marchmeena29

Overview

Fannie Mae (OTCQB:FNMA) is a government-sponsored mortgage financer. First founded in 1938, the company was incepted with the mission that it continues with to this day: providing liquidity to the mortgage market in the United States. Along with Freddie Mac, it is one of the largest (if not the single largest) purchaser of mortgages in the United States.

Fannie Mae doesn’t originate loans itself. That is, it doesn’t operate in the primary market for mortgages in the way that a bank does. Instead, it purchases mortgages that already exist and keeps them on its balance sheet – pocketing income along the way. Additionally, the firm securitizes mortgages on its balance sheet and resells them.

History

Fannie Mae gained a much higher profile in the wake of the 2007/2008 financial crisis, when it was brought back under the conservatorship of the Federal Government. Uncle Sam took on its balance sheet in order to keep it functioning.

This was actually the original arrangement that the company operated under. From 1938 to 1968, Fannie Mae was a de facto part of the US Government; its balance sheet was part of the Treasury. With the fiscal pressures of the Vietnam War mounting in the late 1960’s, however, Fannie Mae was spun out and converted to a publicly traded entity. This involved transferring all the assets on its books. Henceforth, it would now raise capital through the public equity and bond markets and was to be owned by private shareholders. Freddie Mac was created around this time as a near-identical entity, although we will focus on Fannie Mae for this article.

This situation reverted in the 2007 mortgage crisis, and the government had to step in in order to keep Fannie Mae solvent and to keep the housing market itself from undergoing total collapse. Fannie Mae’s balance sheet was now back in government hands – albeit with a slightly different structure. The company was now brought into the formal conservatorship of the US Government, namely the Federal Housing Finance Agency.

Valuation & Investment Considerations

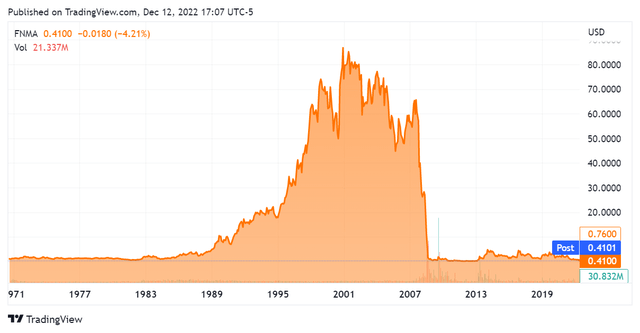

This conservatorship event changed the company’s capital structure, with the security delisting from NYSE roughly 3 years after (Q2 2010). It has since continued to trade on over-the-counter market, depreciating significantly. As of this article it is trading at $0.41 – a steep drop indeed from its historic highs.

SeekingAlpha.com FNMA 12.12.22

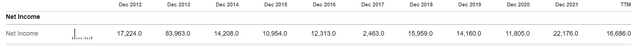

The fundamental picture of Fannie Mae has evolved significantly since it was first brought into conservatorship. The company became profitable again in 2012, and repaid its debts in full by mid-2014. Since then it has acted as a profitable enterprise that feeds into the books of the US Treasury. It also maintains a capital backstop courtesy of the Treasury, structured in the form of preferred notes (short term credit instruments) that act to guarantee the company’s liquidity & solvency.

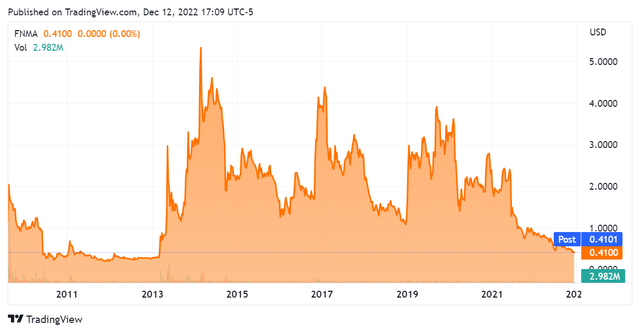

The company’s valuation fluctuated significantly during the post-crisis period. While never reaching the double digits or anywhere near the valuation that it had in late 2007, it has traded as high as $5.33 and has spent plenty of time at a multiple of its present valuation. This predominantly occurred in the $1-4 range.

SeekingAlpha.com FNMA 12.12.22

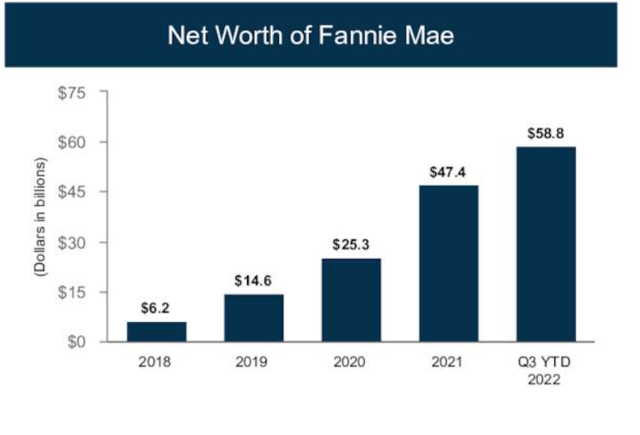

The stock’s price would imply that its financial condition has continued to deteriorate, although we see that this isn’t the case. In fact, the company’s net worth has continued to improve:

SeekingAlpha.com FNMA Q3 2022 Investor Presentation 12.12.22

Along with this, Fannie Mae’s net income has remained positive – and quite significant – for the last decade:

SeekingAlpha.com FNMA Q3 2022 12.12.22

These numbers are all we need to tell us that this entity is significantly more valuable than its market valuation implies. At its current market capitalization of $2.35B, this entity trades at around 10% of the net income it generated in the fiscal year 2021 – extremely cheap by any measure.

This price is actually sensible, however, and is due to the fact that Fannie Mae does not return capital to shareholders but rather to the government. Owing to its ongoing conservatorship status, it is obviously a completely different investment than a comparable fully-private entity. An ownership stake in this company is simply not the same.

Yet, the price chart shows us that significant appreciation is still possible. Ultimately this is a highly secure enterprise; it is too-important-to-fail. Fannie Mae isn’t going anywhere. The investment case here is then centered around an eventual reprivatization event.

This is a clear-cut event-driven trade. The government may take Fannie Mae out of conservatorship and return it to the private markets, and this would allow it to start returning profits to shareholders.

This is possible due to the fact that Fannie Mae’s current capital structure is far superior to what it was prior to the financial crisis, as evidenced by its own reporting and a cursory look at its financials. Additionally, Sandra Thompson, the acting director of the Federal Housing Finance Agency, has made this eventual goal explicit.

This comes with strings attached. Fannie and Freddie need to have a combined $300B in capital reserves – a very significant number, but one that they are approaching in a steady fashion. As of Q2 2021, the entities combined had ~27% of this requirement. Recent progression in Fannie Mae’s net worth, highlighted above, should have brought this to 30% or so. More important is that this trend continues and eventually reaches this level.

This situation on a going-forward basis is made complex by the currently increasing Federal Funds rate. What is interesting about Fannie Mae is that an increase in rates equates to a linear shift in its earnings for the adjustable rate mortgages on its books. A 1% increase in its cost of capital should be roughly equal to a 1% increase in its earnings from adjustable rate mortgages. This effect is a negative when we consider fixed rate mortgages; Fannie Mae will face a higher cost of capital without an associated higher level of return. Overall this should serve to increase the amount of time that it will take the company to hit the required levels of capitalization.

Conclusion

While Fannie Mae’s reprivatization doesn’t appear to be in the cards for the short-term, it may very well still happen. Recent regulatory clarification and the associated discourse around this make me inclined to believe this, although timing is very difficult to calculate in this context. Anywhere from two to ten years is quite possible here.

Yet, Fannie Mae at present levels is extraordinarily cheap, trading at just a fraction of its yearly net income. Additionally, its trendline as to increasing net worth is certainly a healthy one. This, along with the government’s ongoing liquidity commitments, appears to provide a very secure operating environment for the company – as mentioned before, it isn’t going anywhere. This limits downside materially and basically guarantees ongoing operations.

This should give long-term investors comfort and also appears to create an asymmetric return profile. Since the company trades at near-bankruptcy prices, but is certainly not going to go bankrupt, we can acquire exposure on the cheap and then profit significantly in the event that Fannie Mae is returned to the private markets. This is based on the assumption that the company’s valuation will revert to something indicative of its underlying financials if this were to happen – which is a sensible assumption in my opinion. On a long-term basis, with all of these considerations in play, Fannie Mae looks like a buy.