piranka

As the US government works to increase countrywide connectivity, companies providing the infrastructure are hitting the jackpot. Bel Fuse Inc. (NASDAQ:BELFB) (NASDAQ:BELFA), a small-cap stock of $431.34 million which produces electrical products for a diverse range of sectors, is one such company. Since the start of the year, it has had colossal momentum, quietly delivering generous returns of 122.95% to its investors.

Stock trend year to date (SeekingAlpha.com)

Clearfield Inc. (CLFD) and Richardson Electronics, Ltd. (RELL) are two 5G-focused peers that have experienced similar upward trends in stock value against the backdrop of a poorly performing technology industry. BELFB holds many values because of its low price-to-earnings ratio of 9.1 and upward trending stock price. With severe momentum and the share price still well under the analyst year target of $44.50, I believe there is still much upside ahead for this stock, especially if it continues to focus on its network and cloud sector, tapping into a 5G infrastructure industry that is on its way to being worth $167 billion by 2030. Therefore investors may take a bullish stance on this stock.

Overview

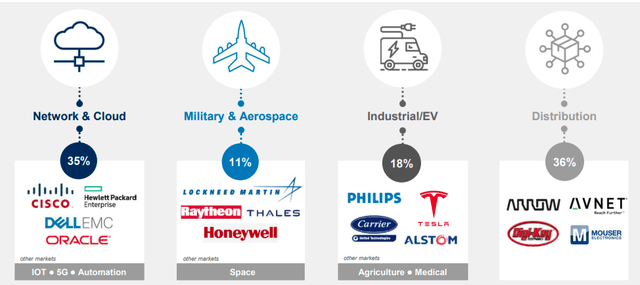

BELFB is a well-established electric component company founded in 1949 in New Jersey. It is a designer, manufacturer and marketer of a wide range of products related to powering, protecting and connecting in various sectors seen in the image below.

Customer Segments (Investor Presentation 2022)

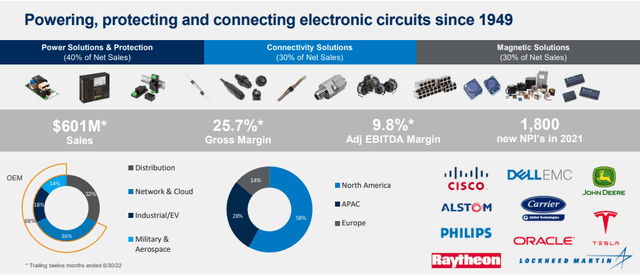

It operates across three main segments: the Power Solution & Protection, which accounts for most of its revenue and includes circuit protection, power and module products. Secondly, Connectivity Solutions includes various connectors and cables; thirdly, Magnet Solutions includes connectors, transformers, inductors and other components.

Company at a Glance (Investor presentation 2022)

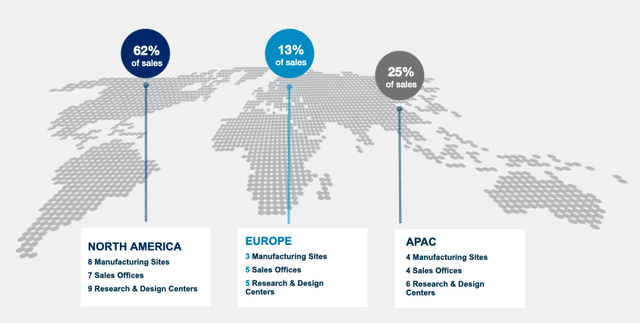

It is a global company with operations and sales across many geographies, although most of its sales derive from its North American market. BELFB has acquired sixteen companies, four of them in the last five years. ABB Power One Solutions’ largest acquisition was $117 million in 2014. In 2021 it acquired EOS in India for $7 million, a power supply manufacturer. These acquisitions have played an ongoing role in the company’s achieving ongoing revenue growth.

Global Presence (Investor Presentation 2022)

Financials and Valuation

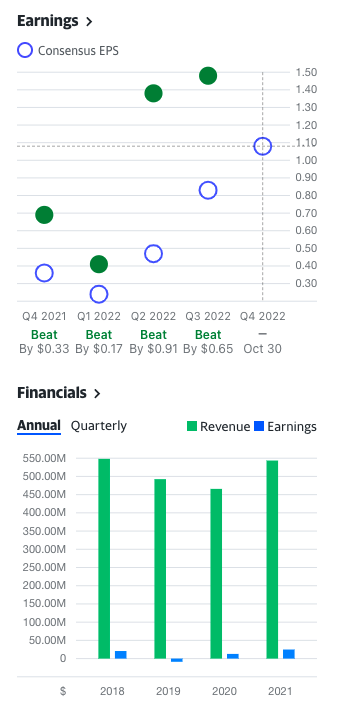

While most tech stocks have had a terrible year, BELFB has done nothing but thrive. Revenue, adjusted EBITDA and backlog were the highest the company has seen in seven years. Over the last four years, the company has improved its top and bottom-line performance. Furthermore, it has beaten EPS expectations in the previous four consecutive quarters and is on its way to a robust financial year finish.

Financial Overview (Finance.Yahoo.com)

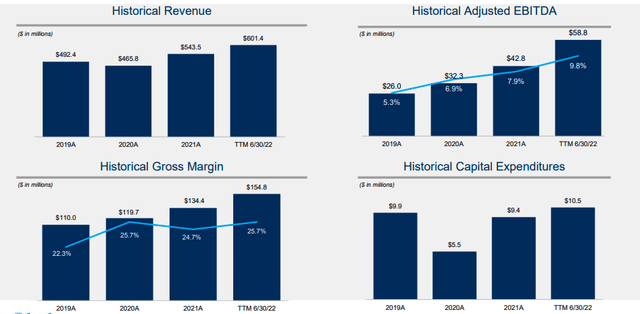

If we look at the company’s historical financial performance, we see a positive upward trend in revenue, adjusted EBITDA and better margins.

Historical Performance (Investor Presentation)

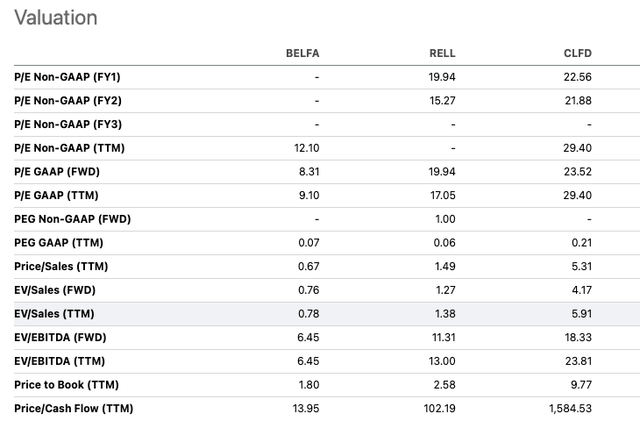

BELFB falls under Zacks Rankings Computer and Technology sector. The company outperforms its technology peers and other prominent 5g players, CLFD and RELL. While BELFB has provided returns of 122.95% since the start of the year, fellow computer and technology stocks have lost an average of 32.9% in value. Suppose we look at fellow 5G-orientated peers RELL and CLFD, although it is essential to note that all three of these companies have been thriving this year. If we look at BELFA’s relative valuation, it is hugely attractive. It has a low price-to-earnings ratio of 9.10. It also has an attractively low price-to-sales ratio of 0.67, indicating that investors are getting more than what they are paying.

Peer Valuation (SeekingAlpha.com)

Risks

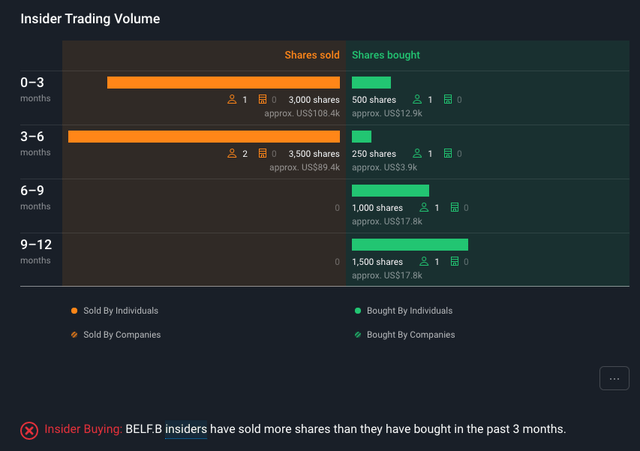

Although the company has not been hugely impacted by the economic slowdown, increase in interest rates and inflation of this year, a significant recession could still affect its future performance and current growth trend. Furthermore, if we look at insider trading over the last few months, we can see that more shares have been sold than those bought. Ideally, we would like to see insiders buying into their company, however at the same time, due to the massive increase in stock value and the uncertainty of a recession that looms in 2023, this could be a perfect moment to cash in on stocks that are worth a lot more than they were one year prior. Another concern is that as a global player, it can be impacted by geopolitical factors, which could disrupt operations and affect the supply chain if we look at its manufacturing plants located in diverse locations worldwide, such as China.

Insider trading (simplywall.st)

Final thoughts

BELFB has improved its top and bottom-line performance for consecutive periods. This year amidst supply chain issues, recession, and worsening inflation, the company has delivered strong results across its diverse segments. Forward-looking, there is massive potential in its role in 5G connectivity within the US and globally. EPS is forecast to expand by 4.9% over the next year. If we look at its fellow 5G peers, there is still a lot of upside potential, and it is undervalued with a low price-to-earnings ratio. Therefore I recommend this stock as a buy.