Leon Neal/Getty Images News

I learned something new when digging into Teledyne Technologies (NYSE:TDY). The stock is a 4% weight in the SPDR S&P Kensho Final Frontiers ETF (ROKT). The fund, according to SSGA, tracks an index utilizing artificial intelligence and a quantitative weighting methodology to capture companies whose products and services are driving the innovation behind the exploration of the final frontiers, which includes the areas of outer space and the deep sea. It’s essentially an aerospace & defense fund with 54% of assets in that industry.

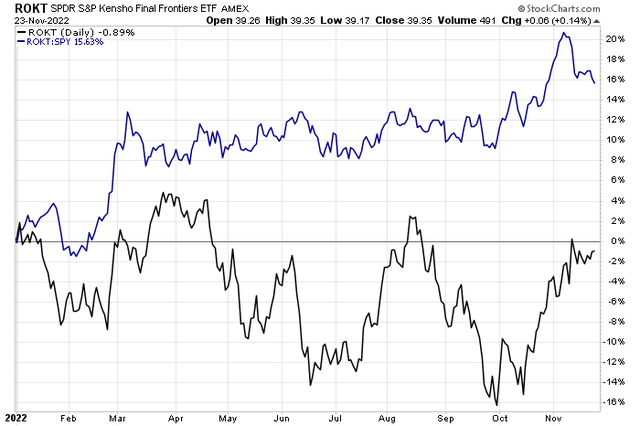

More interesting to me as a technician and investor is ROKT’s performance relative to the S&P 500 this year. The fund has something you do not see with many thematic ETFs in 2022 – more than 15 percentage points of alpha. TDY, likewise, has been resilient in these years.

ROKT Final Frontiers ETF Flat On The Year

Stockcharts.com

According to Bank of America Global Research, Teledyne is a specialized industrial company that makes sensors, transmitters, and analyzers. Since spinning out of what is now Alleghany Technologies over 20 years ago, it has transformed itself from a primarily Aerospace and Defense company into a diversified industrial firm with revenues of $4.6bn in 2021. Key to growth is its acquisition strategy, with its three largest deals to date all focused on the attractive Imaging segment.

The California-based $19.5 billion market cap Electronic Equipment Instruments & Components industry company within the Information Technology sector trades at a high 27.7 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Just recently, George Soros’s Soros Fund Management took a new stake in TDY, according to Seeking Alpha.

Teledyne beat earnings estimates in its Q3 report a month ago and increased its full-year adjusted EPS expectations, assuaging analysts’ fears of ongoing supply chain issues pressuring operators. Shares rocketed higher from about $360 before the report to $420. The firm’s balance portfolio with organic growth and EPS advances stemming from acquisitions make the company attractive to GARP investors. TDY must still focus on maintaining its margins and generating free cash flow in what should be a tough environment next year.

Upside potential comes from a currently low EV/EBITDA ratio compared to its peers and acquisitions that are accretive to earnings and shareholder-friendly activities, per BofA. Its operating leverage could be an asset should business conditions improve. Still, downside risks are apparent by way of poor synergies with FLIR, a drop in the Department of Defense budget, or weak international sales.

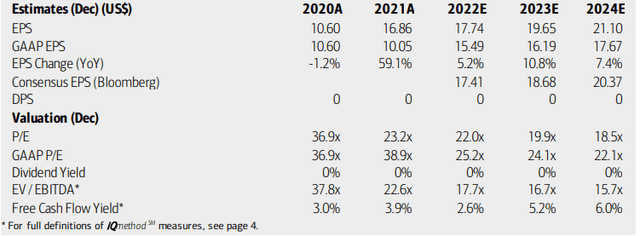

On valuation, analysts at BofA see earnings rising below the rate of inflation this year, but then accelerating in 2023 before moderation in 2024. The Bloomberg consensus forecast is slightly less sanguine than BofA’s outlook. Shares don’t come cheap on both an operating and GAAP P/E basis while free cash flow is currently modest but expected to grow. Overall, the operating PEG ratio using 2023 numbers is under two, which is attractive for this I.T./defense name.

Teledyne: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

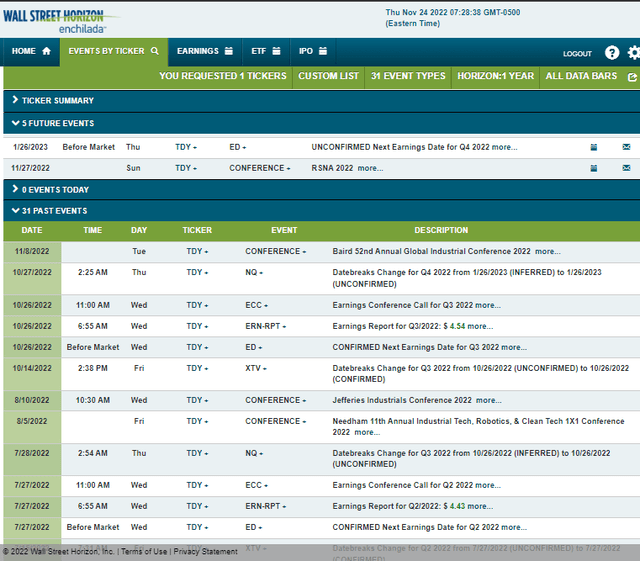

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2022 earnings date of Thursday, January 26 BMO. Before that, though, TDY’s management team is expected to speak at the RSNA 2022 conference. Expect to hear details about its new line of high-performance X-ray detectors at the event from November 27 to December 1 in Chicago.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

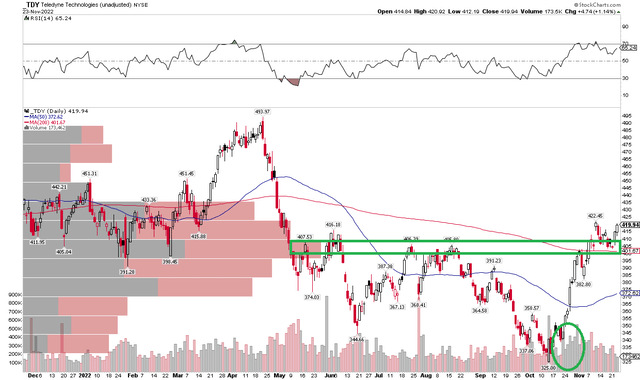

TDY popped above resistance to make fresh six-month highs earlier this month. Some profit-taking resulted in a bull flag, but the stock held its flat 200-day moving average before jolting higher this past Tuesday and Wednesday.

I like the technical setup here – the move indeed has the hallmarks of a bull flag pattern which would trigger a price objective to near $495 – the April high. A tight stop under the 200-day, perhaps $398, makes sense. More cushion can be applied with a stop under the November low of $382.

TDY: Bull Flag Targets the April High

Stockcharts.com

The Bottom Line

I like the growth story with TDY and its valuation, while high, is warranted given decent free cash flow. The technical setup is also constructive. That combination makes Teledyne a buy here.