winhorse

It is not so easy in the current market to find stocks to invest in. We are in a bear market and face a high risk of the U.S. economy entering a recession next year. It also seems likely that the stock market will decline further and in such a market environment many stocks will decline hand-in-hand with the major indices – even when such declines are not justified.

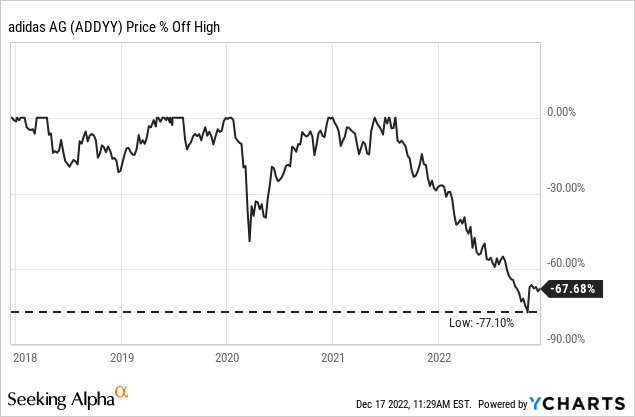

Only a few stocks are able to battle that trend – and one example might be the German sportswear manufacturer adidas AG (OTCQX:ADDYY). The stock declined as steep as 77% since the previous highs in 2021 and seems to be trading below its intrinsic value.

Business Description

adidas is designing, developing, distributing, and marketing athletic and sports lifestyle products. Among other products it mostly offers footwear, apparel, and accessories. The company was originally founded in 1924 in Herzogenaurach in Germany (where it is still headquartered), but the adidas AG we know today was founded in 1949 (after the Dassler brothers split up and founded the two companies adidas and PUMA SE (OTCPK:PMMAF)). In 1995, the company had its IPO and today adidas is generating about €21 billion in annual sales and has slightly above 61,000 employees all over the world.

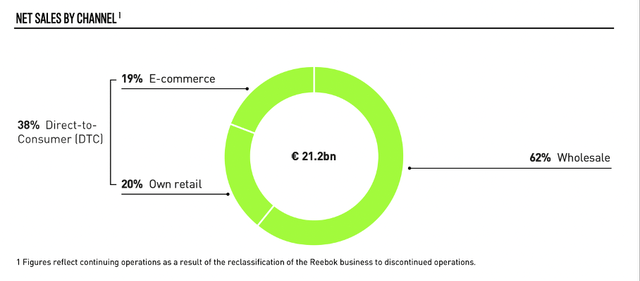

adidas Annual Report 2021

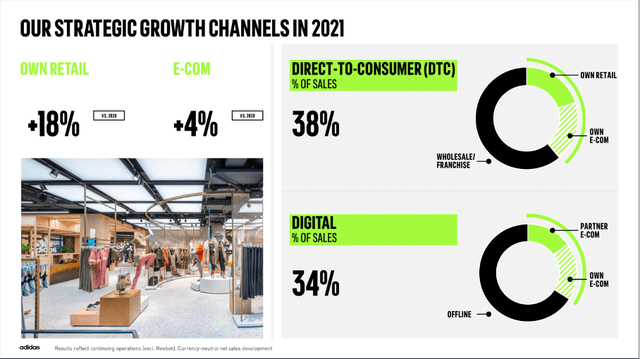

The company has three major distribution channels. The biggest part of revenue is still generated by wholesale (62% of total revenue in fiscal 2021). But like many other companies, adidas is also trying to increase its direct-to-consumer channels. At the end of the third quarter of fiscal 2022, adidas had 2,089 stores (a small decline from 2,168 stores one year earlier) and in fiscal 2021 about 20% of total revenue stemmed from retail stores. And about 19% of total revenue stemmed from e-commerce in fiscal 2021. E-commerce could grow revenue 8% in Q3/22 and especially in EMEA, North America, and Latin America e-commerce sales grew in the double digits.

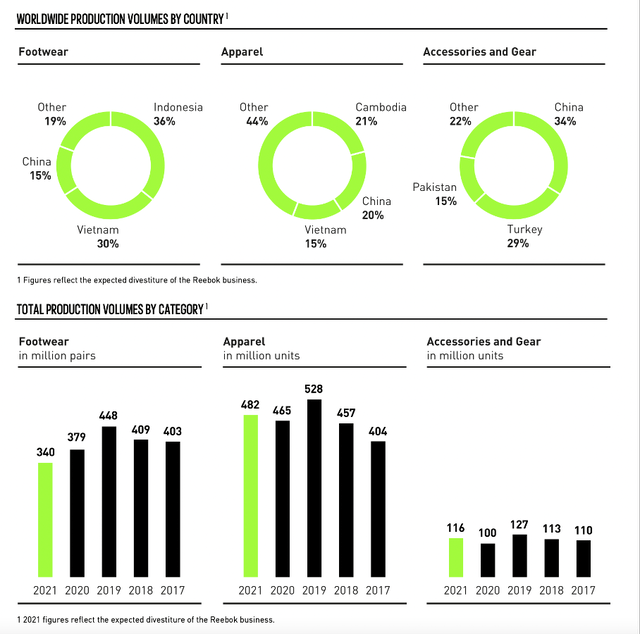

adidas is selling its products in three major categories – footwear, apparel as well as accessories and gear. In 2021, the company sold 340 million pairs of footwear and 482 million units of apparel. And accessories and gear sold 116 million units.

adidas Annual Report 2021

Mixed Results

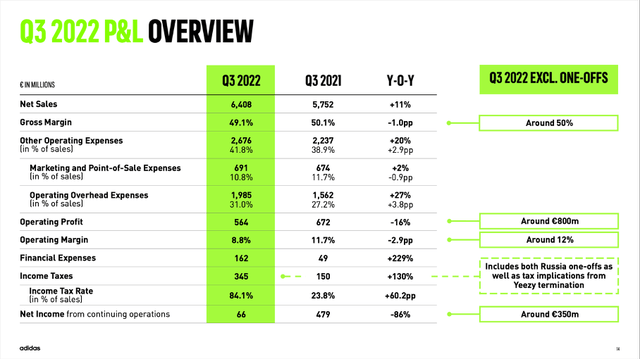

When looking at the last results, adidas is struggling a bit. However, it is still reporting solid results and in the third quarter of fiscal 2022, the company could increase net sales from €5,752 million in the same quarter last year to €6,408 million this quarter – resulting in 11.4% year-over-year growth. We should also mention that adidas profited from currency fluctuations and currency-neutral sales increased about 4% YoY. While the top line could still increase, operating profit declined 16.1% year-over-year from €672 million in Q3/21 to €564 million in Q3/22. And finally, diluted earnings per share from continuing operations declined from €2.34 in the same quarter last year to only €0.34 this quarter.

adidas Q3/22 Presentation

And when looking at the results for the first nine months, we see adidas struggling. However, I don’t know if the stock price decline was justified as revenue still increased 7.5% year-over-year from €16,096 million in the first nine months of 2021 to €17,306 million in the first nine months of 2022. Operating profit declined from €1,920 million to €1,393 million resulting in 27.4% YoY decline. And diluted earnings per share from continuing operations also declined from €6.87 in the first nine months of 2021 to €3.83 in the first nine months of 2022 – a decline of 44.3% YoY.

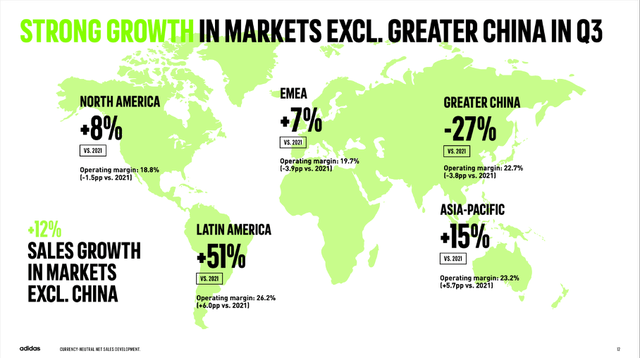

Problem: Greater China

When looking at the growth rates in the different regions around the world, we see one of the major problems adidas has right now. While the EMEA region (7% growth) and North America (8% growth) report solid results, the Asia-Pacific region grew 15% YoY and Latin America grew even 51% YoY. But the problem child right now is Greater China, which had to report 27% decline year-over-year.

adidas Q3/22 Presentation

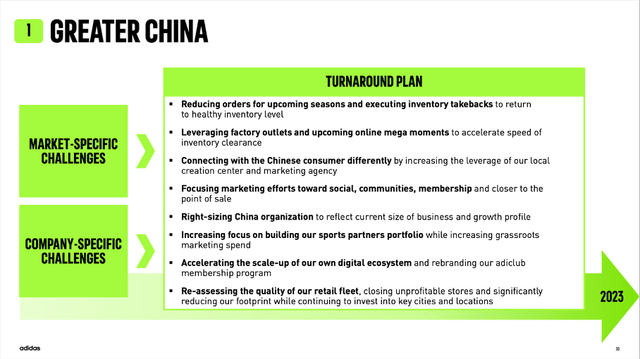

During the earnings call, management mentioned two of the challenges adidas is facing in Greater China:

Starting with Greater China. We continue to see several market specific challenges that are affecting our entire industry. The strict zero COVID-19 policy with nationwide restrictions remains in place amid more than 2000 daily new COVID-19 cases in November. As a consequence, offline traffic is subdued due to the imminent risk of new lockdowns.

In addition, local lifestyle influencers are still hesitant to collaborate with Western brands. While these challenges are industry wide in nature, you also have to admit that we face additional company specific challenges, which is a slower than expected recovery from the market specific challenges just mentioned, our inventory levels, which were higher at the start of the sluggish market and development remain significantly elevated and will keep us busy for some more months.

But adidas also has a turnaround plan for Greater China and it will reduce orders for upcoming seasons to return to healthy inventory levels. Additionally, adidas will also right-size the China organization and adidas will also try to connect with the Chinese consumer differently.

adidas Q3/22 Presentation

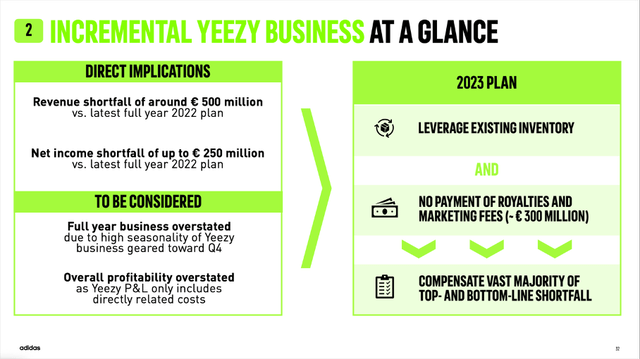

Yeezy Contract Termination

A second negative impact on adidas’ business stemmed from the termination of the adidas Yeezy partnership. Adidas is ending production of all Yeezy products and stopped any payments. The termination of this contract will have a negative impact of €250 million on fiscal 2022 net income. For the 2022 outlook, the negative impact is already reflected.

adidas Q3/22 Presentation

During the Q3/22 earnings call, CFO Harm Ohlmeyer gave more details on financial expectations for Q4/22 and underlined that adidas owns all design rights:

I can confirm that adidas is the sole owner of all design rights, ready to existing product as well as previous and new colorways under the partnership, and we intend to make use of these rights as early as 2023. Let’s have a more detailed look on the incremental Yeezy business. Given the high seasonality of the Yeezy business, where we are typically generating around 1/3 of the total annual revenues and almost 40% of the annual profit contribution in Q4, we expect the revenue shortfall related to the immediate termination of the partnership of around €500 million Euro.

As mentioned, the expected net income shortfall is forecasted to reach up to €250 million in Q4. In this context, let me emphasize that the implied profitability of the Yeezy business is overstated due to the fact. Its cost only includes those expenses that are directly related to the product and the business. In other words, it does not include any further central costs or location for sourcing digital, retail, or any other services that this part of our business has been benefiting from and that we are essential for success.

We can be confident that adidas will be able to compensate the loss in the coming quarters, but we should not ignore that adidas generated about 7% of its total revenue from the Yeezy partnership and we also should expect a small negative impact on fiscal 2023 results. But over the long term, the negative impact should not be measurable.

Recession

Aside from the struggling Chinese business and the Yeezy contract termination, a third risk for adidas is the looming recession. And when looking at the performance of adidas since 1991, the company was usually affected by recessions but could in most cases recover quite well in the quarters following a recession. In 2003 as well as 2009, annual revenue declined about 4% compared to the previous year. In 2020, revenue declined rather steep – 16.1% decline from €23.64 billion in 2019 to €19.84 billion in 2020. However, in this case it was not so much the recession, but rather COVID-19 and the resulting lockdowns.

When looking at the bottom line, adidas had to report a loss in 1992 as well as in 1998 and in 2009, earnings per share declined rather steep from €3.25 in the previous year to €1.25 in 2009 – resulting in a decline of 62%. In 2020, adidas saw a similar steep decline from €10.00 in 2019 to €2.21 in 2020 – resulting in 78% bottom line decline.

And we must expect that another potential recession in 2023 will have an impact on adidas’ business once again. We can already see negative effects but must assume 2023 will be another challenging year for adidas.

Long-term Growth

While adidas is facing several short-to-mid-term challenges – like the three mentioned above – the long-term outlook for adidas is still bright. First, adidas is also focusing on direct-to-consumer channels – like many of its peers. And while adidas had its stores for a long time, e-commerce sales were a driver of growth and between 2015 and 2020 increased with a CAGR of 48%. And in 2021, 34% of total sales were already digital (combination of own e-commerce as well as partner e-commerce).

adidas General Meeting 2022 Presentation

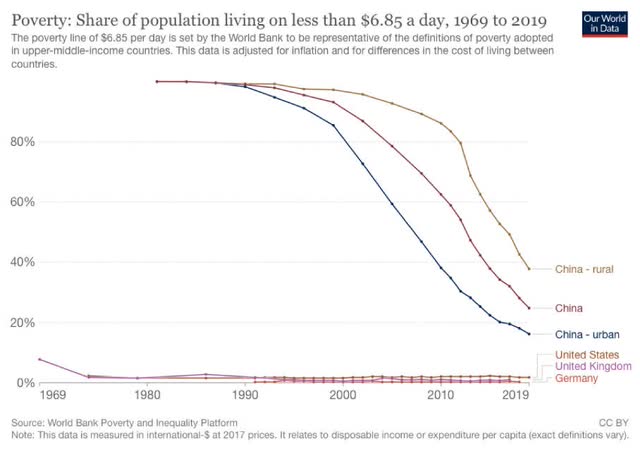

Another driver of growth – at least in the past – was Greater China. Between 2015 and 2020, revenue increased with a CAGR of 15%. And although the market is struggling right now (see above), we can be fairly confident for adidas to return on the path of growth in China again. The country will continue to grow at a high pace and outperform most other countries. Additionally, more and more people will move towards the middle class and will become potential customers for adidas’ products.

Our world in data

And many studies are expecting solid growth for the global sportwear market – and not just for China. In the years to come, we can assume mid-single digit growth rates for the sportswear market. Fortune Business Insights expects a CAGR of 6.6% for the years until 2028 and is especially pointing towards the increasing demand for smart sportswear as well as the increasing health consciousness among the population which should fuel growth. Data Bridge Market Research is a little more conservative and expecting the market to grow with a CAGR of 5.53% until fiscal 2029 and Research Dive is expecting a CAGR of 4.8% between 2021 and 2028.

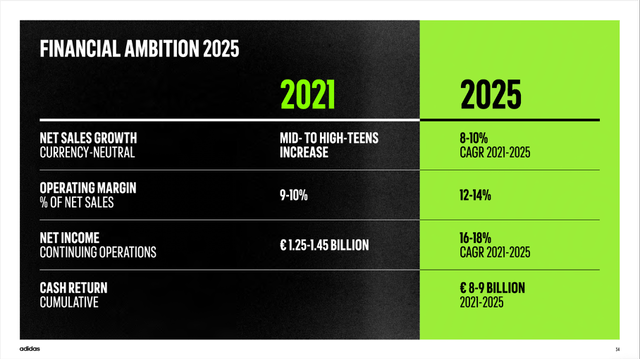

adidas Investor & Media Day 2021

And adidas itself has ambitious financial targets for the years until 2025. According to its “Own the game” strategy, adidas is expecting net sales to grow between 8% and 10% until fiscal 2025 and net income is expected to grow with a CAGR between 16% and 18% in the years 2021 till 2025.

Great Business

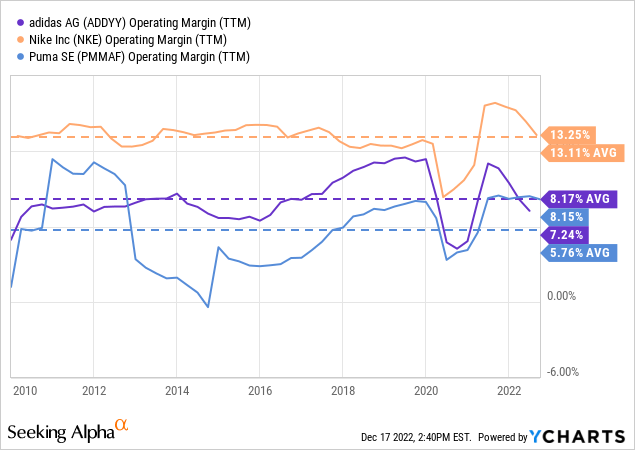

adidas is often seen as the weaker competitor of NIKE (NKE). As I have written in a previous article about Nike, the U.S. sports company is superior to its peers in most categories. Especially when looking at the operating margin, Nike could report much better numbers. While adidas had an average margin of 8.17% during the last decade, Nike reported an average margin of 13.25%.

But Nike and adidas both have an economic moat around the business – based on the brand name as well as cost advantages. While Nike takes the 10th spot on the list of most valuable brands (according to Interbrand), adidas is only 42nd. But we should not forget that we are talking about the most valuable brands in the world. As I have mentioned in my article about Nike, the brand name by itself is not creating an economic moat – the brand name has either to increase the willingness to pay a higher price or the brand name must reduce search costs. And both are true in case of adidas (like they are true for Nike). Customers are clearly willing to pay a higher price for adidas sportswear (especially for sneakers, customers often pay absurd prices). Additionally, the brand is also reducing search costs as many customers will just pick a shoe from adidas (especially in Europe) without even looking at other brands.

And adidas is also profiting from cost advantages. Although adidas is not market leader (it is second after Nike), the company is still selling hundreds of millions of footwears and apparel and is clearly ahead of all the other competitors – like Puma or Under Armour, Inc. (UAA) (UA). With a large amount of footwear and apparel sold, for example development costs will decline and marketing costs are lower per sold item, which is generating cost advantages for adidas.

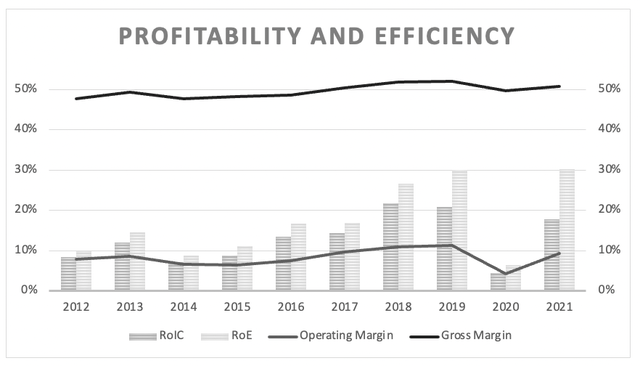

adidas: Gross Margin, operating margin and RoIC (Author’s work)

The economic moat of adidas is also visible by looking at some metrics. Not only has adidas a very stable gross margin, but it could also improve its operating margin since 2015 (aside from 2020), which is a good sign. And in the last decade the company could report an average return on invested capital of 12.95% – indicating an economic moat around the business. When looking at the last five years, RoIC was even higher and around 16%.

Solid Balance Sheet

Aside from the economic moat, adidas also has a solid balance sheet. On September 30, 2022, short-term borrowings were €1,036 million and long-term borrowings were €1,958 million. When comparing the total debt to the total equity of €6,520 million, we get a D/E ratio of 0.46. And when comparing the total debt to the operating profit of fiscal 2021 (which was €1,986 million), it would take about 1.5 years to repay the outstanding debt. Both metrics are no reason for concern. Additionally, the company has €806 million in cash and cash-equivalents on its balance sheet (and only €1,318 million in goodwill).

The only major problem right now is the high inventory levels, which increased from €3,664 million on September 30, 2021, to €6,315 million on September 30, 2022. However, adidas is expecting inventory levels to normalize again during 2023 as the company is aggressively clearing excess inventory and is tactically repurposing existing inventory. But overall, adidas has a solid balance sheet.

Dividend

adidas is also interesting for its dividend. The company is paying a dividend since its IPO in 1995. And as far as I can tell, the company had to cut its dividend only once since then – during the Great Financial Crisis – and suspended the dividend for fiscal 2019 – due to COVID-19. Like many other European companies, adidas did not raise the dividend every single year, but it can still be seen as a stable dividend payer.

For fiscal 2021, adidas paid an annual dividend of €3.30 (an increase of 10% compared to the previous year), which is resulting in a dividend yield of 2.7%. When using earnings per share for fiscal 2021 (€7.47), we get a payout ratio of 44% and I see no reason for the dividend not being sustainable. This is also within the target range of 30% to 50% of net income according to the company’s dividend policy.

adidas is also using share buybacks, which is rather untypical for German (or European) companies. And especially in the last few quarters, adidas reduced the number of outstanding shares quite aggressively, which seems a good move considering the low share price. In December 2021, the Executive Board decided to launch a multi-year share buyback program and so far, the company is using it quite effectively. Between Q3/21 and Q3/22, adidas reduced the number of outstanding shares from 193.2 million to 179.2 million – resulting in a decrease of 7.2%.

Intrinsic Value Calculation

Using aggressive share buybacks right now (it also seems like adidas used cash and cash equivalents it had on its balance sheet) seems like a great strategic move as the stock is undervalued. But when looking at simple valuation metrics, adidas does actually not appear to be so cheap. When taking TTM earnings per share, adidas is trading for 27 times earnings right now – which does not seem like a bargain. However, trailing twelve months earnings per share are not representative for adidas’ true earnings power.

Instead, we use a discount cash flow calculation as it enables us to make more precise assumptions for the years to come. And for fiscal 2023 and fiscal 2024, we remain cautious and assume a free cash flow around €1,000 million. But for fiscal 2025 we assume that adidas will be able to generate €2 billion in free cash flow again (an amount it already generated in the past and still a rather cautious assumption in my opinion). And let’s be cautious and assume only 8% growth for the years to come till the end of the next decade, followed by 6% growth till perpetuity. When calculating with 179.2 million in outstanding shares and 10% discount rate, we get an intrinsic value of €268.07 for adidas and the share is clearly undervalued and a bargain.

Let’s put these numbers a little in perspective. First, 8% growth is clearly below the growth rates adidas could report in past decades. It is also clearly below adidas’ targets till 2025 – according to its “Own the Game” strategy.

|

CAGR |

Since 1991 (for EPS since 1994 as extremely low 1991 numbers would disturb the picture |

Since 2001 |

Since 2011 |

|

Revenue |

8.76% |

6.43% |

4.76% |

|

Earnings per share |

13.58% |

11.95% |

13.04% |

Additionally, I think we are cautious enough for the next two years and are reflecting the risk of a recession. And the assumption of €2 billion in FCF in 2025 is also not too optimistic.

Conclusion

Despite the higher operating margin of Nike, adidas seems to be the better pick right now. Nike is also trading about 40% below its previous all-time high, but still for 30 times earnings and Nike seems to be far away from being a bargain – it is probably fairly valued at best. Adidas on the other hand seems to be trading below its intrinsic value and we are still talking about a great business. And the stock seems like a pick and candidate that might outperform in a most likely challenging year 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!