AndrewJohnson

Applied Materials (NASDAQ:AMAT) detailed its “eBeam Technology and Product Launch” in a webcast on December 14, 2022. The company uses this theatrical approach to introduce new products, and I discussed last year’s launch in my March 17, 2021 Seeking Alpha article entitled “KLA Introduced 4 AI Metrology/Inspection Systems A Year Before Applied Materials.”

According to the bullets in that article:

- Applied Materials introduced its “major innovation” metrology/inspection system utilizing AI.

- However, KLA introduced four metrology/inspection systems utilizing AI a year ago.

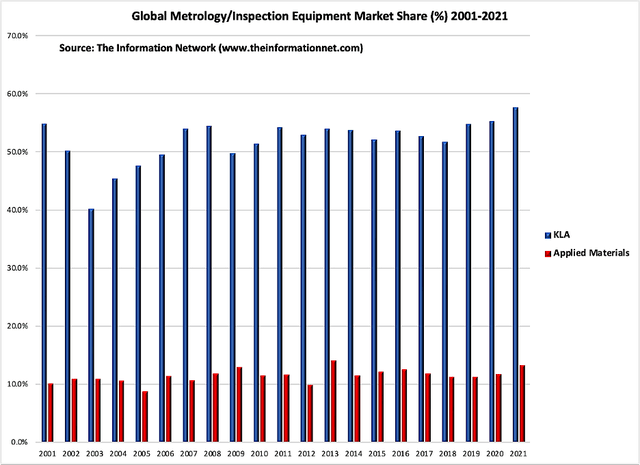

- KLA dominates, enjoying a 4.9X share value over Applied Materials in the global sector and a 4.6X share in the Optical Inspection segment.

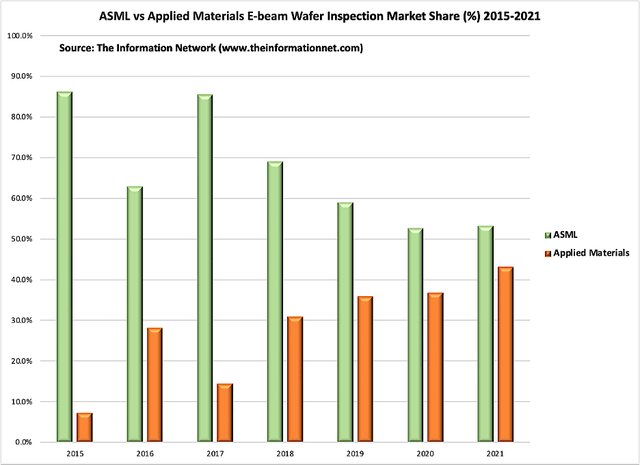

In other words, last year Applied Materials hyped its “new” technology, but neglected to point out that KLA (NASDAQ:KLAC) already had pre-empted AMAT with its “newer” technology. Importantly, AMAT neglected to point out that its “e-beam technology” is not gaining share against KLAC’s “optical technology.” Finally, in the E-beam Wafer inspection sector, AMAT neglected to say its market share is lower than ASML (ASML), and moved lower in 2021.

Another Repeat of its Product Introduction Theatrics

That said, let’s take a deeper dive into AMAT’s presentation from a third-party perspective to “set the record straight.”

There are three e-beam segments: 1) inspection, 2) metrology and 3) review. Inspection and review tools are used to identify, locate, characterize, review, and analyze defects on various surfaces of patterned and unpatterned wafers. Metrology tools are used to measure pattern dimensions, film thicknesses, layer-to-layer alignment, pattern placement, surface topography and electro-optical properties for wafers.

- Wafer defect inspection system detects physical defects (foreign substances called particles) and pattern defects on wafers and obtains the position coordinates (X, Y) of the defects. Defects can be divided into random defects and systematic defects.

- Metrology generally means a method of measuring numbers and volumes, mainly by using equipment (ex. CD-SEM). Metrology, though often considered synonymous with measurement, is a more comprehensive concept that refers not only to an act of measurement itself but to measurement performed by factoring in errors and accuracy, as well as the performance and mechanisms of equipment.

- A Defect Review SEM is a Scanning Electron Microscope (“SEM”) that is configured to review defects found on a wafer. A defect detected by a semiconductor wafer defect inspection system is enlarged using a Review SEM to a high magnification image so that it can be reviewed and classified.

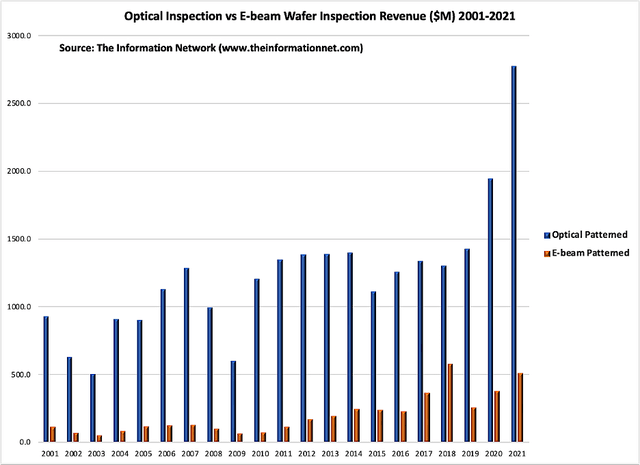

According to The Information Network’s report entitled “Metrology, Inspection, and Process Control in VLSI Manufacturing,” Patterned Wafer Inspection is the largest sector in the overall market, with a combined total of $3.3 billion, with Optical Inspection holding an 84% share of the sector in 2021 compared to 16% for E-beam.

- Optical’s major attributes – high productivity through wafer inspections per 24 hours while still inspecting 97% of the wafer.

- E-beam’s major attribute – high sensitivity with a spot size of 1.5nm compared to 100nm for optical.

In other words, e-beam offers higher sensitivity at slower speeds while optical offers lower sensitivity at faster speeds.

KLAC vs AMAT Metrology/Inspection Market Share

Chart 1 shows that KLAC has continued to dominate the metrology/inspection market and gained share in 2021 while AMAT lost share. KLAC maintains a global share greater than 50% compared to AMAT’s share of just over 10%.

The Information Network

Chart 1

Optical vs E-beam Wafer Inspection Market Share

Chart 2 shows that Optical Inspection has continued to dominate the Wafer Front End sector and gained share in 2021 while E-beam Inspection lost share. YoY revenue growth for Optical was 43% versus 35% for E-beam.

The Information Network

Chart 2

Chart 3 shows that in the E-beam Wafer Inspection sector, AMAT and ASML are the two major suppliers. ASML held a 53.3% share of the sector in 2021, up from 52.7% share in 2020, compared to 43.1% for AMAT.

ASML sells it e-beam systems with its lithography system. The technology was acquired from Hermes Microvision in late 2016 and named ASML’s HMI sector.

The Information Network

Chart 3

In 2019, ASML began segmenting its HMI revenues into the E-beam Wafer Inspection and Overlay sectors, and hence we observe the decrease in ASML’s market share as Overlay applications showed greater demand than Inspection. In 2022 I expect to see further erosion of ASML’s share attributed to strong supply chain issues impacting its lithography system sales.

Investor Takeaway

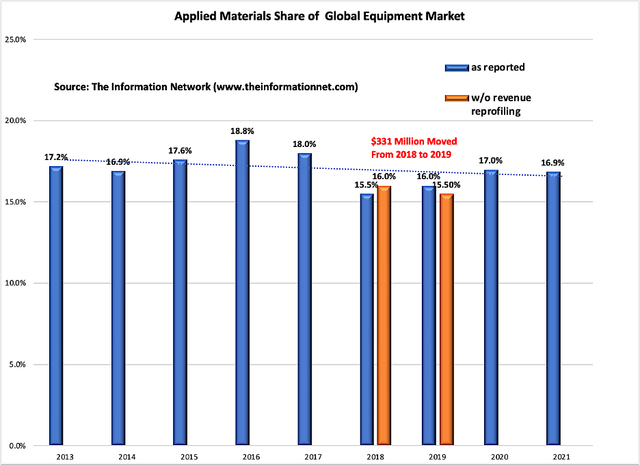

AMAT continues to promote its technology at a time when it is continuing to lose market share in the WFE (wafer front end), as shown in Chart 4. I have pointed out time and time again AMAT is losing share to competitors, according to The Information Network’s report entitled: Applied Materials: Competing Analysis of Served Markets.

Management, which has been losing market share to competitors since they took over AMAT, includes moving $331 million from 2018 to 2019 to pump up share, are desperate to maintain an image of success.

The Information Network

Chart 4

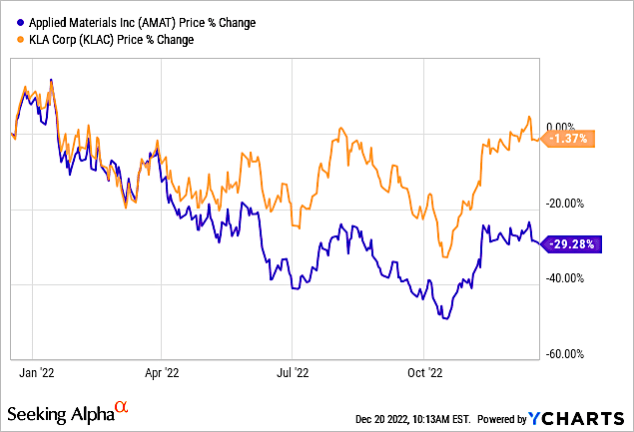

Chart 5 shows share price change for KLAC and AMAT over a one-year period showing significant performance gain for KLAC than AMAT.

YCharts

Chart 5

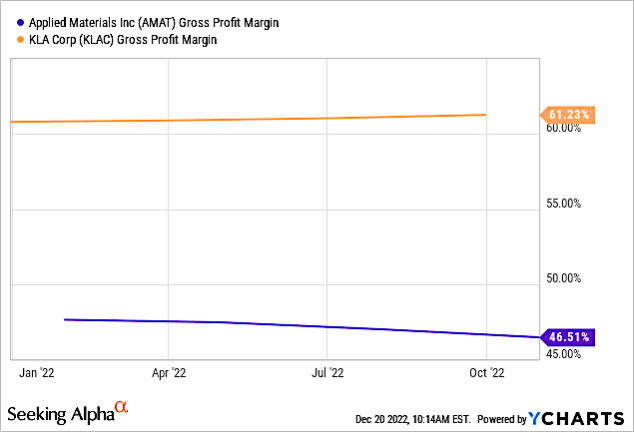

Chart 6 shows a significantly higher gross profit margin for KLAC than AMAT over a one-year period.

YCharts

Chart 6

The hype behind AMAT’s theatrical montage for its new e-beam equipment doesn’t hold water considering market share data I’ve provided in this article in Charts 1-3. When combined with the antics of moving money from 2019 into 2020 and WFE market share losses in Chart 4, indicates a company focused more on promoting products using glossy marketing approaches than making equipment that is “best-of-breed.”

I maintain a sell on AMAT and a buy on KLAC.