Floortje

Introduction

Big Pharma companies, such as those that fall under the iShares Global Healthcare ETF (IXJ), are incredibly safe investments, but growth is slow. 2022 saw share prices rise due to market weakness (flight to safe havens), along with a rebound in pharma sales after the peak of the COVID pandemic. Merck & Co (MRK) was the best performer of the large cap group, rising over 44% in 2022 alone. Part of this is due to significant underperformance in 2020 and 2021, a rising valuation, and continued Keytruda momentum (Merck’s aging, but flagship therapy). However, one problem I have with many major pharmaceuticals is due to their reliance on a few blockbuster therapies or areas of expertise.

For Merck, this is Keytruda. The therapy is so helpful for patients that MRK has earned over $50 billion from Keytruda alone since 2015. The therapy now accounts for over 30% of total revenues per year, and the ratio is rising. With peak sales occurring over the next few years and a patent expiration date in 2028, the good times will not last and growth will slow once again.

Across Big Pharma, the ebbs and flows of blockbuster sales are clear to see. Pfizer (PFE) had a big 2021 and 2022 sales boost from COVID vaccines and antivirals, AbbVie (ABBV) has Humira, and Bristol-Myers Squibb’s (BMY) Revlimid, with the latter two also seeing growth slowdowns due to biosimilar competition. Investors in the industry may be unaware of these intricacies, and wonder why total growth is slow while holdings wait for their next blockbuster.

I feel that perhaps it is not worth a wait. While most Big Pharma’s have plenty of other assets to support profitable cash flows and continued R&D, I would hesitate to say the companies are diversified. That is why I believe a more diversified investment into Merck & Co’s former parent company, Merck KGaA (OTCPK:MKKGY), will be lower risk and offer an equal or higher return. This article will provide the key details why.

MERCK KGaA: Big Pharma Diversified

Merck KGaA, also known as EMD Group in the US or the Merck Group outside the US, is an over 350 year old chemical and pharmaceutical company based in Germany. US-based Merck & Co is a former US subsidiary from the 19th century that was bought by the US government during World War I, and the two entities have been separated ever since (with continued fights over naming rights). Now in 2022, Merck KGaA remains a global force in chemistry and health care with three main operating segments.

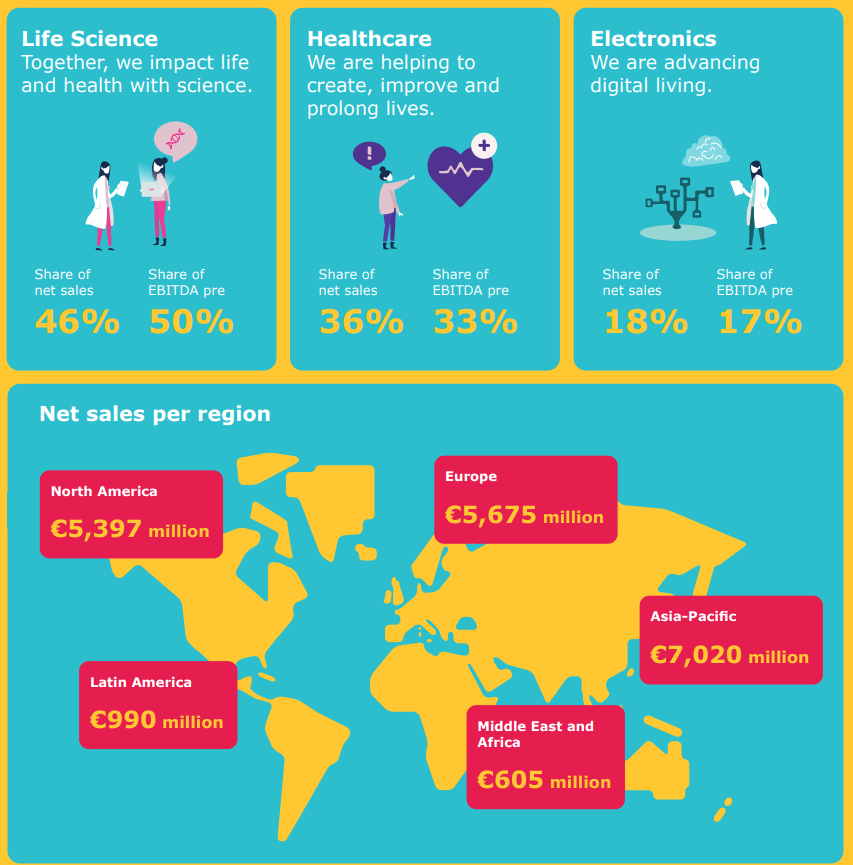

The three segments are: Life Sciences, primarily providing consumables, technology, and services for R&D across the industry; Healthcare, an internal pharmaceutical component with an extensive pipeline; and Electronics, a fully integrated semiconductor equipment and materials provider. The Life Science segment is the largest and most profitable, with a moat-like position generating significant cash flows for continued R&D across all segments. The other two groups are also quite profitable, but focusing more on long-term growth rather than total profitability.

Merck KGaA is also well positioned globally to take advantage of shifting macroeconomic shifts. Whether it is a slowdown in growth in China offset by continued strength in North America, or vice versa, global companies are far more stable than localized entities. Over the past year this also includes significant beneficial foreign exchange benefits that support the current investment. For one, the strong USD allows dollar-based investors to buy the foreign company at a discount. A return to normal currency rates will still create a 5-10% opportunity despite the USD weakening significantly over the past month (50% if the USD drops to 2008 lows). The exchange rates of the past year have also allowed revenues and earnings to increase temporarily, and the longer the USD remains strong the better.

Merck KGaA 2021 Annual Report

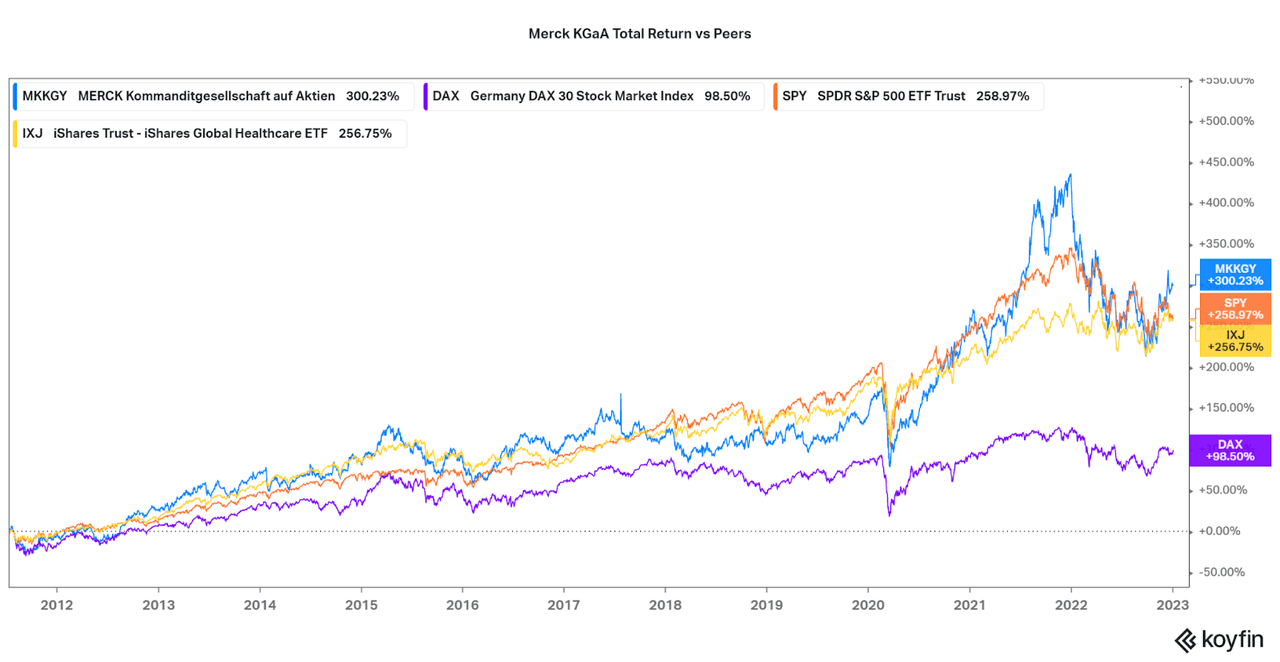

As a large, but foreign entity, Merck KGaA is off most US-investor’s watchlist. However, it is clear that MKKGY can be classed as an elite company. Internal peer comparisons include the German DAX index (Global X DAX Germany ETF (DAX)) and most large cap pharmaceutical companies. One major player I believe is missing is Thermo Fisher (TMO), particularly with overlap in the Life Sciences segment. Well, it is of little consequence as Merck KGaA has performed well compared to the entire list of peers, and with volatility, savvy investors can outperform.

Merck KGaA 2021 Annual Presentation

Koyfin

Life Sciences

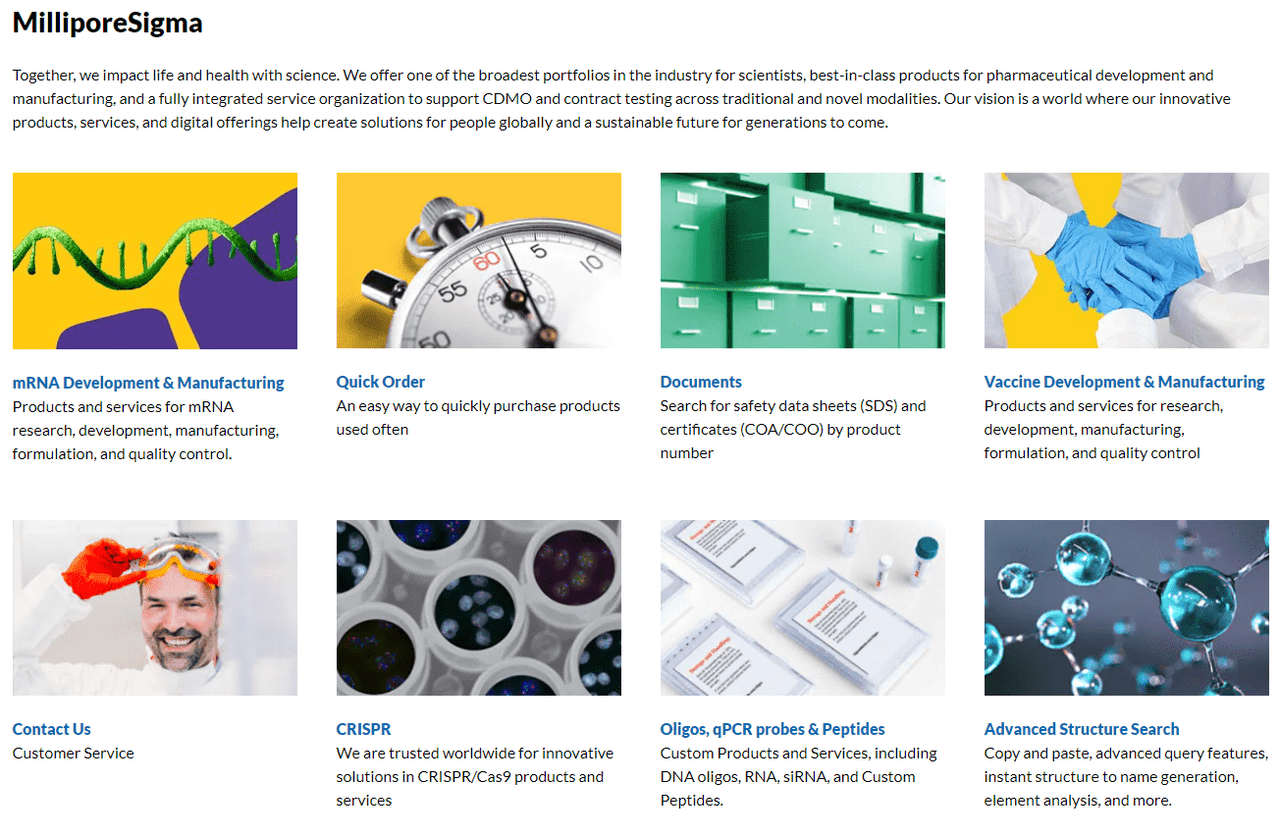

The key Life Sciences group may seem unfamiliar at first, but for anyone who has spent time in any type of research labs will be familiar with Sigma-Aldrich or Millipore. These two major subsidiaries, now referred to as MilliporeSigma, are the main components of the life science segments. The group provides essential materials, tools, and services for laboratories across chemical, physical, or biological fields. The group is also indestructible financially, with a recurring/essential revenue profile, a moat, growth, and profitability. I believe that Merck KGaA is worth a long-term buy and accumulate strategy for this segment alone.

Merck KGaA Website

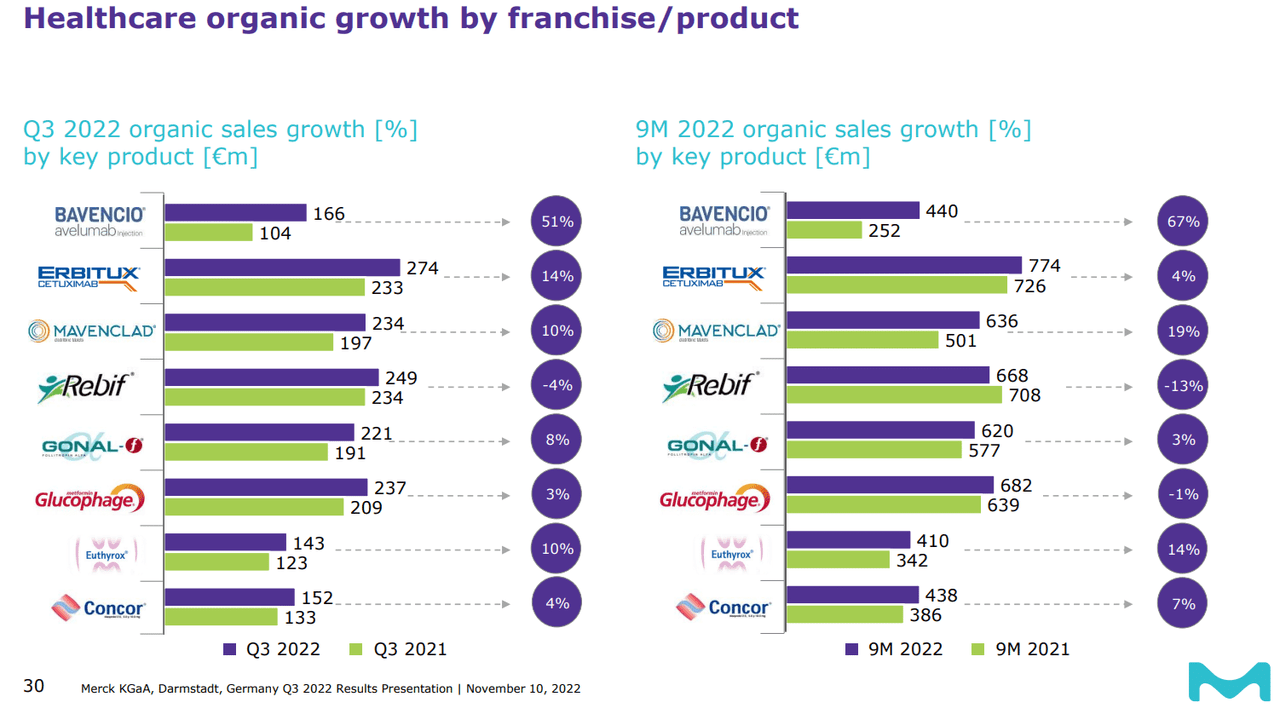

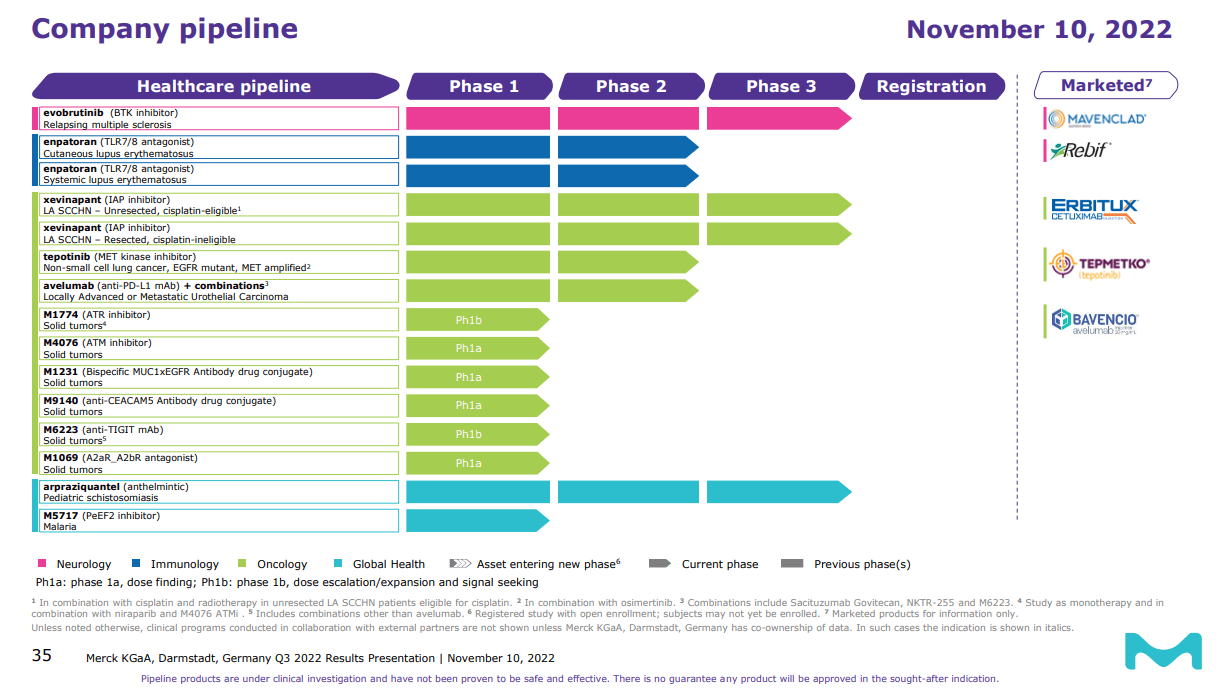

Healthcare

While the Life Sciences segment provides stability, the Healthcare segment provides the opportunity for blockbuster therapies. The current approved therapies offer a varied mix of growth, but are fairly profitable. MKKGY also does not rely on any single therapy for revenues, a positive in my eyes despite the smaller sales. The current in-house pipeline is diversified, although small if compared to other Big Pharma companies. Although, Merck has just recently used cash to expand their pipeline into more antibody-based therapies, as per Fierce Biotech:

The pool of Big Pharmas competing to develop game-changing antibody-drug conjugates continues to grow, with the water now at a boil after two more sizable licensing pacts.

Amgen and Merck KGaA each entered the holiday weekend with separate collaborations aimed at developing the burgeoning cancer-targeting modality, with the deals’ combined value eclipsing $2 billion.

German Merck got the party started with an $830 million pact tapping Mersana Therapeutics, including $30 million in upfront cash in exchange for up to two targets. The deal, unveiled Thursday, lines up with Merck’s recent R&D ambitions, which include half of future product launches coming from external drug developers.

Of the current pipeline, the most promising therapy is a first, and potentially best-in-class treatment for relapsing multiple sclerosis that is currently in a Phase 3 trial. Other catalysts include earning royalties and milestone payments from other drug discoverers, a drug discovery partnership with Palantir (PLTR), and commercialization/manufacturing partnerships across the industry. All-in-all, the healthcare segment is expanding rapidly and will be a major pillar of success for Merck KGaA over the coming decades, rather than a net-drain of R&D cash.

Merck KGaA 22Q3 Presentation

Merck KGaA 22Q3 Presentation

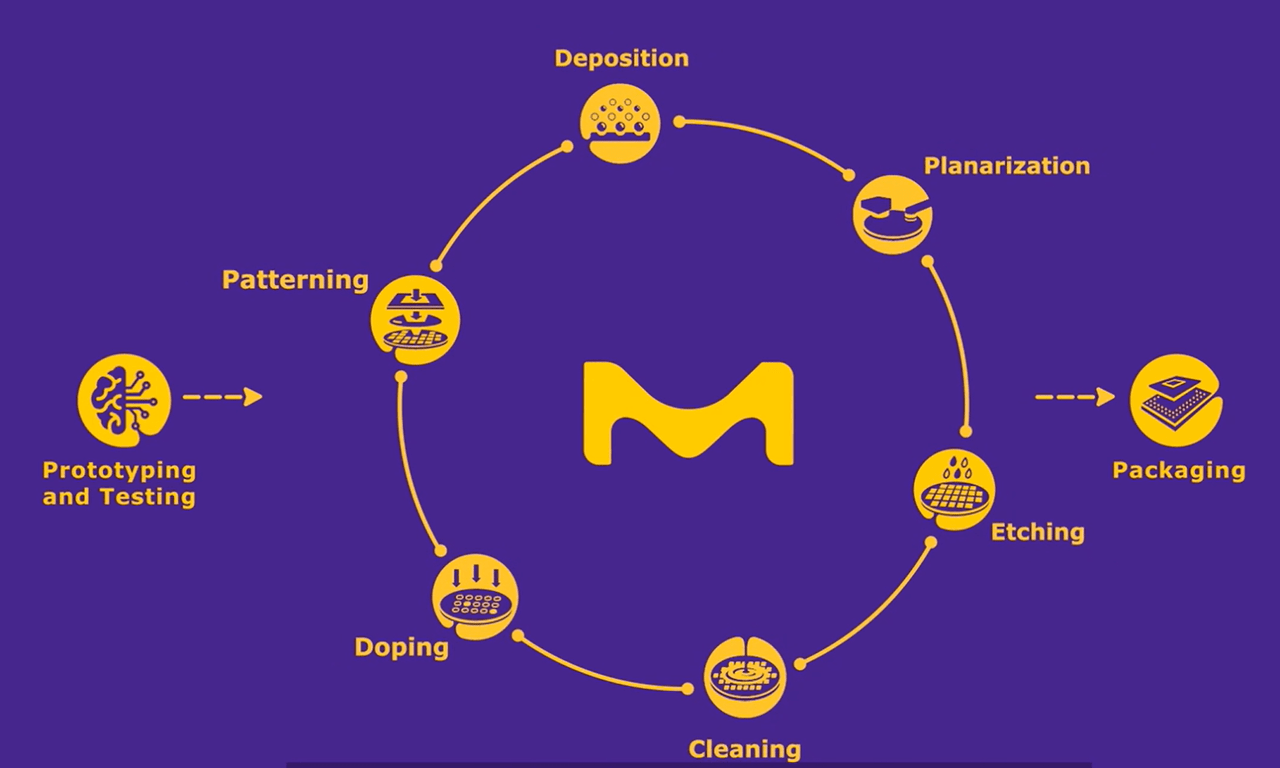

Electronics

Lastly, and perhaps randomly, Merck KGaA also has significant exposure to the Semiconductor industry. The company primarily provides materials and services to other equipment manufacturers, rather than developing any chips internally. However, the group is diversified across the entire manufacturing process and benefits from the secular growth of the industry. The temporary cooldown in 2022/23 after a hot 2020/21 will do little to damper the long-term growth profile of this segment. Major catalysts and developments include:

-

Another partnership with Palantir to use big data to solve issues in semiconductor manufacture.

-

The company pledged over $3.5 billion in investment expenses for the next few years to stimulate organic growth.

-

A partnership with Micron (MU) to develop more sustainable materials, particularly gasses, for the industry.

While having a major Electronics segment may be a worry point for investors, I believe that there is little to worry about. Although growth is slowing, long-term technological advancement requires continued use of semiconductor technology, and diversification allows Merck to maintain revenues in essential or more stable sectors of the market (rather than consumer goods). When combined with the other two revenue segments, the low correlation of health care and semiconductor markets is a benefit, rather than a curse.

Merck KGaA Website

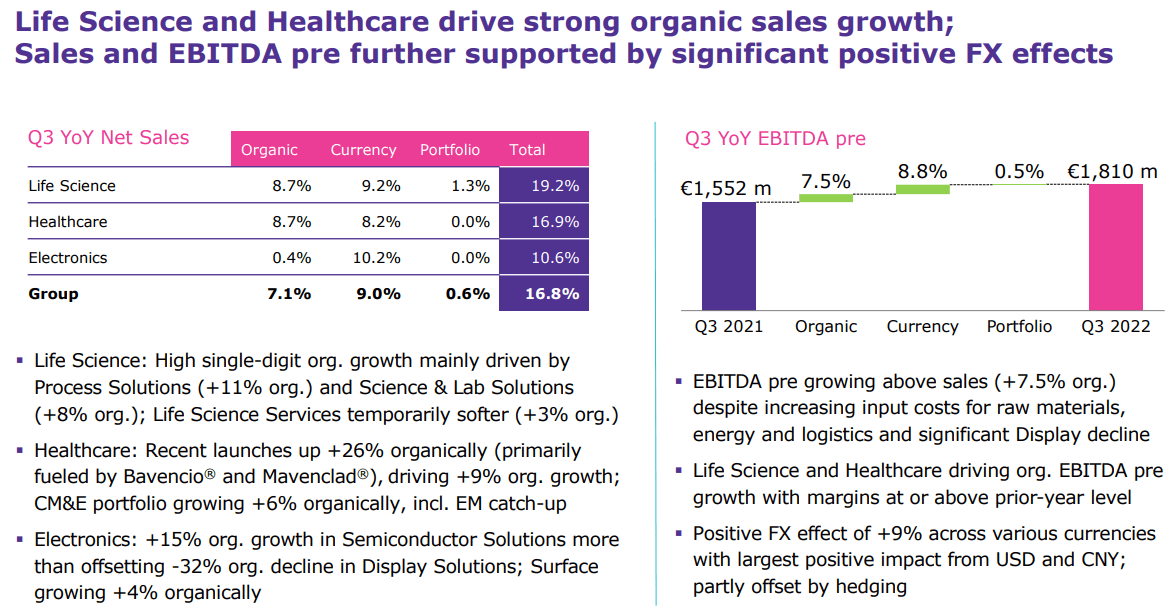

Financials

Strong qualitative factors are not all that make an investment, and the quantitative data must be strong as well. Merck KGaA does in fact have a great financial profile, even when looking across all three segments. In Q3 2022, the two health care segments maintained upper single digit organic growth, alongside favorable currency exchange rates. Despite negative growth in semis peers, the electronics segment also saw flat growth, but a positive 10% in currency benefits. Overall, quarterly YoY revenue and EBITDA growth were 16.8% each. According to managerial notes, the diversification of revenues is a major factor driving the successful performance over the past few quarters.

Merck KGaA 22Q3 Presentation

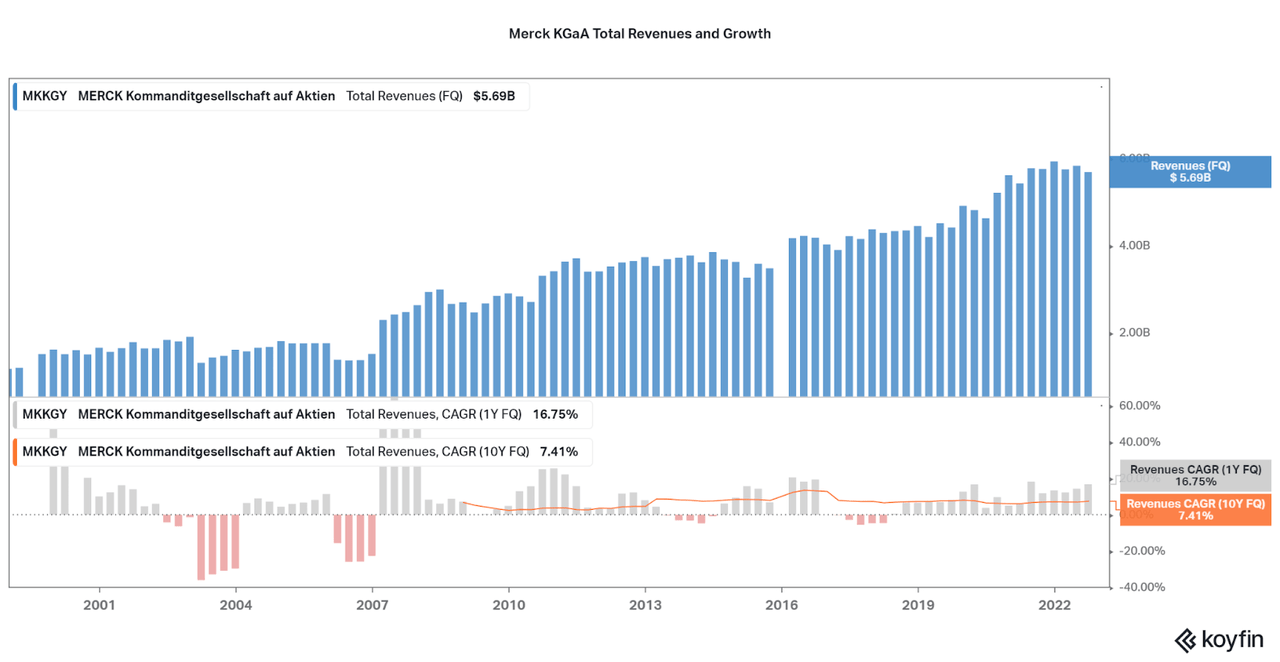

The success continues a longstanding pattern going back decades. However, German Merck really came to form starting in the 2010s after acquiring Millipore and the Electronics businesses. Total revenue growth has remained at approximately 7-8% over the past 10 years for some time now, although 2021 and 2022 has seen growth in the teens. Management currently expects growth to be maintained around 5-8%, although I believe expectations will be beat due to the USD remaining strong. I also do not expect recessionary pressure to have much effect on the company as many of the revenues are essential in nature, or in the case of drug therapies, recession agnostic.

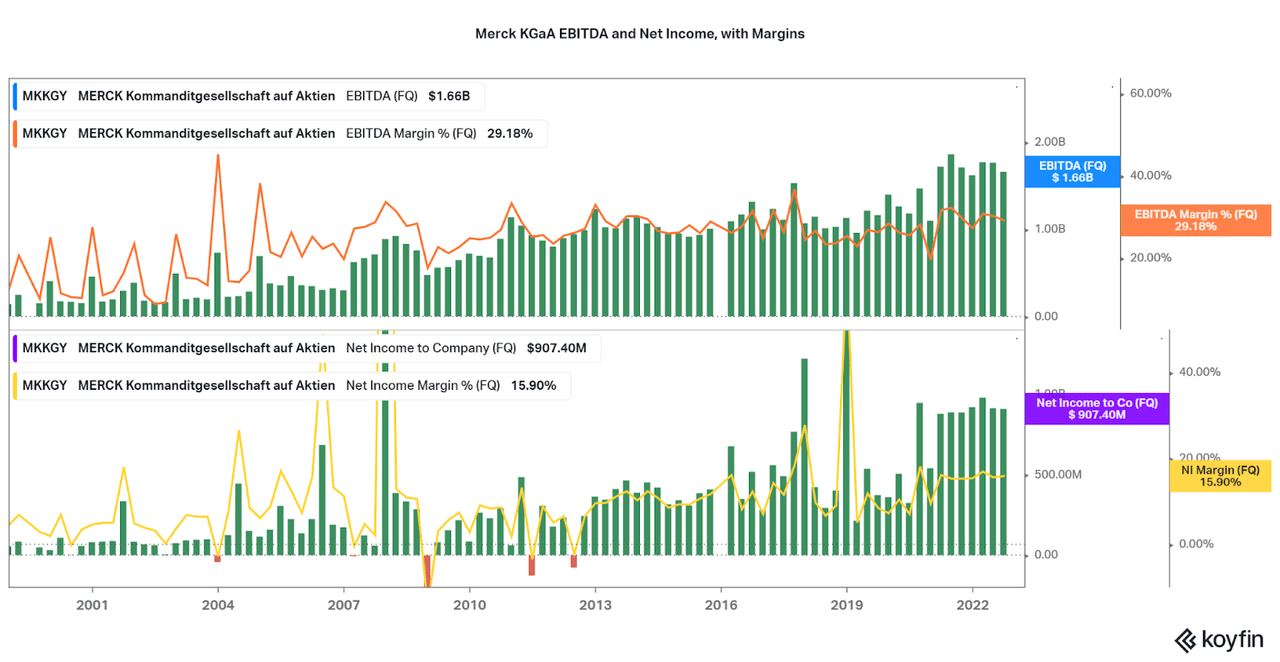

Koyfin

Profits have also seen minor improvements over the years, although Merck has always been quite profitable. The best development has occurred with Net Income growth as the Healthcare and Electronics segments become more profitable. At current levels, I do not expect margins to increase significantly, but they also will not fall. Therefore, earnings growth will proceed in line with revenues for the next few years bar any major investments. However, investors may see some earnings per share growth due to the strong balance sheet.

Koyfin

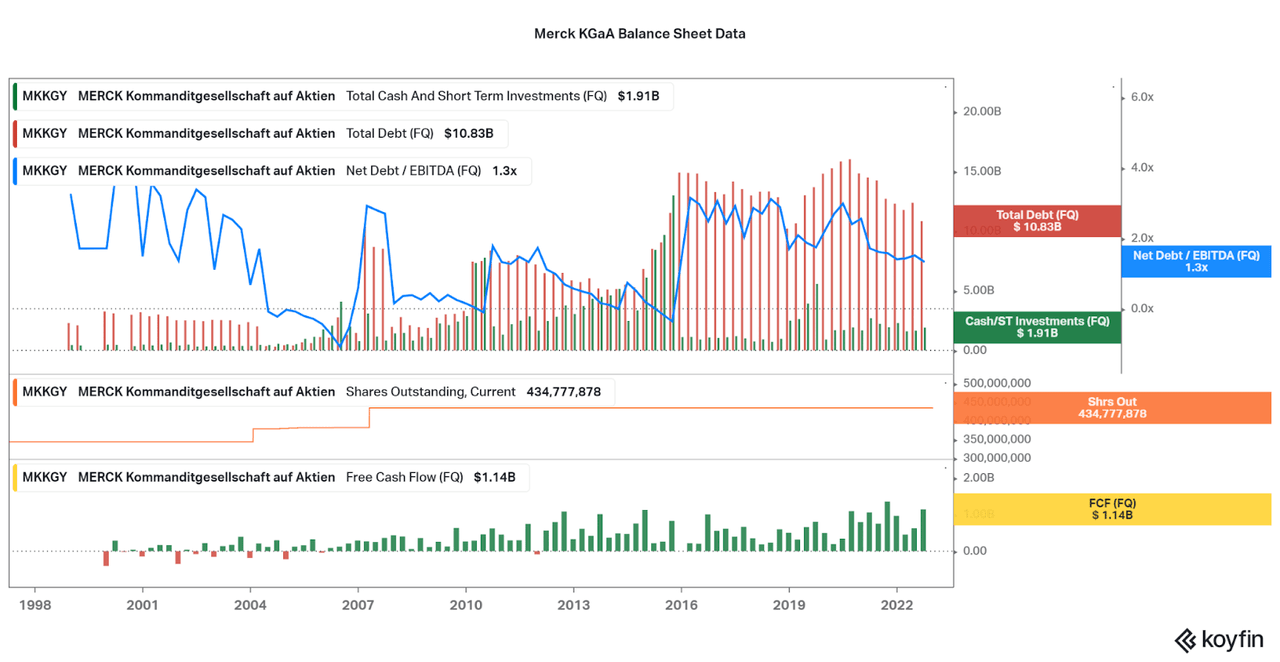

With leverage falling to only 1.3x net debt to EBITDA, Merck KGaA has a safe enough balance sheet to begin buying back shares. The company has yet to buy back any meaningful amount of shares, but I believe with more approvals in the Healthcare segment, this may be possible within a few years. The history of positive free cash flows certainly supports further shareholder benefits such as a rising dividend or buybacks, but I do like the focus on growth investments as a long-term investor.

Koyfin

Valuation

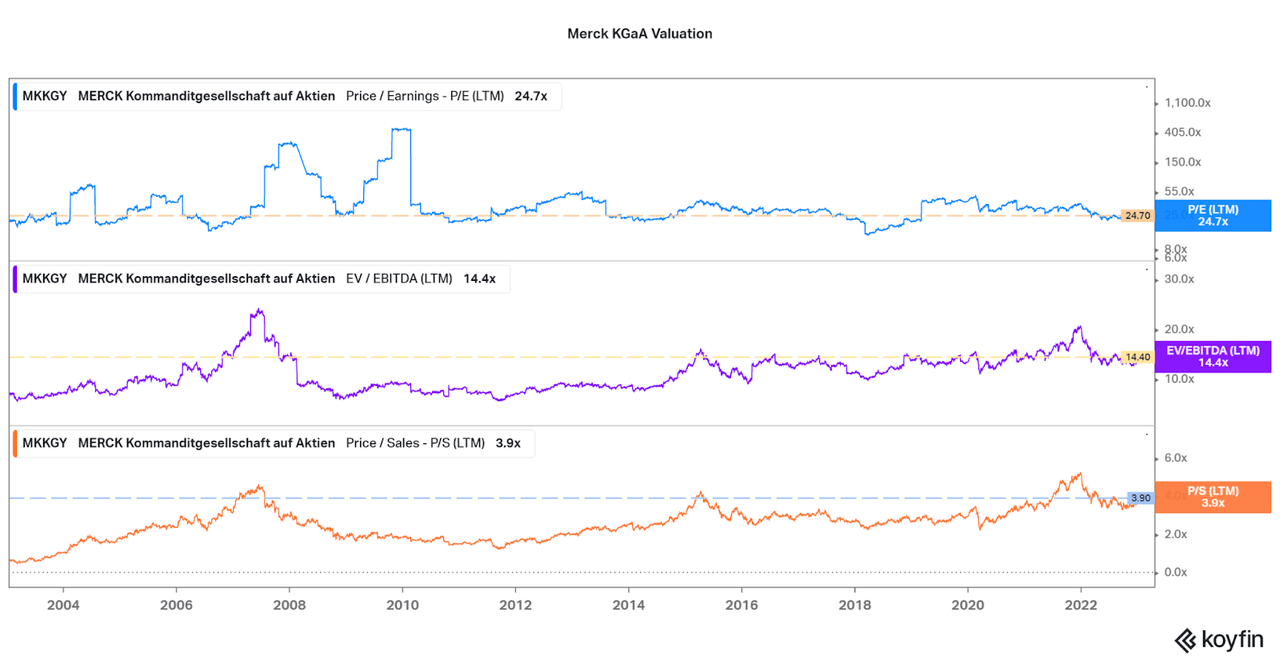

While Merck KGaA is a great company, valuation always is an important factor to consider. The longer you hold, the less so, but in a market of uncertainty we should take a look at the current situation. For the most part, I see MKKGY as fairly valued. However, the point of outperformance may rely on a secular shift in valuation. Merck KGaA trades far below peers listed above, despite the higher growth rate than most. Merck also has a strong balance sheet, decreasing leverage, increased revenue diversity, newly approved profitable therapies, and an expanded pipeline with multiple Phase 3 trials.

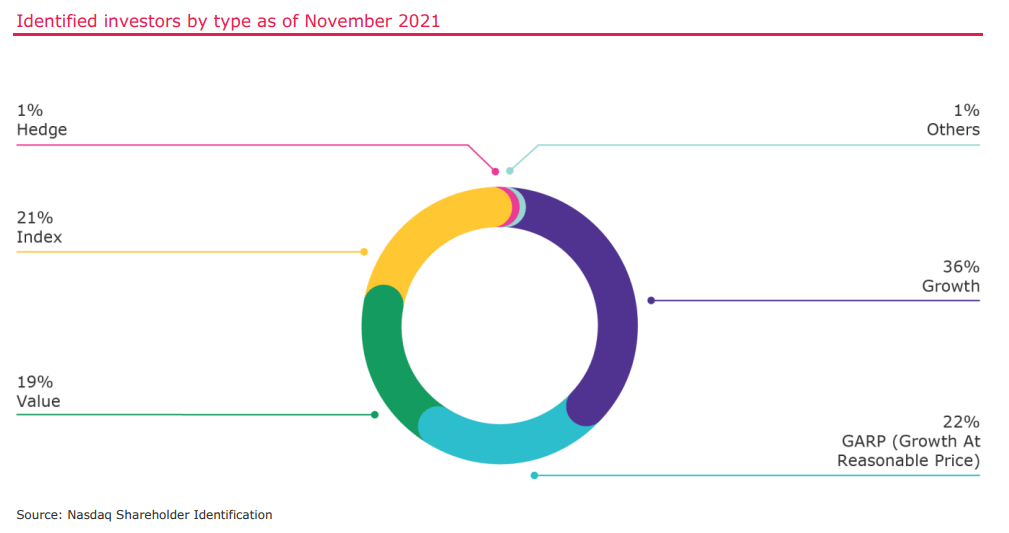

A rising valuation over the past decade is fixing this discrepancy, although I believe more value can be unlocked. We already see investors taking flight towards healthcare companies and if the economy worsens then this trend may continue. Also remember that thanks to foreign exchange, US investors are still getting a bargain compared to Euro investors. Considering most investors are growth oriented, I expect that long-term holders will create strong resistance to falling share prices over the next few years.

Koyfin

Merck KGaA 2021 Annual Report

Conclusion

As a diversified, unique, and healthy equity, I believe Merck KGaA is worth accumulating at current prices. In a bull market, the shares will outperform and can be trimmed. Right now, I believe selling slower moving Big Pharma companies to buy MKKGY is worth consideration as growth slows. However, the thesis is over a long time frame so keeping exposure to a wide range of Health Care assets may be a good idea. Remember, if your outlook is beyond 3-5 years, then recurring investments will be far more important than short-term performance or trading.

Thanks for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.