bymuratdeniz

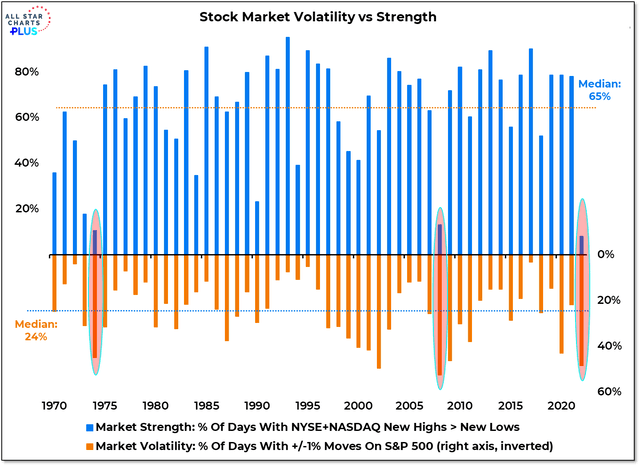

There haven’t been many new highs on the U.S. stock market this year when compared to new lows. Willie Delwiche put out a great chart last week illustrating that market strength has been weak while volatility has been high in 2022.

One international Energy sector name, though, has broken to fresh highs as oil prices have rebounded in the last few weeks. I see more upside in shares of Tenaris.

2022: Weak Market, Strong Volatility

Willie Delwiche

According to Bank of America Global Research, Tenaris (NYSE:TS) is a global supplier of OCTG (Oil Country Tubular Goods) pipe to the oil and gas industry, with an estimated 37% market share globally. Tenaris has manufacturing facilities and sales offices in key oil- and gas-producing regions and has major welded steel operations serving the U.S. and Latin American markets. Sales in the key seamless tubes business are well distributed across the globe.

The Luxembourg-based $20.4 billion market cap Energy Equipment & Services industry company within the Energy sector trades at a low 9.9 trailing 12-month GAAP price-to-earnings ratio and pays a 1.9% forward dividend yield, according to The Wall Street Journal.

Earlier this month, analysts at JP Morgan came out bullish on a few stocks, TS among them. That positive news came after an earnings miss by the firm in early November. But with gradual improvement in the oil industry investment trends, Tenaris stands to benefit as it produces big free cash flow along with boasting a great balance sheet.

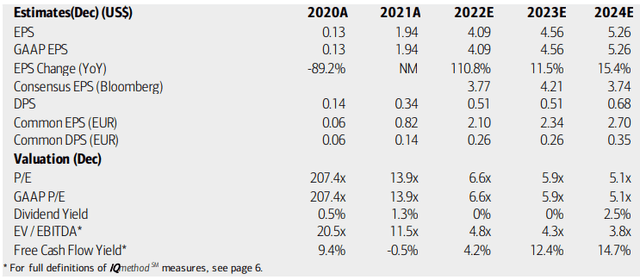

On valuation, analysts at BofA see earnings having climbed sharply in 2022 amid much higher oil prices, and growth should persist through 2024, though at a slower rate. The Bloomberg consensus forecast is not as optimistic as what BofA sees, however. Dividends are expected to grow to $0.68 per share in the next two years, commensurate with per-share profit growth.

With rising earnings, both the operating and GAAP P/E multiples should fall to very attractive levels while TS’s EV/EBTIDA ratio trades about half that of the broad market. Free cash flow, meanwhile, is strong in the coming quarters. Overall, I like the valuation here considering Tenaris’ bottom-line growth.

Tenaris: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

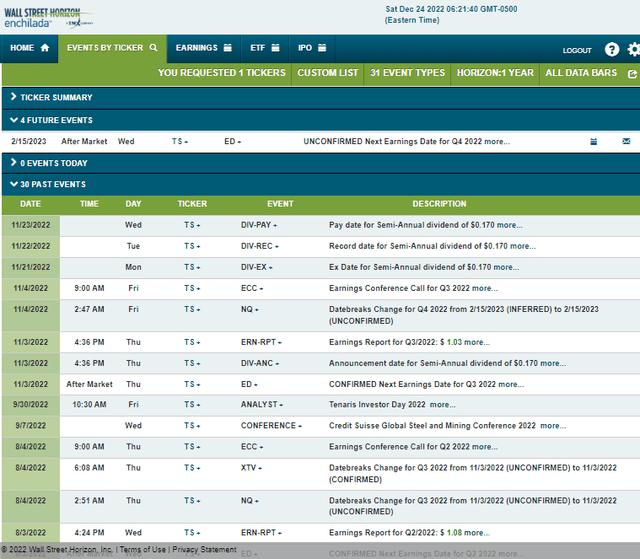

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Wednesday, February 15 AMC. There are no other event/volatility catalysts aside from the earnings date.

Corporate Event Calendar

Stockcharts.com

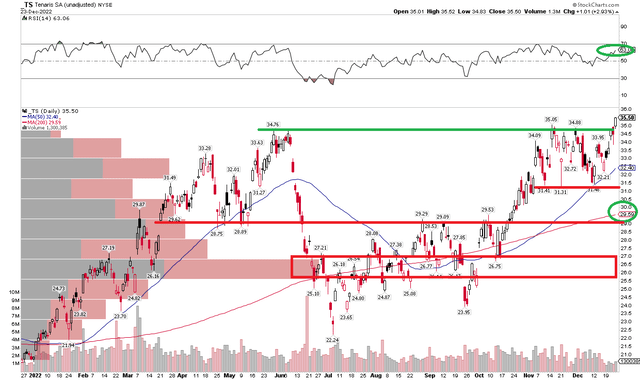

The Technical Take

TS broke out to fresh 52-week highs on Friday, one of the few stocks that can make such a bullish claim. What I like about the chart below is not only the new high but also the levels of support underneath the breakout point. That should lead to dip-buyers on pullbacks. First, the $31 to $31.50 zone was the handle low in a bullish cup with handle pattern while the cup top is near $35. That should lead to a bullish price target of about $46 based on the low near $24 back in Q3.

More support is seen at the rising 200-day moving average and range-highs from July through mid-October near $29 to $30. Finally, there is a high amount of volume-by-price in the $26 to $27 area.

A bearish factor, however, is that RSI has not confirmed the price breakout. I would like to see momentum make a new high soon. Still, long here with a stop under, say, $31 makes sense, targeting the mid-$40s.

TS: Bullish Cup & Handle Breakout

Stockcharts.com

The Bottom Line

Tenaris is among the few global equities breaking out to fresh multi-year highs. I like the valuation and chart, though momentum could improve. I think both long-term investors and swing traders can play this one from the long side.