mohd izzuan/iStock via Getty Images

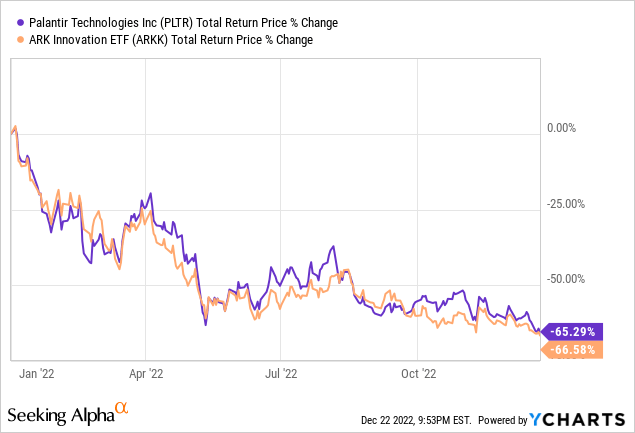

Palantir Technologies (NYSE:PLTR) stock has had a miserable 2022, falling almost in lockstep with the broader high growth technology sector (ARKK):

Looking ahead to 2023, we expect one major tailwind and one major headwind for the company. In this article, we will discuss these potential catalysts and share our view on shares right now.

PLTR Stock Major Tailwind: Soaring Geopolitical Tensions

Geopolitical tensions are very likely to soar moving forward, with many leading investors, businessmen, and think tanks indicating that we may well be in the early stages of the next great Cold War, if not World War 3. China, Russia, North Korea, Iran, and other potential major adversaries are becoming increasingly belligerent and aggressive in both language and action in their respective spheres and China in particular is directly confronting and challenging the United States across the economic and geopolitical domains.

In fact, the biggest near to medium term geopolitical risk facing the world right now is likely a Chinese invasion of Taiwan. In addition to likely leading to horrific loss of life and serving as a potential catalyst for a major regional or even global war, such an invasion would wreak havoc on the global economy. Not only would the U.S. and its allies feel compelled to place major sanctions on China for this action, leading to enormous disruptions to global trade and supply chains (and massive losses for major U.S. companies with significant financial interests in China, ranging from Apple (AAPL) to Tesla (TSLA)), but it would also threaten the global semiconductor supply given that about 65% of semiconductors and 90% of its advanced chips are produced in Taiwan.

This means that the U.S. government has every incentive to invest aggressively in assuring that it is equipped with the very best cutting edge technology to deter and respond to Chinese aggression in the region. PLTR is a key player in making sure this happens as its satellite-linked A.I. and data analytics technology serves as a mission-critical component of the U.S. defense infrastructure. As a result, PLTR’s defense-related contracts with the U.S. government and its allies are not only very likely safe for the foreseeable future, but also likely to experience strong growth in the coming quarters and years.

PLTR Stock Major Headwind: Recession & Falling Inflation

While the geopolitical picture is certainly bullish for PLTR, the macroeconomic picture is likely going to shift against it. The recent re-opening of the economy, supply chain backlogs, labor shortage, and high levels of inflation have served as a tailwind for PLTR in that it has driven companies to seek innovative solutions to solving supply chain and labor shortage problems while also looking to maximize operational efficiencies in order to fight inflationary cost problems and preserve profit margins.

However, with the yield curve inverting and the CPI reports since June showing a consistently declining CPI number, it appears that a recession and continued declines in core inflation are all but inevitable for 2023. This means that companies will have less discretionary dollars to invest in new technologies (though in some cases companies may be driven to use PLTR in order to prop up their slumping businesses) and less incentive to do so if inflation is truly on the decline. As a result, we expect PLTR to have a harder time selling its commercial facing Foundry platform in 2023, thereby offsetting the expected tailwinds to its government-facing Gotham business from soaring geopolitical tensions.

Investor Takeaway

PLTR’s main growth catalysts in recent years have been:

- scaling the sales force in order to spread awareness of the company’s constant stream of product creations and improvements, especially internationally and in the commercial sector.

- geopolitical black swans ranging from COVID-19 to the Russia-Ukraine war which have driven strong demand for its Gotham platform.

- the need for corporations to battle inflationary headwinds.

Moving forward, we expect two of these growth catalysts to lose some steam as further scaling of the sales force will likely soon begin to result in diminishing marginal returns and inflation is likely going to continue declining moving forward. Furthermore, with a recession likely hitting the economy, many companies will have less discretionary money available to invest in expensive new technologies. On top of that, a recession will likely put pressure on government tax revenues, potentially straining budgets and thereby weighing on PLTR contract growth. To see our full macro outlook, you can read our latest Market Outlook report here.

At the same time, we expect geopolitical risks and challenges to remain at elevated levels and quite possibly even escalate further. As a result, while government budgets may be tightened, we believe demand for PLTR’s Gotham business will remain very strong and likely continue to grow as the competition with China in particular continues to increase.

According to the Wall Street analyst consensus, PLTR appears set to grow its revenue and EBITDA by 23.4% and 21.4%, respectively in 2023. Meanwhile, through 2026, analysts expect revenue to grow at a 29.8% CAGR and EBITDA to grow at a whopping 41.2% CAGR as the government business is set to accelerate from its recent sluggish growth as geopolitical concerns begin to flow through to government budgets.

Furthermore, the current consensus is that the upcoming recession will likely be fairly mild and short-lived. This should lead to rebounding consumer demand in 2024 and 2025 where analysts expect 41.7% and 72.8% EBITDA growth, respectively. Ultimately, analysts expect this strong growth to result in an earnings per share of $0.49 in 2026 with a 2026 earnings-per-share growth rate of 28.9% and likely gradually slowing from there.

We believe such a growth rate will warrant an earnings per share multiple of at least 30x, leading to a fair value stock price of ~$15 in 2026. Given that the current stock price is $6.32, that implies a total return CAGR of ~26% between now and the end of 2026. As a result, we rate PLTR a speculative Strong Buy and have been adding to our position on the recent dip into the low $6s.