Ian Tuttle

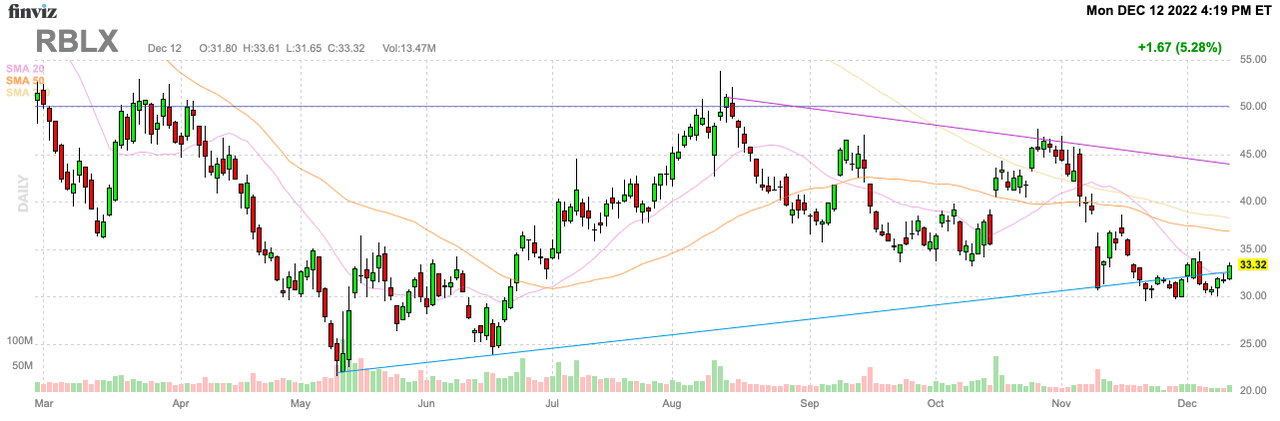

For a couple of years now, Roblox (NYSE:RBLX) has simply been a story of when the company would cross the threshold where a higher user base would finally top the strong spending during initial covid lockdowns. The global gaming platform has reached that point with both Q3’22 and October bookings back to growth mode. My investment thesis remains Bullish on the stock as the company rolls into easy comps in 2023.

Source: FINVIZ.com

Growth Machine

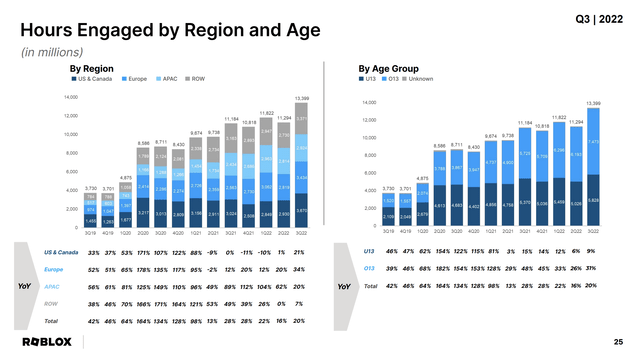

If Roblox was purely valued based on the Hours Engaged metric on the gaming platform, the stock would trade at record highs. The Q3’22 Hours Engaged were a record 13,399 million, up an impressive 20% from prior year levels.

Roblox Q3’22 presentation

Roblox hadn’t even topped 12,000 million hours of engagement in any prior quarter. The company only had a mere 4,875 million back in Q2’20 before the major covid boost nearly doubled hours in the first quarter following lockdowns.

The future metaverse platform has done an impressive job of tripling engagement in the last couple of years. Despite this impressive improvement in engagement, the stock is actually below the initial IPO price.

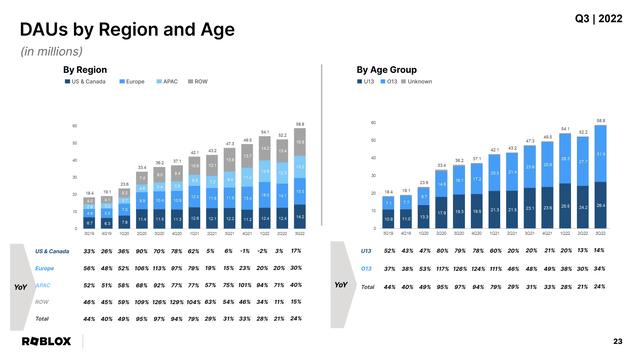

The only real problem facing Roblox is that all users aren’t equal. The amount of users outside the US has exploded while domestic users stalled until recently.

Roblox Q3’22 presentation

As with other social media and gaming companies, user monetization levels are highly skewed to the US & Canada followed by Europe with limited revenue generated by users in Asia and ROW. Roblox follows this general trend, though the company doesn’t explicitly call out the bookings metrics by region.

Domestic DAUs plateaued at 11.4 million in Q2’20, but the Hours Engaged peaked at 3,217 million in that quarter. Roblox faced a scenario where the US & Canada users with only 2,930 million hours of engagement in Q2’20 and didn’t top the metric until Q3’22 at 3,670 million.

Since these users are more valuable and were spending less time on the platform, the bookings totals struggled. Ultimately though, Roblox has momentum in the key domestic sector with the added boost of APAC and ROW users that have tripled in the last 2 years.

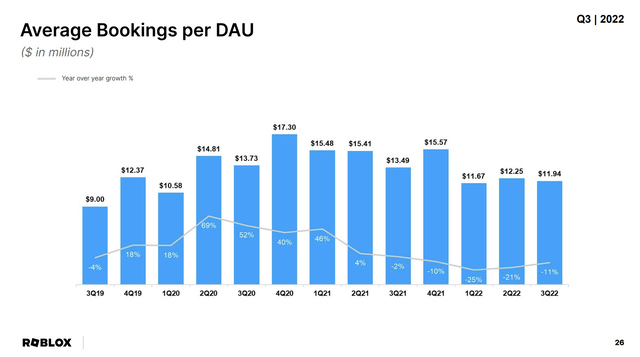

Possibly the worse metric for Roblox investors to focus on is the average bookings per DAU. The company clearly obtains more revenue by adding APAC and ROW users, but it causes this metric to skew negative YoY. Since the start of 2022, at least the ABPDAU is actually flat to up at around $12 per quarter.

Roblox Q3’22 presentation

Ads To The Rescue

The company now is working on unleashing the ad potential of the business. On the Q3’22 earnings call, CEO David Baszucki highlighted the plans for a self-serve platform for immersive advertising:

Riffing on immersive advertising and the opportunity. One of the things we’ve always done at Roblox is built, you can call it UGC or self-serve and that is build platform and products that everyone can use and that treat all of our developers as well as all of our partners equivalent. That is the target for next year, hopefully, in the first part of next year to get this rolled out for everyone without a specific ship date. That said, we are testing right now. So we are testing our immersive advertising technology right now with some brands and with some of our developers. So testing now. Next year, self-serve for everyone.

Roblox believes they can measure immersive ad consumption unlike the real world where billboard or linear TV views aren’t necessarily measurable. These metrics will help brand advertisers spend more on Roblox in the future and also sell digital goods on the platform.

Over time, the company has the potential to sell goods directly from items viewed within games to open up a true immersive commerce experience. In addition, Roblox plans to figure out ways to measure how much gamers immersed in digital brands actually visit the physical stores and purchase gear such as shoes for those visiting the Vans World on Roblox.

Netflix (NFLX) is a notable example of a company pushing into advertising that previously avoided the option. The CEO actually regrets not getting into connected TV advertising sooner in an example of the potential for Roblox shifting towards utilizing the ad model.

Netflix is forecast to generate $1 billion in immediate ad revenues with the potential of reaching $2.7 billion by 2025. While the video streaming company is exchanging ad revenues for additional subscriptions at lower levels, Roblox has a plan to enhance the purchase of digital goods with immersive ads to expand the revenue base versus an alternative plan to attract subscribers.

Roblox doesn’t even need the ad revenues to grow bookings and revenues in the short term. The stock is now appealing again down at $33 trading at ~6x forward sales targets with a $2 billion net cash balance. Coupa Software (COUP) was just acquired for ~8x forward revenues in a sign of the relative valuation in Roblox here.

Takeaway

The key investor takeaway is that Roblox is back in growth mode. The market has learned that all users aren’t equal and the market extrapolated too much on short-term bookings dips.

The stock is appealing here at $33, but Roblox would definitely become very attractive on a dip back into the $20s.