AlanGH/iStock via Getty Images

Overview:

The Timken Company (NYSE:TKR) manufactures high-grade steel products, especially ball bearings. It has been in business since 1899 and has paid a dividend for over 100 years.

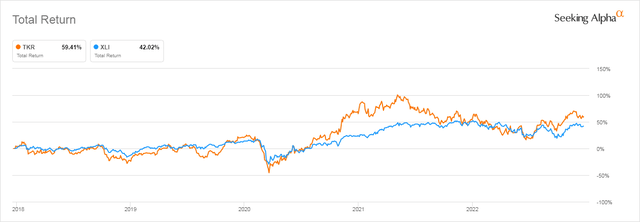

Over the last 5 years, TKR has outperformed the largest manufacturing ETF Industrial Select Sector SPDR Fund (XLI) by 59% to 42%.

Seeking Alpha

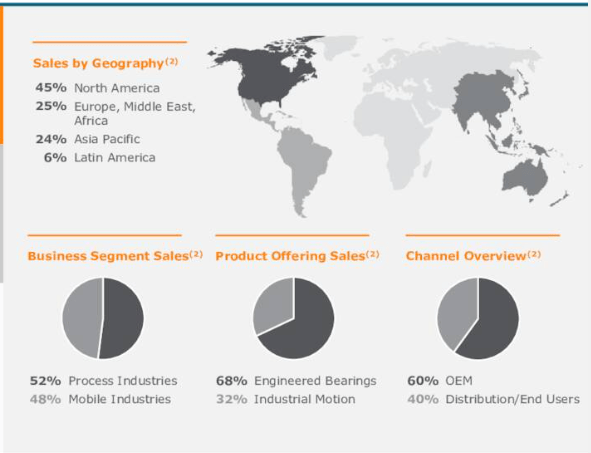

Timken’s product lines include ball bearings and industrial motion products for a wide range of industries spread all over the world.

Timken

In this article, I will analyze whether Timken is likely to thrive in the coming 2023 economic environment.

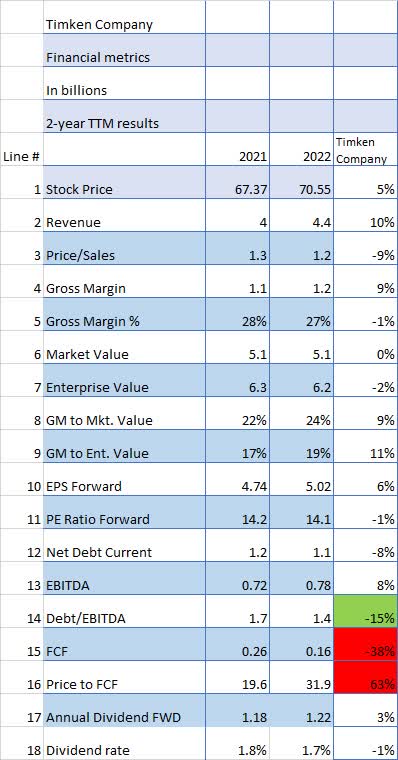

Financial metrics

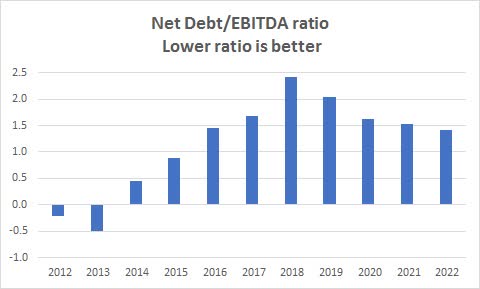

When we look at the financial metrics comparing the TKR on a 2-year TTM (Trailing Twelve Month) basis, several metrics should be noted. The first one is the Debt/EBITDA ratio which has improved by 15% year over year. However, that is offset by the negative FCF (Free Cash Flow metrics) (Lines 15 and 16) which show TKR with a negative FCF of 38% and a resulting increase in the Price/FCF number by 63%.

Per Philip Fracassa – CFO:

“Moving to free cash flow, we now expect to generate $250 million for the full year 2022. This is lower than our prior outlook and reflects higher working capital driven by increased sales and ongoing supply chain issues.” Source: Timken

All the other numbers tend to be in a narrow range plus or minus.

Seeking Alpha and author

The dividend did increase by 4 cents a share year over year.

When looking at the Financial Metrics in total, there is not a significant difference between the two years.

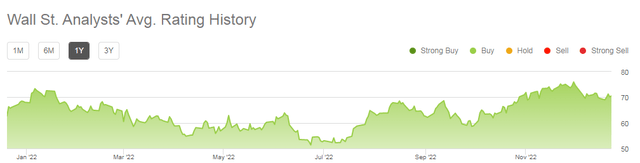

Analysts’ ratings

Wall Street analysts appear to have relatively strong feelings for TKR, with the last year being a solid, continuous Buy.

Seeking Alpha

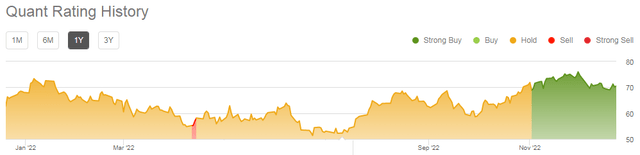

Quants have had a Hold rating for most of the year but since November have switched over to a Buy rating.

Seeking Alpha

Seeking Alpha authors have had a steady Buy rating on Timken for the last 11 months or so but have now switched to Hold.

Seeking Alpha

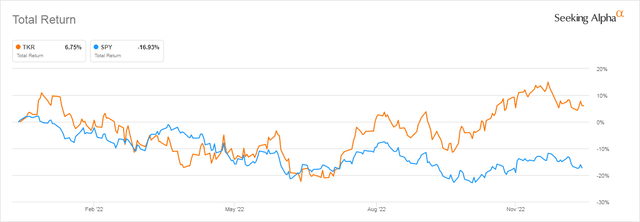

Looking at TKR’s Total Return (including dividends) over the last year shows a 7% gain versus the S&P 500 loss of -17%.

Seeking Alpha

So Timken has outperformed the market over the last year.

Dividends, share buybacks, and net debt

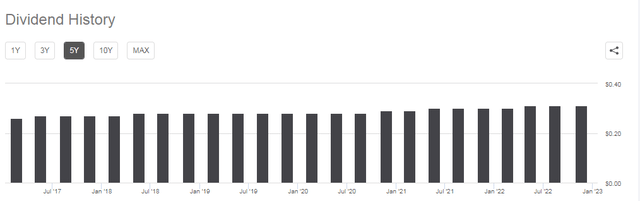

Timken has paid a dividend for an amazing 401 quarters in a row.

From a capital allocation standpoint, we paid our 401st consecutive dividend and purchased about 1% of the outstanding shares. Source: Timken

Over the last 5 years, TKR has raised the dividend every year going from .26 per quarter to .31 per quarter an increase of 20%.

Seeking Alpha

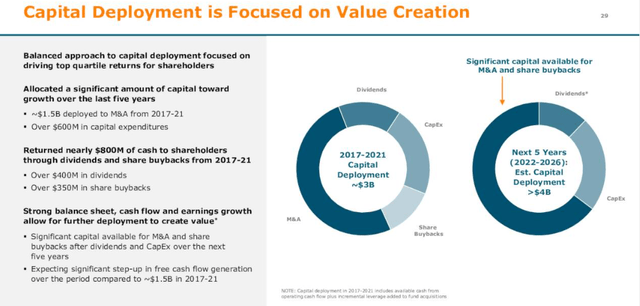

TKR has a balanced plan for capital deployment including increasing the dividend and share buybacks. Note for the coming years 2022-2025 even more capital may be available for share buybacks.

Seeking Alpha

Timken has also been improving its Net Debt to EBITDA ratio ever since 2018. It is currently under 1.5x which is very good for a heavy industrial company like Timken.

Author

So on the three important metrics dividends, buybacks, and Net Debt/EBITDA ratio, Timken looks exceptional.

Risks

Large, capital-intensive industrial companies, like Timken, tend to have problems with debt piling up as they expand their business. This often affects both the price of the stock and the dividend payments as they attempt to pay down the capital expended as the new products come on board but sometimes there is a lag between the two.

In a volatile environment like we’re facing now, cash is also a viable alternative. CD rates are now in excess of 4% a number we haven’t seen literally in years.

In addition, there could be a recession coming or even a depression, according to several economists. That may make profits elusive at best and provide losses at worst.

So please, do your own due diligence on every investment option.

Conclusion

Timken is an outstanding manufacturer and has outperformed both the S&P 500 and the world’s largest industrial ETF, XLI. This shows that on a head-to-head basis Timken could be an excellent long-term investment.

However, one chink in the armor may be how it performed during the last recession period 2007 to 2009. In this particular case, it did not do well falling by more than 35% over that 18-month period.

Seeking Alpha

Since many economists (and investors) think we are headed into a recession or worse, in 2023 Timken may not be the best investment at this time.

I rate Timken as a Hold until we can see how 2023’s economic performance turns out.