will serve as competitive moats that can allow Juniper Networks to keep its business growth going.

Investor Presentation

Shareholder-Friendly Policies

Juniper Networks started to pay out dividends in late 2014 at $0.10 per share. Now, the company pays a dividend of $0.21 per share, which annualized yields $0.84 per year. The dividend growth over the last 8 years is approximately 9.7% CAGR, which is a healthy grow rate that is more than quadruple the inflation rate of that time period.

Given that the payout ratio is hovering near ~70%, we believe that the dividend rate is relatively safe, and the company should be able to raise its dividends along with the growth rate of the business, which is still hovering at high single-digits. It is also important to mention that the company has previously conducted large buyback programs, and has provided intentions on pursuing programs in the future. These policies will support the stock price at the very least, and increase investor confidence in the business prospects of Juniper Networks.

Valuation

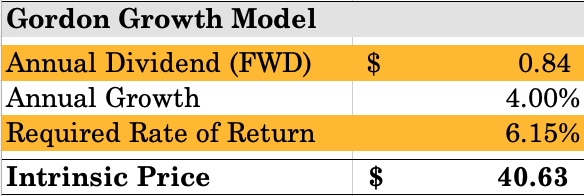

Given the strong capital payout guidance for this mature company, we valued the stock based on a Gordon Growth Model. We based our annual growth rate of dividends to be similar to the company’s long-term target, of “at least low single-digit growth.” Given the current revenue growth of ~10% and a short-term growth rate of “at least mid-single digit growth,” we based our growth assumption to be 4%. Using the WACC for the Software (System & Application) industry, our model presents an intrinsic value per share of $40.63, which presents a 48.4% upside from current levels. We think that this valuation is reasonable given that the stock price was hovering at $35 only a few months ago.

Sweet Minute Capital Valuation Model

Risks

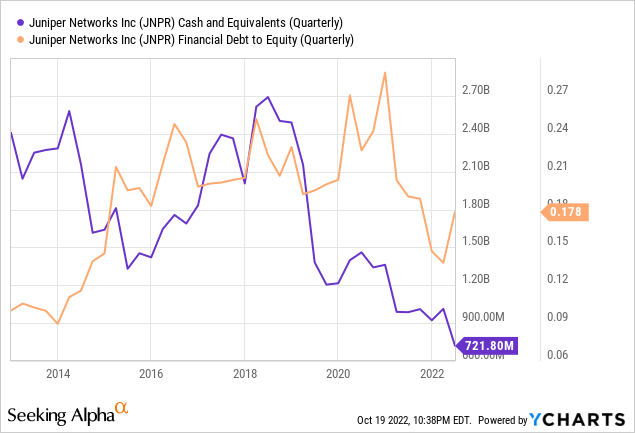

We believe that aside from competitive risks, the company faces headwinds from high interest rate environment due to its debt. Though its debt-to-equity ratio is fairly low, we believe that the trend has been to the upside, and at the expense of its cash balance over the last 10 years, as seen in the chart below. As macroeconomic conditions worsen and interest rates continue to go up, Juniper Networks may see higher interest expenses on its debt, which would compress margins and reduce the company’s ability to commit to its shareholder programs. However, we believe that, despite this, the company still has fairly low leverage on a relative basis. Its cash balance is around ~10% of its market capitalization. Therefore, we see economic risks to be limited for this steady enterprise.

Conclusion

Overall, we recommend a “BUY” rating on Juniper Networks. The company operates in a resilient industry and has a diverse array of products and services that are relied upon by many businesses and other customers. The long-term growth strategy appears feasible based on the increase in market size, and we find that on just dividends alone, the market is undervaluing the stock meaningfully. Though the company won’t be immune to all macroeconomic risks, we believe that the company is financially healthy enough to come out of the recession stronger, and ready to capitalize continued network needs.