Scott Olson/Getty Images News

Inflation Reduction Act Inflates Share Price

I first wrote about Constellation Energy (NASDAQ:CEG) in January 2022, prior to the spinoff from Exelon (EXC). I reviewed it again in May after its first earnings release as an independent company. Both times, I noted that government support for nuclear power would be supportive of Constellation’s earnings and share price. Constellation is by far the largest generator of zero-CO2 electricity in the US and nuclear made up about 86% of the power generated and 63% of the power sold by the company so far in 2022.

Supply sources, GWh, 9 months ended 9/30/2022

| Nuclear | 128,914 | 63.0% |

| Other Gen. | 20,399 | 10.0% |

| Purchased | 55,408 | 27.1% |

| Total | 204,721 | 100% |

Source: Constellation Energy 3Q 2022 Form 10-Q

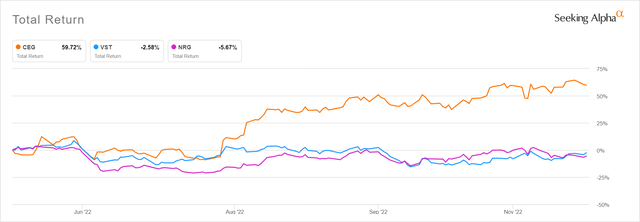

I rated Constellation a Buy in those earlier articles, although my share price estimates turned out to be too conservative. In May, I noted that CEG traded at a slight premium to merchant generation peers Vistra (VST) and NRG Energy (NRG), both of which have only about 6% of their power sales from nuclear. Clearly, Constellation deserved some premium, but this was hard to quantify based on uncertainties around how much government subsidies would be passed and how market sentiment for ESG would influence the price.

Since then, the Inflation Reduction Act passed in early August and the share price took off like a rocket, resulting in valuations now far above peers.

Total return since prior CEG article (Seeking Alpha)

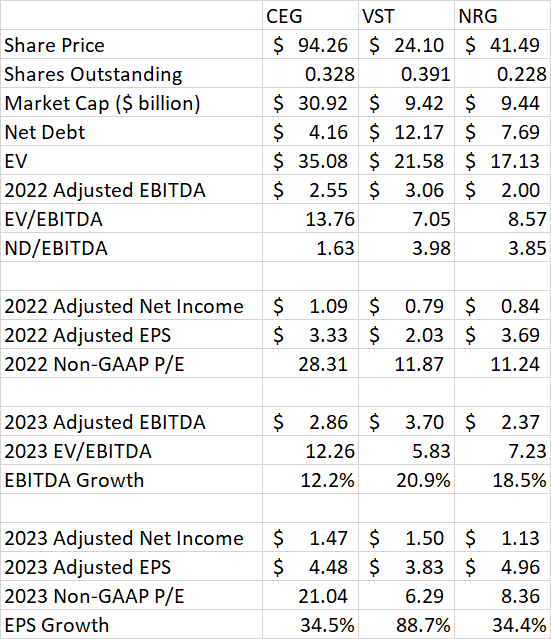

Constellation is also advantaged over these other two companies by its much lower amount of debt. The differing debt ratios make EV/EBITDA a more useful valuation metric to compare all three companies. In May, all three companies traded in the 7-9 EV/EBITDA range. By November, Constellation reached a 2022 EV/EBITDA of 13.8 while the valuations of the other two stayed flat. Looking ahead to 2023, all three companies are expected to grow earnings, but Constellation’s valuation remains nearly double the other two.

Author Spreadsheet

Notes:

EPS numbers are from Seeking Alpha company earnings pages.

EBITDA estimates are from company guidance except for CEG in 2023, which is estimated based on the company’s gross margin forecast.

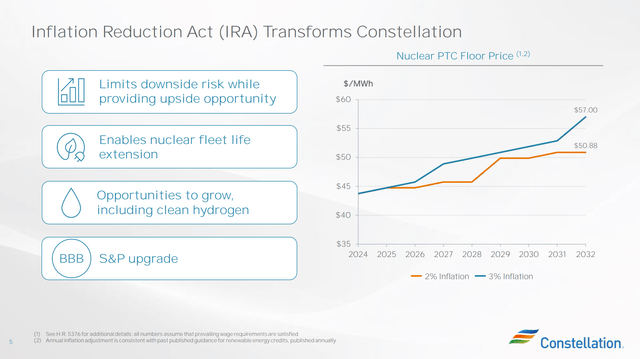

Constellation is now valued similar to some regulated utilities where rates are set by state regulators to provide a required return on capital. The Inflation Reduction Act does effectively set a floor on rates for the 63% of Constellation’s power sales that come from nuclear from 2024-2032, but this benefit is limited by market prices and hedging as we will see below. This is why Constellations now super-premium valuation appears to be driven by ESG sentiment and not just fundamentals, leading me to downgrade it to a Hold.

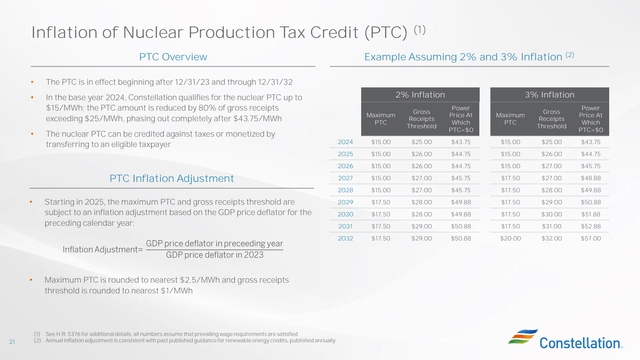

How Does The IRA Work?

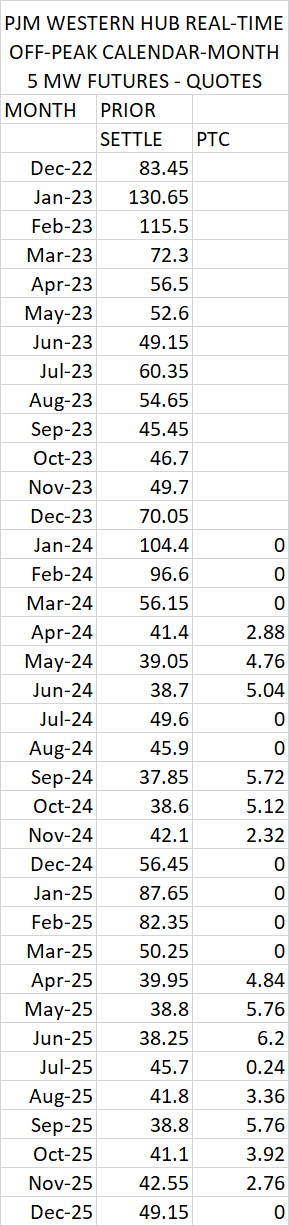

The nuclear subsidies in the Inflation Reduction Act come in the form of a Production Tax Credit with a maximum of $15/MWh. The PTC as available from 2024-2032. The PTC begins to phase out at sales prices above $25/MWh and goes to zero at sales prices above $43.75/MWh. There is an inflation adjustment each year to both the maximum credit value and the sales price where the phase-out starts.

Constellation Energy 3Q 2022 Earnings Slides

The credits effectively set a floor price on nuclear power, which increases each year depending on inflation.

Constellation Energy 3Q 2022 Earnings Slides

While the Production Tax Credit takes away a lot of Constellation’s downside risk from falling power prices through 2032, the benefits in the near term are not that large. In 2023, the PTC is not yet in effect. Beyond that, high market prices may limit the benefit of the PTC. If prices follow the latest futures price curve from the CME, we see that power prices are in or above the phase-out zone for the PTC. On a year average basis, the PTC would add only $2-$3/MWh to the realized price.

Author Spreadsheet (Data Source: CME)

Also, Constellation has already locked in prices on 92%-95% of its 2023 volume by hedging. The effective 2023 realized price in the Midwest is only $29/MWh after hedging, as opposed to market prices north of $60. The company gradually puts hedges on up to 3 years ahead, so we can assume 2024 is already about 67% hedged and 2025 is about 33% hedged. Fortunately, these hedges were probably put on at higher futures prices than the 2023 volume.

Constellation has already provided the $29/MWh forecast for 2023. My estimates for 2024 and 2025 are shown below assuming that the company can put on the rest of its hedges at prices around the current futures curve. This would result in effective prices around $40 in 2024 and $50 in 2025. Revenue growth of 38% followed by 25% looks attractive, but there is still downside risk if futures prices fall before the company is fully hedged.

| 2023 | 2024 | 2025 | |

| Avg. Market Price | $ 66.97 | $ 53.90 | $ 49.70 |

| Avg. Price After PTC | $ 66.97 | $ 56.05 | $ 52.43 |

| Effective Hedged Price | $ 29.00 | $ 37.93 | $ 47.65 |

| Hedged Price After PTC | $ 29.00 | $ 40.08 | $ 50.38 |

| % hedged assumption | 93.5% | 67% | 33% |

If prices hold at the 2025 level over the long term, the current valuation of Constellation might be attractive, but the downside risk of declining prices must be considered. This is why I say ESG sentiment also appears to be driving the current valuation.

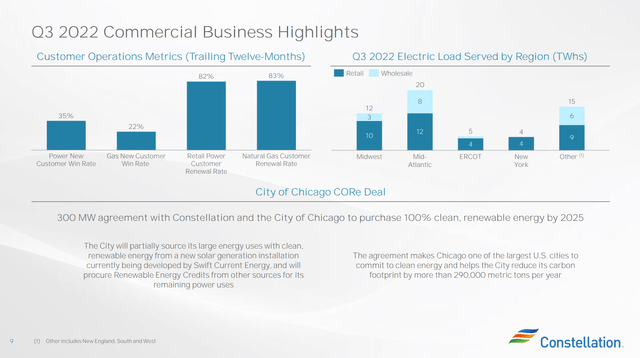

ESG Premium

If Constellation’s valuation is supported by market sentiment toward ESG, then it is hard to estimate numerically what this value should be or how long it will persist. To be fair, Constellation’s low-carbon footprint does have some measurable positive attributes. Many companies and local governments have goals to have all or some of their power consumption come from zero-carbon sources by some future date. To the extent this behavior continues, Constellation will sign up new customers and gain market share.

Constellation Energy 3Q 2022 Earnings Slides

On the other hand, ESG as an investment selection tool could be falling out of favor. The outperformance generated by ESG funds in prior years and their underperformance this year could simply be due more to sector rotation than any inherent correlation between ESG score and long-term profitability.

Any valuation of Constellation as a long-term investment should not include a premium simply for being a low CO2 emitter, however real earnings from added customers who desire low carbon power sources should be considered.

Capital Management

Constellation has not updated its capital return framework since the analyst presentation before the spinoff. At that time, the company estimated free cash flow before growth capex of $3 billion total over 2022 and 2023. Subtracting $400 million for spinoff related costs and capex and $100 million for identified growth projects, the company will still have $2.5 billion of remaining FCF. Year to date free cash flow has been negative, so it looks like most of this cash flow will be back-end loaded into 2023 if the forecast does not change. I would expect an updated capital return strategy to be released with the 4Q and full year earnings results in February 2023.

The dividend is currently $0.141 quarterly (0.6% yield, tiny for a utility stock) but the company expects to grow it 10% per year. Assuming a $0.155 quarterly dividend in 2023, Constellation will spend about $400 million on dividends during the 2-year period. This leaves $2.1 billion for growth projects or other purposes. I expect no further debt payoff given the already low leverage. Management stated on the 1Q earnings call that they would announce plans to return capital in the form of buybacks or a special dividend in the second half of 2022 but gave no further details. This has not occurred so far. The latest earnings call script simply stated that they expect to see growth opportunities with double-digit returns on capital.

And when we don’t have those opportunities or don’t have those opportunities in a particular time frame, we will return capital to our owners through a special dividend or share buybacks.

This looks like a yellow flag for income investors expecting rapid dividend growth. As for the growth or M&A opportunities, they may add value, but Constellation’s limited track record as an independent company leaves some execution risk to consider.

Conclusion

Constellation extended its premium valuation over peers since the announcement of the nuclear Production Tax Credit in the Inflation Reduction Act. The Act does take away some downside risk of lower power prices through 2032, but based the current futures curve, it does not add a huge amount to expected earnings. Constellation’s hedging program also limits upside, especially for 2023. However, there is still opportunity to hedge 2024 and 2025 at current high futures prices.

Constellation’s current share price in the mid-$90’s requires power prices to stay elevated beyond 2025 or for the market to give the stock a premium valuation simply because of its low-carbon ESG attributes. Both of these outcomes may happen, but downside risk also exists.

The current dividend yield of 0.6% makes CEG unattractive for an income investor, even with the stated 10% per year dividend growth. At that payout, the company will have ample surplus cash to institute a large buyback or pay a special dividend. Constellation’s lack of an updated capital return plan however suggests the company may also be conserving cash for uncertain growth opportunities.

Exelon truly unlocked value when spinning off Constellation in February 2022, but the price now reflects a best-case scenario for power pricing and market sentiment for ESG stocks. It remains a good long-term investment for those who bought it lower, but at current levels in the mid-$90’s range, the stock in a Hold.