Bennett Raglin/Getty Images Entertainment

Investment thesis

Due to the adverse economic condition that Citi Trends (NASDAQ:CTRN) has been facing for the last two quarters, its profitability has reduced significantly, and as a result, the stock price has dropped more than 75% from Jan. 2022, but the business model is robust and as the inflationary environment settles company would regain its profitability. Over the period, the stock has become reasonably undervalued despite substantial positive development in the business over the last 2-3 years. And if the company regains its earning power, the stock will not remain at this valuation; Citi Trends is a buy.

Business History

Since its IPO in 2005, CTRN has been consistently increasing its store count; at the time of IPO, the company had 212 stores, which have grown to about 615 stores till Q2 2022, representing approximately two to three percent compounded annual growth rate.

Also, despite consistent growth in the store count, profitability could only improve a little; this is why CTRN couldn’t generate any significant returns for its shareholders since its IPO. But the business model has been attractive and produced significant cash flow. And by recognizing this situation, in 2016, Macellum capital bought some stake in the company to change the operating strategy, and to create long-term value.

Entry of Macellum Advisors GP

Macellum Capital is one of the long-term shareholders of Citi Trends, Inc., in 2016, Macellum acquired more than 3.9% of the stake in the company. With time, Macellum recognized that despite many years of operations and a robust business model, management could not create any recognizable value for their shareholders; by recognizing the need to change business strategies in 2017, to take control of business operations Macellum appointed Jonathan Duskin to the board, and from 2017 onwards till 2019, Duskin tried hard to change the way of business operations, with the entry of Duskin company got the long-term vision and started complying with its shareholders, Duskin desperately wanted to create value for the company’s shareholders and came up with some initiative like buyback policy, Hispanic focused test store and set a long-term goal, but failed to bring any satisfactory operating results due to non-compliance of the existing board, in 2019, Macellum came up with the agreement with Citi Trends to change the board composition and leading team, which led to a substantial change in management positions and company’s business strategy.

With the change in management, Citi Trends’ operating strategy also changed. With the vision of Duskin to create long-term value, new management started seeking gross margin expansion, lower markdown, and started cutting unnecessary expenses to drive the company’s profitability.

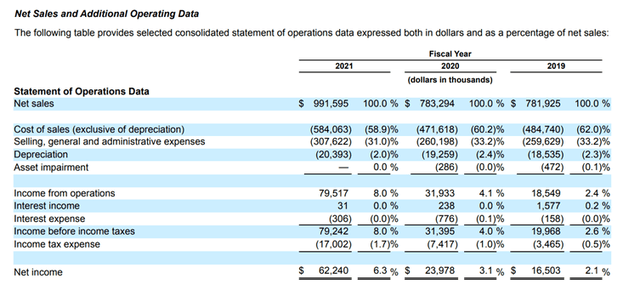

Income statement (annual report)

As a result of such initiatives, we can see in the last three years, the cost of sales and SG&A have reduced substantially, resulting in net margin expansion from 2.1% to 6.3%.

Also, over the last few years, due to the buyback policy, the company has bought back more than 40% of its outstanding shares, which has created huge value for shareholders of CTRN.

Strength in the business model

Citi Trends seek to offer top quality, fashionable merchandise at low cost by offering merchandise at an everyday low price, which has created strong customer loyalty and high shopping frequency, this is the reason why the company does not require to spend huge money on advertisements, most of the advertisement is done by mouth publicity which helps CTRN to reduce its operating cost and provide merchandise at an even cheaper price.

Furthermore, due to the sufficient cash flow generated by the company, over the period, company didn’t require to depend on external sources such as debt and equity dilution to fund its operations, Citi Trends has not used any long-term debt in the last 10 years, only in the difficult economic conditions company had to use revolving facilities, and despite low-profit margins, the company has maintained a strong cash flow because of its strict working capital management.

Citi Trends’ ability to open new stores at low cost has helped the company to keep the cost at efficient levels, as the newly developed store achieve approximately $1.4 million in sales in the first full year of operation and require an investment of just $0.4 million to build it out. In FY 2021, management came up with a new updated store format called “CTx” store, and as per the management, more than 50% of the stores will have the new CTx format by the end of fiscal 2024, which will drive operational efficiency and overall margins.

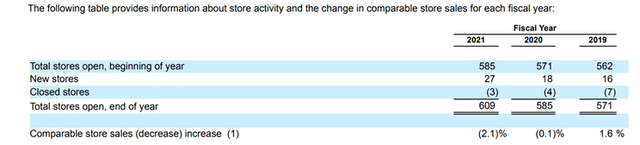

Store count (annual report )

Also, because of strong customer loyalty and good cash flow generated by the stores, CTRN’s store closure rate is substantially lower than other competitors, saving a lot of money for the company and increasing its competitiveness.

These above facts give Citi Trends’ business model enormous strength over its competitors.

Current situation

As the management stated in the recent call transcript, customers are facing one of the most challenging economic environments in history; inflationary pressure across their household necessities is outpacing their wage growth, and due to such an adverse economic condition, purchases from Citi Trends stores have reduced significantly in the last few months.

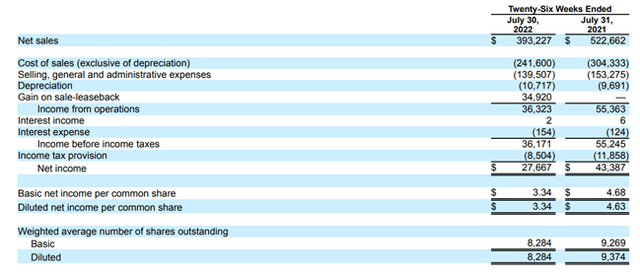

Quarterly income statement (Quarterly report)

From Q1 FY 2022, the company’s overall sales started decreasing; till the end of the second quarter, comparable sales decreased by 25% compared to last year. This eventually led to operating loss, but the company could post a net profit because of a one-time gain from sale-leaseback activity. Also, reduced profitability has affected cash flow significantly, and due to adverse market conditions, the company has to pay down some accrued expenses. This has affected companies cash reserves, but the company ends the quarter with $27 million in cash, any future loss or working capital pressure might consume its cash reserves, and in such case, the company will have to depend on external sources to fund its operations. note that, as the cash flow has been affected significantly, management has stopped pre-planned Capex and has reduced buyback activities.

Management expects a low single-digit increase in second-half total sales compared to first-half total sales; for the entire year, this represents an 8% to 10% decline from the mid-point of previous guidance of $870 million.

The major problem lies in the current inflationary environment, which puts pressure on consumers’ pockets. As a result, many retailers like Tilly’s (TLYS) , and Express (EXPR) are also facing a substantial reduction in profitability.

Risk factors

The investor must consider that the customers’ loyalty that the business has enjoyed in the last ten years is due to the low-cost merchandise that the company has been providing to its customers, historically CTRN used to offer huge discounts to its customers, about 20% to 70% compared to department and specialty stores regular price, which over the period has generated strong customer loyalty, but from FY 2019 as the new management came on the board, company is trying to seek margin expansion to increase profitability, which will increase the overall product price and as a result customers might find the alternative source at the same price which will reduce customer loyalty significantly and to regain the customers again company might need to spend huge money on advertising which will further affect profit margins.

In 2022, David N. Makuen became the new CEO; as we can see, over the last few years, the management position has become so unstable and changing rapidly, which might affect operational strategy and long-term goals.

Also, current economic conditions might persist for a longer time, and as a result, the company might produce losses, affecting its cash flow.

Conclusion

With the entry of Duskin on board, business operations have significantly improved; over the last two years, cash flow has increased substantially with an improvement in net profit margins.

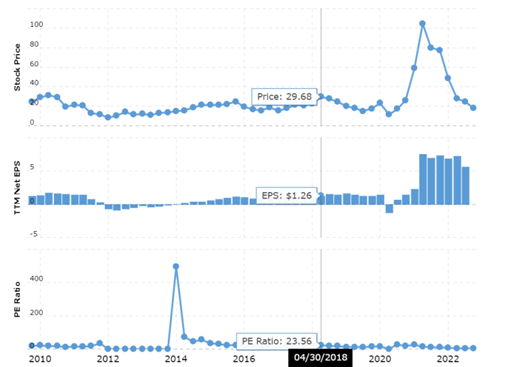

PE ratio (macrotrends.net )

Historically, the company has been trading for more than 23 times its earnings, and due to substantial buyback and margin expansion, EPS has grown significantly in the last few years; as the condition normalizes, the company will see significant improvement in earnings.

The current market value of Citi Trends is nearly $154 million; note that, in 2020, company produced a cash flow of about $110 million, as per the FY 2020 financial performance, the company is currently trading at just 7.8 times its earnings and just about 1.5 times its CFO, which seems substantially undervalued. And with the effect of management’s strategy, further buybacks and margin expansion, substantial growth can be seen in the company’s earnings; CTRN is a buy.