Hispanolistic/E+ via Getty Images

Investment Summary

With the new year bestowed upon us, we are back at it straight away in analyzing high quality growth/value opportunists that lie within the medical technology spectrum. The coming year is sure to be equally as tantalising for equity markets as it was in FY22′, especially considering the distribution of possible outcomes for the global economy. Many are forming a mild recession in the base case, and this means a higher cost of capital for currently unprofitable names, and therefore a higher hurdle rate for investors to accept equity risk.

We had finished the year rigorously covering the investment prospects of OrthoPediatrics (NASDAQ:KIDS) as a potential key differential in our orthopaedics exposure. Whilst the company has a number of growth hurdles to overcome, we believe there’s scope for KIDS to re-rate to the upside on a forward-looking basis. Specifically, our investment thesis is predicated on the following factors:

- KIDS presents as a niche operator in the paediatrics corner of the broad orthopaedics market. It should be noted that the economics for this segment is vastly different than the adult populous, notwithstanding the unique sub-class of orthopaedic conditions present. Foremost is the distribution of revenue from orthopaedic implements. Unlike in adults, children are still developing in musculoskeletal structure, meaning that many implements and treatments are ongoing, and require re-sizing. This creates a long tail of asset returns for each of KIDS’ segments, given the revenue stream attached to each patient as he or she advances in age and development.

- Following from this, given its paediatrics exposure. KIDS is competing in a standalone class of orthopaedics, and isn’t competing against the broader orthopaedic market. This presents investors with an added source of portfolio value, whilst providing diversification benefits.

- The heavy selloff in KIDS equity across FY22′ now sees its share price trade at its lowest mark in over 2-years, providing a more confident case for entry at 2.4x book value.

- Recent strategic acquisitions provide KIDS with ownership of key platforms that have a high probability of success in treatment. I’ll be discussing these in the report below. Hence, it now has an organic growth component combined with revenue accretion from said strategic acquisitions.

- The company reports a total addressable market for its U.S. footprint of $1.7Bn, with an immediate target market of $900mm in the U.S.

Net-net we rate KIDS a buy on an initial $45 initial price objective, and see scope for it re-rating higher into the new year. Below, I’ll outline our investment findings on the company.

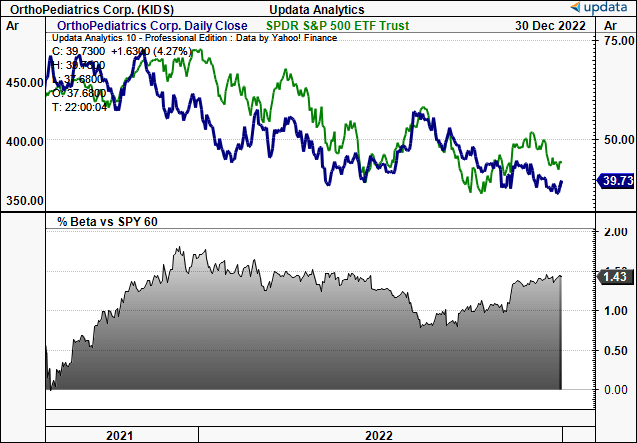

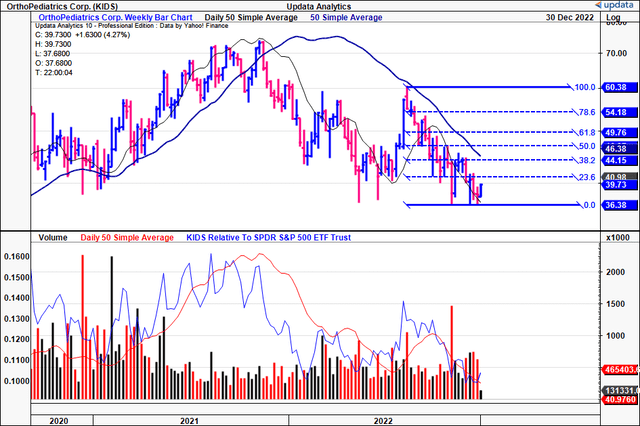

Exhibit 1. KIDS price distribution from FY21-22′ with corresponding equity beta.

Data: Updata

KIDS latest earnings serves as appropriate benchmark for full-year results

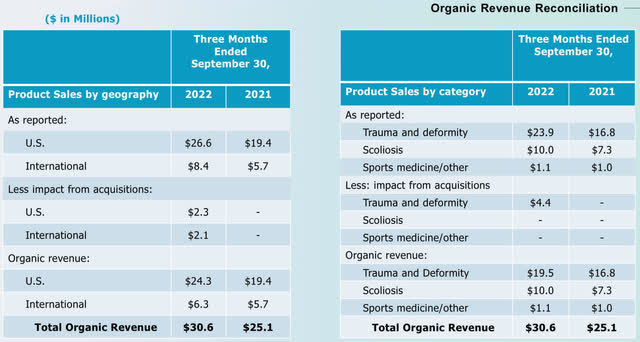

Looking at the operational results, first point is that KIDS booked global revenue of $35mm for the quarter, up 39% YoY. Importantly, KIDS provided a breakdown of its organic growth contributions versus the revenue accretion from its acquisitions [Exhibit 3].

Specifically, organic growth was 22% for the period with $4.4mm in acquisition revenue. Geographically, U.S. revenue was the main growth driver, with a 37% gain over the previous year.

Underlining this, we saw the company deployed $6.4mm in set consignments, bringing the YTD total to ~$14mm. Management estimate the ramp for deployments to have increased across the fourth quarter as well, and we’d be looking forward to its next set of numbers to examine the same.

Moving down the P&L, gross margin saw ~10bps of decompression YoY to 74.1%, whereas quarterly OpEx pulled in at 48% higher YoY, secondary to the variable expenses attached to its sales growth and deployments.

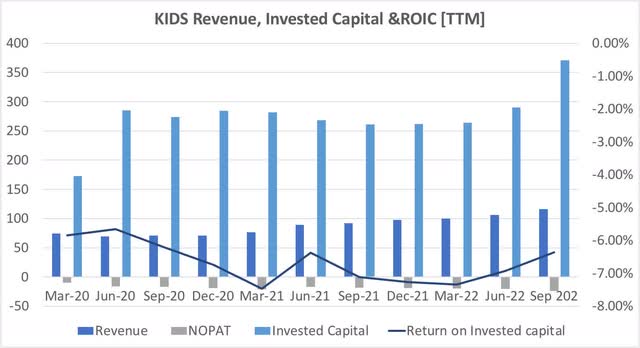

As such, the company has yet to break even at the NOPAT level, meaning it’s yet to see a positive return on its invested capital (“ROIC”) [Exhibit 2].

In order to drive future value creation downstream, the company needs to realize a positive ROIC above the cost of capital at some point in the near future. This would be imperative in the forward-looking macro landscape, especially as the cost of capital, and availability of capital, means a higher hurdle rate for growth companies such as KIDS.

Exhibit 2. As the cost of capital increases, so does the hurdle rate for companies to generate economic value. For KIDS, it must begin to deliver positive ROIC above the hurdle rate in order to unlock mid-to-long term value for shareholders.

Note: All calculations are made with no reconciliations to GAAP earnings. ROIC is also calculated without the inclusion of goodwill from the balance sheet. Doing so yields a negligible change. (Data: HBI, KIDS SEC Filings)

Exhibit 3. Breakdown of organic revenue vs. acquisition accretions, Q3 FY21 and Q3 FY22 respectively.

This would be a key metric to examine for KIDS looking ahead, as:

A). To observe the strategic value created by the acquisitions

B). The run rate of the company’s core business

Both are equally as important in the KIDS investment debate in our opinion.

Data: KIDS Investor Presentation, December 2022, pp.26

Turning to the segment highlights, we’d note there was several points to elaborate on. Being that KIDS has exposure to the paediatrics portion of the orthopaedics market, it’s imperative to analyse each division, by estimation. Our divisional takeouts are as follows:

- With respect to the trauma and deformity segment, we noted that KIDS clipped ~$24mm in revenue, a 42% YoY growth schedule. The breakdown of this included $4.4mm in global MD Orthopaedics and Pega Medical turnover combined. With that, KIDS reported a 16% YoY organic growth to $19.5mm. Growth in the core business was underscored by penetration of the external fixation division, along with the PNP femur and cannulated screw system.

- It’s also worthwhile mentioning that KIDS has potential tailwinds forming in its trauma and deformity segment. In particular, it made advancements in the commercialization of its Orthex pre-planning software during the quarter, in addition to progressing its PNP tibia and Pega deformity pipeline. This extends to its non-surgical DF2 product line, aimed at managing paediatric fractures of the femur [similar to external reduction].

- Switching to its scoliosis franchise, we saw the company posted organic growth of 37% YoY to $10mm. This was underlined by an accelerated period of new user accounts in the RESPONSE and ApiFix segment. Management report that ApiFix turnover more than doubled on a sequential basis. It also mentioned it was successful in consigning “multiple demo units of 7D” as well.

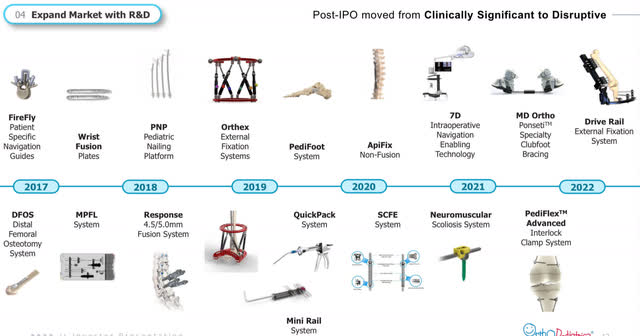

- One final segment that has piqued our interest is the expanding portfolio of its newly-acquired MD Orthopaedics (“MDO”) product line. As a reminder, KIDS acquired MDO in April of 2022 [Exhibit 4], expanding its orthopaedic offering in the non-surgical/conservative realm of treatment modalities. In particular, MDO’s ankle-foot orthoses (“AFO”) are a key differentiator in an otherwise complex area of paediatrics. AFO’s are used in a wide range of applications ranging from neurological disorders [to mitigate dropfoot] and various congenital disorders of the foot. Specifically, MDO’s AFO is aimed at targeting patients presenting with ‘clubfoot’. For reference, talipes equinovarus, more colloquially known as ‘clubfoot’, is a congenital condition of the foot that is characterized by the classical signs of excessive internal rotation and supination of the neonate or infant’s feet. As with most osseo-cartilaginous disorders in neonates and infants, it will not go away on its own, but is corrected with a combination of manual interventions. The Ponseti method is considered the gold standard of treatment for clubfoot. It involves a casting method that will realign the impacted child’s foot, and has a >90% success rate. This is often coupled with use of ‘boots and bars’, which is a name given to the foot abduction brace (“FAB”) worn by children after casting. It is patented by Ponseti and Mitchell, two of the leading authorities in the space. In total, there are 4 AFO solutions that Mitchell-Ponseti have innovated around remedying clubfoot. As a catalyst to KIDS’ portfolio, it should be noted that MDO develops and manufactures the Mitchell Ponseti AFO, and in our opinion, this is a key differentiator looking ahead. Moreover, as is a common theme in the paediatric orthopaedic segment, there is a long tail of revenue attached to each patient, because each child requires multiple sizes of as he or she grows. Given the high success rate of treating the condition with this method [as mentioned, it is now established as the gold standard amongst clinicians and practitioners] there is scope for KIDS to build this into a platform business that required no inventory risk, seeing as MDO assumes manufacturing and consignment responsibilities.

Exhibit 4. KIDS’ most recent pipeline and acquisition developments

Data: KIDS Investor Presentation, December 2022

KIDS technical analysis

Given the lack of earnings power at the bottom line, we turned to technical studies in order to gauge price visibility downstream. You can see below that it was more than a difficult year for KIDS in FY22′, like many of its peers.

The substantial re-rating to the downside saw the stock test its 52-week lows on 3 occasions. It has just come off a double-bottom, although there’s no real certainty this could mean a reversal.

You’ll see it trading below both the 50DMA and the 250DMA as well. Added to that, weekly volume trends imply that selling momentum only increased into the latter portion of the year. Contrast this to the last periods of 2020/early 2021 in Exhibit 5, whereby the volume trend suggested a period of large accumulation. The price response was equally as bullish, just as it was bearish in the latter portion of 2022.

Exhibit 5. Heavy selloff for KIDS equity in FY22′, with no countertrends or reversal rallies seen in the back end of the year. [Note: log scale shown with weekly price/volume bars].

Data: Updata

If we rein the scenario where KIDS did in fact bottom at the levels shown above, then tracing the Fibs down from the last high would suggest the next upside targets to be $40.98 then $44.15. Question is, what market data do we have to suggest it could achieve this?

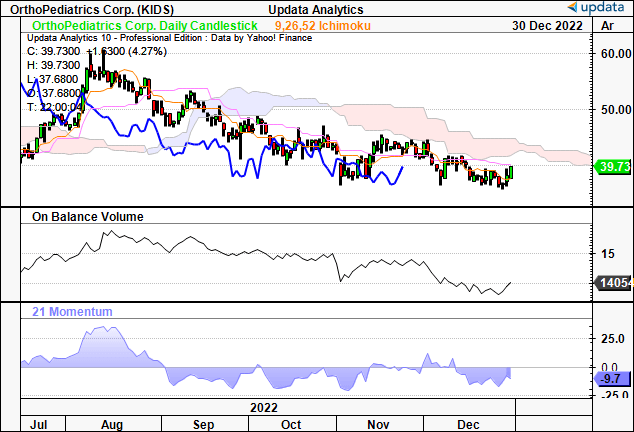

Checking our trend indicators, we see the stock is stroll trading below cloud support, with the lag line in similar position. At the same time, on balance volume (“OBV”) and momentum have maintained course in continuation with their longer-term downtrends respectively.

Seeing that OBV is at a 6-month low, this could suggest a potential reversal in buying volume, as the long-term volume trend suggests buying volume may have dried up. This would be a contrarian stance, as, on face value, further downside could be warranted in KIDS’ case.

Exhibit 6. KIDS currently trading below the cloud with minimal support from long-term trend indicators in OBV and momentum. To opine a reversal from here would be a contrarian view.

Data: Updata

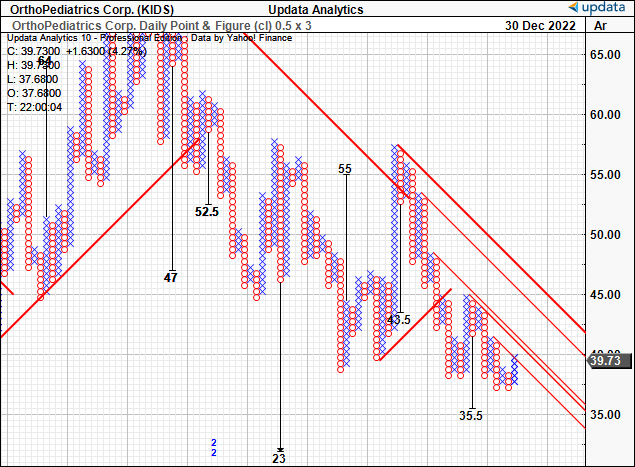

This is further supported in the fact that we have targets to $35 from our point and figure studies. To date, these have served us well, and will give us insights as an input to understanding the market positioning in KIDS over the coming weeks to months.

A move to $35 would see the stock hit another low, placing greater emphasis on the company’s Q4 and FY22 earnings respectively, alongside its forward estimates for FY23′.

Exhibit 7. Further downside targets to $35, placing greater emphasis on the company’s upcoming financial results as a mid-term growth driver to its share price.

Data: Updata

Valuation and conclusion

KIDS currently trades at 2.4x book value following its selloff across the last 12 months. Question is, does this represent value creation or as an overvalued stock.

To examine this,, it should be noted that KIDS increased its book value per share by 49% over the 12 months to $16.74, well ahead of the S&P 500’s total return over the same time. This should be factored into the valuation debate for KIDS by estimation, and we believe demonstrates value creation for shareholders.

Assigning the 2.4x multiple to the $16.74 in book value per share derives a price target of $40.20. Moreover, consensus has the stock priced at 7.3x forward sales, and at consensus FY22′ revenue estimates of $124mm, this derives a price objective of $45.30.

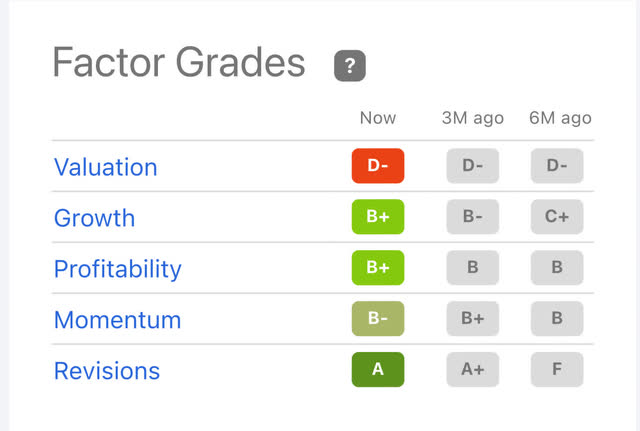

Moreover, Seeking Alpha’s quantitative factor grading has KIDS rated highly across all measures, bar valuation, although not surprising considering the lack of pre-tax profit at this stage. We believe this adds to the case for KIDS to re-rate in FY23′ as well.

Exhibit 8. KIDS Seeking Alpha factor grading, showing the stock is highly rated across most measures.

Data: Seeking Alpha KIDS quote page, see: “Factor Grades”

Net-net, we rate KIDS a buy based on the data points raised throughout this analysis. As I’ve mentioned, we believe there is scope for the stock to re-rate to the $45 range in the near term, however, the company’s Q4 and FY22 earnings will serve as the springboard to achieve this. Should the company fail to meet its numbers in the next report, there’s a high likelihood that investors will continue to sell KIDS shares. Hence, it is imperative for the company to maintain its current trajectory at the top line. Nevertheless, FY23′ could be an exciting year for KIDS. Rate buy.