Shidlovski/iStock via Getty Images

Introduction

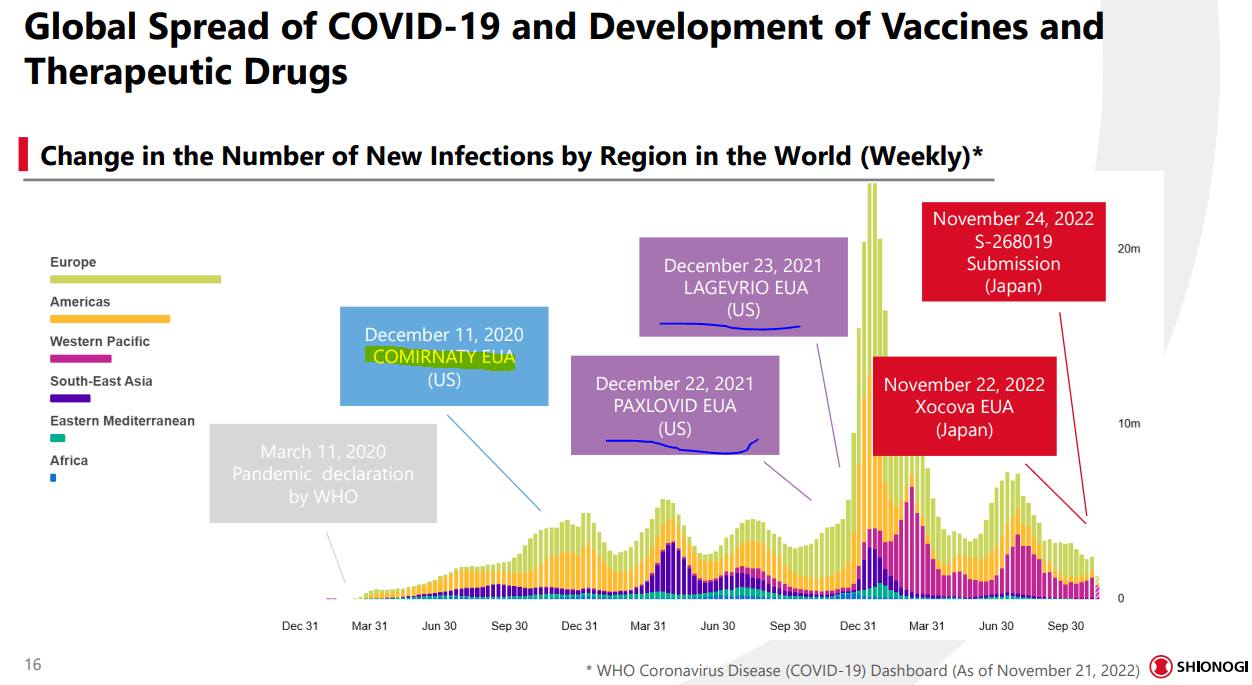

The battle of the vaccines is ending, but the battle of the targeted antivirals is just beginning in the global war against COVID-19. Of note, Pfizer’s (PFE) Paxlovid and Merck (MRK)/Ridgeback’s Lagevrio are two FDA approved therapies directly targeting COVID-19, rather than generalist antivirals such as Gilead’s (GILD) Veklury/remdesivir or AbbVie’s (ABBV) Norvir/riotnavir. However, the battle between the two companies remains profitable for both, despite the conflict, risks, and efficacy.

Over in Japan, mid-cap biopharma Shionogi (OTCPK:SGIOY) has been working on their own version of a COVID-19 antiviral, and the therapy shows promising efficacy particularly against omicron symptoms. However, the drug is only approved in Japan on an emergency basis (as of late November), but FDA approval is in the works. This article will compare the efficacy and opportunity present in all three therapies, along with suggesting investment outcomes.

Xocova Development

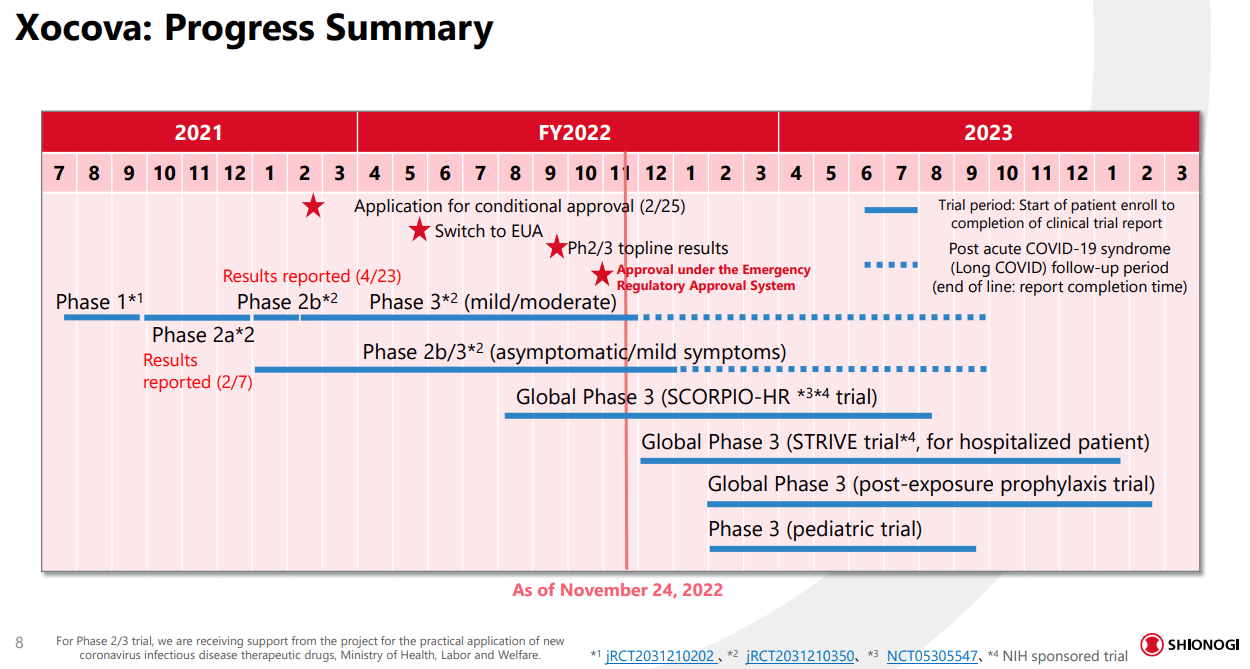

Xocova is a protease inhibitor, a therapy that prevents COVID viruses from replicating in the body. After a swift series of clinical trials starting in summer of 2021, the recent data from phase three trials that are underway has allowed Japanese regulators to allow emergency use authorization. Final trials considering long COVID, global populations, hospitalized/high-risk patients, and children are also set to conclude by the end of fiscal year 2023. As reported by Endpoints News:

The emergency approval, following a back-and-forth with regulators since last February, is based on a safety profile with more than 2,000 patients who have accessed the pill, and clinical symptomatic efficacy for five typical Omicron-related symptoms (primary endpoint) and antiviral efficacy (key secondary endpoint) in patients with mild to moderate SARS-CoV-2 infection, regardless of risk factors or vaccination status, and during the Omicron-dominant phase of the pandemic.

New data in September showed that when the pill was administered daily for five days, it led to a significant reduction in symptoms such as stuffy or runny nose, sore throat, cough, feeling hot or feverish, and low energy or tiredness within 72 hours of its onset, the company announced. A total of 1,821 mostly vaccinated patients from Japan, South Korea and Vietnam were enrolled in this study.

Shionogi R&D Investor Presentation

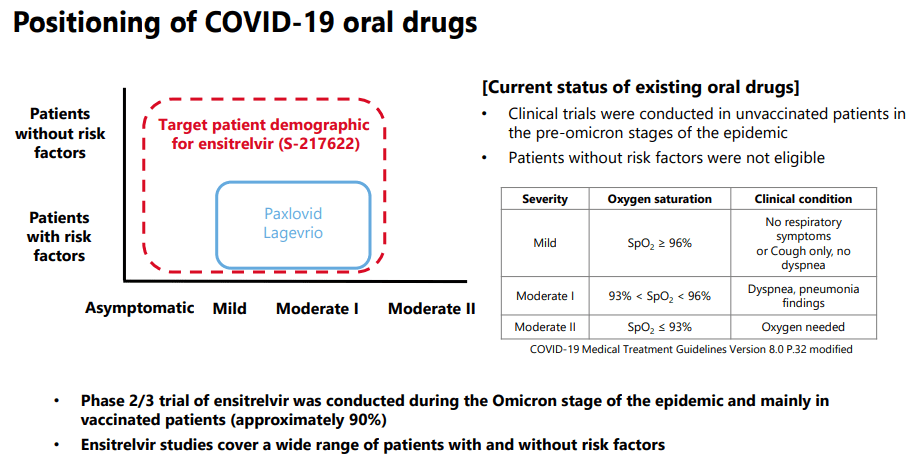

Let’s start to dive into the key clinical data that supports Xocova’s approval. First and foremost, Xocova has been clinically tested on a far wider patient population than the two competitor therapies. The trials also occurred during the omicron stage of the epidemic, and included vaccinated and high-risk patients, so the data is far more comprehensive than early data by Pfizer or Merck.

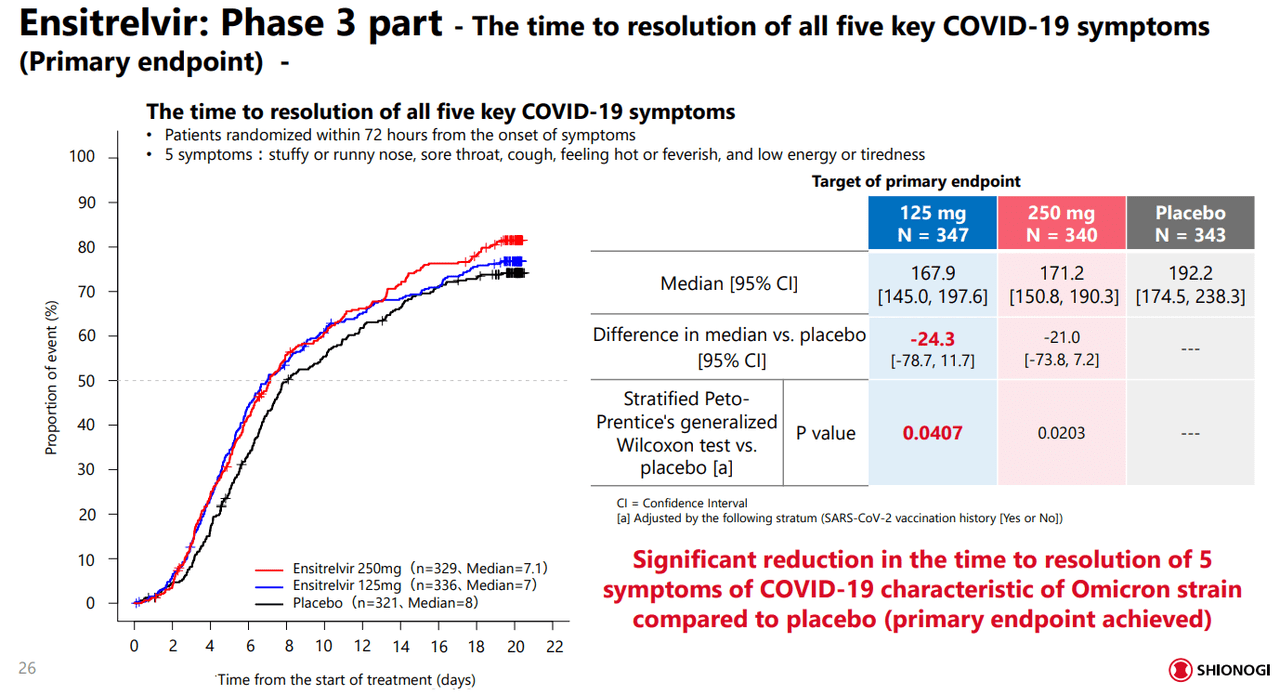

The primary endpoint for the trial was measuring a meaningful reduction in time to resolve the five primary COVID-19 symptoms of the period: stuffy or runny nose, sore throat, cough, feeling hot or feverish, and low energy or tiredness. This primary endpoint was met as the data, shown below, showed a significant reduction in symptoms compared to the placebo across both dosages.

Shionogi R&D Investor Presentation

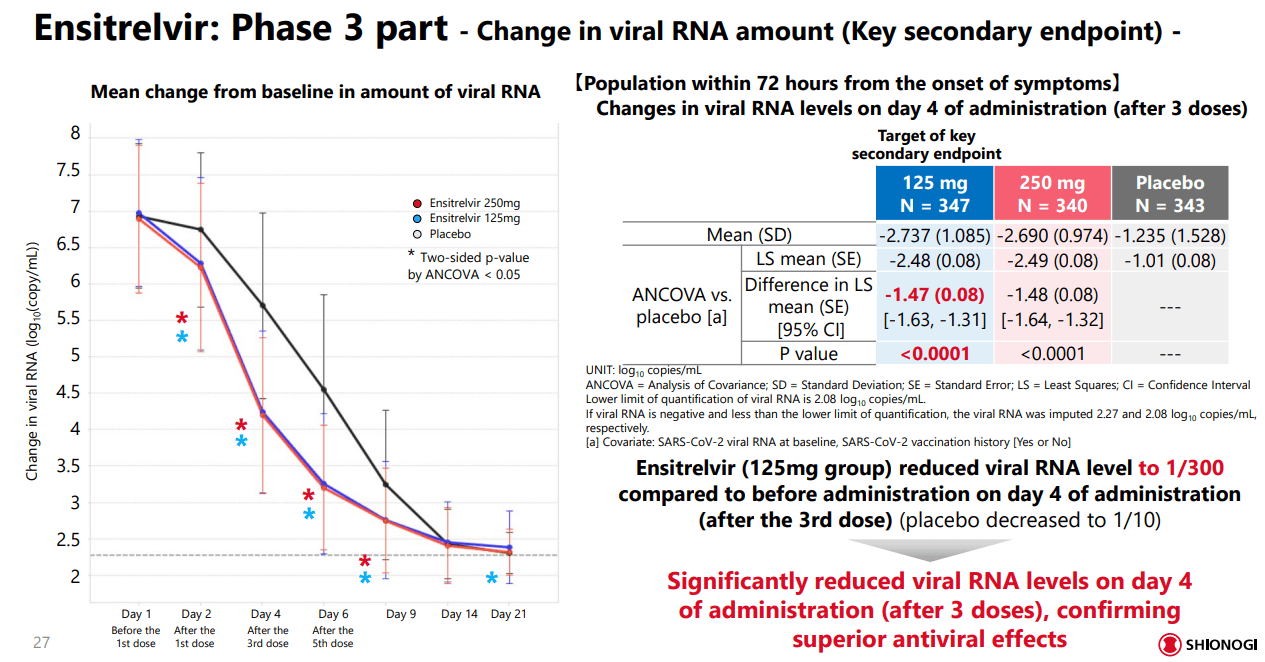

The study also had a secondary endpoint evaluating the change in viral RNA quantity, measured on days 1, 2, 5, 6, 9, 14, and 21. As with the primary endpoint, Xocova offered a significant reduction in viral RNA levels, even starting on day two when compared to the placebo. However, the maximum effect was measured on day four after three doses, with the lower 125mg dose group seeing just as much efficacy as the larger dose. There were also no serious adverse events or deaths, although there were some cases of changing fat levels in the body.

Shionogi R&D Investor Presentation

Pfizer and Merck Therapies

Pfizer’s Paxlovid is a dual-protease inhibitor therapy with many issues in terms of usage to consider. This is also the case with Merck’s similar Lagevrio (molnupiravir), although the mode of action of Lagevrio is to cause issues with replication due to changing the virus’ nucleotides. As I will discuss, the major issue is about whether the drugs even help at all, plus there is additional risk of making the pandemic worse! As per Science:

William Haseltine, a virologist formerly at Harvard University known for his work on HIV and the human genome project, suggests that by inducing viral mutations, molnupiravir could spur the rise of new viral variants more dangerous than today’s. ‘You are putting a drug into circulation that is a potent mutagen at a time when we are deeply concerned about new variants,’ says Haseltine, who outlined his concern Monday in a Forbes blog post. ‘I can’t imagine doing anything more dangerous.’

Beyond the mutagenesis speculation, widespread distribution and usage for both antivirals is restricted only to mild to moderate I level cases of the disease and in high-risk populations. If a therapy is not safe, the risks are increased. Even Pfizer’s therapy is under fire, as reported by Fierce Pharma and the Wall Street Journal:

According to a story this week in the Wall Street Journal, doctors in many countries are prescribing Lagevrio instead of Paxlovid because of safety concerns with the Pfizer pills.

‘Molnupiravir is a lot easier because it’s got a couple of minor restrictions, but it’s actually much, much, much less risk for contraindications,’ Australian Medical Association VP Chris Moy, told the WSJ.

Shionogi R&D Investor Presentation

There are also issues of efficacy in the drugs targeted towards high-risk groups. Due to the influence of risk, the data provided by the clinical trials has not shown significant efficacy for usage. As per results from Pfizer’s recent EPID-SR study of Paxlovid:

–In the EPIC-SR study of PAXLOVID™(nirmatrelvir [PF-07321332] tablets and ritonavir tablets), the novel primary endpoint of self-reported, sustained alleviation of all symptoms for four consecutive days was not met, as previously reported

–Pre-specified secondary endpoint resulted in a nominally significant 62% decrease in COVID-19-related medical visits per day across all patients, relative to placebo

–In a sub-group analysis, non-significant 57% reduction in hospitalizations and death observed in PAXLOVID-treated vaccinated patients with at least one risk factor for severe COVID-19

At the same time, management also states:

–Data from standard-risk patients, both vaccinated and unvaccinated, while not all statistically significant, are supportive of efficacy data observed in EPIC-HR study and will be included in upcoming NDA submission to U.S. FDA for high-risk patients.

I believe this highlights a mindset focused on rushing out a product for emergency use, similar to the vaccines. Now that there is a therapy, Xocova, that offers increased safety and effectiveness, I believe the FDA may be hesitant to fully approve the therapy. For Merck, the story sounds the same as recently reported:

— A preliminary analysis of the University of Oxford’s open label, prospective real-world evidence study, PANORAMIC, conducted in the UK in highly-vaccinated adults mostly <65 years of age, showed no evidence of a difference between LAGEVRIO added to usual care compared to usual care alone for the reduction of hospitalizations and deaths through Day 28 (primary endpoint was not met); the incidence of hospitalizations and death through Day 28 was very low overall (0.8% in both groups).

However, there were some good signs in older patients:

— An analysis of real-world data from a separate observational, retrospective study conducted by investigators in Israel (known as the Clalit study) showed that in a cohort of non-hospitalized, high-risk patients, LAGEVRIO reduced hospitalizations and mortality due to COVID-19 in patients 65 years and above; no evidence of benefit was found in younger adults ages 40 to 64 years.

Part of the issue for Merck and Pfizer is their relegation to only high-risk groups, and focus on reducing hospitalization and death. COVID is no longer as impactful as with the earlier stages of the pandemic, so a focus on symptom reduction like Shionogi is yet to come. Plus, Xocova has shown to be effective in younger and lower risk patients, with less adverse events, suggesting that Shionogi’s therapy has far wider application.

Already, we can see that Shionogi’s therapy is targeting a much larger available market, is far safer and effective, and if approved around the world, may outcompete Paxlovid and Lagevrio. However, despite the lack of efficacy, the money keeps pouring into the two healthcare giants and it is unknown whether Shionogi will be able to keep up.

Financial Implications

Despite the data showing no significant differences from placebos, Merck and Pfizer still have been able to reap tremendous reward from their therapies. As of the last earnings report, Merck has guided for full year sales of Lagevrio to reach $5.2 to $5.4 billion. Pfizer reported Paxlovid sales of over $7.5 billion just last quarter, and is due to reach $22 billion this year alone (over a third of sales). Partially due to group buys by governments for stockpiling, partially due to the need for treatments in high-risk groups suffering from the disease, it is clear that the financial implications are immense.

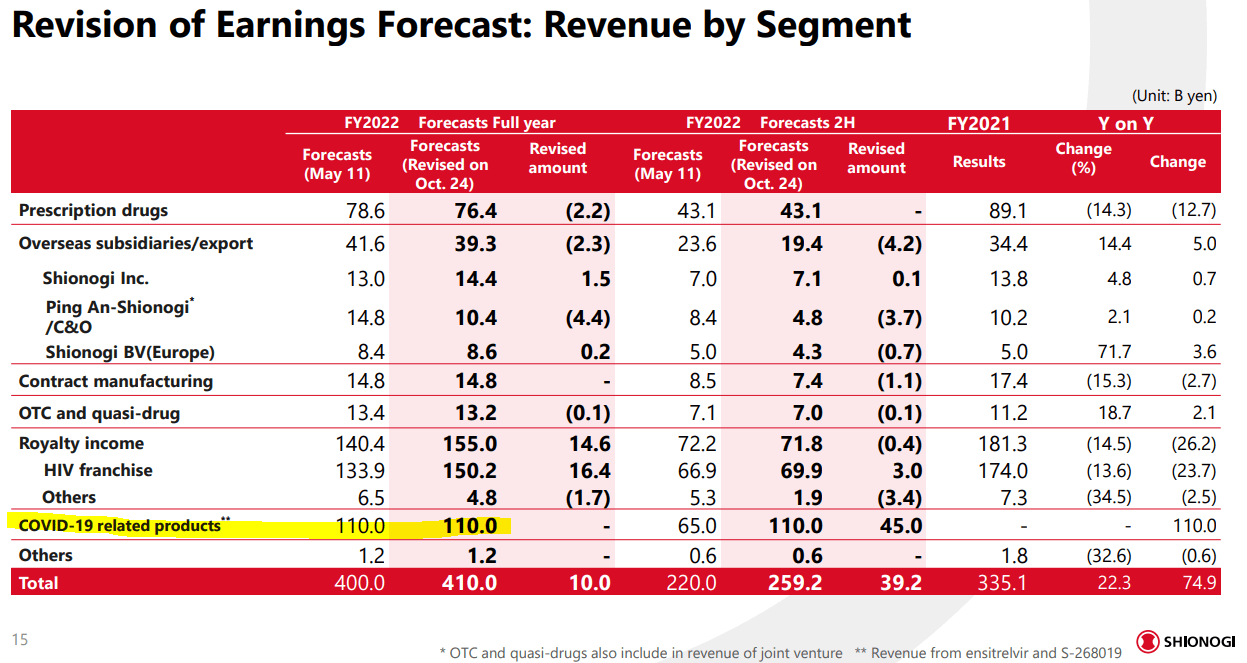

For Shionogi, early estimates are putting sales at over $2.5 billion as the Japanese government loads up on the therapy. However, much of the potential remains with global approval of the therapy and investors will not know the outcome for at least three or so quarters. As of last earnings, Shionogi is only guiding for about $3 billion in revenues for FY 2022, or 25% of total revenues for the year. Imagine the impact to this highly profitable and only $15 billion market cap company!

This does not mean the fruitful nature of COVID-19 antivirals will last. Both Merck and Pfizer are expecting slowdowns in sales of their therapies and they claim it is due to lack of need. However, I believe they have realized that Xocova may be the better choice in the years to come. Also, the future depends on the state of COVID-19 globally.

Shionogi Financial Investor Presentation

Distribution and Manufacture

Despite the high likelihood of high amounts of revenues coming in for Shionogi, there are some risks to consider. First is whether the company is able to handle the high levels of demand, and if manufacturing can scale appropriately. Thankfully, Xocova is a small molecule therapy, reducing the costs and risks to produce compared to a vaccine or other biologics.

To meet demand, Shionogi has partnered with intermediates provider Kaneka Corporation (OTCPK:KANKF) as the key raw material source. Shionogi also already has in place significant antiviral small molecule manufacture capability due to their work developing therapies for infectious diseases such as HIV and Influenza. Although, investors should consider a rise in capex as full demand is determined with time. I would also suggest investors should not expect Pfizer or Merck levels of revenues at the moment as scale is increased.

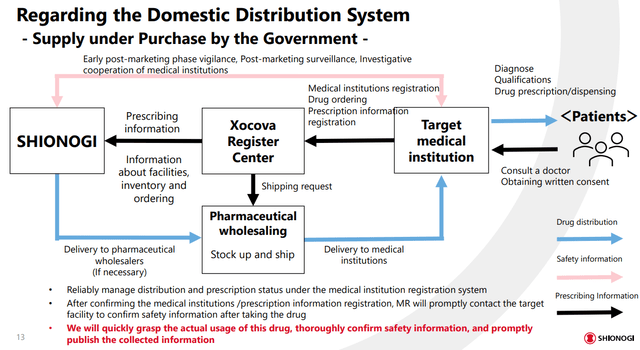

Other important areas of concern regard viable distribution networks, risk surveillance post-treatment, and demand insight for proper manufacturing loads. To offset the highly volatile nature of the pandemic, Shionogi has partnered with government entities, medical institutions, and pharma wholesalers in order to address all these risks at the same time. As an established biopharma with an extensive working history, I do not believe that there will be major issues following the initial stages of commercialization, despite the small market cap of the company.

Shionogi R&D Presentation

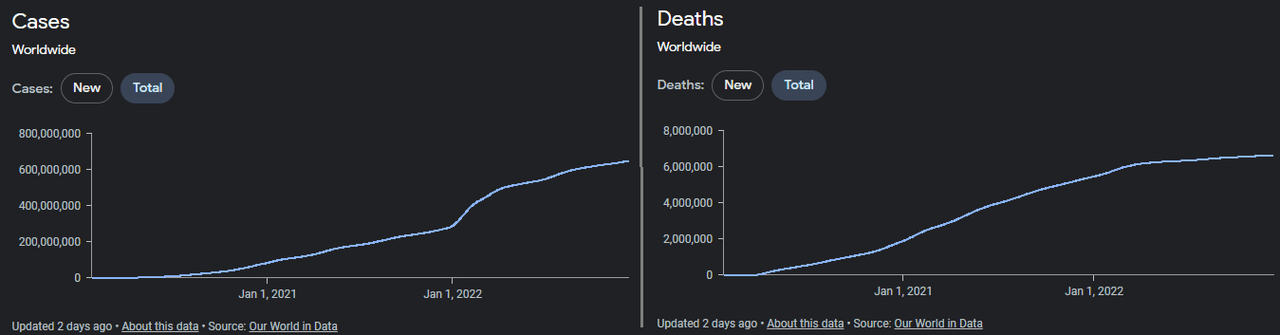

The Future of COVID

Despite vaccines being introduced way back in December 2020, COVID levels have been persistently high even until we are about to reach the third year of the pandemic. The disease has also shifted, with the numbers of cases rising higher than deaths. In particular, we are entering the winter with global cases trending upwards again (not just in China), colds and flus are already rebounding after a few years of suppression, and hospitals remain overloaded. Therefore, there is still an immense need for antiviral treatments that can keep folks out of the hospital. I expect Xocova to remain in demand for years to come.

Shionogi R&D Investor Presentation

Conclusion

The data seems to suggest that Shionogi will have a best-in-class antiviral therapy for use within five days of COVID symptoms appearing. Considering the less effective Pfizer and Merck therapies earn billions per year in revenues, I believe the opportunity for Shionogi is immense. However, there are issues with implementation including manufacturing and the wait for global approvals, so if you would like a detailed article on Shionogi, please let me know.

I would recommend performing due diligence in the coming weeks as both the Yen is strengthening compared to the USD, and further trials come out that support Xocova’s success. I believe that even a temporary influx of cash from the COVID therapy is beneficial for Shionogi, so the investment is worth consideration. Stay tuned for further updates.

Thanks for reading. Feel free to share your thoughts below.