kynny

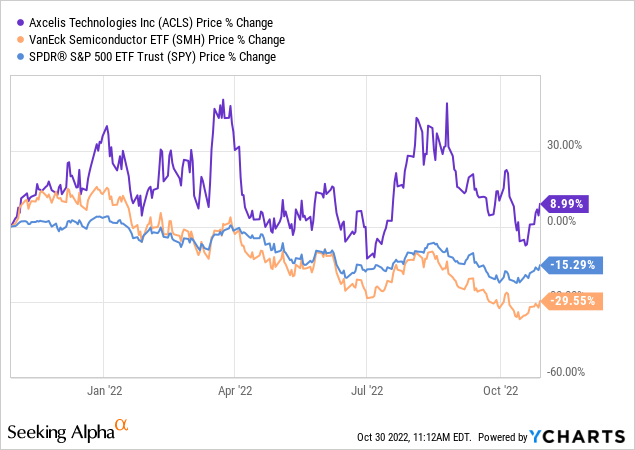

The stock of Massachusetts-based semiconductor equipment maker Axcelis (NASDAQ:ACLS) is up 146% since my initial BUY rating on the company back in October 2020 (see: Axcelis: Beam Me Up Scotty). The company has continued to significantly outperform both the overall semiconductor sector and the S&P500 this year (as measured by the (SMH) and (SPY) ETFs, respectively – see graphic below). Going forward, Axcelis is well-positioned to benefit from mature process demand in the ion-implant market – including from the use of silicon-carbide (“SiC”) in the EV market. The company’s current valuation level (forward P/E of only 12.5x) appears totally out-of-sync with its demonstrated growth rate and its excellent prospects going forward.

Investment Thesis

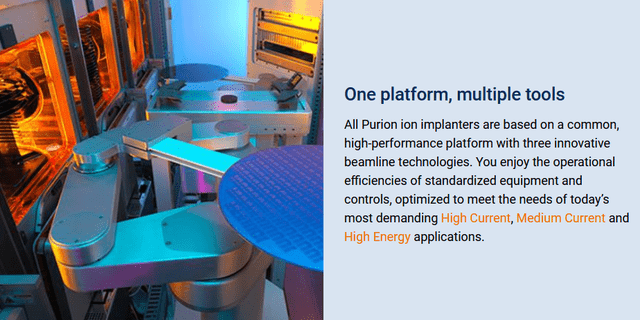

Axcelis designs, manufactures, and sells a complete line of high-energy, high- and medium-current ion-implanters for the global semiconductor market. The company’s full-lineup of Purion platform offerings delivers a high-level of precision, purity, and productivity. The company has established its Purion products as a reliable and relatively low-cost of ownership solution within the ion-implantation space.

Axcelis’ Purion Platform (Axcelis)

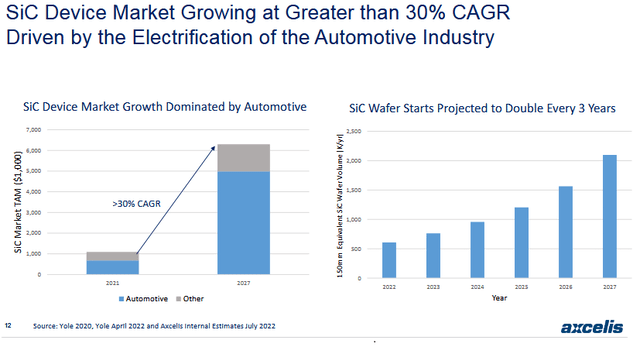

In particular, Axcelis is ideally positioned to benefit from strong growth in the silicon-carbide (“SiC”) market that is driven by fundamentally strong EV adoption due to the excellent power efficiency of SiC-based power devices. Moving forward, this is a huge TAM opportunity for Axcelis that is expected to grow at a CAGR of ~30% over the next 5-years. The slide below comes from a recent Axcelis Investor Presentation:

Axcelis

Earnings

As mentioned earlier, ACLS has continued to deliver strong financials: the Q2 earnings release in August reported record bookings & backlog and a big beat on both the top- and bottom-lines. Highlights included:

- Revenue of $221.2 million (+50.2% yoy and +8.6% sequentially).

- GAAP EPS of $1.32/share was a $0.31 beat.

- Q2 gross margin was 44.8% (above guidance) compared to 44.1% in Q1.

- Cash and cash-equivalents at the end of the quarter was $287.9 million, or an estimated $8.58/share.

The company spent $12.5 million on stock buybacks during Q2. Note back in March the company announced a $100 million buyback program.

Axcelis President and CEO Mary Puma commented on the quarter:

Axcelis delivered outstanding second quarter financial performance well above our guidance due to robust demand and our strong execution. It is an exciting time for Axcelis with significant growth in the ion implant TAM, solid customer demand for our products and long term growth prospects in the power device market.

In the release, the company said it expects full-year revenue of greater than $875 million. At the time, the consensus revenue estimate for 2022 was $856.92 million.

Going Forward

On the Q2 conference call, CFO Kevin Brewer said:

Multiple customers are planning new fabs and expansions for 2023 and 2024, which is driving bookings out beyond 1 year.

However, shareholders don’t have to wait until next year to benefit. I say that because since the Q2 release ACLS has announced multiple additional shipments of Purion ion-implanters:

- Multiple new and follow-on shipments for power device makers.

- Multiple shipments to a leading analog chip-maker.

In the first announcement listed above, CEO Puma said:

The power device market continues to drive our growth globally and will likely account for between 35 and 40 percent of our system shipments in 2022. This growth is a long-term trend driven by the transition to electric vehicles and should benefit Axcelis for many years to come.

In my recent Seeking Alpha article on KLA Corp (KLAC), I pointed out that the wicked 2022 bear- market has pushed several semiconductor companies to valuation levels considerably lower than the S&P500 (see KLA: Semiconductor Companies Are Not Dead Money). One such company I mentioned was Netherlands-based ASML Holding (ASML) with a TTM P/E of 11.8x, a bit more than half-that of the S&P500. While I understand that the semiconductor industry is cyclical, I disagree that it is as cyclical as it was back in the day (20 years ago…) when PC and auto shipments dominated the market. Today, we have a plethora of semiconductor use cases: 5G infrastructure, smartphones, high-speed networking, IoT, high-performance computing (“HPC”), crypto, and gaming – just to mention a few. My point is that it is my opinion that the death of the semiconductor industry has been greatly exaggerated. That being the case, the big sell-off this year (the SMH ETF is down ~29%) offers an opportunity for investors. That is especially the case given the Biden administration’s “CHIPS & Science Act“, a mid- to long-term positive catalyst for the domestic semiconductor industry.

Risks

In ACLS’s 2021 annual report, the company said that two company’s – Samsung (OTCPK:SSNLF) (OTCPK:SSNNF) and Semiconductor Manufacturing International (“SMIC”) (OTCQX:SMICY) – represented at least 10% or more of total revenue.

Upside risks include other relevant semiconductor companies in the automotive market (and thus, potential ACLS customers) that are headquartered outside of China and already have or are in the process of designing SiC chips for the EV market are Infineon (OTCQX:IFNNY) (OTCQX:IFNNF), STMicroelectronics (STM), Wolfspeed (WOLF), and NXP Semiconductor (NXPI). NXP is collaborating with Hitachi (OTCPK:HTHIY) on power modules to accelerate SiC adoption in EVs. Each of these companies cannot afford to miss-out on the SiC boom in the EV market and will likely fight to grab its share of the market.

That said, international sales accounted for 92.6% of total revenue in 2021 and customers based in Asia dominated ACLS’s international sales. Ion-implanter shipments to customers in Asia represented 83.9% of ACLS’s total system revenue in 2021. The Chinese market is both a risk and an opportunity. Indeed, the fore-mentioned SMIC is based in Shanghai, China. Indeed, on the Q2 conference call previously referenced, ACLS reported:

The geographic mix of our system shipments in the second quarter was China 55%, the U.S. 16%, Korea 14%, Europe 4%, Taiwan 3% and the rest of the world 8%.

That said, ion-implanters for mature processes (like those being used in the EV market) have not, to my knowledge, been hit by “high-tech” trade restrictions because they are not considered “cutting edge”. After all, power-chips for EV don’t need (or want…) the latest 5nm technology from Taiwan Semiconductor (TSM). It is not uncommon to see SiC power chips for EVs – which need to be reliable and long-life components at automotive specifications – implemented in 20-24nm. Indeed, in March, it was reported that “Licenses for U.S. wafer fab equipment companies to supply to SMIC are progressing enough to allow the Chinese foundry’s capacity expansion for mature process nodes, according to TrendForce.”

ACLS would not be immune to global and severe recession in the semiconductor market that would depress cap-ex for the type of systems ACLS sells.

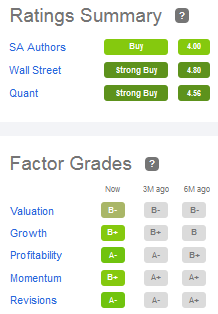

Lastly, note the Axcelis currently has a very strong ratings profile according to the factors that Seeking Alpha tracks:

Seeking Alpha

Summary & Conclusions

Axcelis appears to be in a sweet-spot of semiconductor equipment manufacturers. I say that because its Purion platform for mature processes do not appear to fall under the “cutting edge tech” classification such that U.S. sanctions would kick-in and negatively impact the company’s sales. However, that could certainly change and considering China is such a big customer for ACLS, that would obviously be a very negative development. In the meantime, ACLS looks significantly undervalued considering it is trading at only 12.5x forward earnings while the most recent quarterly revenue growth was 50%+ yoy. The backlog is at a record and continued order growth and shipments are strong.

The company is scheduled to report earnings on Wednesday, November 2. The current consensus is for Q3 earnings to come in at $1.13/share as compared to $0.82 last year, or an estimated +37.8%. That being the case, I expect another strong quarterly report from ACLS rate the company a BUY.

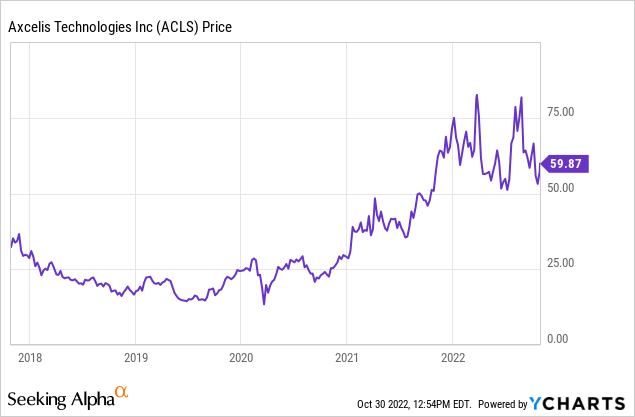

I’ll end with a 5-year price chart of ACLS and note that it has digested the big gains of 2021 and has gone sideways for the past year even as revenue continued to surge: