Amy Sussman

Thesis

Warner Bros. Discovery, Inc. (NASDAQ:WBD) is slated to release its Q3 earnings report on Nov. 3. We note that the market is likely anticipating a “not that bad” report, corroborated by the recent robust earnings releases from Netflix (NFLX) and Comcast (CMCSA).

We highlighted in our previous article that WBD offered investors a fantastic buying opportunity. WBD investors know that the company remains in a transition phase. However, management is confident of achieving cost synergies through its diversified platform.

While Street analysts have cut their revenue projections for WBD since our last update, they remain confident in their profitability outlook. Management also highlighted in a recent September conference that it was confident in its previous guidance despite the worsening macroeconomic conditions.

Therefore, WBD needs to demonstrate its execution as we head into its earnings release.

Our analysis indicates that the market could have forced a capitulation low in September, drawing in weak holders and bearish investors, before recovering remarkably.

We also observed that industry analysts had cut their earnings projections for WBD and its peers markedly through October, auguring well for their medium-term recovery from these levels.

Hence, if WBD can continue to execute its transition plans accordingly, we postulate that the current levels are attractive.

Accordingly, we reiterate our Buy rating on WBD but cut our medium-term price target (PT) to $16 (implying a potential upside of 24%) to reflect more conservative target multiples through the recession.

WBD Is Expected To Deliver On Its Profitability Guidance

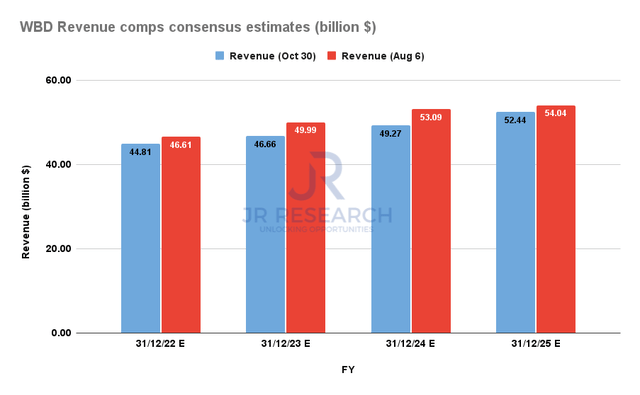

WBD Revenue comps consensus estimates (S&P Cap IQ)

Analysts have markedly cut their projections for WBD and its peers over the past two months. As seen above, the consensus estimates (bullish) suggest that the revenue revisions are expected to hamper its topline growth through FY25.

We believe the estimates cuts are prudent as a weaker macro outlook could broadly hamper WBD’s growth drivers as a weaker consumer takes shape. Furthermore, the ad market has weakened considerably, as seen in the recent results of Google (GOOGL) (GOOG) and Meta Platforms (META).

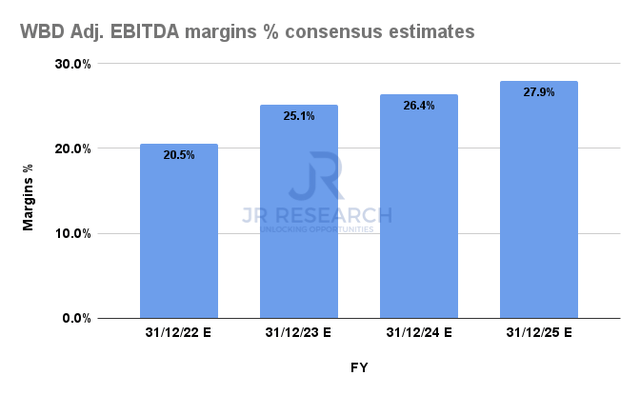

WBD Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the projections for its adjusted EBITDA profitability were revised to a lesser extent than its topline revisions. Hence, Wall Street expects WBD to deliver its adjusted EBITDA guidance, despite weaker topline growth.

We believe the bar has been set higher for WBD to cross, as Q3 profit margins for S&P 500 companies have continued to fall (based on the most recent results). Therefore, investors must consider the potential risks that WBD could disappoint against its guidance.

Notwithstanding, management reiterated in a September conference that it remains confident in its execution, despite the weaker macro outlook. CFO Gunnar Wiedenfels highlighted:

I never had any doubts about our ability to deliver those financial targets. I’m very, very happy with the progress we’ve made. We already spoke about $1 billion worth of run rate initiatives already implemented. We’ve got a very full funnel of further initiatives fully staffed, hundreds of people now, again, owning individual initiatives, and I think lots of momentum as we go into 2023, which is driving the confidence in those financial outcomes for (the) next year. (Goldman Sachs Communacopia + Technology Conference 2022)

Analysts Have Slashed Estimates For Its Peers

We analyzed the industry estimates for WBD and its peers across various industry data sets. We gleaned that Wall Street has continued to cut earnings estimates through October. Hence, we believe that significant pessimism already has been baked into WBD’s earnings estimates.

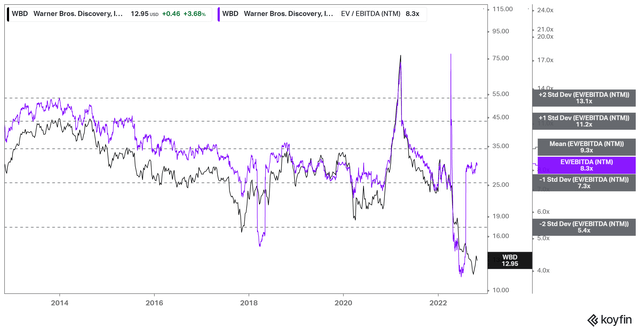

WBD NTM EBITDA multiples valuation trend (koyfin)

Also, we gleaned that analysts already had slashed WBD’s adjusted EBITDA projections in early August (leading to a spike in NTM EBITDA multiples, as seen above). Hence, it’s reasonable to give management some credibility to execute its guidance for FY22 and FY23. We will find out more next week, but we deduce that WBD’s prior earnings cuts set up its valuation profile well.

Is WBD Stock A Buy, Sell, Or Hold?

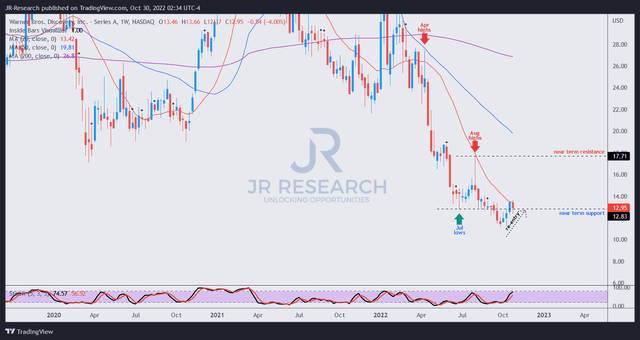

WBD price chart (weekly) (TradingView)

WBD was consolidating well even after the significant rejection from its August highs, post-Q2 earnings.

We also gleaned a steep selloff in September, which was unexpected. However, the market likely used that down move to force weak WBD holders / bearish investors to capitulate before recovering its near-term support (re-entry) recently.

If our thesis of WBD’s bottoming process is correct, it should continue to consolidate along its near-term support, with September’s bear trap corroborating the robustness of the current levels.

Hence, it gives us more confidence that the market is likely anticipating WBD not to report a significantly worse-than-expected Q3 release.

As such, we reiterate our Buy rating on WBD.