Liens

Investment Thesis

Cameco (NYSE:CCJ) dilutes its shareholders and takes on debt. That’s the bad news. Bad news at a time, when investors believe that the uranium market is about to improve.

Even as the uranium market is perceived to be on the cusp of fundamentally improving, Cameco is still unprofitable, so unless investors fully buy into the uranium thesis, this stock simply looks expensive.

That being said, I believe that Cameco has a significant amount of operating leverage. Thus, when the uranium market improves, what is now seen as an unprofitable company lacking direction, will rapidly become a large and profitable uranium company.

I’m still bullish on Cameco.

What’s Happening Right Now?

Two different aspects are at play right now. Cameco acquired Westinghouse Electric Company from Brookfield Renewable Partners (BEP). This ensures that Cameco is no longer a pure-play uranium player. That Cameco is an integrated uranium operator with a utility company attached.

This will smooth out Cameco’s profitability. That’s one element of the thesis. The other side of the argument is that by being less exposed to uranium’s potential, Cameco will in time be valued as a utility, rather than a pure-play uranium miner. And get a more commensurate multiple.

For many investors that got interested in Cameco, because they fundamentally believe in the uranium bull case, this was a frustrating setback, at a crucial time.

Not only was their company leaving what they presumed to be the long-term game. But their company was doing it at a crucial time. And to compound matters, Cameco was diluting shareholders, as Cameco issued nearly 30 million shares.

Furthermore, the Westinghouse deal will not change Cameco’s prospects, but it will also add very roughly $2 billion of debt to its balance sheet.

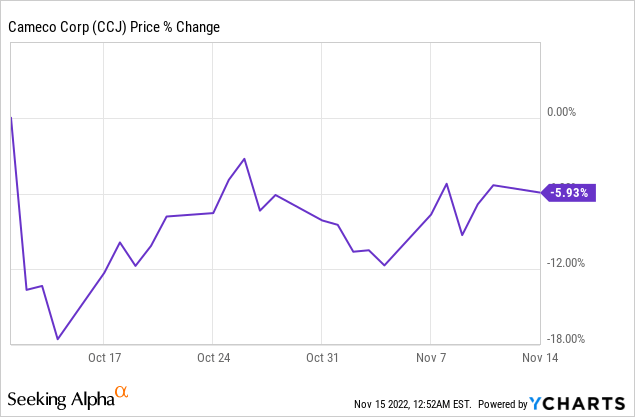

Understandably, for investors, this was a negative surprise at a bad time. And the share price sold off on the back of this news.

But over time, despite a somewhat shaky market, we can see that Cameco’s share price has retraced back up.

Hence, it could be said that even though investors didn’t welcome the deal, Cameco’s prospects are not as bad as first considered.

For its part, Cameco used its results to assuage investors.

Q3 2022 Results in Focus

The message that Cameco wanted investors to take from its earnings results was this

[W]e believe that Cameco remains the best way to invest in the recovery [the] in uranium market.

Meanwhile, Cameco’s guidance for 2022 as a whole continues to point to $1.9 billion in revenues at the high end. On the other hand, we should keep in mind that Cameco did ever-so-slightly raise uranium’s average realized price from $56.60/lb back in Q2 to $56.90/lb.

Consequently, the outlook is a steady-as-you-go outlook, without much change.

That being said, given that inflation costs are ravaging through the mining sector, I believe that we shouldn’t look too dismissively that Cameco’s administrative costs and capex for 2022 have not increased for 2022 as a whole.

In fact, as I look elsewhere in the mining sector, there are substantial signs of inflation gripping companies’ prospects already.

CCJ Stock Valuation – Slightly Complicated

How does one even look to value a leveraged and unprofitable mining uranium company?

Particularly when the uranium price is still some distance away from $60 per pound, a mark that many uranium companies will become substantially profitable.

That being said, this is the overall thesis. Uranium bulls, myself included, believe that we are finally on the cusp of seeing demand for uranium go higher. Why?

Because there’s a very consistent stream of newsflow that more and more countries are now turning to uranium to be part of their energy security. Not only does it work alongside the decarbonization agenda, but it also provides relatively cheap baseload energy.

What’s more, uranium’s by-products, known as depleted uranium, are contained within its rock and not released into the atmosphere, which complies with the green agenda too.

The Bottom Line

This is the summary of what’s at play. Cameco has moved away from being a uranium miner towards more of a utility. While abandoning its strategy it has taken on debt and is diluted its shareholders.

Also, investors have been waiting for the uranium market to see its pricing increase for years. So, investors are understandably losing patience.

For investors that still have some stamina, I believe that paying a $10 billion market cap for what’s possibly the second-biggest uranium producer is compelling.

Particularly if you believe, as I do, that uranium is going to be a key energy fuel in the coming years.