mbbirdy

The Gold Miners Index (GDX) has put together a decent bounce off its lows after a violent 2-year cyclical bear market, but many gold developers continue to tread water, with some of this being self-inflicted (excessive share dilution), and in other cases, it’s simply a case of being painted with the same negative brush for the sector. The negatives for developers are numerous, with a tight labor market, inflationary pressures, rising contractor costs, a risk-off environment, and low equity prices. The result is that developers who must regularly raise capital will see their dollars go further, and each dollar being raised is being done at a lower price due to the steep drop in share prices sector-wide.

Given the deterioration in the fundamentals, I have been less inclined to buy exploration/development stories, given that the outlook for share dilution was negative and project economics were becoming stale as input costs rose and upfront capex also increased considerably (rising steel, fuel, and labor costs). That said, there are always exceptions to the rule, and while producers have been the safer bet, the time to go shopping for the developers that offer more torque is when considerable damage has already been done and the excess has been wrung out of the sector. The caveat is that focusing on quality is paramount in this smaller-cap space of the sector, and buying laggards can lead to zeroes. Hence, the best opportunities are those that have been thrown out with the proverbial bathwater with little fundamental justification.

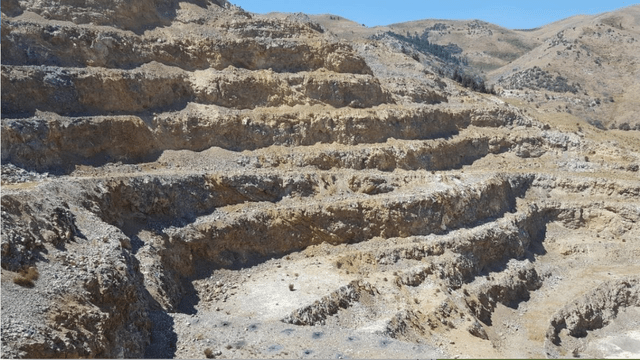

Black Pine Project (Company Report)

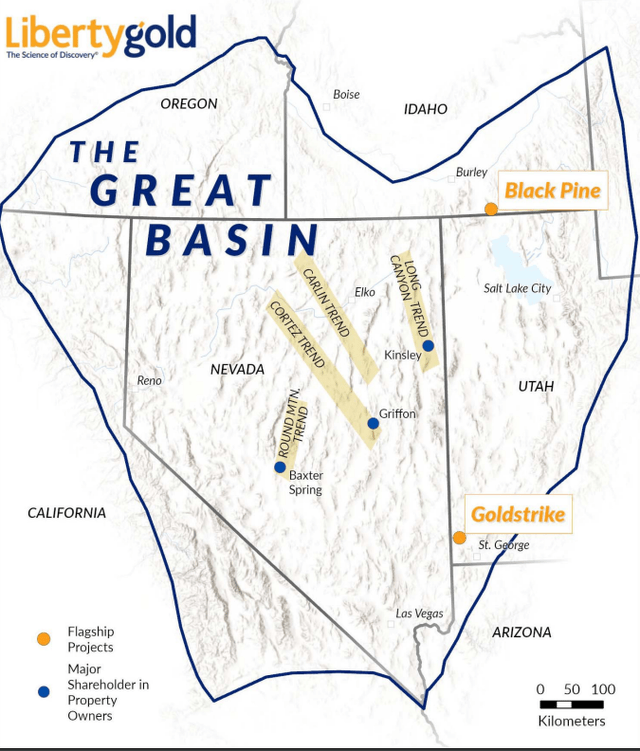

One name that fits this bill that is sporting one of the largest valuation disconnects sector-wide is Liberty Gold (OTCQX:LGDTF), a gold developer with two oxide gold projects in the Great Basin in the Western United States. Its flagship project is Black Pine which sits on the Idaho/Utah border and is the focus of the company’s exploration/development dollars. However, the company has another solid project in southern Utah (Goldstrike), capable of producing ~95,000 ounces per annum at sub $1,000/oz all-in-sustaining costs [AISC]. Let’s take a closer look at the company below and why this developer is worth keeping near the top of one’s speculative watchlist:

While Liberty Gold has two projects in the Great Basin, it’s become quite clear after more than two years of drilling that Black Pine may not be the most advanced, but it has the most geological potential, with the possibility that this asset could ultimately host a 4.5+ million-ounce resource. Given that I see this southern Idaho project as the clear leader in the company’s portfolio, this article will focus exclusively on Black Pine. Still, as previously stated, Goldstrike is a very enviable #2 project and one that boasts an estimated NPV (5%) of ~$250 million, even at a $1,725/oz gold price. All figures are in United States Dollars unless otherwise noted.

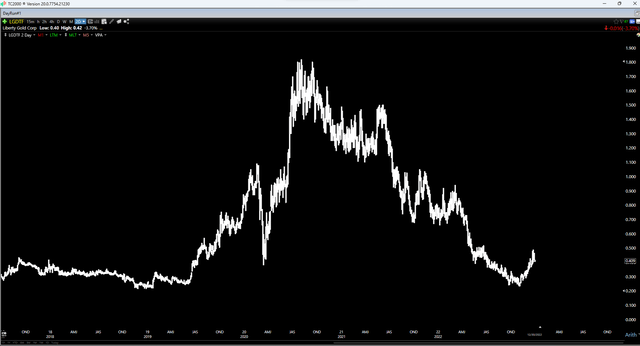

A Significant Fall From Grace

Liberty Gold has seen a significant fall from grace over the past two years, giving up most of its Q1 2019 to Q3 2020 advance, where it was one of the best performers sector-wide (~690% return). This is evidenced by the stock suffering an 86% decline from its Q3 2020 highs above US$1.80 per share and ultimately falling to near US$0.20 per share, a price that the stock hasn’t visited since the gold price sat near $1,500/oz. However, while declines of this magnitude in other juniors are partially justified due to considerable share dilution, Liberty has done an excellent job keeping share dilution to a minimum.

In fact, the company has seen less than a 20% increase in its fully-diluted share count from ~295 million fully-diluted shares at the end of Q3 2020 (stock’s peak) to just ~344 million fully-diluted shares estimated at year-end. This has been achieved by selling off non-core assets in a favorable environment, including the sale of Hailaga in Turkey near the peak for gold juniors, its share in Kinsley Mountain, a Net Profit Interest [NPI] on the Regent gold project, and the Griffon Property, as well as a few smaller transactions. The result is that Liberty could fund ~$30 million in exploration without diluting shareholders, something that many other juniors should have done with several non-core assets in their portfolio.

LGDTF – 3 Year Chart (TC2000.com)

Fortunately, while some other projects have seen a significant decline in the quality of drill intercepts despite maintained or increased exploration budgets, Liberty’s Black Pine mineralized system continues to show excellent continuity and continues to grow in size, with the project almost unrecognizable vs. how it looked nearly two years ago at the time of its maiden resource estimate. So, while share-price performance alone might suggest that Liberty Gold has failed to make any meaningful progress on its flagship assets, I do not believe this to be the case. Instead, I think this is a case of a stock that got ahead of itself in Q3 2020 at a ~$530 million valuation but has now overshot to the downside by a wide margin despite a massive improvement in the fundamentals.

Black Pine Project

Liberty Gold’s Black Pine Property is a past-producing mine that is located 29 kilometers northwest of Snowville, Utah, right along the Idaho/Utah border. The property was purchased from Western Pacific (OTC:WPMLF) (WP:CA) for $1.1 million in cash/shares and a 0.50% NSR royalty. This has turned out to be a hell of an acquisition near the bottom of the gold market, with this project already hosting a pit-constrained resource of ~135 million tonnes at just shy of 0.50 grams per tonne of gold, with the bulk of this resource in the indicated category. However, a lot has happened since its maiden resource in May 2021, and I would be shocked if the resource base didn’t ultimately double in size, given all of the positive developments from an exploration standpoint.

Liberty Gold Exploration (Company Website)

For those unfamiliar with the project, Black Pine saw historical production from the Tallman Pit of ~109,000 tonnes at 5.14 grams per tonne of gold in 1949-1955 and saw additional production of ~435,000 ounces of gold by Pegasus at grades of 0.52 to 0.82 grams per tonne gold between 1991 and 1997. After production was completed, the heap-leach pad at the project was rinsed and reclaimed. The project mostly sat idle from then to 2016, with sparse drilling by Western Pacific and geophysical surveys being completed before the eventual sale to Liberty Gold in 2016. Black Pine is unique from a geological standpoint because it has Carlin-style mineralization (named after the town of Carlin in Northeastern Nevada), but it is located off the main and well-endowed Carlin/Cortez trends (famous for Carlin-style mineralization).

Cortez Complex – Nevada Gold Mines (Company Presentation)

These types of deposits represent some of the largest hydrothermal deposits globally, typically form at shallow depths, and can host monster deposits, with the most notable being Newmont’s Carlin Mine in Nevada, which was discovered in 1961. Other notable examples include Goldstrike, a company-maker for Barrick Gold (GOLD), and Cortez Hills on the neighboring trend to the west. The main benefit to Black Pine is that the project is located just off Interstate 84 and it is oxidized, meaning that it has simple metallurgy and is amenable to heap-leaching. This is a very attractive attribute, given that heap-leach projects can be built for relatively modest capex yet still boast very solid production profiles. One example is Orla’s (ORLA) Camino-Rojo in Zacatecas, producing ~100,000 ounces per annum at sub $700/oz AISC.

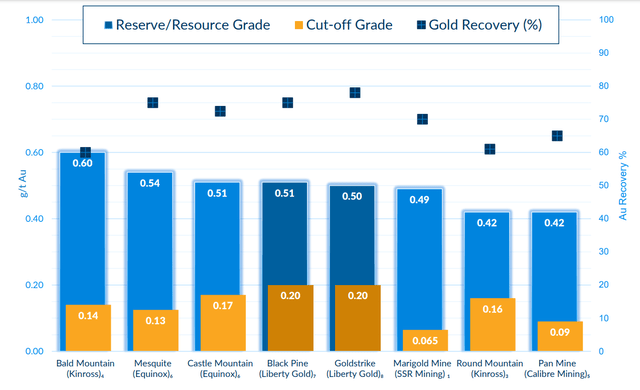

When it comes to Black Pine’s metallurgy, early work suggests that 80% of leachable gold can be extracted within ten days, and there’s a high correlation between head grades and gold extraction, with final column leach gold extractions ranging up to 94%. This suggests the potential for a straightforward run-of-mine operation at Black Pine, similar to SSR Mining’s (SSRM) Marigold Mine in Nevada, an asset that’s been in production since 1989 in the neighboring state of Nevada and which still has an 11+ year mine life with considerable exploration upside south of its main deposit. Now that we have some basic information about the project, let’s take a closer look at the project and the progress made to date:

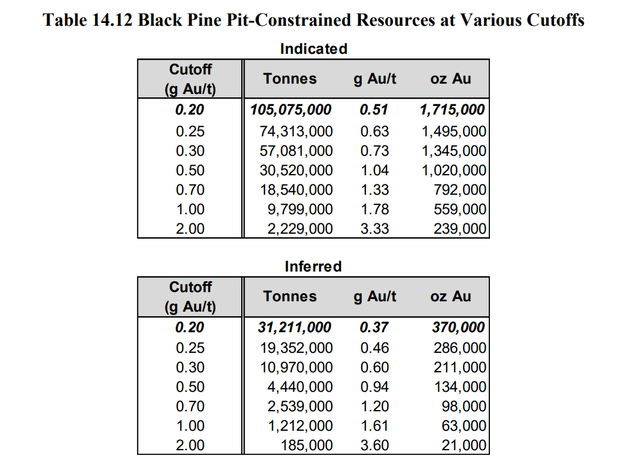

Black Pine Today vs. Black Pine 2021

As shown in the below table, Black Pine hosts a large pit-constrained resource of ~1.72 million ounces in the indicated category (0.51 grams per tonne of gold) and another 370,000 ounces in the inferred category at 0.37 grams per tonne of gold. At first glance, these grades might seem alarmingly low, and they certainly don’t fit the “grade is king” model when there’s a fraction of a gram of gold per tonne of rock. However, run-of-mine heap-leach assets can be very productive assets even at low grades.

Liberty Gold Resource Base (Company Report)

Some examples include Marigold for SSR Mining (0.49 grams per tonne of gold), Round Mountain for Kinross (KGC) at 0.42 grams per tonne of gold, Bald Mountain for Kinross (0.60 grams per tonne of gold), Kisladag for Eldorado Gold (EGO) at 0.68 grams per tonne of gold, and Veladero for Barrick (0.75 grams per tonne of gold). Given Black Pine’s above-average projected recovery rates (80%) recovery, this should more than offset its slightly lower grades than operations such as Bald Mountain (Nevada) and Mesquite (California).

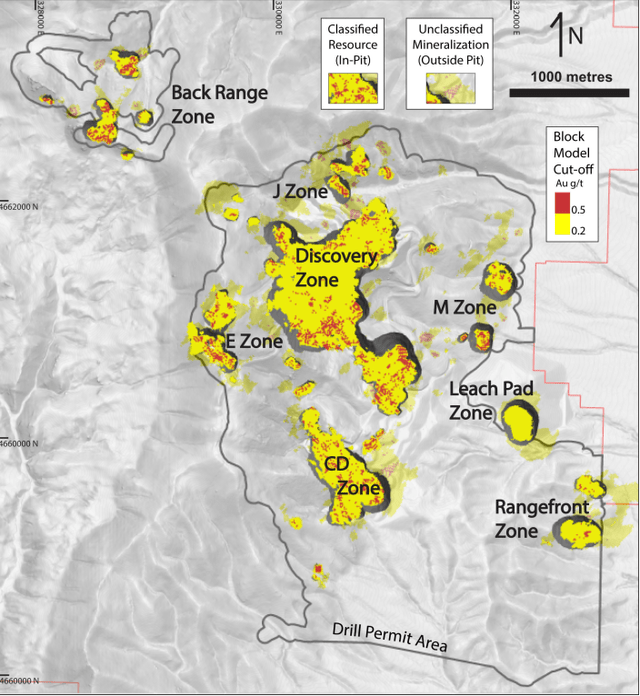

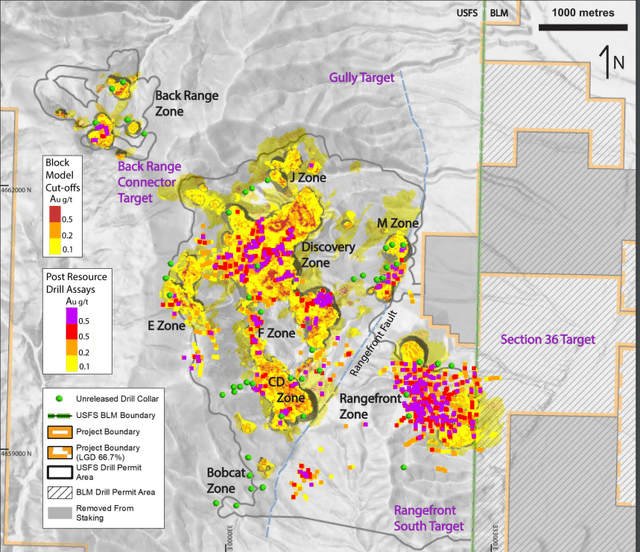

Black Pine 2021 Resource Distribution (Company Presentation)

While the ~2.1 million-ounce resource base already represents a sizeable resource, it’s important to note that Liberty Gold has made considerable progress since 2021 regarding expanding the footprint at Black Pine. To provide some perspective, we can look at the above image. This highlights the eight zones included in the resource, with nearly 83% of the resources contained in the Discovery and CD Zones combined, which host a total resource of ~1.73 million ounces. The notable difference between the above image and the below image of Black Pine today is that we’ve seen a massive increase in the size of the Range Front Zone, which also hosts a high-grade core (southeast of the main deposit); drilling at the F Zone has merged the gap from the CD Zone to the Discovery Zone, and two small zones to the east at the M Zone look to be merging into a single larger pit.

Black Pine Today (Company Presentation)

In addition to delineating the Rangefront Zone, a new deposit that looks to be similar in size to the Discovery Zone (the main contributor from a tonnage standpoint to Black Pine’s previous resource base), the company continues to see drill success at multiple new targets, and it has several new targets to follow up on next year. These include the Bobcat Zone to the south (highlight intercept of 19.8 meters at 0.64 grams per tonne gold 500 meters south of CD Zone), the Gully target two kilometers north of the M Zone, and the Back Range Connector target, which could close up further gaps in what’s already massive seven-kilometer-long northeast to southwest section.

The particularly encouraging news is that the high-grade core at Rangefront and the M Zone is relatively high grade (multiple 0.90+ grams per tonne of gold intercepts) and sits right near where the company will likely look to place future processing infrastructure (east of the Discovery Zone). It’s also exciting that the company has recently encountered shallow oxide mineralization in yet another unfilled corridor (the northern portion of the F Zone/Discovery Zone gap) and the previous heap-leach operation. Finally, while Liberty initially hit non-oxide mineralization at the South Rangefront target (51.8 meters at 0.57 grams per tonne of gold), it does indicate that the Black Pine system extends another 500 meters south of the southern edge of Rangefront, and more work is planned here next year to hunt down additional oxide material.

So, what does this mean for the company?

While it’s early and difficult to nail down the size of this resource without knowing exactly what might be included in the resource and drill spacing, I would not be surprised to see the total indicated resource at Black Pine increase from ~1.72 million ounces to 2.8 plus million ounces in its upcoming resource estimate, with further growth to 3.1 to 3.2 million ounces with the benefit of another year of drilling (Q1 2024). Meanwhile, it looks like the total resource at Black Pine could ultimately have ~5.0 million-ounce potential, which could support a nearly 3.0 million-ounce reserve base. This is excellent news, given that deposits of this size in Tier-1 jurisdictions aren’t easy to come by and can lead to potential suitors sniffing around (increasing Liberty’s attractiveness as a possible takeover target).

The other major takeaway is that this could support a much larger operation than the 10 million tonnes per annum initially contemplated, with the possibility of a 20+ million tonne per annum operation. While this would result in lower head grades due to being less selective on what it’s mining (sub 0.15 cut-off grade), we would see a significant improvement in the strip ratio to 1:1 or better by bringing in more material with the massive halo of lower-grade mineralization surrounding high-grade pockets within the Black Pine mineralized system. The result is that what previously looked like a ~130,000-ounce per annum operation over its life of mine could be a ~170,000-ounce per annum operation, with 200,000+ ounces in its earlier years with a focus on shallow high-grade ounces to accelerate the payback.

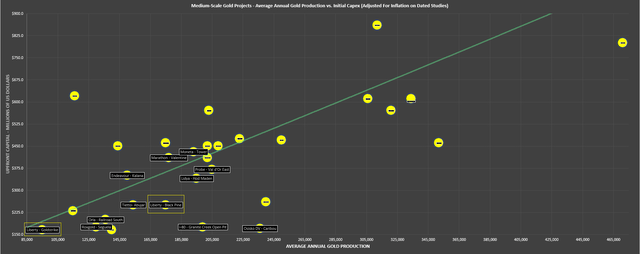

Obviously, with no updated resources in place yet (Q1 2023) and some work still left to be done, the below chart comparing undeveloped gold projects might be a little premature. Still, this is a look at the potential of Black Pine and Liberty’s other Goldstrike project vs. other undeveloped/construction-stage gold projects. As we can see, its projects stack up exceptionally well, well below the trend line, which compares average annual production profiles vs. upfront capex to build these projects. In fact, Liberty Gold’s Goldstrike Project is one of the best projects globally, with a respectable production profile and very low up-front costs, which is certainly nice to have as a #2 project behind Black Pine. And, as we can see, with both of these assets in production, Liberty could be a 275,000-ounce per annum producer.

Undeveloped Gold Projects – Average Annual Production vs. Initial Capex Estimates (Company Filings, Author’s Chart)

While no two companies or projects are exactly alike, and there are many factors at play, Orla Mining briefly traded up to a market cap of $1.50 billion as a heap-leach producer. However, it had a massive sulphide project in the development stage at Camino Rojo. Still, even if we shave $600 million off this valuation to adjust for the value of the Sulphides Project, Orla still traded at a ~$900 million valuation in April with one operating mine (Camino Rojo in Mexico), and Cerro Quema in Panama with ~225,000-ounce combined potential. So, if Liberty Gold put these two assets in production post-2026, I wouldn’t rule out an $850+ million valuation for the stock long-term.

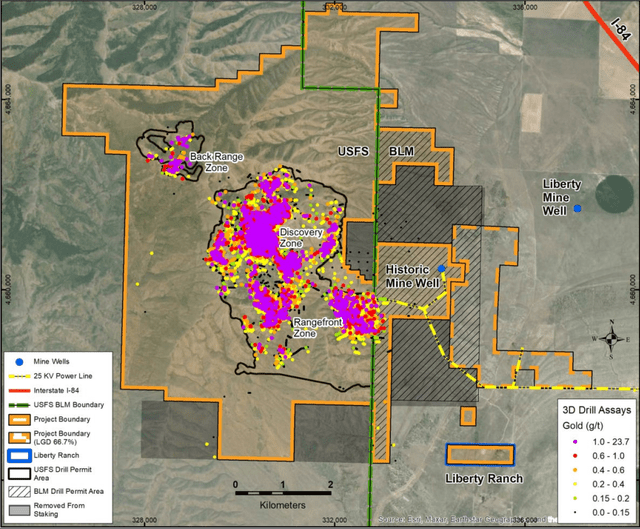

Finally, it is worth noting that Liberty is being very proactive when it comes to de-risking this project. Not only has it secured ample water rights to support a massive operation that’s even larger than it’s currently contemplating at Black Pine. The company also completed the acquisition of a controlling interest in private mineral rights held over BLM lands, giving it additional room for exploration and, most importantly, prime real estate for a future heap leach pad. In fact, when it comes to its future process water supply, the company now has over 4 million cubic meters, which could support well over 100,000 tonnes per day or double the initially planned throughput rate. Let’s take a look at Liberty’s valuation:

Black Pine Project (Company Presentation)

Valuation

Based on ~344 million fully-diluted shares and a share price of US$0.41, Liberty Gold trades at a market cap of ~$141 million, which is a dirt-cheap valuation for a company with two heap-leach projects in its portfolio in Tier-1 ranked jurisdictions. If we compare this figure to an estimated NPV (5%) of $520 million at Black Pine ($1,725/oz gold price assumption), we can see that Liberty is trading at a fraction of Black Pine’s estimated value, sitting at just 0.27x P/NAV. However, it’s important to note that this ignores its TV Tower Project, the company’s year-end cash position of ~$16 million, and its Goldstrike asset in Utah.

Even if we value cash at zero (given that it will be spent on development) and we value Goldstrike at just $250 million ($1,725/oz gold) after adjusting for inflationary pressures, this translates to a fair value for Liberty Gold’s two core projects of $770 million. Even if we use a P/NAV multiple of 0.45 to value the company, which I would argue to be a fair multiple for a development-stage company with two projects in Tier-1 jurisdictions, this translates to a fair value for Liberty Gold of ~$347 million. After adding a conservative $20 million for TV Tower (a non-core asset in Turkey that could be monetized), fair value comes in at $367 million or US$1.06 per share. Hence, even after Liberty’s recent rally, I still see a 158% upside to fair value.

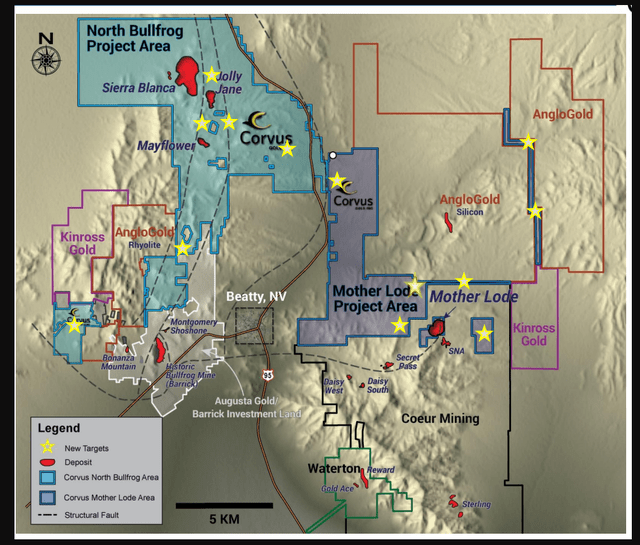

A 158% upside to fair value might seem like a stretch to some investors, and investors should be skeptical since it always pays to be conservative. In fact, one should always try and vet price targets that imply triple-digit return potential to ensure numbers aren’t being massaged to paint the rosiest case possible. One way to vet these figures is to look at acquisitions over the past two years of open-pit, heap-leach projects in the United States. The two that stand out are Gold Standard Ventures, which was acquired for ~$190 million, and Corvus Gold, which was acquired for $370 million.

These acquisition prices translated to a valuation per measured & indicated ounce [M&I] of ~$97 and ~$106, respectively, with these figures being more than 100% higher than where Liberty currently trades at ~$44/oz based on an estimated ~3.2 million M&I ounces at Black Pine proven up by Q2 2024 (US$141 million market cap / 3.2 million ounces). That said, there are some unique attributes and differences worth pointing out between these two acquisitions and Liberty Gold’s situation, which could have impacted the price that Orla Mining and AngloGold Ashanti (AU) were willing to pay to acquire these development-stage juniors (Corvus and Gold Standard Ventures).

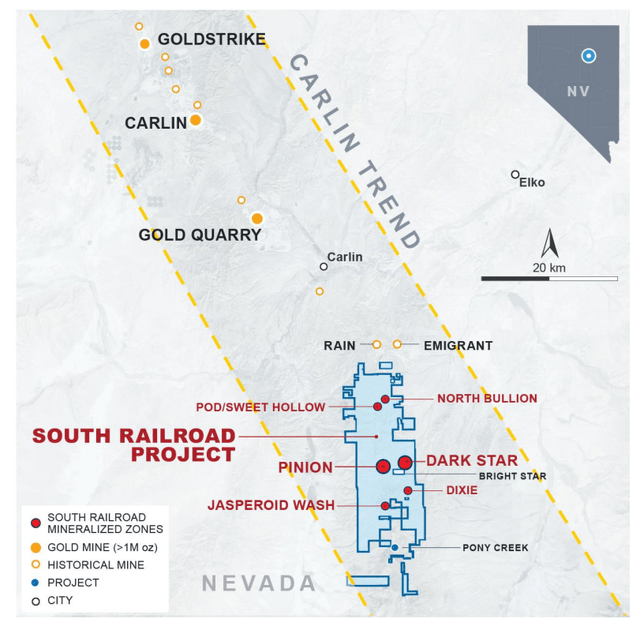

Orla Mining – South Railroad Project & Land Package (Orla Mining Presentation)

AngloGold Land vs. Corvus Gold Land/Deposits (Corvus Presentation)

In Orla’s case, the company added a Tier-1 jurisdiction project to help diversify itself away from Mexico/Panama, meaning it might have been willing to pay a little more for this diversification. Secondly, Gold Standard Ventures Railroad South Project came with an absolutely massive land package, with Orla Mining scooping up the second-largest land package on the Carlin Trend. Meanwhile, in AngloGold’s case, the company added strategic ounces in an area where it already had a presence (Silicon), suggesting potential future synergies and a willingness to pay a little more than it might have for more orphaned ounces in a separate jurisdiction. Based on the unique benefits of these acquisitions, I don’t think it’s unreasonable to place a 20% discount on the prices paid in these acquisitions to be conservative.

Still, even applying a 20% discount to the average price paid per M&I ounce would translate to a fair value for Black Pine’s ounces of ~$81/oz. If we multiply this figure by an estimated 3.2 million M&I ounces delineated by Q1 2024, this translates to a fair value of $259 million. So, the value of Black Pine alone, based on a 25% discount to the price paid in previous acquisitions, translates to a fair value of US$0.75 per share. The other $108 million can easily be covered by Goldstrike and TV Tower with an estimated NPV (5%) of $250+ million at Goldstrike or $112 million at a 0.45x multiple. To summarize, this sum-of-the-parts valuation is corroborated by the price paid in recent M&A transactions, and one could argue that investors are still getting TV Tower and exploration upside at Black Pine (RF South, Bobcat, Gully, and other regional targets) for free.

Risks

There are several major risks when investing in gold developers, and one could write a multi-page report dedicated solely to these risks. However, I would argue that three of the major boxes that must be checked once a project reaches critical mass and looks like it could be mine are the following:

1. a competent management/technical team with the ability to efficiently move a project forward (minimal share dilution)

2. a project that ideally has simple metallurgy and is robust enough that it has some margin for error coupled with a high probability of being permitted in a non-volatile jurisdiction (geopolitical surprises)

3. an ability to finance the project with a mix of ideally primarily debt and equity without major dilution, an ideally an initial capex to market cap ratio of 2.0 or less

The importance of #2 cannot be overstated because no matter how great a project’s drill results might appear, these drill results and resources have to be able to translate into an economic mine at the end of the day, and a mine that will be permitted so it can eventually move into operation. While permits weren’t an issue for Pure Gold’s (OTC:LRTNF) Madsen and AG&S’ (USAS) Relief Canyon, which did go into production, excess mining dilution and too ambitious of a mine plan broke Madsen’s back, and carbonaceous material in the Relief Canyon Pit put a quick end to AG&S’ ambitious plans for this asset.

Resource/Reserve Grade, Cut-off Grade, Recovery Rates – Select United States Heap-Leach Projects/Operations (Company Presentation)

Fortunately, Liberty has simple metallurgy at Black Pine and Goldstrike, and projected recoveries are above average at both assets. And from a permitting and de-risking standpoint, Black Pine benefits from having more than enough process water rights already secured (~4 million cubic feet per year of process water), plus it sits on a property with no timer values, no water within the mineralized area, and most importantly, no fish-bearing streams and no threatened or endangered species. Given the limited environmental footprint and the fact that this robust project would immensely benefit Idaho’s economy, I would expect strong support for the project.

Some investors in Perpetua (PPTA) might prefer to steer clear of Idaho with the difficulties that Stibnite has had moving into production. However, it’s worth noting that these projects are apples and oranges from a capex standpoint (sub $275 million vs. $1.0+ billion), and there are no previous environmental issues at Black Pine like we have seen in Northern Idaho at Stibnite.

Liberty Gold Projects (Company Presentation)

Point #3 is just as important as point #2 because even if a project is relatively straightforward, it’s not going into production if it can’t be financed. Meanwhile, financing through streams and or royalties can severely impact project economics depending on the structure of the deal. In Liberty’s case, I would expect upfront capital for Black Pine to come in below $270 million even in an expanded throughput scenario and upfront capex for Goldstrike is likely to come in below $175 million even when adjusting for inflationary pressures (2018 estimates: $113 million). Hence, both meet the 2.0 to or lower initial capex to market cap ratio, which assumes no further share price appreciation for Liberty Gold.

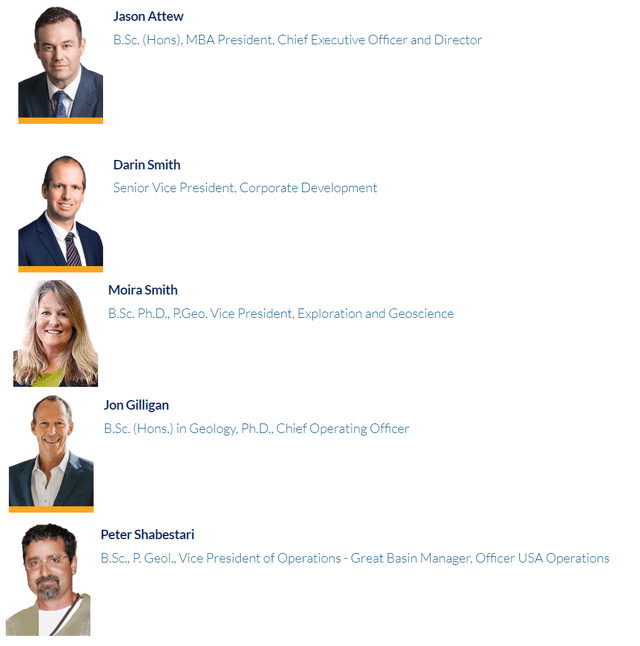

While #2 and #3 might seem the most important, I would argue that #1 is the real one to be careful of because some management teams do a much better job of mining shareholders than they do their gold deposits (assuming they ever make it into production. In the case of some of these companies, the share dilution and warrant overhang are so significant that the stocks see lifeless returns even if they do head into production, given that production per share or expected production per share drops like a stone due to constant share dilution. While Liberty Gold passes with flying colors when it comes to #2 and #3, I would argue that it excels just as much on point #1 with an all-star management team with considerable experience and arguably one of the most well-rounded teams in the junior space.

Liberty Gold Management (Company Website)

For starters, the company’s CEO is Jason Attew, with 25 years of experience in the sector, including investment banking experience at BMO Metals & Mining (structuring/raising growth capital and M&A) and experience at a previous top-10 gold miner as the CFO of Goldcorp. Secondly, Darin Smith is VP of Corporate Development with over twenty years of experience in the sector, also spending time at BMO in their Metals & Mining Group and as VP of Corporate Development of Kirkland Lake Gold before its merger with Agnico Eagle (AEM).

Backing up the considerable experience in these two positions are Moira Smith and Peter Shabestari, who are the company’s VP of Exploration & Geoscience, and VP of Operations, respectively. Moira Smith was formerly the Chief Geologist for Fronteer Gold and was instrumental in the advancement of Long Canyon, one of the most significant discoveries and acquisitions ($2.0+ billion) in North America in the past two decades. For those unfamiliar, Long Canyon was an ultra-high-grade run-of-mine oxide heap-leach project in Nevada with grades more than quadruple the industry average for heap-leach projects. Notably, Peter Shabestari was also part of the Fronteer Long Canyon Team and is in charge of advancing Black Pine and Goldstrike through development and oversees engineering, metallurgical, hydrological, and geotechnical studies.

Finally, one of the more recent appointments, which is a huge value add for the Liberty team that any operating company would be elated with, is Jon Gilligan as Chief Operating Officer. Jon Gilligan previously held senior and technical project roles at Torex (OTCPK:TORXF), SSR Mining, and BHP (BHP). He has an impressive 35 years of experience in the sector at projects that include the Chinchillas Open Pit, the Olympic Dam Expansion, the Escondida Mine, and SSR Mining’s Marigold Mine in Nevada. This doesn’t only add key experience to help advance Black Pine and Goldstrike but also applicable experience. The reason is that given how Black Pine is increasing in size, Marigold is an example of what this asset could look like once in production (60,000+ tonne per day heap-leach operation in the United States.

To summarize, the addition of Jason Attew, Darin Smith, and Jon Gilligan is a solid addition to a team that already had experience with oxide projects in the United States (Fronteer Gold team at Long Canyon). Investors can be comforted that this team knows exactly what it’s doing; it can raise capital efficiently and optimize its two heap-leach assets. Given the solid team in place, I see a very bright future for Liberty Gold. Finally, while no longer CEO, I’d be remiss not to point out that Liberty’s former CEO, Cal Everett, did an exceptional job getting Liberty to where it is over the past two years and minimized dilution in arguably the toughest market for juniors in years. This was accomplished by being realistic and recognizing early what assets were core vs. non-core and monetizing those assets in a hot market.

So, to end a long-winded Risks section, I don’t see any major or unusual risks for Liberty relative to most other developers. In fact, I would argue that it has a clearer permitting path. In addition, while Black Pine and Goldstrike’s upfront capex will come in higher than investors might have been forecasting as of 2021 (partially due to scope changes at Black Pine, but mostly inflationary pressures at both assets), this isn’t company-specific, and heap-leach projects benefit from low capital intensity already. Plus, this is a team capable of raising money to move these assets into production. So, arguably the biggest negative is that permitting takes time, so investors will require patience to see this story blossom.

Summary

The gold developers/explorers have been massacred over the past two years, and to be fair and unbiased, this violent correction isn’t entirely without merit. This is because, in a pocket of the sector that is already high-risk and where only a fraction of developers makes it into production, their path to production has become much bumpier, and the likelihood of considerable share dilution has increased immensely. However, I believe that some very solid companies are thrown out with the proverbial bathwater and painted with the sector’s negative brush despite their execution.

I believe Liberty Gold is clearly one of these companies, and the major theme of 2022 for Liberty has been closing the gaps, with the company successfully filling in key gaps between pits to consolidate smaller pits into larger pits and ultimately creating a project which will benefit from greater economies of scale and solid economics. Investors should get a better idea of these economics by December 2023 as the company works toward a Pre-Feasibility Study. Ultimately, I expect this to be one of the better-looking undeveloped projects sector-wide. Plus, we already know Goldstrike is a very solid asset that just needs to secure water, even if capex increases to $160+ million with inflationary pressures. So, with Liberty trading at just ~0.20x estimated P/NPV (5%), I would view any pullbacks in the stock below US$0.36 as a buying opportunity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.