Poly Isepan/iStock via Getty Images

Introduction

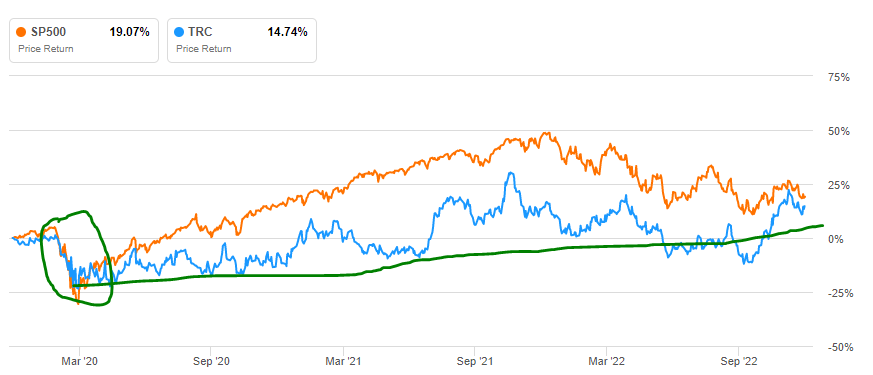

2023 will be an interesting year, and certainly unpredictable. While I have posted an article on the possibility for the market to end positive for the year, I also want to search for low-risk investments to preserve some capital for the year ahead. I have already discussed Central Japan Railway (OTCPK:CJPRY) as a traveler growth play for the year. I expect a low-volatility and risk 5-15% return on the investment, rather than the widely varied return that is possible for the S&P 500 (SP500).

Another viable candidate of event driven stability is with Tejon Ranch Co (NYSE:TRC), owners of the largest single plot of private land in California. Located in between the LA suburbs and Bakersfield. The land is in a high traffic volume region and the company has first developed a commercial center along the highway to take advantage. In fact, despite the opportunity for the company to develop over 35,000 homes across their land, approximately $28 billion in value at average California house prices, the real value over the next year relies on selling commercial plots along the highway.

In fact, due to rising land prices, there remains over $100 million in direct land value that is available to be sold in the coming year. This will provide plenty of cash to the balance sheet to be reinvested in the future-facing early-stage developments at the other master developments. Combined with the reduced overhand of litigation on the progress of their housing developments, I expect the company’s value to rise. At the same time, the risk for downside is limited as financial health and outlook improve. I have discussed the opportunity in far more detail in a prior article.

Litigation Has Been Settled

While I will discuss the developments underway, one of the key factors in unlocking value for TRC is the settlement of the various lawsuits against their developments. Over the past three years, most litigation has been settled in favor of TRC as they have made significant environmental concessions over the past 20 years. In order to continue growing and maintain positive investor sentiment, progress on future master developments is required. Now that most main lawsuits are now complete, the outlook is quite positive in this regard. As such, the company can be valued higher purely due to the future opportunity.

This effect is great for the short-term expectations as well due to the fact investors are less likely to sell out despite the general market weakness. As evident by company performance so far this year, TRC is up 1.3% while the market has fallen 18%. Even the past three years show reduced drawdowns and a narrower trading range compared to the S&P 500 (for an individual holding of course). My investment thesis relies on the low-volatility and slight appreciation in value as a way to support my portfolio over the coming year. Stability now, then the unlocking of value over the decades to come.

Seeking Alpha

Real Estate Valuations – Commercial and Housing

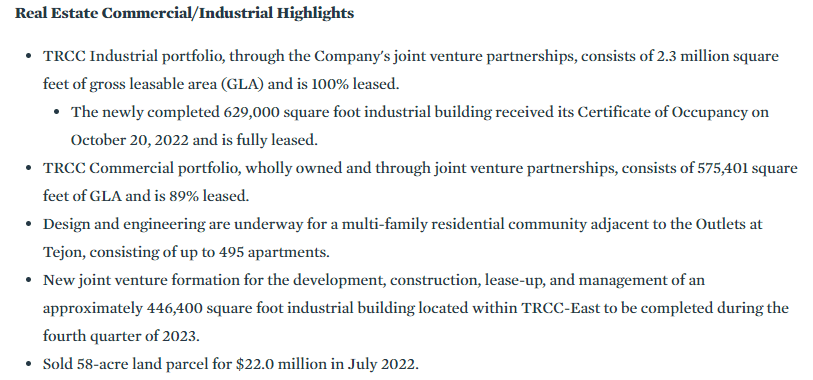

To maintain momentum and earn cash to use on future developments, TRC sells plots of land to developers at the commercial center along the 5 freeway. Some development expenses are taken up by TRC, and some by partners, and both parties have the potential to earn lease expenses in the future. The sales have been frequent over the past few quarters as demand for logistics facilities grow. It’s no question why: the location can access over 70 million people within two days. One press release offered these insights in November, along with the earnings report:

[TRC and Majestic Realty have] completed construction and secured a full-building lease of its 629,274-square-foot industrial distribution facility to an undisclosed major retailer at the Tejon Ranch Commerce Center (TRCC). This latest transaction follows a series of recent deals at TRCC involving four building sites, comprised of more than 2.5 million square feet of industrial development, that is currently under construction or planned for construction in 2023…

Commercial/industrial real estate development segment revenues were $32.2 million for the first nine months of 2022, an increase of $19.4 million, or 152%, from $12.8 million for the first nine months of 2021. The increase was attributable to a 58-acre land sale mentioned above.

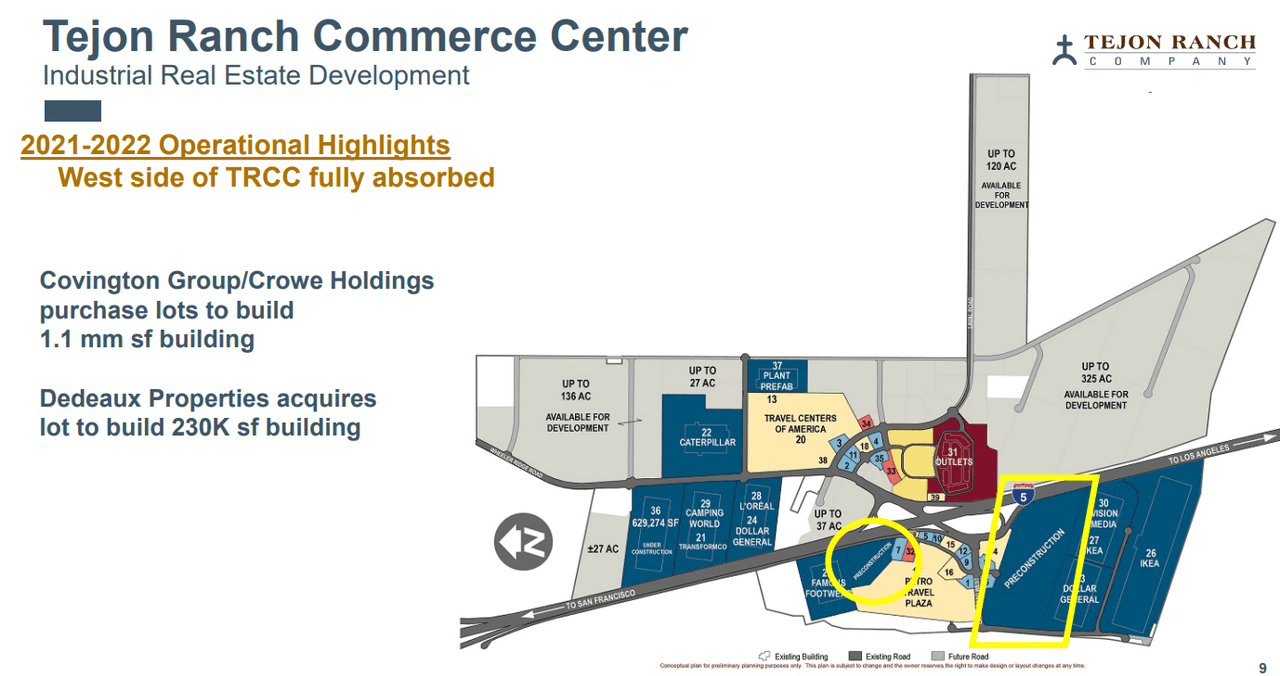

Land pricing has risen 150% from $3.50 to $8.75 per square foot

The 2.5 million sq feet of industrial development would account for an additional influx of $22 million at current land pricing of $8.75 per sq ft. Other developments include expanded commercial sites like three hotels/motels and the coming residential multi-family apartments. The site already has an outlet mall and travel plazas, increasing the land value through traffic and usage. Current tenants include Caterpillar (CAT), TravelCenters of America (TA), Tesla superchargers (TSLA), L’Oreal (OTCPK:LRLCY), Dollar General (DG), and IKEA. Highlights and future works are listed in the image below.

TRC Press Release

If prices remain the same, the available 11.75 million sq ft of space left would account for an additional $102 million in revenues over the next year or so. However, I expect only about 50% of that to occur in the next year, or around $50 million. Keep in mind that the investment in this developer is not just about sales over the next year, but the potential for up to an additional 35000 houses and 35 million sq. ft. of commercial space being sold over the next two decades or so. Any profits now will be support for those future cash flows.

Tejon Ranch Investor Presentation

Tejon Ranch Investor Presentation

The Company will continue to aggressively pursue commercial/industrial development, multi-family development, leasing, sales, and investment within TRCC and its joint ventures. The Company will continue to invest in its residential projects, including Mountain Village at Tejon Ranch, Centennial at Tejon Ranch and Grapevine at Tejon Ranch.

When all four master planned developments are fully built out, Tejon Ranch will be home to 35,278 housing units, more than 35 million square feet of commercial/industrial space and 750 lodging units.

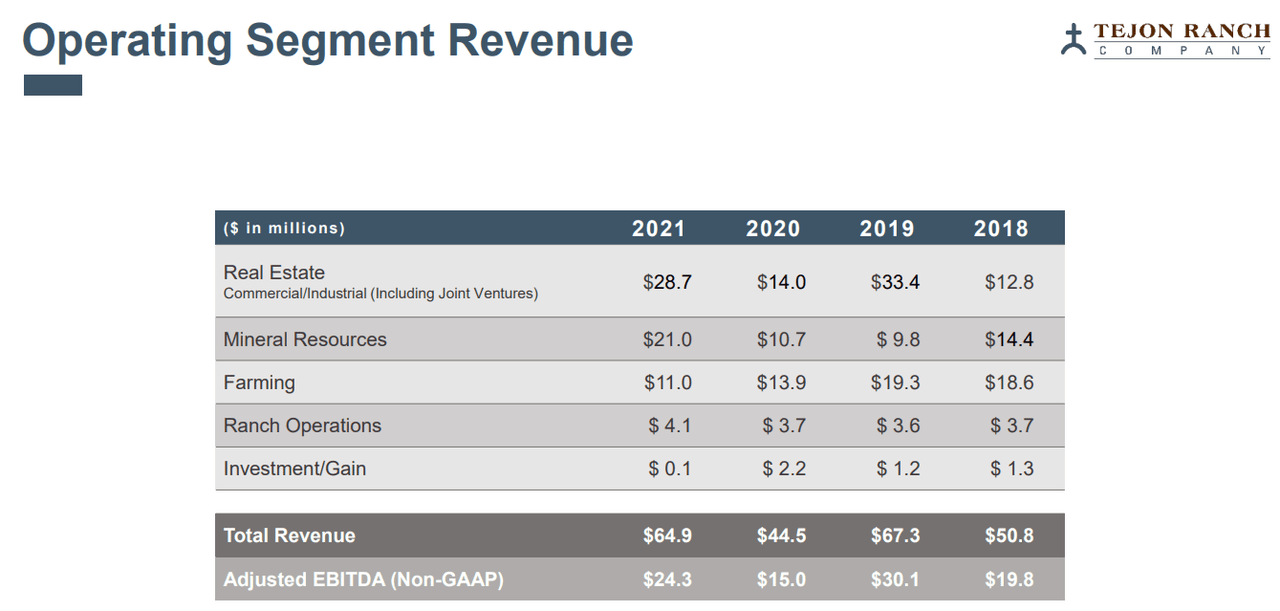

Relative Valuation

It is also important to note that the company has legacy assets that still earn $30-50 million in revenues per year. Most of these are related to other parts of Tejon Ranch used for mining, water wells, oil rigs, and farms. While far more cyclical, unpredictable, and less profitable than the land sales, there is a base for investors to rely on in the case that asset sales do not occur every quarter. EBITDA margins typically range around 20-30%, meaning investors have little worry about cash not being available for operations.

Tejon Ranch Co 2022 Shareholder Presentation

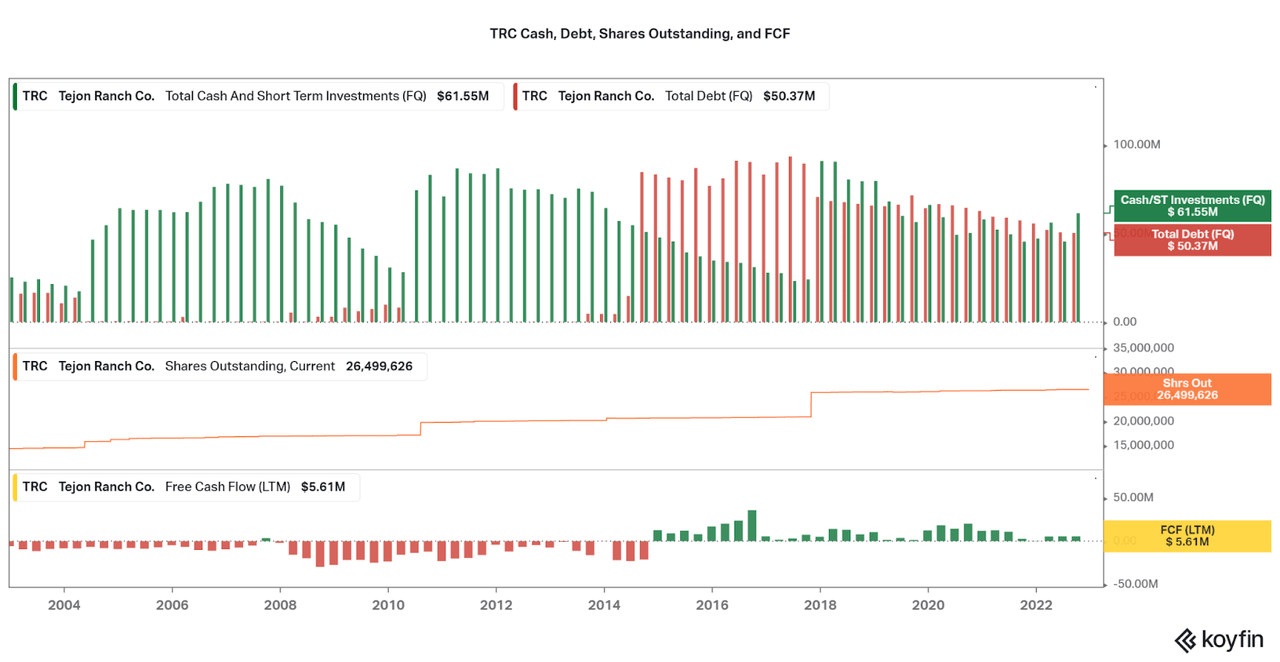

We can also see that recent increases in land development has allowed for debt to be repaid. In fact, cash is now higher than total debt for the first time since 2018. Investors can also be confident in the prolonged periods of positive free cash flow per quarter despite investments in litigation defense, planning, and development. Dilution has also not been an issue since 2017, although if groundbreaking occurs at a master development, positive sentiment may be used to list shares again. For now, leases, legacy assets, and land sales will continue to drive positive cash flows, and any negative quarters must be assessed carefully.

Koyfin

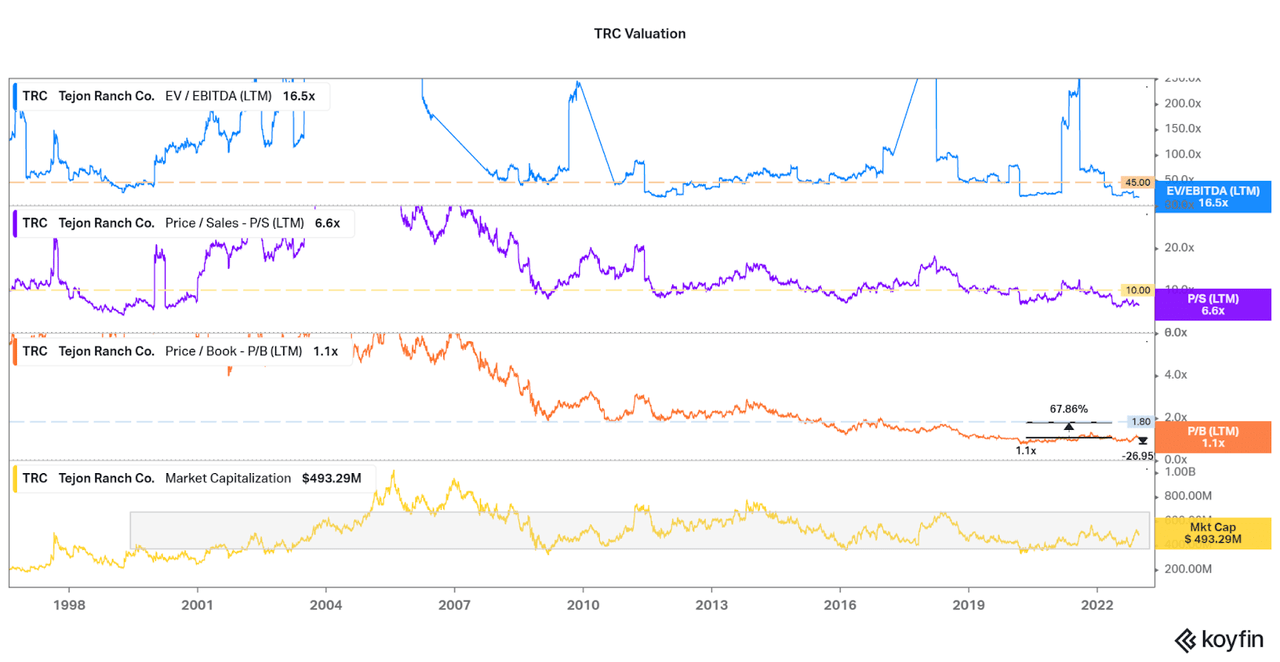

All these data points influence the TRC’s valuation in a positive way. No indications currently exist to underperformance, even with weakening commodity markets over the next year. There is also reason to increase the company’s valuation based solely on historical trading levels. As shown below, TRC is approaching all-time-low valuations. When a company is seeing positive operational developments, but a low valuation, typically the upside chance is high. In fact, the potential returns due to a reset in valuation would be extensive.

From just a P/S standpoint, the shares may rise over 60% just to return to prior ranges. Considering just real estate prices have increased significantly while TRC’s valuation has fallen is a major catalyst to consider. This is why the company’s book value has fallen to all-time-lows. It is also strange because short-term investor sentiment is having so much influence on a company whose value will not be fully unlocked for years. Low demand through 2023-24 will have little impact on communities being built in the 2030s. As such, I believe that Tejon Ranch’s market cap has a chance to break through the $400-$700 million range highlighted below, leading to a 40% return or more.

Koyfin

Conclusion

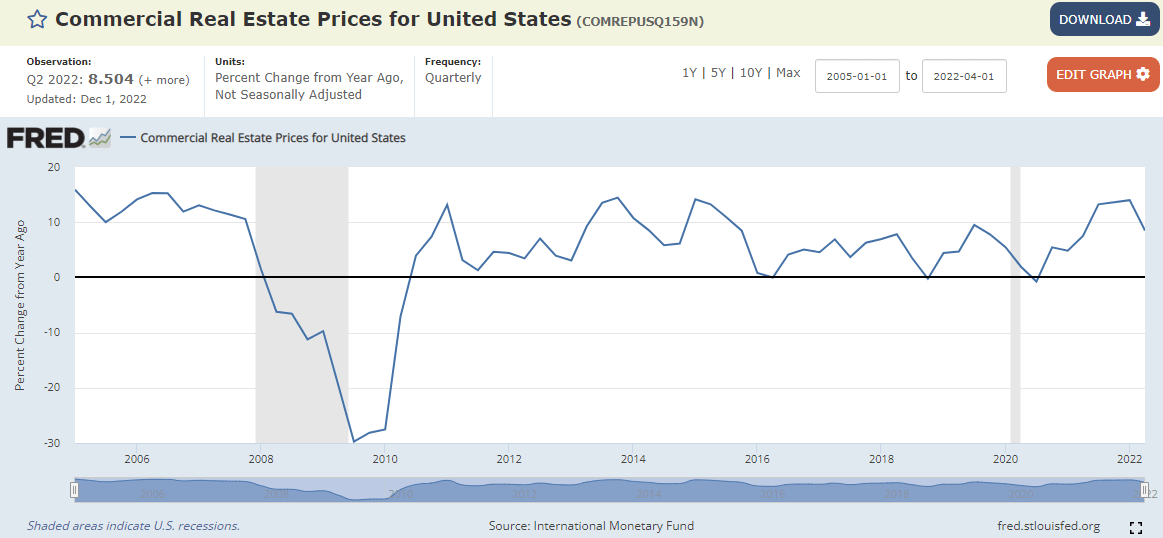

A combination of extensive periods fighting lawsuits, fire danger, and Californian demographic shifts have all had negative influences on Tejon Ranch over the past decade or more. At the same time, the outlook of a successful establishment of multiple master planned communities becomes more clear. Over the past 10 years, Tejon Ranch has lost value, but real estate prices have grown. The balance sheet has improved and free cash flows remain positive, but the valuation has fallen to all-time lows. I would not be surprised if many investors would hesitate to go long against such poor momentum.

FRED

However, I began investing in the company recently, and it has helped keep some of my assets flat while many fall. I personally believe that the trend is about to be broken, and do not mind having my investment remain flat through 2023. There is a chance that the rest of the market continues falling. But, I believe the catalysts are too much to ignore for TRC, and the investment will not trade in line with the market. Therefore, the upside is far more likely than the downside over the year. I look forward to these catalysts driving TRC to be my best performer in 2023.

Thanks for reading. Feel free to share your thoughts below.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!