PrathanChorruangsak

Thesis highlight

I believe Trulieve Cannabis (OTCQX:TCNNF) is undervalued as of today. With the cannabinoid science and cannabis market expanding around the world, Trulieve is well positioned to take advantage of this and capture share using its unique customers centric and patients-first approach.

Company overview

Trulieve is a vertically integrated cannabis business, meaning it has expanded into different steps along the production, manufacturing, and supply chain. Trulieve is an all-out company, with a multi-state presence, and provides services based on the brand philosophy of “patients first.” Services are focused on quality cultivation and manufacturing practices backed by customer experience at affiliated retail locations, in-house call centers, and various home delivery programs.

Investments merits

All about the go-to-market strategy

Currently, the marketing strategies are focused on education, adults, and outreach for medical practitioners and patients where possible. Each focuses on delivering and sharing practices that are in line with regulatory bodies and meet quality and production standards.

Firstly, the education material targets physicians to help them understand cannabinoid science and how it is adopted at Trulieve to ensure quality at each step, starting from cultivation to production. How Trulieve’s practices are in-line with the standards required by regulatory bodies. The dedicated physician education team plays a vital role by providing awareness-raising sessions and online or phone support to physicians who may have any queries in this regard. Trulieve doesn’t directly work with the targeted audience, which in this case are patients, but they are reached via different patient outreach or community events each month. Several popular social media platforms are also used by the digital content marketing team to reach out to patients.

On the other hand, the targeted audience also involves raising awareness of potential customers who are non-patients like veterans, seniors, organizations, as well as various health and wellness groups. The SEO on Trulieve’s website also draws in potential patients and consumers who are learning more about the advantages of medical marijuana, giving them another access point to educational materials about the therapeutic applications of cannabis and TRUL’s products, and how to legally obtain them.

Quality customer service, industry-leading products, and easy access to patients and non-patients all combine to generate brand loyalty. Brand loyalty is also accomplished through strategies like training, branded store experiences, brand awareness, multiple channels of distribution that are focused on promoting the brand, loyalty programs, and social platforms.

Trulieve pays significant focus to clients, whether they are patients or non-patients. And to keep them updated with the new development of products to further refine the customer experience across all branded locations, Similarly, Trulieve regularly conducts numerous refresher training programs for front-line workers to deliver the information and resources they need to provide top-notch customer service. There is also specialized training for managers so that the best ways to treat patients and customers are reinforced every day.

In selected markets, Trulieve has a customer-centric approach where phone ordering, online ordering, home delivery, and in-store are some of the various purchase options. Further, it has medical facilities for patients and adult-use customers in many selected locations.

Various distribution channels to capture demand

Trulieve’s distribution networks strategy center around the policy of branded product distribution through branded retail locations and wholesale mediums. The branded retail locations are committed to setting high standards of excellence and providing excellent patient care and customer service. Similarly, Trulieve’s regional hubs have their own branded retail products portfolio. These include a variety of premium brands including Avenue, Alchemy, and Cultivar Collection; mid-tier brands such as Modern Flower, Momenta, Muse, and Sweet Talk, and value brands such as Co2lors and Loveli, and Roll One.

Furthermore, several partnerships with brand partners have also allowed the company to sell partner-branded products in select markets and retail locations. Apart from licensing the Moxie Brand in Pennsylvania and exclusive arrangements with Connected and El Blunto in Arizona, Trulieve has several brand partnership collaborations, in Florida, with Binske, Black Tuna, Blue River, Connected, Love’s Oven, Bellamy Brothers, Bhang, SLANG, and Sunshine Cannabis.

Oct 22 investor presentation

Strong brand equity

In the home state of Florida and across the broad global market, Trulieve has built brand recognition, intending to build the brand’s commercial value that derives from consumer perception. All this is done through branded retail stores and interactions with customers and patients. Similarly, Trulieve is growing with the larger policy of enhancing its branded retail reach and rebranding affiliated locations, with a planned future strategy. Also, to offer its patients and customers a uniform experience, it has maintained a consistent design approach across its retail stores.

Loyalty program to retain customers

To attract customers, Trulieve has loyalty programs where patients and customers get special discount packages through points earned by regular customers. The company also invites such customers to its exclusive promotions and events. Similarly, Trulieve maintains its relations with customers, patients, and physicians through text, email, social media, and online chats. These small gestures create a positive communicative relationship with them.

Vertically integrated model

The company’s investment policy of investing in vertically integrated operations in several markets allows the company to maintain ownership of the entire supply chain. This has a two-way effect for Trulieve; first, it mitigates the risks of involving third parties, and second, it allows the company to completely control the quality of the product and brand experience.

Trulieve produces high-quality cannabis flowers for direct consumption and uses a variety of processes to transform this high-quality biomass into an extensive portfolio of products sold through stores and wholesale channels. The cornerstone market of Florida is the prime example of Trulieve’s focus on the quality and affordability of its products. Trulieve has put in place SOPs, detailed design standards, and training protocols to make sure that all of its cultivation sites are consistent and of high quality.

Valuation

Price target

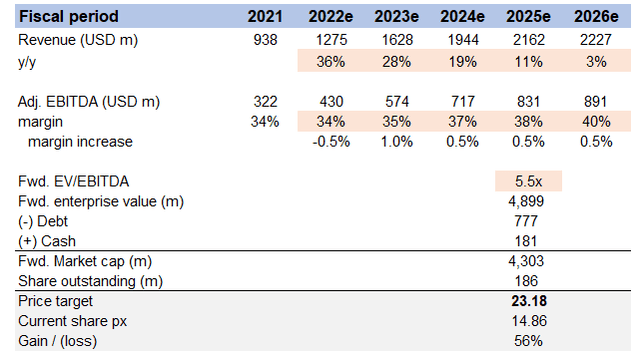

My model suggests a price target of ~$23.18 or ~56% upside in FY25 from today’s share price of $14.86. This assumes that revenue growth will slow from FY22 to 2026e, EBITDA margins will increase to 40%, and the forward EV/EBITDA multiple will be 5.5x in FY25e.

Image created by author using data from TRUL’s filings and own estimates

The idea of my model is to show how “cheap” the stock is and what the expectations are embedded in it.

For FY22e, I used the mid-point of management guidance during 2Q22. Moving forward from FY22e to FY26e, I assumed revenue growth would decelerate to 3% (inflation rate) as it reaches maturity and adj. EBITDA margins would increase over time to management’s long-term margins.

As for a valuation, Trulieve currently trades at 5.5x forward EBITDA, and I assumed no change in multiples since the market is pricing this asset to mature in FY26.

Risks

Highly Competitive & New Market

Trulieve competes directly with many multi-state operators in the cannabis market. Apart from these direct competitors, there are well-established companies with greater capitalization, more experienced management, and more access to public equity markets. All these players involved in the cannabis industry make the market a highly competitive one.

In this regard, Trulieve is operating relatively in a new market. Besides general business risks, it had to invest significantly in building strategy, production capacity, quality assurance, and compliance with regulations to build brand awareness and market share. Furthermore, there is another risk involved regarding the lack of product awareness in the international markets. Cannabis or isolated cannabinoids, such as cannabidiol, CBD, and THC, haven’t been tested much in Canada, the U.S., and other parts of the world to find out what medical benefits they have, if they work, if they are safe, how well they work, and how much they should be used.

Regulatory Hurdles

In the Cannabis-related business, the activities are subject to regulatory hurdles in different states and by local government authorities. Trulieve’s business goals include getting all of the regulatory approvals it needs to sell its products in the places where TRUL does business, and making sure it follows all of the rules that these government bodies have set up. In this regard, any delays or failures in obtaining required regulatory approvals would negatively impact the product and market development of the company. In the same way, this could be bad for the business.

Conclusion

I believe TRUL is undervalued as of today. Trulieve is operating in a relatively new market and, also, the lack of proper awareness regarding the cannabis industry and products around the world is the main factor behind the current under-valuation of the company’s share value. The future trends for Trulieve’s market share value are very bright. Furthermore, the high-quality branded products, unique management, brand promotion programs, various distribution networks, vertically integrated models, and customer and patient-first approach are some of the attributes that make Trulieve Cannabis prominent among its competitors.