DLocal is a digital payments growth stock

martin-dm

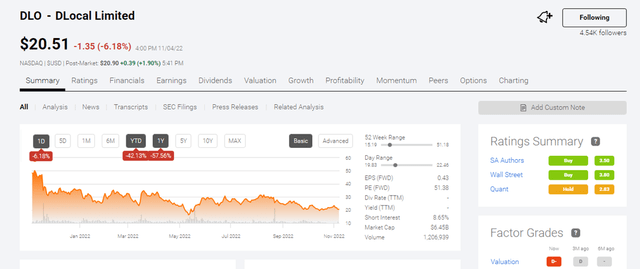

You should not go long or average down on Uruguay-based DLocal Limited (NASDAQ:DLO). Please heed the hold rating that Seeking Alpha Quant has for DLO. Yes, DLocal Quant only had its IPO in June 2021. The Quant AI does not yet have enough data to make a fully accurate assessment. However, the chart below shows DLO now persists as a fallen angel.

Seeking Alpha

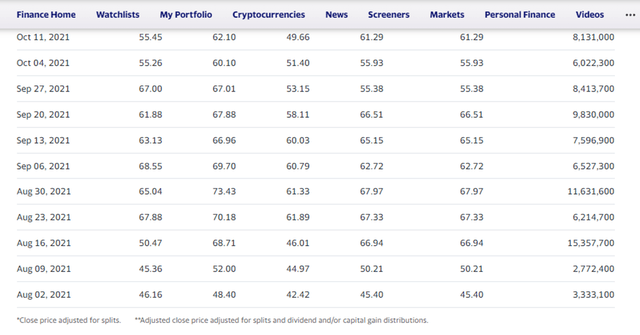

DLO currently trades well below its 52-week high of $51.18. Its IPO closing price was $32.39 last June 2021. The lack of support over the past months is jarring. There was a Short-term IPO euphoria. After which many promptly took profits in August to October 2021. DLO’s highest closing price was $67.97 on August 30, 2021. The screenshot below explains my supposition that there was much profit-taking after August of last year.

Yahoo Finance

DLocal reported a Q2 earnings beat last August, and yet the stock still tanked. My view is that the IPO big boys of the stock market has abandoned DLO. I hope this article attracts hedge fund managers and institutional investors. I have a hold rating for DLO because it might eventually fulfill Wall Street’s average price target of $33.30. I opine the valuation of a company rises and falls according to the emotion of the general investing public. My conviction is that stock analysis is not an exact science because most investors are emotional. They tend to act on herd instinct.

Emotional/Technical Indicators Are Bearish

I have a hold rating for DLO because of its bearish RSI score of 41.86. This stock is in bearish territory, but not yet near the oversold score of 30. A check on its Exponential Moving averages also told me the negativity on DLO is strong. This stock’s 5-day EMA is 21.53, which is lower than its 13-day EMA of 21.61. The 13-day EMA is lower than that 21-day EMA of 21.71. EMA indicator is only bullish when the 5-day average is greater than the 13-day, and the 13-day is greater than the 20-day EMA.

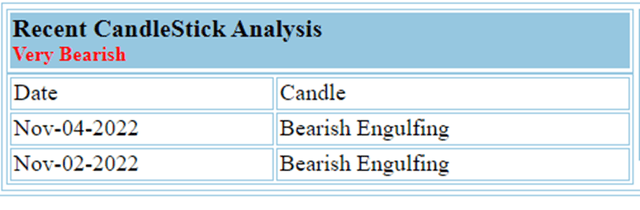

If you respect candlestick trade alerts, the A.I. tracker of StockTA has detected a Bearish Engulfing trade signal last November 4 and November 2.

StockTA.com

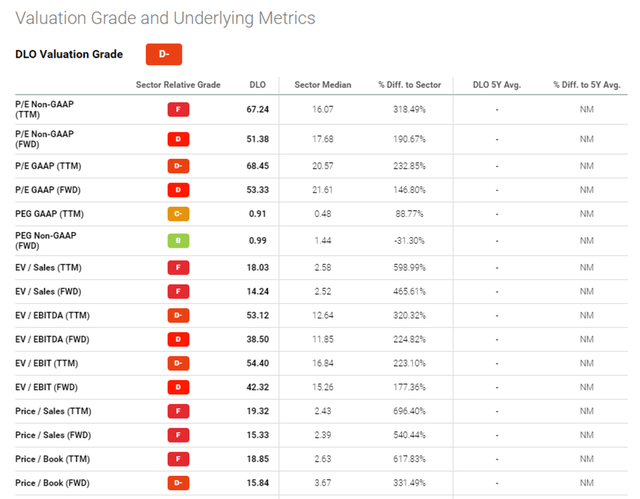

Significant Overvaluation Due to High-Growth Potential?

The massive drop from $67.97 to less than $21 has not erased the relative overvaluation of DLO. The obstinate bearish emotion on DLO is likely because of the screenshot below. A forward Price/Sales of 15.33x is not ideal in my book. DLO’s 15.33x forward P/S ratio is 540.44% higher than its Information Technology sector peers’ average of 2.39x.

Seeking Alpha

DLocal is a software platform for digital payments. I opine the P/S ratio is ideal when gauging emerging fintech and software growth stocks. DLocal’s revenue in 2019 was only $55.3 million. It finished FY2021 with $244.1 million, more than double that of FY 2020’s $104.1 million. The TTM revenue is $333.5 million. The quarterly revenue pattern justifies my conviction that DLO could finish Q3 and Q4 with greater than $100 million per quarter.

The emerging scenario for FY2022 is that it might replicate the 102.49% YoY revenue growth.

What do you think? Does a forward revenue growth estimate of 50% to 100% justify a forward P/S ratio higher than 15x? If you think DLO can achieve a forward 3-year revenue CAGR of 70%, you can average down or go long on it.

This article’s thesis is that DLO only deserves a hold recommendation.

The global digital payments industry is now only growing at a 17.25% CAGR. It will not be easy for a small company to achieve a 50% sales CAGR over the next three years. DLocal is a midget in an industry that is expected to be worth $374.9 billion by 2030.

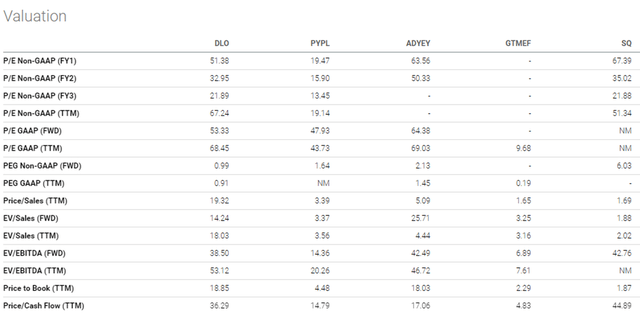

DLocal is a fast-growing, overvalued midget competing against giants like PayPal (PYPL). Even Philippines-based Globe Telecom (OTCPK:GTMEF), which operates GCash, is now exceptionally undervalued when compared to DLO.

Seeking Alpha

DLO’s TTM GAAP P/E valuation is 68.45x. This is notably higher than PYPL’s 43.73x and GTMEF’s 9.68x. Value investors would instead go long on GTMEF instead of risking a buy on DLO.

High Profitability Justifies Very High P/E?

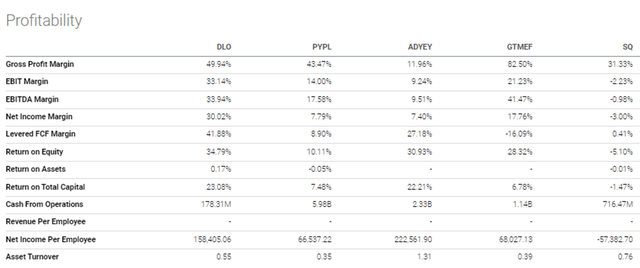

The notable relative overvaluation that gave DLO 68.45x P/E valuation might also be because of its high-profitability. I cannot justify a forward P/S of 15.33x with a YoY revenue growth of 102%. I can justify it by saying that the high revenue growth performance is NOT preventing DLocal posting a TTM net income margin of 30.2%. The traders and speculators should appreciate this fact.

Seeking Alpha

Growth at unreasonable price could be vindicated when the company does 100% YoY revenue and still enjoys a 30% net income margin. The notably higher TTM P/E valuation of 68.45x is excused. PYPL’s net income margin is only 7.79%. Globe Telecom’s 17.7% is still much lower than GLO’s 30% net margin.

The 30% net income margin helps fortify the sturdy financial health of DLocal. This company’s total debt is only $18.58 million. Its total cash is $455.05 million, and its leveraged free cash flow is $139.67 million. These numbers help DLO’s high Altman-Z score of 20.47.

High profitability also helps fortify DLO’s Piotroski F-score of 6. Going forward, high profitability and high revenue CAGR might just provide DLocal the perfect F-score of 9.

Upside Potential

The first thing that could reverse DLO’s decline is to deliver a big Q3 and Q4 earnings surprise. Predicting next quarterly EPS is not an exact science. However, my guesstimate is that Q3 EPS of $0.15 is feasible. It would be better than Q2’s EPS of $0.10. The management will just have to improve on that already high TTM net income margin of 30%. This could be done through a big YoY growth in quarterly revenue and cost-cutting.

The average FY 2022 for DLO is $0.43. The stock could bounce back to $30 if management reports a full-year EPS of $0.50 and $450 to $500 million in revenue. Beating Wall Street estimates usually provokes bullish emotions from retail and institutional investors.

The other event that could attract the big money bulls again is for DLocal to find another fintech company that it could buy. It has more than $400 million cash and very little debt. It can use its overvalued stock power to do an all-stock merger/acquisition of another fintech unicorn.

Consolidation among fast-growing small companies will eventually allow them to compete better against giants like PayPal.

My Verdict

This is not a bearish article. You should wait for DLO to decline some more. Bearish technical indicators indicate the investing/trading public’s pessimism. There’s no recent game-changing press release that would attract the attention of large hedge and institutional fund managers. Shareholders who are still underwater should not average down on this stock.

Big beats on Q3 and Q4 EPS and revenue estimates might evoke bullish emotions from investors.

You can hold on to DLO. Its best investment quality is posting a 30% net income margin while also doing 102% YoY revenue growth. DLocal’s $400 million cash and very high valuation gives it flexibility to buy other digital payments firms.

Due to its high valuation, don’t expect DLocal to get bought by a bigger fintech firm.

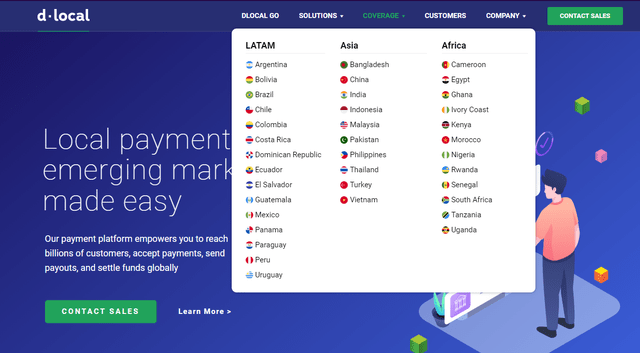

The recently expanded partnership with Deel is nothing special. Deel also recently signed a partnership with WeWork (WE). What would impress me is if DLocal could challenge the Philippine leadership of GCash. DLocal now operates in the Philippines. It has expanded outside South America.

Dlocal.com

The relative overvaluation could attract more shorts. Like it or not, DLO’s very high 68.45x TTM P/E ratio makes it a seductive target for shorts. Going forward, the current 9.7% short percentage of float might surpass the 14.5% short interest on 1/15/2022.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!