Justin Sullivan

The Chart of the Day belongs to the packaged food company General Mills (GIS). I found the stock by using Barchart’s powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker first signaled a buy on 11/18, the stock gained 7.98%.

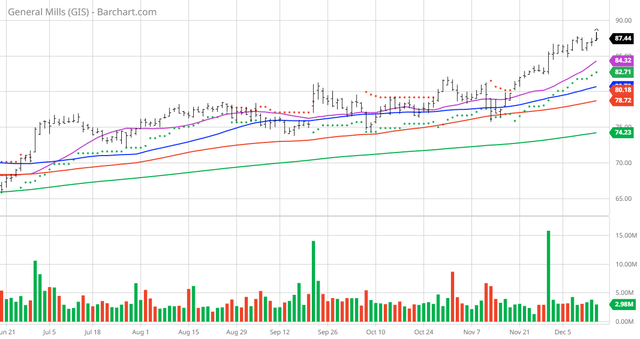

GIS Price vs 20, 50, 100 DMA

General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company operates in five segments: North America Retail, Convenience Stores & Foodservice, Europe & Australia, Asia & Latin America, and Pet. It offers ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and salty snacks, ice cream, nutrition bars, wellness beverages, and savory and grain snacks, as well as various organic products, including frozen and shelf-stable vegetables. It also supplies branded and unbranded food products to the North American foodservice and commercial baking industries; and manufactures and markets pet food products, including dog and cat food. The company markets its products under the Annie’s, Betty Crocker, Bisquick, Blue Buffalo, BLUE Basics, BLUE Freedom, Bugles, Cascadian Farm, Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Cookie Crisp, EPIC, Fiber One, Food Should Taste Good, Fruit by the Foot, Fruit Gushers, Fruit Roll-Ups, Gardetto’s, Go-Gurt, Gold Medal, Golden Grahams, Häagen-Dazs, Helpers, Jus-Rol, Kitano, Kix, Lärabar, Latina, Liberté, Lucky Charms, Muir Glen, Nature Valley, Oatmeal Crisp, Old El Paso, Oui, Pillsbury, Progresso, Raisin Nut Bran, Total, Totino’s, Trix, Wanchai Ferry, Wheaties, Wilderness, Yoki, and Yoplait trademarks. It sells its products directly, as well as through broker and distribution arrangements to grocery stores, mass merchandisers, membership stores, natural food chains, e-commerce retailers, commercial and noncommercial foodservice distributors and operators, restaurants, convenience stores, and pet specialty stores, as well as drug, dollar, and discount chains. The company operates 466 leased and 392 franchise ice cream parlors. General Mills, Inc. was founded in 1866 and is headquartered in Minneapolis, Minnesota.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can, therefore, change during the day as the market fluctuates. The indicator numbers shown below, therefore, may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 34.61+ Weighted Alpha

- 32.86% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 13 new highs and up 13.77% in the last month

- Relative Strength Index 68.50%

- Recently traded at $87.33 with 50-day moving average of $80.71

Fundamental Factors:

- Market Cap $52 billion

- P/E 21.39

- Dividend yield 2.48%

- Revenue expected to grow by 3.10% this year and another 2.30% next year

- Earnings estimated to increase 4.30% this year, an additional 6.10% next year and continue to compound again at an annual rate of 5.41% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock, it’s hard to make money swimming against the tide:

- Wall Street analysts have 0 buy and 15 hold and 3 underperform opinions in place on this stock

- Analysts have price targets from $63.00 to $90.00 with an average of $79.21 – which is under today’s close of $87.33

- The individual investors following the stock on Motley Fool voted 1.161 to 74 for the stock to beat the market, with more experienced investors voting 267 to 10 for the same result

- 69,760 investors are monitoring this stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Ranked Overall

Ranked in Sector

Ranked in Industry

Quant Ratings Beat The Market »

Dividend Grades

Dividend Grades Beat The Market »