huettenhoelscher

Airbus (OTCPK:EADSF) is ambitiously aiming for significant increases in production in the coming years. This year the company aims to deliver around 700 aircraft. With only slightly less than 495 deliveries, there obviously is a risk that expectations do not materialize and therefore, it is also important to keep track of how things are going now in the form of deliveries and how they might develop as indicated by orders. In this report, I do just that by analyzing the orders, deliveries and other backlog mutations for October.

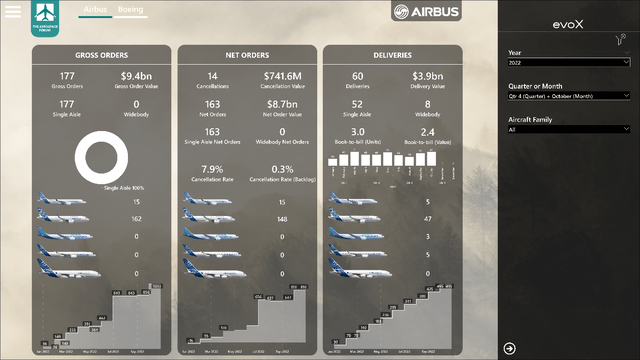

For this report, I will be using the evoX order and delivery monitor developed by The Aerospace Forum. For those who have been following the monthly order and delivery reports that I write for Airbus and Boeing (BA), you might notice that this monitor looks completely different. The evoX platform introduces a completely new look for interactive monitors, but it does not stop there. We consolidated various monitors and pages into one, making more data accessible with a single tool and from the same data we present more information to you. So, we are better leveraging the hundreds of thousands of datapoints we got, which allows us to better highlight the data-driven approach of the analysis.

Just like before, using these tools, we are able to analyze orders and deliveries and see where manufacturers are falling short, meeting or exceeding expectations.

Airbus Aircraft Orders Jump

Airbus orders and deliveries October 2022 (The Aerospace Forum)

In October, Airbus booked 177 gross orders, marking an increase of 164 orders, solely consisting of single-aisle aircraft with an estimated value of $9.4 billion:

- Air Canada (AC:CA) ordered 15 Airbus A220-300s.

- Xiamen Airlines ordered 25 Airbus A320neos and 15 Airbus A321XLRs.

- Jet2.plc ordered 35 Airbus A320neo aircraft.

- An undisclosed customer ordered 28 Airbus A321neos.

- International Airlines Group (OTCPK:ICAGY) ordered 31 Airbus A320neos and 28 Airbus A321neos.

During the month, the following changes were made to the order book:

- Three orders from JetSmart for the Airbus A320neo were transferred to Avolon.

- BOCOMM Leasing was identified as the customer for one Airbus A320neo.

- International Airlines Group cancelled orders for 11 Airbus A320neos.

- SMBC Aviation Capital converted orders for three Airbus A320neos to three Airbus A321neos.

- International Airlines Group cancelled orders for 3 Airbus A321neos.

- Two orders previously listed for the Airbus A330-800 are now listed as orders for Air Cote d’Ivoire for the Airbus A330-900.

- Two Airbus A330-900 orders from Virgin Atlantic have been transferred to Air Lease Corporation (AL).

In October, we saw that the Airbus A220 and Airbus A321neo enjoy continued customer interest but the same cannot be said about wide body aircraft. While international traffic is expected to be recovering in the coming two years, we are not seeing a strong uptick in wide body demand in the same way we saw it for single aisle aircraft. If Airbus is in the slightest able to replicate a scaled success as seen for the single aisle programs that would allow for remarkable growth in the wide body arena. During the month we International Airlines Group canceling some orders and replacing them with a bigger order. So, that is good news for Airbus and we saw Airbus capturing follow up orders from Air Canada and new orders from Xiamen Airlines.

Airbus logged 177 gross orders with a value of $9.4 billion while it scrapped 14 orders valued $740 million from the books, bringing the net orders to 163 orders with a value of $8.7 billion. A year ago, Airbus booked 22 order and 30 cancellations, bringing its net orders to -8 units with a net order value of -$268 million. So, we see that order inflow increased sharply year-over-year.

Year-to-date, the European jet maker booked 1,033 gross orders and 223 cancellations, bringing the net orders to 810 units with a net order value of $38.5 billion. In the first ten months of 2021, Airbus booked 292 gross orders and 125 net orders with a net value of $8.7 billion. So, Airbus is having a far better year this year driven by revival of demand and really we are comparing a risk-on low year (2021) to a year where customers are quickly finding out that the recovery is much faster than they anticipated.

Airbus

In October, Airbus delivered 60 jets compared to 55 in the previous month. The European jet maker delivered 52 single-aisle jets and eight wide-body aircraft with a combined value of $3.9 billion:

- Airbus delivered five Airbus A220s.

- A total of 47 Airbus A320neo family aircraft were delivered, consisting of one Airbus A319neo, 21 Airbus A320neos and 26 Airbus A321neos.

- Airbus delivered three Airbus A330 family aircraft including one -300 and two more fuel efficient Airbus A330-900s.

- Five Airbus A350s were delivered, four -900 models and one -1000 model.

In October, we saw deliveries drop slightly but the drop was not as strong as we saw for previous quarter. The good news is that Airbus A320 deliveries were better aligned with the production rate this month while wide body deliveries also looked strong and this is actually the kind of delivery mix one would like to see from Airbus to meet and exceed the annual delivery target.

Compared to last year, deliveries increased by 19 units while the delivery value increased by $1.7 billion. Year-to-date, Airbus delivered 495 aircraft valued at $32.7 billion compared to 460 aircraft valued at $29.4 billion last year. The good thing is that since July deliveries are higher year-over-year, and that also holds for the value of the deliveries. However, with two months remaining for Airbus, the path towards getting to the targeted delivery number of around 700 remains challenging and I only see this happening if Airbus is able to push itself to 70+ deliveries in November and 130 deliveries in December.

The book-to-bill ratio for the month was 3 in terms of orders and 2.4 in terms of value. For the first ten months of the year, the gross book-to-bill is 2.1 in terms of units and 1.8 in terms of value while the cancellation rate is 21.6% and 4.5% when measured against the backlog. The book-to-bill ratio for the year is looking extremely strong. This is primarily driven by a combination of the big order from Chinese airlines, but also by the underwhelming delivery numbers due to supply chain issues. So, book-to-bill ratios higher than one do show balance or oversold positions in general, but in this case, they also reflect the big challenges when it comes to hiking production.

Conclusion: Airbus Stock A Buy, But Delivery Target Remains in Doubt

My conclusion on Airbus has been more or less the same for months. Orders are rolling in, some months faster than others and after a slow September the order inflow ticked up again in October. On the order side of the story, I don’t see any problems. The backlog is strong and a weaker order year will not disrupt production. The problem I am seeing is on the delivery side. Airbus has a lowered target of 700 deliveries this year, but with three months remaining that would require >100 deliveries per month until year-end and that might be challenging. Wide-body delivery numbers are looking strong, but single-aisle deliveries remain underwhelming.

I continue to like shares of Airbus for the longer term and continue to be invested in the company, but it should be kept in mind that the delivery target remains under pressure and production rate increases have been pushed to the right.