AndreyPopov/iStock via Getty Images

High Probability in the Financial Services Sector of Catching a Winner

Investors are drawn to U.S.-listed financial services companies because these stocks should benefit from the U.S. Federal Reserve’s rate-hiking policy, but uncertainty about the economy and other factors kept them out of the sector for a while.

This has created pent-up demand for U.S.-listed financial services stocks, potentially leading to a surge in equity market valuations as bearish sentiment in the U.S. stock market abates.

Market valuations of financial services stocks have also fallen over the past year as investors have had little interest in U.S.-listed stocks and other riskier assets.

As a result of the above, there could be many investment opportunities among financial services stocks today, and one of them is Encore Capital Group, Inc. (NASDAQ:ECPG). This stock has amazing upside potential that may not be reflected in the current market valuation.

Because of the nature of Encore Capital Group, Inc.’s business, the Federal Reserve’s next decision on the interest rate, which is quite a hot topic in the financial press these days, and the impact of its transmission on the economy, will be the catalyst for this company.

Encore Capital Group, Inc. in the Financial Services Sector

Headquartered in San Diego, California, Encore Capital Group is an international specialty finance company. That is, Encore Capital Group collects consumer debt and provides related services that span a wide range of financial assets.

Encore Capital Group purchases portfolios of consumer receivables from major banks around the world, as well as from credit unions and utility companies.

Encore Capital Group helps consumers pay off their debts. The company offers these troubled consumers a guide to financial recovery, helping them transition from a bad borrower state to a consumer with healthy economic conditions.

The Context of Record Inflation

It’s been about a year since the U.S. Federal Reserve [the Fed] began raising interest rates on federal deposits and sending signals of recession to the economy in an attempt to ease high inflation, which stood at 7.7% in October.

Current high inflation, a level not seen in 40 years, coupled with expensive utility bills, fueled by speculation in commodity markets following Russia’s aggression against Ukraine, are bringing household finances to their knees. This limits not only their purchasing power but also their creditworthiness to repay the debt they took on to finance consumption.

It’s difficult to quantify the risk, but based on the factors just mentioned, the likelihood of a U.S. consumer defaulting is certainly higher today than it was a few months ago, fueling demand for debt collection services.

This becomes an exceptional opportunity for Encore Capital Group, Inc., which specializes in debt collection solutions.

As a result, the third quarter of 2022, whose performance was still hampered by the fallout from lower defaults from consumers purchased in recent quarters, is showing signs of a strong recovery as the company encounters increasingly favorable momentum in the collections industry.

While collections and revenues, respectively, declined 19% YoY to $458.3 million and 25% YoY to $307.8 million in the third quarter of 2022, the value of the portfolio of defaulted receivables increased 38% to $232.7 million.

Purchases of defaulted receivables in the third quarter of 2022, with the global portfolio hitting its highest level since the fourth quarter of 2019, were driven by strong 73% year-on-year growth in the U.S. In Europe, on the back of a weaker British pound and Euro currencies, purchases fell by 15%.

It must be said that without the effect of the stronger U.S. dollar compared to the European currencies, the value of the European portfolio would have remained at approximately the previous year’s level.

The prospect of higher yields on U.S. loans has fueled market demand for U.S. dollars, causing the American currency to appreciate against other currencies.

However, it shouldn’t be long before the British pound and Euro rebound against the U.S. dollar, positively impacting the non-U.S. portion of the portfolio, which accounts for 24% of Encore Capital Group’s total portfolio purchases. This is because the U.S. Fed is expected to slow down the pace at which it has been raising interest rates.

On Wednesday, November 30, U.S. Fed Board Chairman Jerome Powell, speaking at the Brookings Institution, said the hawkish stance of higher interest rates could be toned down at the next meeting in December. This is because policymakers are beginning to anticipate the approach to cautious consumption levels, which, once reached, should help bring inflation growth back to its normal rate of 2% per year.

The Context of Rising Interest Rates

At its last meeting in November 2022, the U.S. Fed raised interest rates for the sixth time this year, sending borrowing costs to a new 14-year high.

Pressured by the rising cost of money combined with record inflation, an impressive amount of consumer credit could potentially house many more defaulting consumers than in the past, fueling demand for Encore Capital Group.

As an indication of the current consumer debt burden, credit card debt in the United States piled up to a whopping $0.93 trillion in the third quarter of 2022. This level is much higher compared to $0.89 trillion in the prior quarter of 2022 and doubled the record $0.93 trillion in the fourth quarter of 2019. Also, the current level of U.S. credit cards with debt balance is well above the 20-year average of $0.76 trillion.

More Hawkish from the US Fed for the Good of Encore Capital Group

The rapid increase in the prices of goods and services is still a long way from the Federal Reserve’s twin goals of price stability and healthy employment levels. Thus, rates will continue to be hiked. Also, it seems that the final rate [or ‘terminal rate’] that will result from the hawkish stance has been revised upwards from ≈ 4.6% in the September forecasts. Currently, the interest rate range is 3.75% to 4% for interest on federal funds.

In terms of the stock market, the shares of banks should benefit as the spread between interest rates on loans and deposits widens. But the market will also welcome Encore Capital Group’s application of a higher discount rate when purchasing defaulted consumer debt.

Therefore, Encore Capital Group’s profitability and financial health are on track to improve due to the acquisition of cheaper defaulted consumer receivables and the other factors described above.

Shareholders should thus see progressive improvement in the following two financial indicators: the before-tax ROIC, which declined slightly year-over-year by 10 basis points to 15.1%, and the leverage ratio, which rose 0.3 times year-on-year to 2.1 times in the third quarter of 2022.

The Bearish Sentiment in the Financial Services Sector Combined with the Bright Prospects for Encore Capital Group Make the Stock Look Cheap

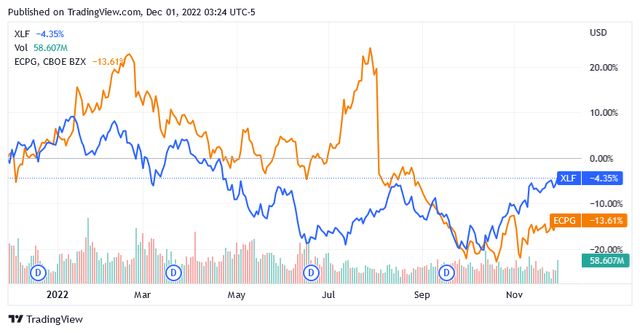

As shown in the chart below, banks and other financial services firms are down more than 4% over the past year, according to the performance of the Financial Select Sector SPDR Fund (XLF), a proxy index for the financial services sector.

Source: Seeking Alpha

The financial services stocks were hit by the same bearish sentiment that gripped the stock market across sectors, driven by headwinds from the war in Ukraine that sparked the energy crisis as well as other geopolitical tensions around the world. Additionally, during the energy crisis, shares of multinational energy companies soared as their profits were boosted by the astounding rise in fossil fuel and electricity prices, diverting investors’ interest from almost everything else, including financial stocks.

The above chart also shows a 13.61% fall in Encore Capital Group, Inc.’s stock price this year, likely allowing the stock to trade cheaply compared to the rosy outlook.

Encore Capital Group shares are trading at $50.56 as of this writing, giving it a market cap of $1.16 billion and a 52-week range of $44.06 to $72.73.

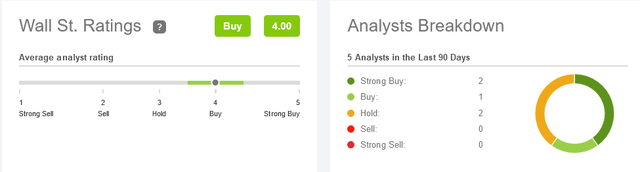

Source: Seeking Alpha

Shares are in the lower half of the 52-week range and well below the long-term trend of the 200-day simple moving average line of $57.24.

Also, the stock has a [FWD] P/E Non-GAAP of 4.45 versus the sector median of 10.45 and a [FWD] Price / Sales of 0.79 versus the sector median of 2.91.

As a result, market valuations of this stock are lower than they have been in the recent past and compared to most of its peers.

On Wall Street, the stock has a buy median rating made up of 2 strong buys, 1 buy, and 2 hold ratings.

Source: Seeking Alpha

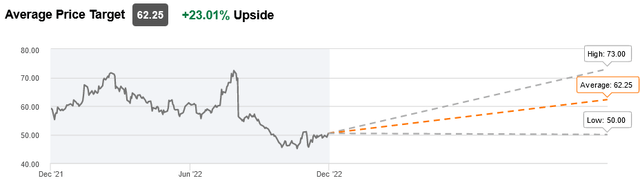

Analysts have also issued price targets averaging $62.25 per share, reflecting growth of 23.01% since this writing.

Source: Seeking Alpha

There is a risk that an investment in the Encore Capital Group will not bring the expected return, as the environment is very competitive.

However, if the economy soon slides into a negative cycle of a significant slowdown or a worse recession, conditions will be such as encouraging the accumulation of defaulted consumer receivables.

Therefore, a downside scenario for these price levels is possible as nothing can be ruled out, but this risk is small.

Conclusion

Rapidly rising inflation, which has yet to be addressed, combined with tighter monetary policy, poses the risk of a significant economic slowdown and, worse, a recession.

This economic cycle will affect consumers, but this segment of society has already built up huge debts on its credit cards, raising fears of more consumer credit defaults than anticipated a few months ago.

The debt collection solutions industry is highly competitive, but there are still great opportunities for Encore Capital Group, Inc.