Boogich/iStock Unreleased via Getty Images

The US automotive market has been tumultuous over the past two years. The events of 2020 initially caused a significant decline in demand for vehicles but also spurred an even more substantial and long-lasting drop in vehicle production and the production of crucial vehicle inputs (i.e., semiconductors). As many US vehicles were aged and interest rates were low, demand for cars improved in late 2020 through 2021, creating a substantial shortage that spurred a tremendous rise in new vehicle prices.

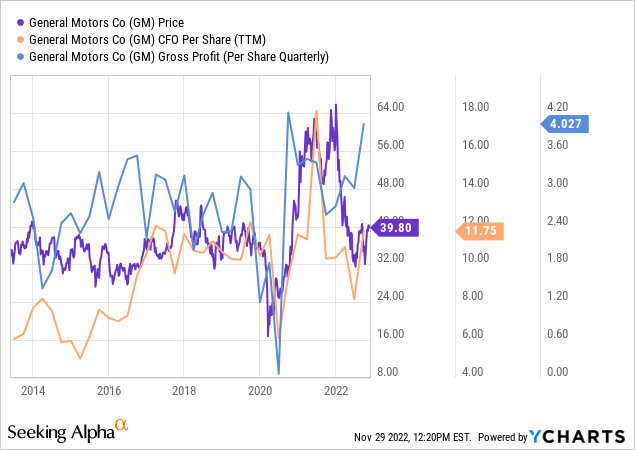

Despite a record increase in new vehicle prices, top producers such as General Motors (NYSE:GM) have not retained high profits. The company’s stock initially rose through 2020 until the middle of last year but has since declined back to 2019 levels. GM is now back in the $30-$40 price range it was stuck in from around 2013 through 2019. Despite that, the company is seeing above-trend cash flows and gross profits per share. See below:

General Motors’ valuation is weighed on various factors impacting today’s automotive market. High new vehicle prices have considerably boosted the company’s gross margins, but now that critical bottle-neck shortages are over, many anticipate a reversal in the price impact. Further, the vehicle shortage has dramatically caused total US vehicle sales to decline and persist at low levels. Total US auto production is beginning to rise. Still, many producers are seeing inventory ratios climb as the slowing US economy and interest rate hikes likely negatively impact demand for expensive durable goods.

GM is currently trading at a very low forward “P/E” valuation of 5.5X and is expected to raise its dividend back to normal levels over the coming year as long as prospects continue to normalize. The stock trades at an apparent discount, particularly compared to the electrical vehicle giant Tesla (TSLA). Although Tesla still produces far more EVs, GM is ramping up its EV production and has an extensive global supply chain to allow it to scale efficiently, improving its EV competitive potential. With that factor in mind, it may seem GM is a solid long opportunity today. That said, shifting economic winds may pull the entire US vehicle market lower at the expense of GM’s EV expansion goals.

Auto Sales Likely To Remain Low As Rates Rise

Not unlike homes, the vehicle market has become highly unaffordable now that prices and interest rates are both elevated simultaneously, causing new monthly car loan payments to average around $748 per month in October, up from ~$540 in 2019. Even without further rate hikes (which are likely), auto loan rates are virtually certain to climb significantly over the coming as lenders face higher deposit borrowing costs (since most banks’ CD and savings account rates slowly adjust toward Treasury rates). Further, real wage declines, low personal savings, and weak consumer confidence all indicate waning demand for large purchases.

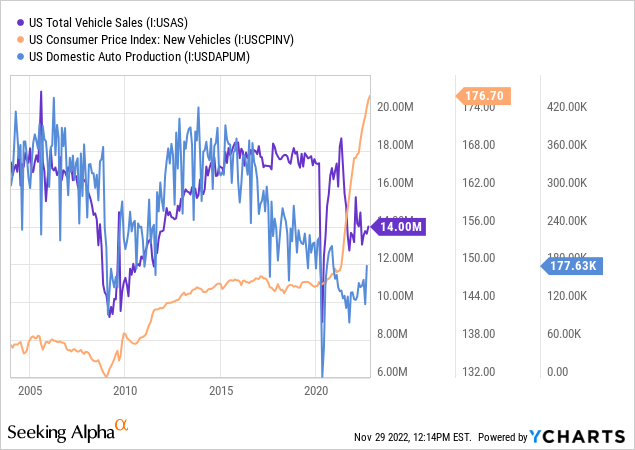

First, US vehicle sales and production are both meager today. Production is rising, but sales are not growing as quickly, increasing the potential for new vehicle prices to decline or stagnant. See below:

New vehicle prices have risen rapidly over the past two years amid an immense vehicle shortage. The last measure of the total US domestic auto inventory to sales ratio is slightly outdated but was still very low, though reversing higher as production improved. Comparatively, consumer sentiment remains near extreme lows while total US commercial bank automobile loan growth has stagnated. See below.

Looking on a short-term basis, it seems the US auto market is still in a shortage. Still, with loan growth weak amid weak consumer sentiment (and spending capacity), the shortage may quickly become a glut as vehicle production increases. I expect this will occur by the end of next year as auto sales remain low or even decline due to rising rates and weakening spending capacity, combined with increased vehicle production.

GM, Ford (F), Honda (HMC), Toyota (TM), Tesla (TSLA), and other peers have lost considerable value over the past ~18 months despite general increases in cash flows (excl. Ford). Much of this stems from the fact that the industry’s economic prospects have generally declined. First, from significant sales declines due to parts shortages. More recently, from negative outlooks for durable consumer discretionary demand – primarily driven by higher consumer interest rates and falling consumer spending capacity. In my view, the latter is a significant factor that will likely weigh on the earnings and cash-flow of all of these firms over the next two years.

General Motors Takes on Tesla

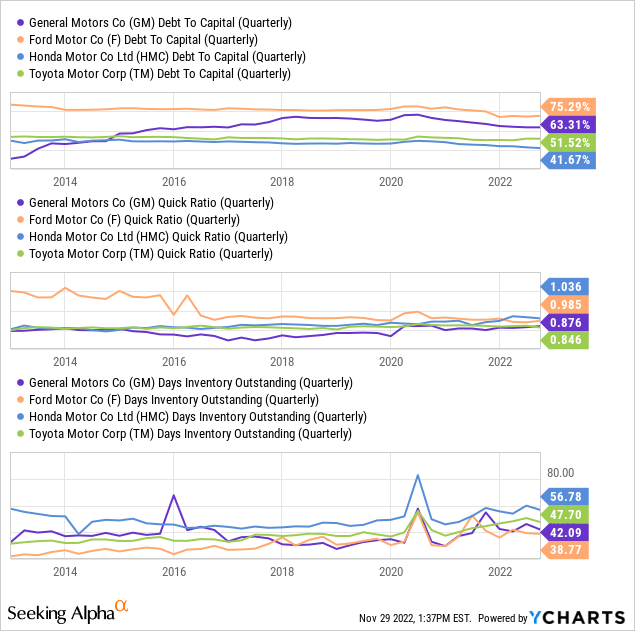

General Motors may lose some sales and cash flow over the next two years, but its valuation is low enough that it is not necessarily likely to decline in value. As long as losses are not too extreme, the economic slowdown seems somewhat priced into the stock. Of course, like its peers, GM does not have a solid balance sheet and is highly exposed to an economic recession. It ranks slightly higher on debt-to-capital with a lower quick ratio than peers. That said, all of the peer groups generally have poor balance sheet health. See below:

Vehicle companies often operate with a leveraged balance sheet as they use debt to grow and finance vehicle components. The US giants, Ford and GM, run at significantly higher debt-to-Capital than Asia’s Honda and Toyota. All are functioning at quick ratios around 1X, indicating they have as many short-term assets as needed (excluding inventories) to pay short-term liabilities. However, if inventory levels continue to rise, as shown in growing “days inventory outstanding” levels, they may all face some degree of liquidity strain.

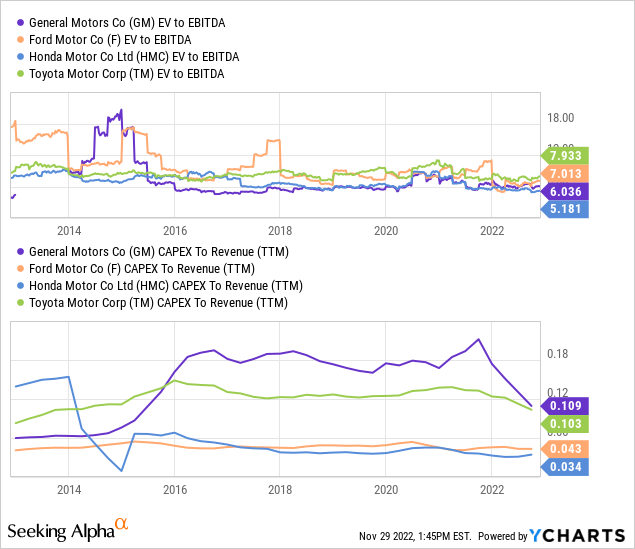

Compared to peers, General Motors has a slightly lower “EV/EBITDA” ratio of 6X, roughly the average long-term level for the industry. Honda and Ford have higher valuations, potentially due to their considerably larger dividend yields. Instead of reinstating its dividend, General Motors has focused on keeping Capex spending high to build a more substantial electric vehicle supply chain. See below:

Ford’s EV focus on more short-term in nature, focusing on creating an initial model with relatively low up-front costs. Comparatively, General Motors is playing the “long game,” building a dedicated EV architecture, including being the only automaker besides Tesla to produce its own battery cells. The market is changing, but it seems General Motors offers more long-term value in its approach. Its investments today should create lower EV production costs and potentially superior products 3-7 years from today.

Comparing General Motors or Ford to Tesla adds levels of complexity. Both are growing their EV market share, and General Motors is poised to accelerate its EV platform dramatically over the coming years. TSLA trades at a much higher “EV/EBITDA” of 35X, nearly 6X that of its competitors. Tesla is, by a large degree, the dominant EV player, but that may not persist as its Capex-to-sales ratio is now at just 9.5%, below that of GM and well-below older levels of 20-60%. This data indicates that Tesla is becoming less focused on long-term growth, while General Motors is. Primarily due to equity sales at extreme valuations, Tesla has a much more heavily debt-to-capital ratio of just 5.7%. Still, it seems clear that either TSLA is overvalued or GM is undervalued based on the convergence of their business models.

The Bottom Line

General Motors is a comparatively tricky stock to value as there are various bullish and bearish factors facing the firm. Looking 3-12 months out, I am mildly bearish due to solid evidence that vehicle sales and new vehicle prices will decline in 2023 amid negative economic trends. However, General Motors does not appear overvalued compared to its direct peer group and may be slightly undervalued due to a “dividend premium” on its dividend-paying peers. General Motors may also benefit from raising its dividend to normal levels; it has the capacity to do so, but I believe long-term investors will benefit more from GM making more significant EV investments instead of a dividend.

Looking at GM long-term, the stock appears undervalued and likely to deliver decent returns. It carries mild balance sheet risks that could surface if the economic downtrend becomes too extreme. However, looking beyond that period, I believe GM has excellent growth potential due to vertically integrated EV investments. Ford and most of GM’s other peers are not focusing so much on vertical integration into the EV market, making GM a much more robust long-term growth investment for EVs. Tesla, in my opinion, is a terrible EV investment today due to its egregiously high valuation combined with a sharp decline in capital investments.

If I were to value GM like Tesla, then GM would be trading for 4-6X higher than it is today. Of course, Tesla seems significantly overvalued based on its falling growth, even after its share-price declines. Accordingly, the “EV upside” for GM is likely closer to 2-3X, considering Tesla’s valuation is not necessarily based on a realistic discounted future cash-flow outlook. That said, the economic situation may cause General Motors and all peers (including Tesla) to see prospects decline temporarily. Overall, I am neutral on GM for now, but I may look to buy the stock as a long-term investment at a lower price in the future.