jaanalisette

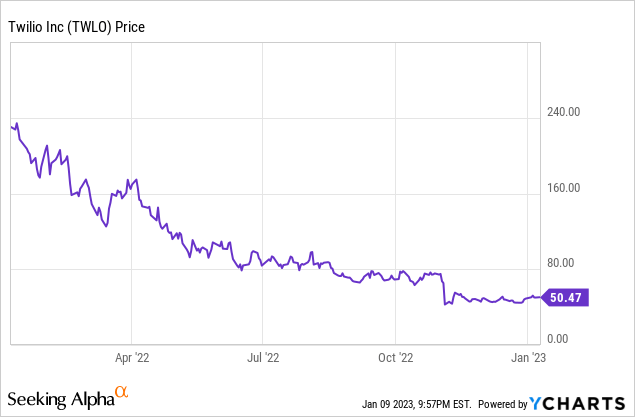

For investors who are keen to add risk back into their portfolios and re-emphasize growth, few investments are as appealing as Twilio (NYSE:TWLO). It’s amazing how quickly a stock like Twilio has dropped from the spotlight as a Wall Street favorite to a penalty-box name, but this breather gives long-term oriented investors a great opportunity to buy into a quality name at pennies on the dollar.

Over the past twelve months, Twilio has shed nearly 80% of its value. And while it’s true that there are some go-forward fundamental risks that we should be mindful of, I think the Twilio selloff is far overdone.

Twilio, for investors who are less familiar with the name, is an API (application programming interface) software company that helps power the communications functions within many of the applications we use today. The easiest example of what Twilio does is to use the example of Uber (UBER) – when you communicate with your driver via messaging or an internet-powered voice call, a platform like Twilio is facilitating that communication. Twilio is paid for each instance of these in-app communications, across thousands of applications.

So then the long-term thesis for Twilio becomes rather simple: as long as we still believe in the growth of the internet and an app-based economy, and that consumers will continue to purchase goods and services through their phones and interact with various companies within applications, then the future for Twilio is solid. I remain very bullish on Twilio and am steadfastly holding onto the name in my portfolio.

Here, to me, are the key drivers of the bullish thesis for this name:

- Universal, horizontal software platform that has limitless opportunities for expansion. Many kinds of applications require the ability to connect with their customers through talk and text, and as more and more of our lives go digital, Twilio’s potential base of customers will continue to widen. Twilio has also been adept at expanding its core product set, adding call-center software capabilities as well as email marketing tools through its acquisition of SendGrid. A recently added product called Twilio Live also introduces live-streaming capabilities for Twilio clients.

- Land and expand; growth alongside the customer base. Twilio is one of the best examples of a “land and expand” software company. Because it prices its services by usage (for example, per messages sent), its revenue grows when the underlying apps it powers does. This gives Twilio a powerful, built-in growth engine.

- Customer diversification. Twilio used to be heavily reliant on large accounts; now, the company’s top 10 customers represents only 13% of revenue and the company has over 280k total customers.

- Path to profitability. Driven by expanding gross profit dollars per message sent, as well as economies of scale on opex as Twilio continues its organic growth path, the company expects to be above breakeven profitability on a pro forma basis by FY23.

The biggest appeal to Twilio at the moment, to me, remains its valuation. At current share prices near $50, Twilio trades at a market cap of $9.31 billion. After we net off the $4.21 billion of cash and $987 million of debt on the company’s most recent balance sheet, Twilio’s resulting enterprise value is $6.09 billion.

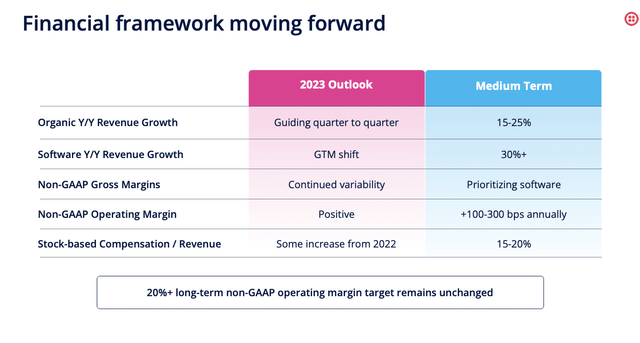

Meanwhile, for the upcoming fiscal year FY23, Wall Street analysts are expecting Twilio to generate $4.43 billion in revenue, representing 17% y/y growth – which is on the lower end of the company’s range of 15-25% y/y growth that it delivered in its November analyst day.

Twilio outlook (Twilio 2022 analyst day presentation)

Irrespective of this, taking Wall Street’s expectations at face value, Twilio trades at just 1.4x EV/FY23 revenue – a perfect time for us to leap into the name.

Let’s now take some time to dissect the big recent worries clouding Twilio, but the bottom line here: Twilio’s cheap valuation is more than enough compensation to offset these risks.

Organic revenue growth is holding strong, at least through Q3

Understandably, investors have re-rated Twilio stock to prepare for the reality of mid-teens / low 20s revenue growth. It’s worth noting that Wall Street’s 17% y/y growth forecast for 2023 is leaning quite on the conservative side of Twilio’s own 15-25% y/y growth range (and Twilio also has a history of exceeding its conservative internal estimates).

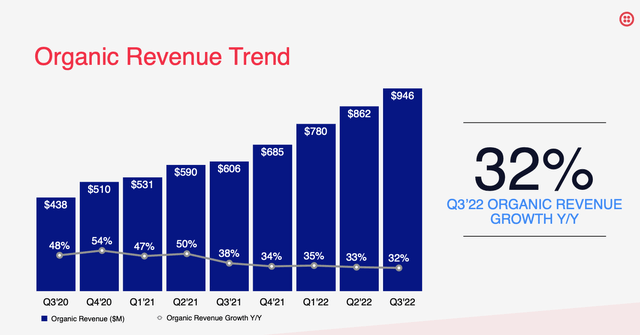

Twilio organic revenue growth (Twilio Q3 earnings deck)

Through Q3 (Twilio’s most recently reported September quarter), Twilio achieved 32% y/y organic revenue growth, barely decelerating at all since the fourth quarter of FY21.

Yes, it’s true that macro pressures intensified from Q3 to Q4, and we should expect some weakening in growth rates. The company also noted that sales cycles are elongating and certain industries like crypto, consumer on-demand, and social media are seeing noticeable pullbacks. But also do note that unlike other software companies, Twilio is not a subscription-based business: meaning its growth is less predictable and more subject to a fast rebound rather than a software company that relies on a monthly intake of subscriptions for its revenue.

In other words, there is a reality that Twilio’s growth headwinds are short-lived and that the sharp deceleration that is now baked into Twilio’s consensus expectations may not materialize.

Gross profit dollar expansion

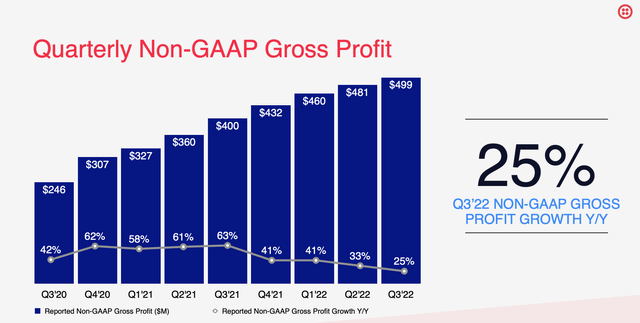

The other black eye that investors are attributing to Twilio is its drop in pro forma gross margins. In its most recent quarter, Twilio’s pro forma gross margins dropped to 51%, a three-point decline from 54% in the year-ago quarter.

The company has an explanation for this, however. Carrier fees for messaging delivery have increased, in particular overseas. Twilio has passed on this added zero-margin cost to its consumers, optically lowering its gross margin profile. However, gross profit per message continues to increase, which is a better representation of Twilio’s attractive unit economics.

Some helpful detail from CFO Khozema Shipchandler’s prepared remarks on the Q3 earnings call surrounding the company’s most recent gross margin trends (key points highlighted):

Our messaging product has attractive gross profit unit economics across both the U.S. and international. Looking at our gross profit per message over the past couple of years, we’ve seen stability in the U.S. at an increase in the gross profit we receive per message internationally. In fact, even though our international gross margins are lower, we actually generate more gross profit per message internationally than in the U.S. With over 144 billion messages being sent annually, we’re able to generate increasing levels of gross profit that we can use to reinvest strategically back into the business.

As highlighted, the drivers behind the reset reduction in messaging gross margins have been twofold. First, our strong growth internationally has shifted the mix of our revenues, which has reduced gross margins by 470 bps since Q2 2020. Second, the introduction of 10DLC fees by the U.S. carriers has reduced our messaging gross margins by further 280 bps as these fees are passed onto our customers at no margin […]

To summarize, the drivers behind the recent reduction in messaging gross margins have been fees and mix, not a pricing nor competitive dynamic, put simply, we make gross profit on messaging. In fact, we make even more gross profit per each message internationally that gross profit has been steady and even increased a little over the past two years. While the gross margin percent has decreased over that period of time, we see no reason to slow down this product, as it generates attractive unit economics.”

I view the company’s ~$500 million of quarterly gross profit dollars (still growing at a healthy mid-20s pace) as a powerful base for the company to work toward pro forma profitability above breakeven in FY23. Certainly Twilio should not be trading at just a ~1.5x forward multiple of revenue or ~3x gross profits.

Twilio gross profit growth (Twilio Q3 earnings deck)

Key takeaways

Just because it has fallen out of favor with mainstream investors does not mean that Twilio is no longer a fantastic recurring-revenue software business with powerful secular tailwinds behind it. Focus on the long-term appeal here – Twilio grows alongside a booming app economy – and ignore the short-term noise.