Sundry Photography

Right now, amid hyper-choppy markets, the best thing investors can do is to be very judicious in stock picking. I continue to be of the opinion that the broader indices will rise and recover at least double-digits over the next 6-9 month timeframe – but as we’ve seen over the past week when inflation reads came in lower than expected, beaten-down tech stocks are surging far more than the indices and are the main opportunity to beat the markets.

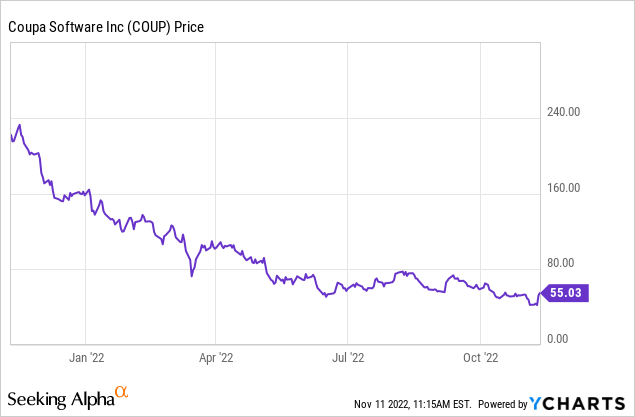

Coupa (NASDAQ:COUP), in particular, remains a mainstay hold in my portfolio. This procurement software company has seen its stock crater by nearly 70% in the year to date. And while I agree that macro risks do weigh on Coupa in particular due to its exposure to enterprise spending, I think the selloff is far overdone.

I remain bullish on Coupa for the medium term, though I am taking my rating down on the stock from “very bullish”. This is entirely due to the fact that other beaten-down SaaS stocks have seen far steeper corrections over the past 1-2 months, and I think from a relative valuation perspective, these names have become more attractive: Asana (ASAN), Zoom (ZM), C3.ai (AI), Palantir (PLTR), and HubSpot (HUBS).

This being said, I am still quite confident in Coupa’s upward path. The company’s latest Q2/July quarter results beat expectations and didn’t show any meaningful deceleration versus Q1 despite the macro deterioration that started in the late summer (we’ll see if Coupa can live up to its guidance for Q3). The company also bolstered its buyback program by $100 million (covering roughly 3% of the company’s market cap at current stock prices), indicating both confidence in the direction of the stock as well as comfort in its liquidity position.

The long-term thesis for Coupa

When we look at a multi-year horizon for Coupa and ignore the short-term noise being driven by what I believe will be a very short-lived recession, I still see a very vibrant bull case for Coupa.

Here’s a full rundown of all the upside drivers the company has:

- Enormous TAM, and plenty of room to “land and expand” within the existing customer base. If not evidently obvious, business procurement is a huge space. Coupa estimates that it has 100,000+ potential global customers and a market opportunity of $94 billion, indicating that even at its current respectable scale, there is still a large market out there to grab. Coupa notes it is only currently ~20% penetrated into the Global 2000. Moreover, within the company’s existing base of ~2,000 customers, Coupa is estimating a $2.3 billion “expansion” opportunity, which is roughly 3x its current annual revenue scale.

- Procurement as a function got elevated after a pandemic era dominated by supply constraints and inflation. The hot-seat department to be working in post-pandemic is procurement. Companies around the globe had, or are still having, tremendous difficulty sourcing various components. Procurement practices are in a serious review in the post-pandemic era, making the conversation for onboarding a modern software tool like Coupa very natural.

- Coupa Pay. Coupa is leaning more and more into Coupa Pay, which is its embedded payment solution tied to its procurement platform. Attach rates across new deals have been ~30%, and specifically for mid-market customers where Coupa is seeing the most growth, attach rates are well over 50%.

- Sticky product. By integrating itself into its clients’ supply chain, finance, and operations, Coupa makes itself a very difficult product to rip out.

- High recognition from tech analysts and reviewers. Coupa’s procurement platform has been named a leader and the industry benchmark by a number of industry analysts, including Gartner and Forrester, making it a “best in breed” and default vendor.

- Profitable on a pro forma and free cash flow basis. In FY22, Coupa generated both positive pro forma net income and positive free cash flow, another rarity for a software company growing as fast as it is.

It’s worth noting as well that with an enterprise value of ~$5 billion as well as a sticky SaaS-based revenue base, Coupa could be earmarked for an acquisition. Though I never like to base any bull case on the possibility of M&A, I do view this exit opportunity as a “lower bound” on the stock price.

Valuation check

At current share prices near $55, Coupa trades at a market cap of $4.18 billion. After we net off the $809.4 million of cash and $2.16 billion of debt on Coupa’s most recent balance sheet, the company’s resulting enterprise value is $5.53 billion.

For FY24 (the fiscal year for Coupa ending in January 2024), Wall Street analysts are banking on the company delivering $998.0 million in revenue, representing 19% y/y growth. This puts the stock’s valuation multiple at 5.5x EV/FY24 revenue.

To me, this is still quite a cheap multiple for a company currently growing billings in the mid-20s (and a steep fall from when Coupa traded in the mid-teens during the pandemic). At the same time, as previously mentioned, other stocks like Asana are currently deeper underwater.

Q2 download

Let’s now take a brief recap of the latest results that Coupa released. The Q2 earnings summary is shown below:

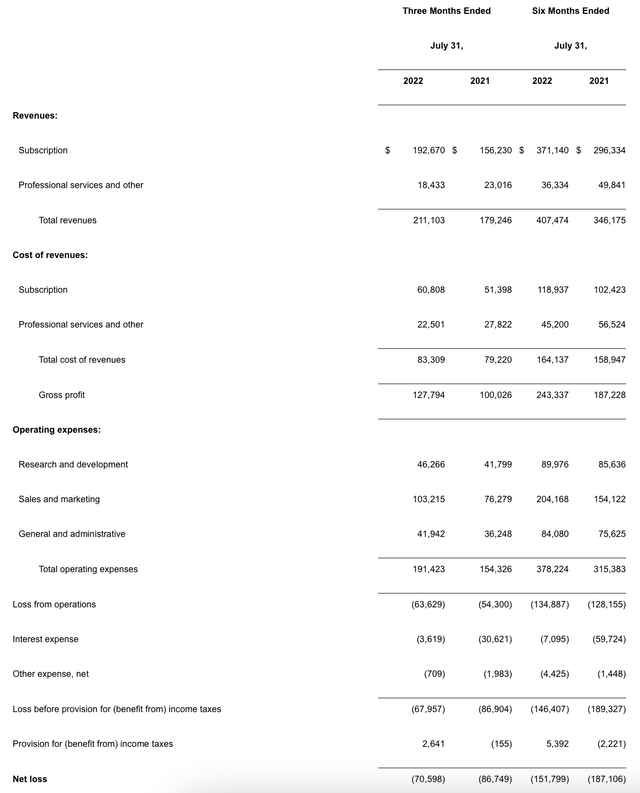

Coupa Q2 results (Coupa Q2 earnings release)

Coupa’s revenue grew 18% y/y to $211.1 million, beating Wall Street’s expectations of $204.1 million (+14% y/y) by a significant four-point margin. It’s worth noting as well that revenue growth accelerated versus 16% y/y growth in Q1 (a rarity in a quarter in which most other tech companies saw sharp deceleration). Also good to note is that professional services revenue declined by -20% y/y (while subscription revenue grew 23% y/y) – which is a positive sign for Coupa as it matures, as the company performs these services below cost at a drag to its margins.

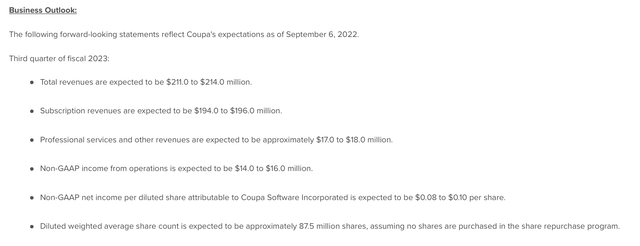

For Q3, as shown in the snapshot below, Coupa is guiding to $211-$214 million in revenue, representing deceleration to 14-15% y/y growth. We’ll see if this materializes, however, as the company had originally guided to 14% y/y growth in Q2 as well.

Coupa outlook (Coupa Q2 earnings release)

Coupa’s billings in Q2 clocked in at 25% y/y as well – and as seasoned software investors are aware, billings represent a better picture of longer-term growth trajectory than current quarter revenue growth. Coupa’s billings are yet another indicator that sharp deceleration from here is unlikely.

The company is acknowledging that sales cycles are lengthening (which it has factored into its guidance for Q3 and beyond), but so far, metrics have held up. Per CFO Tony Tiscoria’s remarks on the Q2 earnings call:

In Q2, our gross renewal rate and net retention rate were in the consistent historical range of approximately 94% to 96% and 110% to 112% respectively. The number of customers with annualized subscription revenue greater than $100,000 was 1,519 at the end of the quarter, up 23% from a year ago. These results illustrate the leverage and scale we have in our financial model. We are focused on top line growth. But as Rob noted, we also prioritize strong unit economics, gross and operating margins and free cash flow margins.

With that, let’s now turn to guidance. As Rob noted in his remarks and as we discussed last quarter, in Europe, we continue to see a softer demand environment with lengthening sales cycles, which is factored into our guidance. Consistent with Q1, our Q2 performance in North America was strong. However, we recognize the global macro environment is uncertain. So we have factored the potential for additional macro headwinds into our guidance to derisk the outlook for the back half.”

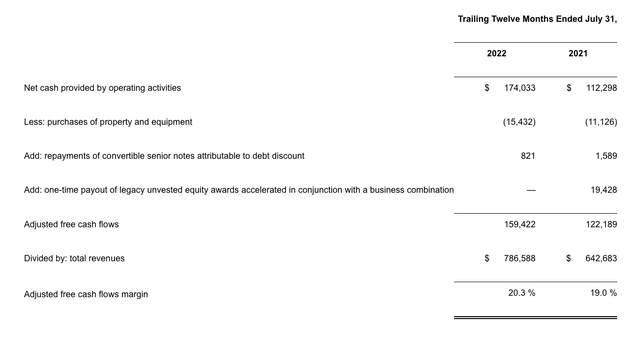

We note as well that Coupa’s enlarged scale has bolstered its profitability profile. In particular, note that the company has generated $159.4 million in adjusted FCF over the past twelve months, up more than 30% y/y and representing 130bps of FCF margin lift.

Coupa Q2 FCF (Coupa Q2 earnings release)

Key takeaways

Both as a standalone software company that continues to gain share in a growing procurement software market, as well as a potential takeover target by a larger portfolio software company (none of the major software giants have a procurement solution to compete against SAP’s Ariba), Coupa is an attractive buy at ~5.5x forward revenue. Stay long here and use any dip as a buying opportunity.