Michael Derrer Fuchs

By a show of hands, how many of you would have bet around this time last year that International Business Machines Corporation (NYSE:IBM) would outperform the likes of Amazon.com, Inc. (AMZN) and Meta Platforms, Inc. (META) by more than 50% in 2022? Okay, the two of you in the last row, please put your hands down.

I wrote this article on IBM a couple of months ago recommending investors buy in the $120s. Since then, the stock has returned almost 18%. Let’s find out how things look for IBM stock as we head into 2023.

28th Dividend Increase Expected

IBM is a reputed name in the dividend growth community, as the company has increased its quarterly dividend for 27 consecutive years.

- If history is an indicator, IBM is very likely to announce its 28th increase in April 2023.

- As I covered in this article, IBM’s overall free cash flow level supports not just the current dividend but also has sufficient breathing room for a small increase.

- Investors may be better served by erroring on the side of caution as IBM’s annual dividend growth rate has averaged just 3% over the last five years.

- Assuming a 3% increase, the new quarterly dividend will be around $1.70/share, which places the annual yield at 4.65%.

- With a forward EPS of $9, the payout ratio for the new dividend will around 75%, which once again supports the expectation of low dividend growth.

While the dividend growth rate may not attract many investors, IBM’s commitment to investors is underlined by the statement below in their recent Q3 earnings:

“Our portfolio mix, business fundamentals, strong recurring revenue stream and solid cash generation allow us to invest for continued growth and return value to shareholders through dividends.“

Fundamentally Sound

IBM, as a business, appears fundamentally sound as we head into 2023.

- When you think of Cloud, IBM (justifiably) flies under the radar. However, IBM’s cloud revenue grew by 19% in the recent quarter. IBM’s hybrid Cloud strategy is hailed as being the front-runner in what is expected to become the future of Cloud solutions.

- Hybrid Cloud, by leveraging the benefits of both Private and Public Cloud, is expected to grow to $145 Billion by 2026 and this justifies the company’s ongoing investment in this category. In hindsight, the Red Hat acquisition is now making more sense. As covered in this Seeking Alpha article, Red Hat is expected to increase IBM’s Total Addressable Market (“TAM”) by leveraging existing Red Hat customer base.

IBM Hybrid Cloud (IBM.Com)

- Software revenue, in general, has held ground despite macroeconomic issues as reported here by Seeking Alpha. This may appear contradictory on the surface as we see many high-flying software stocks getting slaughtered but mature players like IBM have many factors in their favor including product stickiness, deeper pockets, and reputation.

Technical Indicators

IBM is one of those rare stocks in the market that has positive returns in almost any time interval this year, including 1-Month, 6-Month, and 12-Month time frames.

IBM YTD Chart (Seekingalpha.com)

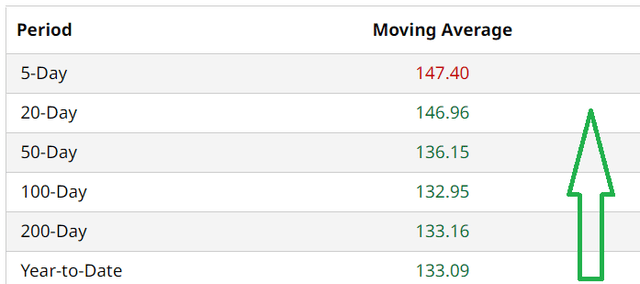

Hence, it is not surprising that the stock performs well in the moving average test as well in the Relative Strength Index (“RSI”) category. The stock sits at a comfortable 10% above the all important 200-Day moving average and is only a hair below the 5-Day moving average. With a RSI of 56, IBM has enough room to the upside and the chart does not show any weakness in the short-term or medium term indicators, with only one “Sell” indicator in the long term section.

IBM Moving Averages (Barchart.com)

Valuation and Price Target

With a forward multiple of 16 and an expected annual earnings growth rate of 9%, IBM stock appears fully valued here. For now, the $120s region still remains my recommended range to add the stock as that would represent a PEG of around 1.40 and a dividend yield well above 5%.

Although analyst price targets need to be taken with a pinch of salt, a median price target of $140 does not bode for those looking at buying here. Even the highest price target of $165 represents only about a 10% upside and that does not offer much downside protection in a market looking for excuses to sell off.

Conclusion

IBM investors will be hoping CEO Arvind Krishna has the Satya Nadella touch in sparking a turnaround. He was credited with the Red Hat acquisition, even before he took over the reigns officially. IBM will not keep me awake at night as my position in, say, Tesla (TSLA) does at times. This also means the flip-side is true, that IBM may not provide me with the same accelerated returns as some of the more riskier names. And that is perfectly fine with me.

I know why I hold IBM as we head into 2023: a reasonably valued technology stock that not only pays a respectable dividend but also is positioning itself for a turnaround. That makes IBM a Hybrid stock, keeping in sync with its Hybrid Cloud strategy.